Webray Security (688651) Surges 100% with 6 Consecutive Limit Ups: Analysis of Strong Catalysts from Commercial Space Concept and Foreign Institutional Buying

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Webray Security hit a strong daily limit on January 7, 2026, closing at RMB 54.07, successfully achieving 6 consecutive limit ups and becoming the first stock to double in value in the 2026 A-share market[1][2][3]. On the day, the stock had an intraday amplitude of 22.68%, a turnover rate of 28.04%, and a trading volume of RMB 457 million, indicating extremely high capital participation. According to the Dragon and Tiger List data, top foreign institutional investors showed a significant net buying trend: Goldman Sachs (China) Securities Shanghai Pudong New Area Century Avenue Branch net bought RMB 22.0738 million, JPMorgan Chase Securities (China) Shanghai Yincheng Middle Road Branch net bought RMB 21.3122 million, and Guotai Haitong Securities Headquarters net bought RMB 27.2652 million, with a combined net inflow of approximately RMB 45.0796 million[2]. The active influx of institutional capital provides solid financial support for the stock’s strong performance, and also reflects professional investors’ recognition of its fundamentals and growth logic.

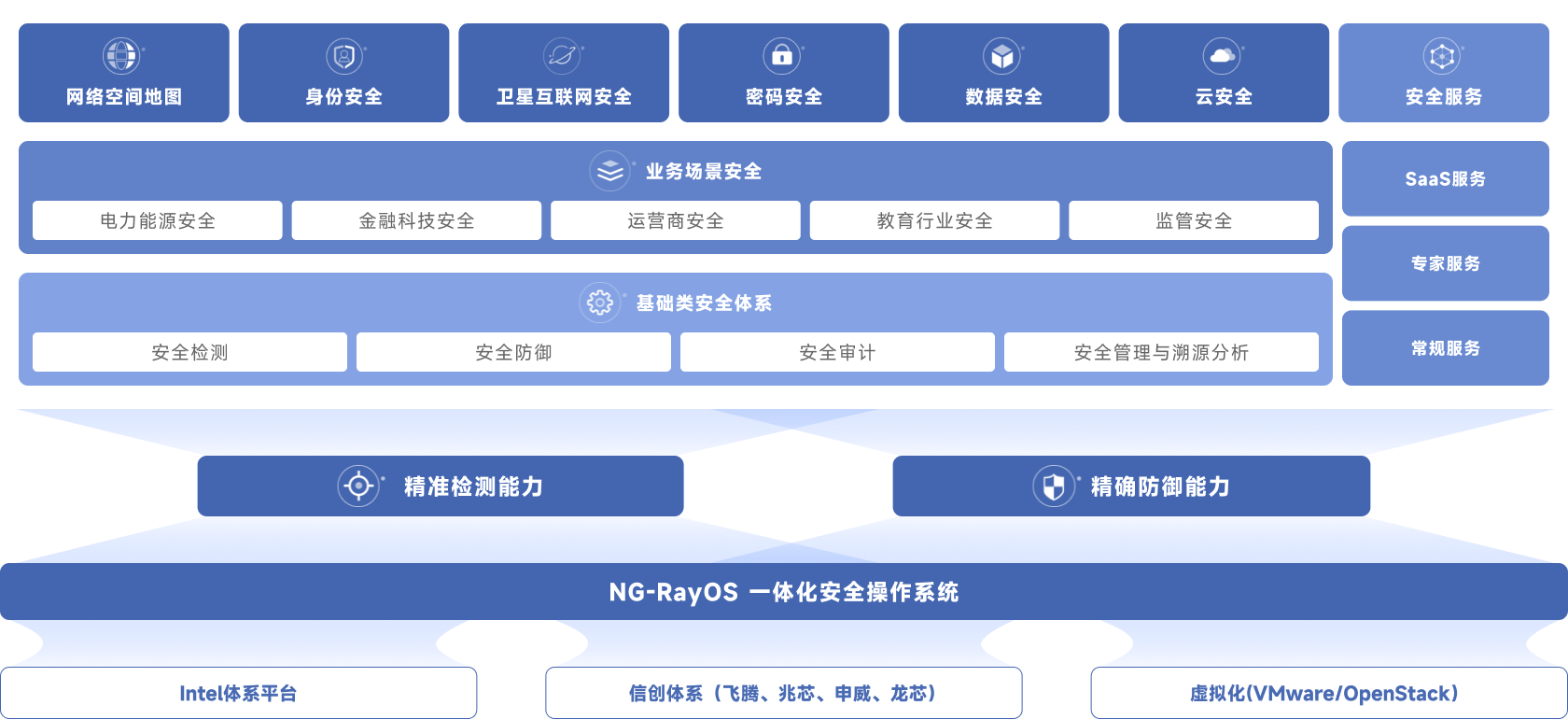

On January 7, the commercial space sector rallied collectively. As a “20CM” (20% daily limit) stock with satellite internet security business, Webray Security significantly benefited from the sector’s positive momentum[3]. Although the company’s satellite internet security business only accounts for 6.11% of its total revenue, its strategic layout in the space new infrastructure security field is forward-looking[4]. Webray Security has made a strategic investment in Weina Xingkong, laying out its presence in the space new infrastructure security field, and has reached a strategic cooperation with Zhongwang Weitong to build a full-chain product system covering satellite internet simulation, testing, mapping, and protection[4]. Against the backdrop of the rapid development of the commercial space industry and increased policy support, the company is expected to fully benefit from the industry’s dividend release, and this expectation has become an important factor supporting the stock price.

From a technical perspective, the stock shows typical characteristics of a strong stock: 6 consecutive limit ups indicate an extremely strong bullish trend, and the high turnover rate (28.04%) paired with high trading volume (RMB 457 million) indicates active capital acceptance and sufficient share turnover[2]. However, technical indicators also send risk warning signals: the short-term surge of over 100% means an extremely overbought state, the intraday amplitude of 22.68% shows high volatility, and the 28.04% turnover rate indicates that profit-taking investors have the motivation to exit quickly[2]. Key support levels to watch are around RMB 50 (intraday moving average) and RMB 45-47 (previous consolidation platform), while the previous high range of RMB 56-58 may face pressure from trapped investors unwinding their positions. If signals such as volume expansion without price increase, institutional sell-offs shown on the Dragon and Tiger List, or an overall pullback of the sector appear subsequently, investors need to be wary of the formation of a periodic top.

Webray Security holds multiple national-level certifications, including being a National Specialized, Sophisticated, Unique, and New “Little Giant” enterprise, a key software enterprise under national planning and layout, and a national-level cybersecurity emergency service support unit (only 13 such units nationwide)[4][6]. The company has a clear main business structure: cybersecurity products and services account for 77.56%, cyberspace mapping accounts for 16.23%, and satellite internet security business accounts for 6.11%[4]. The company has been selected into the “Top 50 Competitors in China’s Cybersecurity Industry” by the China Cybersecurity Industry Alliance for five consecutive years, and its vulnerability scanning and management products rank third in China’s response and orchestration software market[4]. In terms of financial indicators, the net asset per share is RMB 12.31, undistributed profit per share is RMB 0.7963, and its core information security business maintains a high gross profit margin[4]. However, the valuation corresponding to the current stock price is at a historical high, and the stock price surge is mainly driven by concept speculation, with the realization of performance yet to be verified in the future.

The strong performance of Webray Security reveals several important market characteristics: First, the intersection of commercial space and cybersecurity is emerging as a new hotspot for capital attention, reflecting the market’s forward-looking layout in the blue-ocean track of “space security”; Second, the active participation of top foreign institutional investors in Sci-Tech Innovation Board (STAR Market) stocks indicates their long-term optimism about domestic cybersecurity technologies and the independent and controllable strategy; Third, the 6 consecutive limit ups and 100% surge occurring at the beginning of 2026 suggests that the capital market’s risk appetite for high-growth tech stocks may be recovering in the new year. Notably, the company will hold its first extraordinary general meeting of shareholders in 2026, which may involve major strategic or business matters, providing a potential catalyst for the subsequent market performance[5].

The current strong performance of Webray Security is driven by multiple factors: the 100% surge with 6 consecutive limit ups coupled with the soaring popularity of the commercial space sector, substantial net purchases by top foreign institutional investors providing capital endorsement, and the satellite internet security concept aligning with the national strategic direction. The company’s fundamentals are supported by national-level certifications and technical strength, but the short-term surge has significantly deviated from the fundamental support range. The sustainability of the subsequent market performance depends on the continuation of the commercial space sector’s popularity, the company’s business progress announcements, and the realization of performance. Investors should closely monitor changes in trading volume, institutional movements on the Dragon and Tiger List, and the company’s announcements, and avoid blindly chasing the stock at extremely overbought levels.

[0] Jinling Analysis Database - Quantitative market data and technical indicators

[1] Sohu Securities - Webray Security Real-Time Market (https://q.stock.sohu.com/cn/688651/index.shtml)

[2] Sina Finance - Dragon and Tiger List | Webray Security Hits Daily Limit (https://finance.sina.com.cn/stock/aiassist/lgbzz/2026-01-07/doc-inhfnqzm6166814.shtml)

[3] Sina Finance - 6 Consecutive Limit Ups! 100% Surging Stock (https://finance.sina.com.cn/stock/roll/2026-01-07/doc-inhfnktp6272092.shtml)

[4] Webray Security Official Website - Company Introduction (https://www.webray.com.cn/about/index.html)

[5] Panorama News - Weekly Stock Review: Webray Security to Hold 2026 First Extraordinary General Meeting (http://stock.stockstar.com/RB2026010200000634.shtml)

[6] iFinD - Webray Security Successfully Shortlisted for State Grid Information & Telecommunication Group 2026 Core Team Labor Service Framework (http://m.10jqka.com.cn/20251212/c673168167.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.