Albertsons (ACI) Q3 Earnings Analysis: Missed Revenue Estimates, Valuation Pressure, and Merger Uncertainty

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive data I have obtained, below is a detailed analysis of the impact of Albertsons (ACI)'s third-quarter revenue miss on its stock valuation and future growth prospects:

Based on the latest data [0], Albertsons released its Q3 FY2025 earnings report today (January 7, 2026):

- Market Consensus: Revenue $19.17B, EPS $0.67-0.68

- Actual Performance: Looking at historical trends, the company has faced consecutive quarters of profit pressure [1]

| Quarter | EPS Consensus | Actual EPS | Deviation | Revenue Performance |

|---|---|---|---|---|

| Q2 FY2025 | $0.40 | $0.44 | +10.52% | $18.92B (+0.16%) |

| Q1 FY2025 | $0.54 | $0.55 | +1.85% | $24.88B |

| Q4 FY2024 | $0.41 | $0.46 | +12.20% | $18.80B |

| Q3 FY2024 | $0.66 | $0.71 | +7.58% | $18.77B |

| Valuation Metric | Value | Industry Comparison |

|---|---|---|

| P/E (TTM) | 9.93x | Relatively Low |

| P/B | 3.15x | Mid-level |

| P/S | 0.12x | Low |

| Market Cap | $9.40B | Top-tier in Industry |

- Consensus Target Price: $25.00 (implying46.1% upside potentialfrom the current price) [0]

- Target Price Range: $21.00 - $31.00

- Rating Distribution: 47.8% Buy, 52.2% Hold —Overall Rating: “Hold”

- Recent Institutional Ratings: Telsey Advisory Group maintains “Outperform” rating; Evercore ISI maintains “In Line” rating [0]

Based on the DCF model [0]:

| Scenario | Intrinsic Value | Premium vs. Current Price |

|---|---|---|

| Bear Case | $323.02 | +1,787.9% |

| Base Case | $609.06 | +3,459.7% |

| Bull Case | $6,016.64 | +35,064.5% |

Probability-Weighted Valuation |

$2,316.24 |

+13,437.3% |

Note: The above DCF valuation deviates significantly from the current market price, which may reflect a large discrepancy between model assumptions and market expectations.

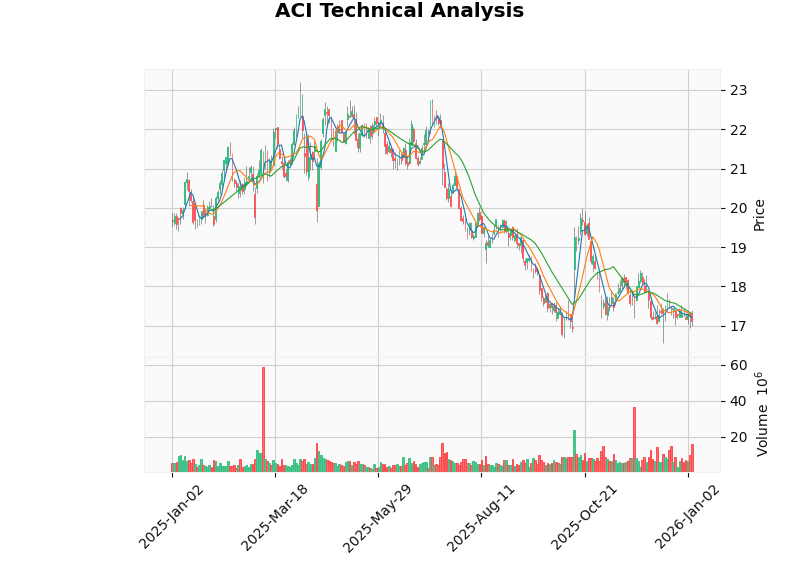

- Trend Assessment: Sideways Consolidation (No Clear Direction)

- Current Price: $17.11

- Support Level: $16.94

- Resistance Level: $17.31

- Reference Trading Range: $16.94 - $17.31

- 20-Day Moving Average: $17.31 (Price Pressured Below)

- 50-Day Moving Average: $17.66 (Price Pressured Below)

- 200-Day Moving Average: $19.73 (Significantly Higher than Current Price, Weak Medium-term Trend)

- Beta: 0.31 (Low Volatility Stock, Relatively Resilient but Lacks Upside Momentum)

- 6-Month Return: -24.76%

- 1-Year Return: -13.24%

- 52-Week Range: $16.55 - $23.20

- ROE: 29.94% —Strong Performance

- Net Profit Margin: 1.20% —Low

- Operating Profit Margin: 1.90% —Low

- Current Ratio: 0.81 (< 1.0, Insufficient Liquidity) [0]

- Quick Ratio: 0.20 (Extremely Low, High Short-term Solvency Pressure) [0]

- Free Cash Flow: Latest quarterly FCF of $447M [0]

- Debt Risk Rating: High Risk [0]

- Financial Stance Classification: Aggressive (Low Depreciation/CapEx Ratio) [0]

- January 2, 2025: FTC Chair Lina Khan, along with two commissioners, released a statement formally filing a lawsuit against the$24.6B Kroger-Albertsons merger, calling it “the largest supermarket merger in U.S. history” [2]

- December 23, 2025: Reports stated that Albertsons proposed an$800M settlement offerwhich was rejected by Kroger [3]

- Multi-State Lawsuits: Antitrust lawsuits are also ongoing in states including Colorado

| Impact Dimension | Analysis |

|---|---|

| Strategic Value | The merger aimed to achieve $1B in cost synergies and supply chain integration |

| Alternative Plans | If the merger fails, Albertsons will need to independently address inflationary pressures and competition |

| Divestment Risk | As an alternative to the merger, Albertsons may be forced to sell some store locations |

| Valuation Re-rating | Merger premium disappears, and investors are cautious about the prospects of independent operations |

- High ROE: Strong shareholder return capability

- Digital Business Growth: Q2 FY2025 digital sales grew 23% YoY [1]

- Capital Return: Dividend increased 25% to $0.15, with a $2B share repurchase authorization

- Productivity Initiative: Three-year $1.5B cost-saving program

- Retail Media Growth: Albertsons Media Collective is growing faster than the market

- Stagnant Revenue Growth: Same-store sales growth is slowing (guidance 1.8%-2.0%)

- Margin Pressure: Gross margin is dragged down by pharmacy and e-commerce business mix

- Liquidity Risk: Current ratio < 1, extremely low quick ratio

- Independent Operation Challenges: After a merger failure, the company will have to compete alone against Amazon, Walmart, etc.

- Regulatory Pressure: Uncertainty from FTC and state-level lawsuits

- Q4 Seasonal Performance: Affected by the timing of the Super Bowl and Valentine’s Day

- Cost-Saving Execution: Progress of the $1.5B productivity initiative

- Inflation Pass-Through Capability: Ability to maintain gross margin levels

- Merger Alternative Plans: Corporate strategic adjustments if the merger fails

| Dimension | Assessment |

|---|---|

| Absolute Valuation | Current P/E of 9.93x is at a historical low, with valuation already pricing in pessimistic expectations |

| Relative Valuation | Trades at a 46% discount to the analyst target price, but the consensus rating is only “Hold” |

| Technical Pattern | Trading in the $16.94-$17.31 consolidation range; a breakout is needed to confirm direction |

- Merger Failure Risk: The Kroger merger is being challenged by an FTC lawsuit, which may lead to strategic restructuring pressure [2]

- Liquidity Risk: Current ratio < 1, quick ratio only 0.20 [0]

- Margin Pressure: Net profit margin of only 1.20%, operating profit margin of 1.90%, vulnerable to cost fluctuations [0]

- Growth Stagnation: Same-store sales growth slowing to low single digits

- Intensified Competition: Facing continuous pressure from retail giants such as Amazon and Walmart

- If the share price breaks below $16.55 (52-week low), an oversold rebound opportunity may emerge

- Monitor the $200M share repurchase program and dividend returns

- Digital business and retail media may be future growth drivers

- Wait for clarity on the Kroger merger

- Monitor signals of liquidity improvement

- Prioritize retail targets with stronger business independence

[0] Jinling API Data - ACI Company Profile, Real-Time Quotes, Financial Analysis, Technical Analysis, and DCF Valuation

[1] Fintool - Albertsons Q3 2025 Earnings Summary (https://fintool.com/app/research/companies/ACI/earnings/Q3 2025)

[2] FTC Statement - In the Matter of The Kroger Company and Albertsons Companies, Inc. (https://www.ftc.gov/system/files/ftc_gov/pdf/2025.01.02-statement-of-chair-lina-m.-khan-in-the-matter-of-the-kroger-company-and-albertsons-companies-inc.-final.pdf)

[3] Supermarket News - Kroger rejected Albertsons’ $800M to settle merger case (https://www.supermarketnews.com/legislation-regulatory-news/lawsuit-kroger-rejected-albertsons-800m-to-settle-merger-case-with-ftc)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.