In-Depth Analysis of the Reasons for Topps Tiles' Consecutive Five-Quarter Same-Store Growth and Its Market Reference Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

:fill(white)/https://www.toppstiles.co.uk/static/media/magestore/storepickup/images/store/gallery/m/0/000226_04.jpg)

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and industry information, I will prepare a detailed analysis report for you.

Topps Tiles Plc (London Stock Exchange ticker: TPT.L) is a leading UK tile and flooring retailer with approximately 300 stores. The company achieved a significant performance turnaround in FY2025 (for the year ended September 27, 2025), with full-year same-store sales growth of 5.3%, representing a substantial improvement from the 9.1% decline in the previous fiscal year [0][1]. This growth momentum has lasted for five quarters, marking the company’s entry into a steady recovery trajectory.

In terms of stock performance, TPT.L has risen 19.62% over the past year, with a current share price of $44.50 and a market capitalization of approximately £87.5 million [0]. The company generated revenue of £295.8 million in FY2025, a year-on-year increase of 17.5%, and turned around from a pre-tax loss of £16.2 million in the previous year to a pre-tax profit of £8.3 million [1].

The core driver of Topps Tiles’ same-store growth comes from the strong performance of its trade customer business. The company’s management has clearly identified B2B business as a strategic priority, and this strategy achieved remarkable results in FY2025:

- Growth in Active Trade Customers: The number of active trade customers reached 152,000, a year-on-year increase of 12% [1]

- Surge in Online Trade Traffic: Online trade traffic increased 66% year-on-year [1]

- Surging Online Trade Sales: Topps Tiles’ online trade sales increased 70% year-on-year [1]

- Increase in Total Trade Sales: Total trade sales under the Topps Tiles brand increased 13.3% year-on-year [1]

Vince Deery, CEO of the company, stated that the strong performance of the trade business “demonstrates resilience and discipline in a complex and uncertain macroeconomic environment” [1]. Approximately 75% of the company’s revenue comes from trade customers, who are mainly professional decorators and contractors with relatively stable demand and high repurchase rates.

The company continues to advance its digital transformation, achieving important progress in FY2025:

- Increased Share of Online Sales: The group’s online sales share (excluding CTD) reached 21.1%, an increase of 2.6 percentage points from 18.5% in the previous year [1]

- Rapid Growth of Professional Tools Platform: Sales of Pro Tiler Tools (online professional tools platform) reached £35.2 million, a year-on-year increase of 22.2% [1]

- Explosive Growth of Tile Warehouse: Tile Warehouse’s sales increased 82.4% year-on-year to £3.1 million [1]

- Steady Growth of Parkside: Sales of the Parkside brand increased 11.8% year-on-year to £8.5 million [1]

The online pure-play business grew 25.6% overall to £38.3 million, becoming the group’s fastest-growing business segment [1].

The acquisition of CTD (Ceramic Tiles Direct) in August 2024 brought approximately £30.4 million in sales revenue to the group [1] and significantly accelerated the group’s trade strategic layout. In November FY2025, the company acquired the IP, website, and inventory of the Fired Earth brand, a high-end complementary brand [1]. Through these acquisitions, the group currently owns five tile-focused trade brands, forming a brand matrix covering different market segments.

While growing on the revenue side, the company focuses on improving operational efficiency:

- Improved Gross Margin: The group’s adjusted gross margin increased by 0.5 percentage points [1]

- Growth in Transaction Volume: The momentum for same-store growth comes from increased transaction volume driven by improved conversion rates, although average transaction value (ATV) remained basically flat [1]

- Inventory Optimization: The company continues to optimize supply chain and inventory management, disposed of 3 non-core stores, and completed the integration of operations for the remaining 22 stores [1]

Topps Tiles’ performance can serve as an important lagging indicator of the health of the UK real estate market. As a building materials retailer targeting the renovation market, its business performance directly reflects the decoration demand after property transactions and consumers’ willingness to invest in property improvement.

The UK real estate market showed unexpected resilience in 2025. Despite facing high mortgage rates and economic uncertainty, market activity stabilized and housing prices maintained a growth trend [2][3]. Data from RICS (Royal Institution of Chartered Surveyors) shows that mortgage approval rates increased quarter by quarter in 2025, rising 1% compared to the previous year [3]. This trend is highly consistent with Topps Tiles’ same-store growth trajectory.

Topps Tiles’ management stated in the FY2025 annual report that “sales growth in the first nine weeks of the new fiscal year slowed due to weakened consumer confidence” [1]. This statement reveals the close correlation between building materials retail performance and consumer confidence.

The UK mortgage market underwent significant changes in 2025:

- Bank rates were cut continuously over 18 months [3]

- Swap rates stabilized, and inflation approached the target level [2]

- Mortgage predictability improved, which is a positive signal for both buyers and sellers [2]

- Mortgage reforms will improve the borrowing capacity of homebuyers [3]

However, Oxford Economics predicts that UK GDP growth will slow in 2026, unemployment will rise, and economic conditions are expected to improve from 2027 onwards [4]. This uncertainty about the economic outlook directly affects consumers’ willingness to spend on home improvements.

The structural characteristics of the UK housing market provide sustained demand support for building materials retail:

- Severe Aging of Housing: The UK’s existing housing stock is generally aging, and homeowners need to continuously invest in maintenance and renovation [5]

- Stable Renovation Activities: The 2025 UK Houzz & Home Report shows that 51% of homeowners carried out renovations in 2024, up from 48% in 2023 [5]

- Growth in Renovation Spending: The median homeowner renovation spending increased 26% from £17,000 in 2023 to £21,440 in 2024 [5]

- Positive Future Plans: 60% of homeowners plan to carry out decoration in 2025, and 49% plan to carry out renovations [5]

These data indicate that even when new housing market activity slows, the renovation demand for existing housing still provides a stable business foundation for Topps Tiles.

Topps Tiles’ business performance provides a stratified perspective on UK consumer spending trends:

Topps Tiles’ growth trajectory reveals several important shifts in UK consumer behavior:

- From New Housing to Existing Housing Renovation: As the new housing market is constrained by high interest rates, more consumers are investing in improvements to their existing housing

- Integration of Online and Offline Channels: The company’s online sales share increased from 18.5% to 21.1%, and consumers are accustomed to a hybrid model of online research and offline purchase [1]

- Recognition of the Value of Professional Services: The growth of trade customer business (+13.3%) indicates that consumers prefer to hire professionals to complete renovation projects rather than doing it themselves (DIY) [1]

The direct statement by Topps Tiles’ management about weakened consumer confidence provides a “canary in the coal mine” effect for assessing UK consumer spending trends:

- FY2025 full-year same-store growth was 5.3%, but same-store growth slowed to 2.0% in the first nine weeks of the new fiscal year [1]

- Sales growth (including CTD) fell from 3.9% for the full year to 3.3% in the first nine weeks [1]

- This slowdown coincided with the weakening of market sentiment ahead of the 2025 Autumn Budget [4]

This indicates that building materials retail performance is highly sensitive to changes in consumer confidence and can be used as a leading indicator for predicting broader consumer spending trends.

| Metric | Value | Assessment |

|---|---|---|

| Market Capitalization | £87.5 million | Small-cap stock |

| P/E (TTM) | 14.61x | Moderate, below industry average |

| P/B | 11.32x | Relatively high |

| ROE | 99.37% | Extremely high (leverage effect) |

| P/S | 0.30x | Relatively low |

From a valuation perspective, TPT.L’s P/E and P/S metrics indicate that its pricing is relatively reasonable, especially considering the company has just returned to profitability from a loss [0].

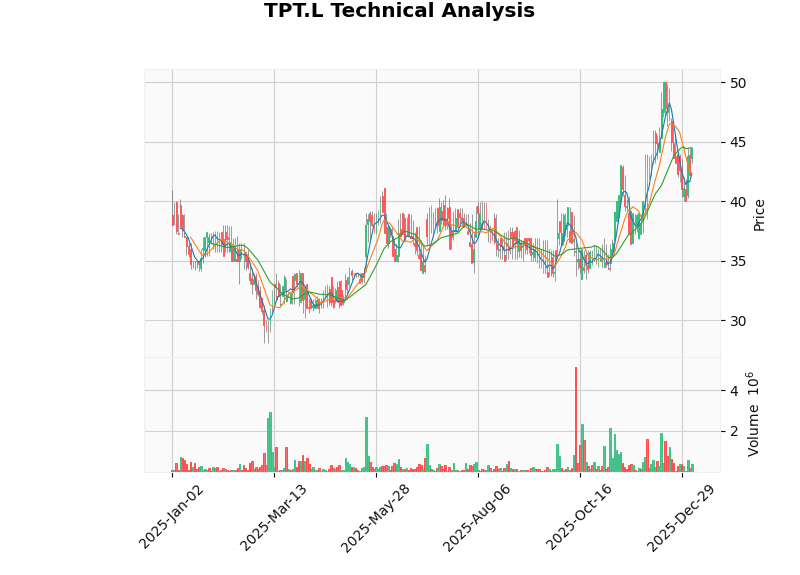

Technical analysis shows that TPT.L is currently in a sideways consolidation pattern:

- Current Price: $44.50

- Reference Trading Range: $43.14 - $45.86 [7]

- Beta Coefficient: 0.82 (lower volatility relative to the FTSE Index) [7]

- MACD Indicator: No crossover, showing a neutral-weak signal [7]

- KDJ Indicator: Showing a buy signal [7]

- Financial Risk: Financial analysis shows that debt risk is classified as “high risk” [0]

- Sensitivity to Consumer Confidence: The company’s performance is highly sensitive to changes in consumer sentiment [1]

- Economic Cycle Dependence: The business is highly correlated with the real estate market cycle

- Intensified Competition: The DIY retail market is highly competitive, with strong competitors such as B&Q and Homebase continuing to exert pressure

- Cost Pressure: Rising inflation and labor costs may compress profit margins [1]

- Interest Rate Downward Cycle: Continuous interest rate cuts by the Bank of England will improve consumer purchasing power [2][3]

- B2B Channel Expansion: The network effect of 152,000 active trade customers is expected to continue to be unleashed

- Brand Portfolio Optimization: The acquisitions of CTD and Fired Earth will bring synergies

- Online Channel Growth: There is still room for increasing the share of online sales

- Mission 365 Strategy: B2B projects targeting £35m-£40m sales opportunities are underway [1]

Topps Tiles’ consecutive five-quarter same-store sales growth is the result of multiple factors: strategic breakthrough in B2B trade business (+13.3%), continuous advancement of digital transformation (+66% online trade traffic), and scale effects from acquisition expansion. This growth trajectory reflects a new characteristic of the UK real estate market in the post-pandemic era – the structural growth of renovation demand for existing housing.

From a macro perspective, Topps Tiles’ performance can serve as a reliable indicator for assessing the UK real estate market cycle and consumer spending trends:

- Real Estate Market: Showing resilience in a high interest rate environment, with existing housing renovation demand offsetting the slowdown in the new housing market

- Consumption Stratification: Strong demand for high-end renovations among high-income groups, while middle-income groups shift to cost-sensitive DIY

- Confidence Barometer: The company’s performance is highly sensitive to changes in consumer confidence

[0] Jinling AI Financial Database - Topps Tiles Company Overview and Financial Data

[1] Morningstar - “EARNINGS: Topps Tiles’ growth since year-end eases; Gooch profit rises” (https://global.morningstar.com/en-gb/news/alliance-news/1764672973608563200/earnings-topps-tiles-growth-since-year-end-eases-gooch-profit-rises)

[2] Rettie - “UK Mortgage Market Update 2025–2026” (https://www.rettie.co.uk/blog/looking-ahead-to-2026-your-mortgage-market-guide)

[3] RSM UK - “UK housing tracker outlook - Q3 2025” (https://www.rsmuk.com/insights/advisory/uk-housing-tracker-outlook)

[4] Savills - “UK Housing Market Update - December 2025” (https://en.savills.es/research_articles/263315/383408-0)

[5] KBBFocus - “Key findings from the 2025 UK Houzz & Home Report” (https://kbbfocus.com/news/5027-key-findings-from-the-2025-uk-houzz-home-report)

[6] Mintel Store - “UK DIY Retailing Market Report 2025” (https://store.mintel.com/report/uk-diy-retailing-market-report)

[7] Jinling AI Financial Database - Topps Tiles Technical Analysis Report

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.