IPPs Face Competition From Distributed Power In Race To Energize Data Centers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The competitive dynamics described in the January 6, 2026 Seeking Alpha report represent a fundamental restructuring of the power generation value chain for large-load customers [1]. This transformation is occurring against the backdrop of unprecedented data center power demand, with projections indicating demand could triple by 2030 and data centers driving a 22% power demand increase in 2025 alone [2][5]. The convergence of AI infrastructure growth, manufacturing reshoring, and transportation electrification has created a supply-demand imbalance that traditional grid infrastructure cannot address within conventional timelines.

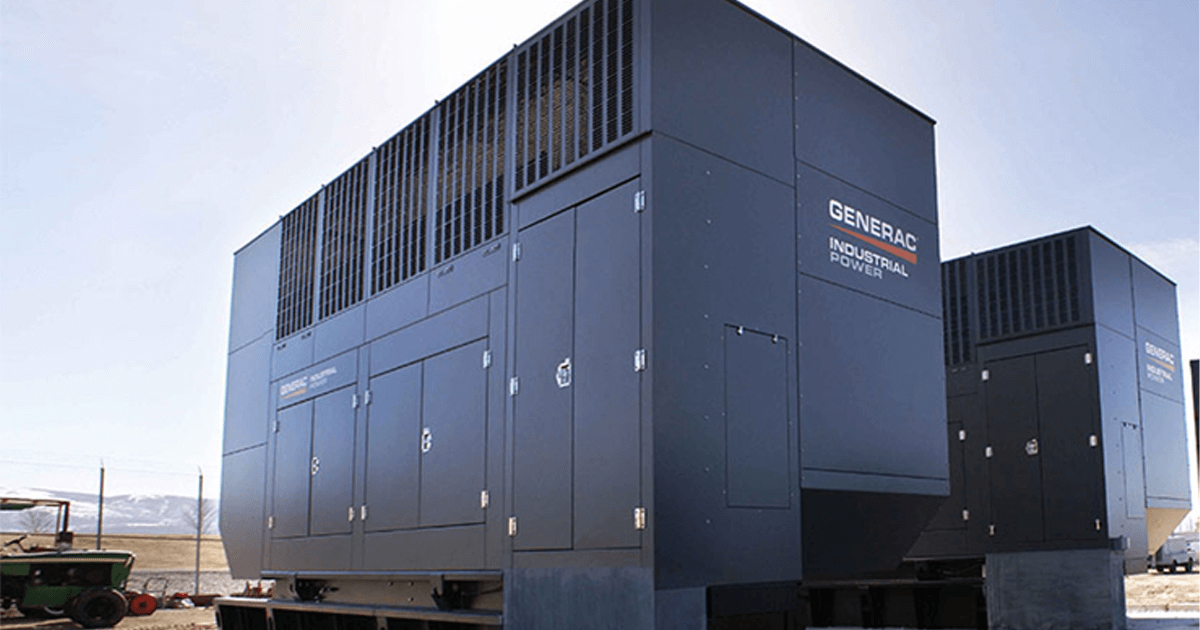

The core competitive advantage of distributed power providers lies in their ability to address the “time-to-power” constraint that has become the primary limiting factor for data center development. Grid congestion and interconnection delays—particularly the absence of federal rules for load interconnection queues, which fall under state public utility commission jurisdiction—have elevated power access to the key gating variable for growth, overtaking capital and land as the primary constraints [4][9]. Distributed power providers offering combinations of small gas turbines, reciprocating engine generators, battery storage, and renewable energy effectively bypass these grid dependencies by deploying behind-the-meter solutions.

The entry of oilfield service companies into this market represents a particularly significant competitive development. Halliburton, through its VoltaGrid partnership, has committed 400 MW for data center power in the Eastern Hemisphere, leveraging expertise with turbine and engine technologies originally developed for oilfield operations [10]. Baker Hughes is similarly positioned to supply modular power solutions. These companies can repurpose existing mobile power assets from oilfield applications for rapid, cost-effective modular deployment, often outpacing traditional IPPs in speed and efficiency [1].

The distributed power disruption reveals several structural changes in the energy industry that extend beyond immediate competitive dynamics. First, the market is experiencing a fundamental shift from grid-dependent power procurement to on-site generation solutions, with up to 25 GW of behind-the-meter power expected to be deployed over the next five years [11]. This represents a permanent change in how large-load customers approach power infrastructure planning.

Second, the competitive landscape is expanding to include players from adjacent industries who possess transferable technological expertise. Oilfield service companies bring experience with mobile, modular power systems that translates directly to data center applications. The Superpower turbines from Boom Supersonic, for example, deliver 42 MW of ISO-rated power in a package roughly the size of a shipping container, enabling modular deployment that traditional generation developers cannot match [13].

Third, traditional IPPs are responding strategically through consolidation rather than organic capability development. The Constellation Energy acquisition of Calpine Corporation for $29.4 billion—the largest energy sector deal in 2025—demonstrates the premium being placed on existing generation assets and operational capabilities [16]. This M&A trend is likely to continue as IPPs seek to compete with the agility of distributed power providers.

Fourth, the supply chain is adapting to support modular deployment, with companies like Vertiv, Schneider Electric, and Eaton aligning around standardized power and cooling systems [20]. This standardization enables faster deployment while creating new dependencies on specialized equipment providers.

The analysis reveals distinct risk and opportunity profiles for different market participants. For distributed power providers, the primary opportunity lies in capturing market share from incumbents while grid interconnection delays persist. Crusoe Energy’s $11.6 billion in debt and equity financing demonstrates strong investor confidence in the model [12]. However, execution risk remains significant, particularly regarding operational reliability at scale and maintaining quality standards during rapid expansion.

For IPPs and utilities, the risks include potential erosion of customer relationships and revenue streams if distributed power solutions become the preferred approach for new data center loads. The regulatory uncertainty surrounding large-load interconnection adds complexity to planning and investment decisions. However, IPPs retain advantages in scale, financing capabilities, and existing infrastructure that could prove decisive as the market matures and reliability requirements become more stringent.

For data center operators and hyperscalers, the shift toward distributed power introduces new considerations for capital allocation and operational management. While behind-the-meter solutions offer faster power access and greater operational independence, they also require expertise in power generation operations that traditionally fell to utilities. The 20-year power purchase agreement between Constellation Energy and Microsoft illustrates how traditional procurement models are evolving to address these new dynamics [17].

The overall market trajectory suggests a multi-year transition period during which multiple approaches coexist. Grid interconnection reform, if implemented through FERC rulemaking, could alter competitive dynamics by reducing delays for traditional utility connections [4]. However, even with regulatory improvements, the scale of data center power demand is likely to exceed grid capacity in many regions, maintaining the opportunity for distributed solutions.

The offsite data center power infrastructure market, valued at USD 15.9 billion in 2025, is projected to reach USD 79.76 billion by 2035, representing a compound annual growth rate of 17.50% [7]. The global data center power management market is calculated at USD 8.17 billion in 2025, predicted to increase to approximately USD 16.04 billion by 2035 [8]. These market projections underscore the substantial scale of opportunity and competitive investment flowing into this sector.

The PJM capacity auction results for the 2027/28 capacity year illustrate the financial stakes involved: Constellation Energy cleared 17,950 MW generating approximately $2.2 billion, Vistra cleared 10,566 MW for $1.3 billion, and Talen Energy cleared 8,745 MW for $1.1 billion [18]. These figures demonstrate the revenue significance of capacity commitments to data center loads.

Technology diversification is accelerating beyond natural gas turbines. Crusoe’s partnership with Redwood Materials to launch Redwood Energy, using recycled battery packs in microgrid configurations, exemplifies innovation in storage integration [19]. Fuel cells and small modular reactors may gain traction in coming years as data center operators seek decarbonization options alongside reliability [11].

The microgrid-as-a-service market is projected to grow to USD 8.3 billion, with Schneider Electric leading at approximately USD 1.2 billion in microgrid-related revenues in 2025 [14]. This service model offers data center operators alternatives to direct ownership of generation assets while maintaining power reliability requirements.

As one industry analysis noted, “The market’s really just a demand play, at least in the short term, until the forecast related to data center growth and AI growth crystallize a little bit better” [16]. This observation captures the current market dynamic in which supply-side solutions race to keep pace with demand growth, creating opportunities for innovative competitors while challenging traditional industry structures.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.