Weili Medical (603309) 2025 Performance Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected information, I will provide you with a detailed analysis of the root causes of the sharp decline in Weili Medical’s 2025 performance and its future recovery prospects.

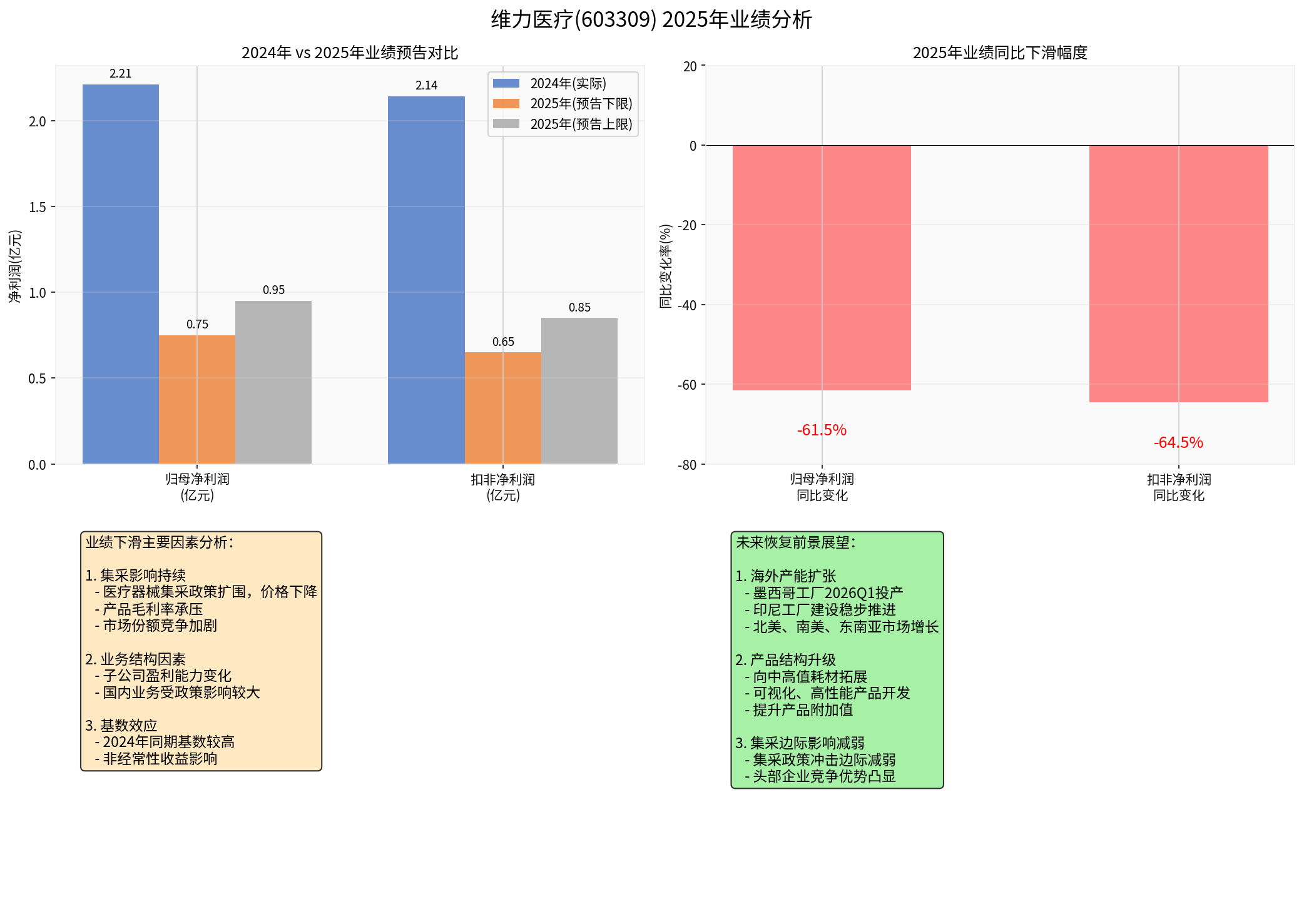

According to the information provided, Weili Medical’s 2025 performance forecast shows [0][1]:

| Indicator | 2025 Forecast | 2024 Actual | YoY Change |

|---|---|---|---|

| Net Profit Attributable to Parent Companies | RMB 75 million - 95 million | Approx. RMB 221 million | Down 57% - 66% |

| Net Profit After Deducting Non-recurring Gains and Losses | RMB 65 million - 85 million | Approx. RMB 214 million | Down 60% - 69% |

- The centralized procurement policy for medical devices has been expanding rapidly since 2023, exerting significant price pressure on low-value consumables [1]

- Centralized procurement has led to a decline in product gross margins, and the company’s traditional products are facing substantial price competition pressure

- The distribution model has been impacted, with the company’s domestic distribution revenue falling by approximately 60% year-on-year in 2024

- Domestic operations are significantly affected by policies: In 2024, the company’s domestic revenue reached approximately RMB 452 million, down 55.23% year-on-year, with a gross margin of approximately 67.23%, a year-on-year decrease of approximately 6.98 percentage points [1]

- Changes in subsidiary profitability: The performance of some subsidiaries has declined, negatively affecting overall profits

- Business integration costs: The company is in a period of product structure and market layout adjustment, resulting in certain one-time costs

- The base for the same period in 2024 was relatively high, with net profit attributable to parent companies reaching approximately RMB 221 million in 2024, resulting in a significant base effect

- In 2024, the company’s investment cost in a joint venture was lower than the fair value of the identifiable net assets of the investee entity that it was entitled to at the time of investment, resulting in a large non-operating income

According to the latest financial data [0]:

| Indicator | Value | Evaluation |

|---|---|---|

| Market Capitalization | USD 414 million | Mid-sized medical device enterprise |

| P/E | 16.95x | Valuation is in a reasonable range |

| ROE | 12.81% | Strong profitability |

| Net Profit Margin | 14.94% | Maintains positive profitability |

| Current Ratio | 1.77 | Good short-term solvency |

| Debt Risk | Low Risk | Robust financial structure |

- Mexico Factory: The first-phase construction is expected to be completed and put into operation in the first quarter of 2026 [1]

- Indonesia Factory: Currently in the construction and pre-product certification stage, and is expected to gradually start shipping by the end of the first quarter of 2026

- Market Expansion: Rapid growth has been achieved in regions such as North America, South America, and Southeast Asia, and the proportion of overseas business continues to increase

- Expanding into mid-to-high value consumables, transforming from low-value consumables to high-value-added products [1]

- Launched innovative products such as visual double-lumen endotracheal tubes, reinforced flexible endotracheal tubes, and neuro-monitoring endotracheal tubes

- Enhance product value-added and improve profitability

- The marginal impact of the centralized procurement policy is weakening, and the competitive advantages of leading enterprises are gradually emerging [1]

- The company is expected to achieve volume growth through price concessions via centralized procurement, rapidly increasing its market share

- Starting from the second quarter of 2025, the price base effect will gradually be eliminated

- The implementation of new healthcare reform policies and the acceleration of the domestic substitution process for medical devices

- The company’s products have effectively covered more than 4,000 hospitals across the country, including over 1,000 tertiary hospitals [1]

- Brand awareness has increased, and market position has been strengthened year by year

- Rapid growth of overseas business: In 2024, overseas business revenue reached RMB 353 million, a significant year-on-year increase of 78%

- The Mexico and Indonesia factories are soon to be put into operation, which is expected to contribute new growth drivers

- Product structure upgrade provides room for gross margin improvement

- Robust financial structure with strong risk resistance capabilities

- Uncertainty risk of centralized procurement policies

- International trade frictions may affect overseas business

- The construction progress of overseas factories may fall short of expectations

- Risk of intensified industry competition

Weili Medical’s significant performance decline in 2025 is mainly due to the combined impact of the continuous influence of centralized procurement policies, pressure on domestic operations, and base effects. The company is actively responding by seeking performance recovery through measures such as

From a long-term perspective, as the impact of centralized procurement diminishes at the margin, overseas factories are put into operation, and the proportion of high-value-added products increases, the company’s performance is expected to

[0] Jinling API Financial Data - Weili Medical (603309) Company Profile and Financial Analysis

[1] Huaan Securities - 2025 Mid-year Report Summary and Outlook for the Medical Device Industry: High-value Consumables Emerge from the Impact of Centralized Procurement

[2] Pacific Securities - Focus on Innovation, Embark on a New Journey - 2026 Annual Investment Strategy for the Medical Device Industry

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.