Analysis of the Limit-Up of Oriental Pearl (600637): Valuation Reassessment Driven by Hyperfusion's Listing Expectations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Oriental Pearl (600637) strongly hit the upward limit on January 7, 2026, closing at ¥11.01 with a 9.99% increase and a trading volume of 167 million shares, representing a 122% increase compared to the average[0]. This limit-up was mainly catalyzed by Hyperfusion Digital Technologies Co., Ltd. submitting its listing guidance filing on January 6. Oriental Pearl invested RMB 499 million in Hyperfusion’s equity and is expected to share the dividends from its listing[1]. Meanwhile, the company’s strategic layouts in satellite internet (approximately 4.39% equity in Yuanxin Satellite) and AI content also provide long-term growth potential. However, the current P/E ratio reaches 75.3x, significantly higher than the industry average. In addition, institutional capital is in an outflow trend, and technical indicators have entered the overbought zone, so investors need to be wary of the risk of consolidation in the subsequent period.

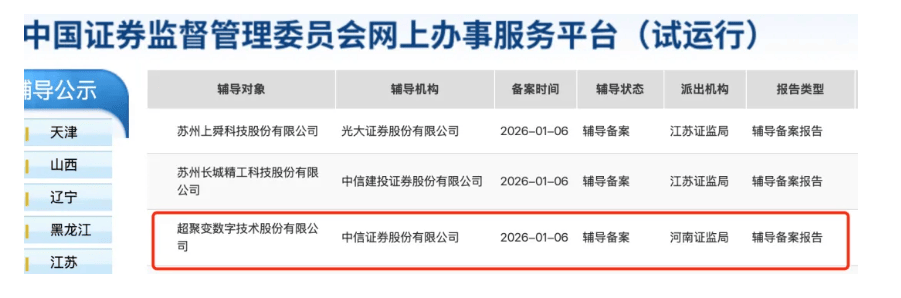

According to China Fund News, Hyperfusion Digital Technologies Co., Ltd. submitted its listing guidance filing to the Henan Securities Regulatory Bureau on January 6, 2026, with CITIC Securities serving as the guidance institution[1]. This news directly triggered Oriental Pearl’s limit-up movement. As a limited partner, Oriental Pearl invested a total of RMB 499 million of its own capital in two special funds: Zhengzhou Airport Economy Zone Advanced Computing Phase I and Phase II, with the core purpose of acquiring Hyperfusion’s equity[1]. Hyperfusion’s predecessor was Huawei’s X86 server business unit. After Huawei spun off this business in 2021, it settled in Zhengzhou, Henan. The market has high expectations for its listing, and Oriental Pearl, as an important investor, is expected to share significant investment returns.

Oriental Pearl indirectly holds approximately 4.39% of Yuanxin Satellite’s equity through Shanghai Information Investment. Yuanxin Satellite is the core operator of Shanghai’s “Qianfan Constellation” (China’s version of Starlink), which plans to deploy thousands of low-orbit satellites and accelerated its networking and commercialization process in 2025[2]. This layout has three investment logics: First, it seizes a strategic position in the scarce track of low-orbit satellite internet; Second, it can integrate the company’s 450,000-hour film and television copyright library with the satellite network to achieve industrial synergy; Third, if Yuanxin Satellite completes an IPO, it will bring significant financial appreciation to the company.

According to data from Eastmoney.com, multiple securities firms have given Oriental Pearl positive ratings: Jin Yuan Securities pointed out that the company “took the lead in realizing an AI monetization model” and gave an “Add” rating; Wanlian Securities and Guojin Securities gave “Add” and “Buy” ratings respectively[2]. The media industry had a good start in the New Year’s Day schedule, with sequels of top IPs performing prominently. In addition, the continuation of the “national subsidy” policy in 2026 is beneficial to the overall valuation recovery of the media sector.

From the analysis of technical indicators, the stock price has risen for 3 consecutive days, with a cumulative increase of 3.52%[3]. Today’s limit-up hit a 52-week high of ¥11.01, representing an increase of approximately 58% compared to the 52-week low of ¥6.96[0]. The current stock price is far from the 20-day moving average of ¥9.64, and the RSI (14) is about 75, which has entered the overbought zone[0]. From the capital perspective, the trading volume hit a recent high of 167 million shares (222% of the average 75.31 million), indicating active capital inflows[0]. However, it should be noted that on the same day, the net outflow of institutional capital in the digital media sector reached RMB 3.24 billion[4], and Oriental Pearl itself also saw a net outflow of institutional capital of RMB 5.99 million[5], while retail capital had a net inflow of RMB 2.957 billion[4]. This reflects that the limit-up was mainly driven by market sentiment and retail investors chasing the upward trend.

From a valuation perspective, the company’s current P/E (TTM) is approximately 75.3x, significantly higher than the industry average, while its ROE is only 1.64% and net profit margin is 6.46%, raising concerns about the matching degree between profitability and valuation[0]. In terms of fundamentals, the Q3 FY2025 revenue of RMB 172 million was 10.41% lower than expected, and the latest annual free cash flow was -RMB 931 million[0]. The accounting treatment is relatively conservative, and the high depreciation/capital expenditure ratio means there is certain room for profit adjustment. It is necessary to closely monitor the company’s performance improvement and the substantial progress of Hyperfusion’s IPO.

Oriental Pearl’s investment logic is transforming from a single digital media target to a “technology + media” dual-driver model. The equity investment in Hyperfusion represents the company’s layout in the computing power infrastructure field, while the shareholding in Yuanxin Satellite reflects the company’s forward-looking strategic position in the satellite internet track. If these two investments achieve IPO or business implementation in the future, they will bring significant valuation reassessment opportunities for the company. Meanwhile, taking the lead in realizing an AI content monetization model is expected to achieve cost reduction and efficiency improvement in the media industry ahead of peers.

From a market perspective, Oriental Pearl has increased by 50.20% in the past year and 47.00% in the past six months[0], but compared with the overall performance of the technology growth sector in the same period, its growth has a certain catch-up nature. The news of Hyperfusion’s listing guidance provided a clear catalytic timing for the market, pushing the stock price to a historical high. However, it should be noted that the market’s attention to the media sector has increased overall, and it is necessary to distinguish whether it is driven by fundamentals or sentiment.

A noteworthy structural feature is the divergence phenomenon where institutional capital has a net outflow while retail capital has a substantial net inflow[4]. This pattern of “institutional withdrawal and retail taking over” often means that short-term fluctuation risks are rising, and the sustainability of the limit-up order needs to be closely tracked. If the turnover rate increases sharply and the limit-up order is not firm in the subsequent period, it is necessary to be wary of the profit-taking pressure after the limit-up is broken.

Short-term (1-2 weeks): Focus on the announcement of Hyperfusion’s IPO progress and the company’s performance forecast, and be wary of technical pullbacks.

Medium-term (1-3 months): Observe the progress of satellite internet business implementation and the effectiveness of the AI monetization model.

Long-term (more than 6 months): Evaluate the realization of investment returns after Hyperfusion’s listing.

The core driver of Oriental Pearl’s limit-up today is the valuation reassessment brought by the expectation of Hyperfusion’s listing guidance. The company’s RMB 499 million investment in Hyperfusion’s equity is expected to share its listing dividends[1]. The company’s strategic layouts in satellite internet (Yuanxin Satellite) and AI content provide long-term growth potential[2]. However, investors should pay attention to the following objective facts: there are concerns about the matching degree between the current valuation level (P/E 75x) and profitability (ROE 1.64%)[0]; institutional capital is in an outflow trend while retail investors’ sentiment of chasing upward trends is obvious[4]; technical indicators have entered the overbought zone, and the stock price is far from the moving average[0]. It is recommended to focus on the substantial progress of Hyperfusion’s IPO, the company’s performance improvement, and changes in capital flows in the subsequent period, with consolidation as the main judgment tone in the short term.

[0] Jinling Analysis Database - Market Data, Technical Indicators, Financial Analysis

[1] China Fund News - Three Major A-Share Indices Rose Across the Board, Hyperfusion Launched Listing Guidance

https://www.chnfund.com/article/ARd3f6adc4-f74e-7db1-63c9-3a1ea8901562

Release Time: 2026-01-07 10:52

[2] Eastmoney.com - Institutional Ratings for Oriental Pearl (600637)

http://quote.eastmoney.com/sh600637.html

Institutional Rating Period: January 5, 2026 to January 6, 2026

[3] Sina Finance - Oriental Pearl’s Stock Price Rises 6.49%, Hwabao Fund Holds a Heavy Position

https://finance.sina.com.cn/money/fund/aiassistant/zcgyd/2026-01-07/doc-inhfmtvz7740613.shtml

Release Time: 2026-01-07

[4] Sohu - Digital Media Index Rose Slightly, Oriental Pearl Led the Market Rebound

https://m.sohu.com/a/973572109_122066678

Release Time: 2026-01-07

[5] NetEase - Cloud Gaming Concept Rises 4.64%, Institutional Capital Flows Into These Stocks

https://m.163.com/dy/article/KIHAUHRU053469RG.html

Release Time: 2026-01-07

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.