Saudi-UAE Tensions Over Yemen and Implications for Oil Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my research, I can provide a comprehensive analysis of how the escalating tensions between Saudi Arabia and the UAE over Yemen may affect oil markets and energy sector investments.

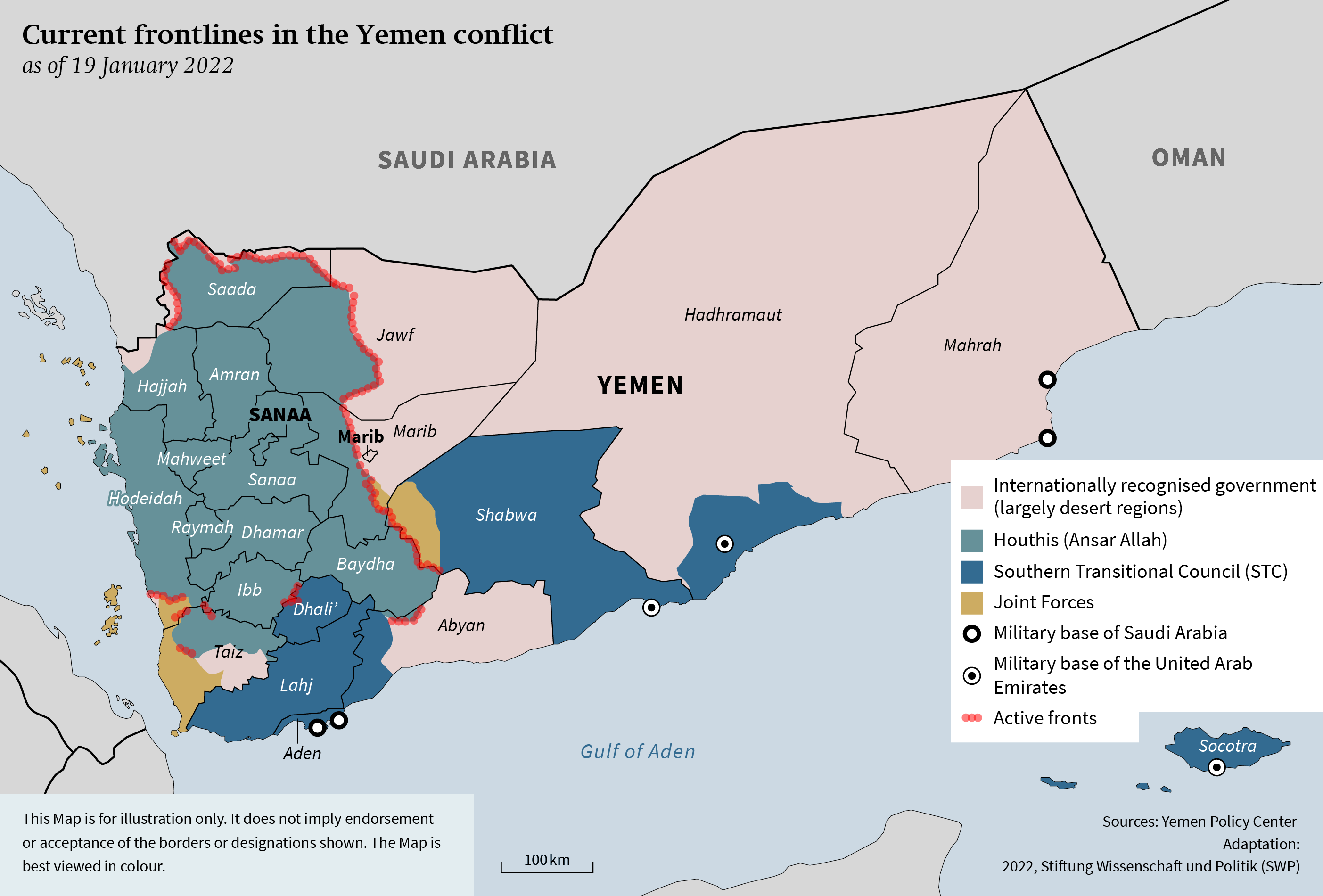

The relationship between Saudi Arabia and the United Arab Emirates—long-standing allies within OPEC+—has deteriorated significantly over Yemen, exposing fundamental divergences in their regional strategies. In December 2025, Saudi Arabia conducted airstrikes on UAE weapons shipments at Yemen’s Mukalla port, targeting arms the UAE claimed were for its own security forces but which Saudi Arabia accused were being funneled to the Southern Transitional Council (STC), a separatist group seeking an independent southern Yemen [1][2].

This direct confrontation led the UAE to announce the withdrawal of its remaining forces from Yemen after Saudi Arabia issued a 24-hour ultimatum for Emirati troops to leave. On January 2, 2026, the Saudi-backed Yemeni government launched operations to recapture military positions from UAE-aligned separatists, with reports of multiple Saudi airstrikes following the declaration [2].

According to analysts, this rivalry represents a broader “Cold War” between the two Gulf powers, driven by fundamentally opposing foreign policy visions. Saudi Arabia prioritizes regional stability, domestic development, and working through formal institutions, while the UAE follows a “break-to-build” strategy involving support for armed non-state actors across Sudan, Libya, Somalia, and Yemen to gain influence through maritime routes and energy infrastructure [3].

According to market data, crude oil prices (CLUSD) have remained relatively stable despite the tensions, trading around $57 per barrel as of January 7, 2026 [4]. The market’s muted reaction reflects several factors:

-

OPEC+ Cohesion Maintained: Despite the public rift, OPEC+ sources confirmed that the January 4, 2026 meeting of eight key producers (Saudi Arabia, Russia, UAE, Iraq, Kuwait, Kazakhstan, Algeria, and Oman) decided to maintain the existing output freeze through Q1 2026 [1][5]. The group has historically prioritized market management over political disputes, as seen during the Iran-Iraq War.

-

Oversupply Dominates Price Dynamics: Oil prices fell more than 18% in 2025—the steepest annual decline since 2020—primarily due to global oversupply concerns rather than geopolitical factors [1][2]. Forecasters predict oil prices will average around $55–60 per barrel in 2026, with potential downside to $50 by mid-year if oversupply persists [6].

-

Production Unaffected: Current oil production in both Saudi Arabia and the UAE continues as normal, with no indication that the Yemen dispute has disrupted output or export operations [1].

While immediate market impact has been limited, several escalation scenarios could affect oil markets:

| Scenario | Probability | Potential Impact |

|---|---|---|

| Further military escalation disrupting Red Sea shipping | Medium | Oil prices could spike $5-15/barrel; tanker insurance costs would rise |

| OPEC+ fragmentation leading to production cuts disagreement | Low-Medium | Significant volatility; potential price collapse if cooperation breaks down |

| Targeted infrastructure attacks (pipelines, facilities) | Medium | Supply disruptions depending on scope and duration |

| Prolonged diplomatic freeze affecting investment decisions | High | Indirect impact through delayed projects and reduced capital flows |

-

Risk Premium Minimal: Current market pricing reflects limited immediate supply risk, suggesting the tensions are being viewed as primarily political rather than economically disruptive.

-

Volatility Potential: Option markets and energy sector derivatives may show increased implied volatility around OPEC+ meeting dates and any escalation events in Yemen.

-

Sector Performance: Energy sector equities have demonstrated resilience, with the market pricing in the expectation that tensions will not translate into sustained supply disruptions.

According to PwC’s GCC economic outlook for 2026, regional oil-producing economies will face tighter fiscal conditions with lower hydrocarbon receipts, heightening the need for fiscal discipline and revenue diversification [7]. The Saudi-UAE tensions add an additional layer of complexity:

-

Investment Risk Premiums: Extended geopolitical uncertainty could elevate risk premiums for Middle East energy investments, potentially increasing capital costs for upstream projects.

-

Diversification Acceleration: Both nations may accelerate non-oil economic diversification efforts to reduce vulnerability to oil market disruptions and geopolitical leverage.

-

Infrastructure Security Focus: Increased spending on energy infrastructure protection, including offshore facilities and shipping lanes in the Persian Gulf and Red Sea.

The underlying rivalry between Saudi Arabia and the UAE suggests a structural shift in Gulf cooperation that could have lasting implications:

-

Separate Policy Pathways: Analysts do not expect open conflict, but the two states are likely to pursue increasingly divergent regional policies, potentially complicating coordinated OPEC+ decisions [3].

-

Regional Order Fragmentation: The UAE’s support for secessionist movements and non-state actors creates alternative power structures that could destabilize traditional state-based regional frameworks [3].

-

Competition for Asian Markets: With both nations competing for market share in key Asian importing countries, the tensions could intensify pricing competition in key destination markets.

-

Maintain Current Allocation: For diversified portfolios, the current tensions do not warrant significant changes to energy sector allocations, as OPEC+ unity remains intact and production continues unaffected.

-

Monitor Red Sea Shipping: Any disruption to the ~10 million barrels per day of oil and products passing through the Bab al-Mandeb Strait would have immediate market implications.

-

Watch OPEC+ Compliance: The group has maintained solidarity despite tensions, but any sign of non-compliance with production agreements could signal deeper fractures.

-

Consider Hedging Strategies: For direct energy exposure, maintaining modest protective put positions or collar strategies may be prudent given the elevated geopolitical uncertainty.

-

Focus on Company Fundamentals: Select energy equities with strong balance sheets and diversified asset bases that can weather potential volatility.

The Saudi-UAE tensions over Yemen represent a significant geopolitical development that signals a structural shift in Gulf Cooperation Council dynamics. However, the immediate impact on oil markets has been limited due to:

- OPEC+'s demonstrated ability to maintain unity despite internal political differences

- Current oversupply conditions dominating price dynamics

- Both nations’ shared interest in stable oil revenues

- No direct disruption to production or export infrastructure

The primary risks to oil markets would materialize only if tensions escalate to the point of disrupting Red Sea shipping, targeting energy infrastructure, or fragmenting OPEC+ cooperation. For energy sector investments, maintaining diversified exposure while monitoring escalation indicators appears to be the appropriate strategy. The medium-term outlook suggests continued pressure on oil prices from oversupply concerns, with geopolitical risk premium likely to emerge only upon significant escalation events.

[1] Reuters - “OPEC+ to maintain oil output policy amid Saudi-UAE tensions over Yemen, sources say” (https://www.reuters.com/business/energy/opec-maintain-oil-output-policy-amid-saudi-uae-tensions-over-yemen-sources-say-2026-01-02/)

[2] The New Arab - “OPEC+ to maintain oil output amid Saudi-UAE tensions over Yemen” (https://www.newarab.com/news/opec-maintain-oil-output-amid-saudi-uae-tensions-over-yemen)

[3] Deutsche Welle - “Saudi Arabia, UAE and a new ‘Cold War’ in the Middle East” (https://www.dw.com/en/saudi-arabia-the-uae-and-a-new-cold-war-in-the-middle-east/a-75409779)

[4] Market Data - Crude Oil Prices (CLUSD) January 2026

[5] Yahoo Finance - “OPEC+ Reaffirms Output Pause as Eight Producers Cite Market Stability” (https://finance.yahoo.com/news/opec-reaffirms-output-pause-eight-122858329.html)

[6] OilPrice.com - “OPEC+ Set to Keep Oil Production Policy Despite Saudi-UAE Spat” (https://oilprice.com/Latest-Energy-News/World-News/OPEC-Set-to-Keep-Oil-Production-Policy-Despite-Saudi-UAE-Spat.html)

[7] PwC - “Five GCC economic themes to watch in 2026” (https://www.pwc.com/m1/en/blog/five-economic-themes-to-watch-2026-gcc.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.