In-depth Analysis of Investment Opportunities from Policies on the Integration of Industrial Internet and AI

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected policy information and market data, I will systematically evaluate the investment opportunities brought by policies on the integration of industrial internet and artificial intelligence.

Based on the Action Plan for Industrial Internet and Artificial Intelligence Integration and Empowerment recently deployed by the Ministry of Industry and Information Technology (MIIT) and the spirit of the 2026 National Work Conference on Industry and Information Technology, the core policy measures focus on the following four directions [1][2]:

- Accelerate integrated application of “three types of computing centers”: Promote deep integration of industrial internet with general computing centers, intelligent computing centers, and supercomputing centers

- Open public computing power services: Encourage public computing power service providers to offer inclusive computing power services to industrial enterprises

- Accelerate edge device deployment: Guide industrial enterprises to speed up the deployment of edge computing devices and promote intelligent upgrading of end-side devices

- Cultivate a batch of key industry intelligent agentsandAI-native enterprises

- Support research and development of next-generation intelligent manufacturing systems and equipment

- Expand the industrial internet platform system and advance the intelligent development of all industrial factors [1]

- As of 2025, a total of over 7,000 advanced-level and 500+ outstanding-level smart factorieshave been built [1]

- The number of national industrial 5G private network projects exceeds 20,000, and there are over 8,000 5G-enabled factories nationwide

- China’s intelligent computing power scale is projected to reach 1037.3 EFlopsby the end of 2025, representing a year-on-year growth of over 40% [3]

According to IDC data, China’s intelligent computing power scale stood at 75.0 EFLOPS in 2020, and is expected to reach

| Company | Core Logic | 2025 Highlights |

|---|---|---|

Sugon (603019) |

Leading domestic computing power infrastructure provider, deeply compatible with domestic chips such as Cambricon and Hygon | AI server revenue accounts for over 60% of total revenue [4] |

Inspur Information (000977) |

Global leader in AI servers | AI server shipments surged 120% year-on-year [4] |

Foxconn Industrial Internet (601138) |

Leading manufacturer of AI servers | Revenue from GPU-based AI servers in the first three quarters grew over 300% year-on-year [5] |

Unisplendour (000938) |

Integrated solutions provider for cloud computing and servers | AI cloud service revenue increased by 90% [4] |

- Domestic substitution has shifted from “policy-driven” to “market-oriented”, with the market share of domestic AI chips rising rapidly

- Domestic computing power ecosystems such as Huawei Ascend, Cambricon, and Hygon Information are increasingly improving [5]

- Liquid cooling technology is expanding from large data centers to broader application scenarios, significantly benefiting related enterprises

The policy explicitly proposes to “promote intelligent upgrading of end-side devices”, making industrial edge computing a key hub connecting cloud computing power and industrial scenarios [2].

| Sub-sector | Representative Companies | Competitive Advantages |

|---|---|---|

Edge Computing Chips |

Cambricon (688256), Hygon Information (688041) | Continuous enhancement of end-side AI inference capabilities |

Edge Computing Devices |

Meig Smart (002881), Fibocom Wireless (300638), Quectel Wireless (603236) | Leading 5G+AI module technology |

Industrial Edge Boxes |

Yingxueguang, Nengke Technology (603859) | Customized solutions for industrial scenarios |

Smart Terminals |

ZTE Corporation (000063), Topway Information (002261) | Intelligent upgrading of end-side devices |

- Industrial AI edge computing boxes have become standard equipment in smart factories

- The blue-ocean market for automotive-grade AI chips (e.g., intelligent driving domain controllers) has opened up [6]

- Collaboration between 5G private networks and edge computing accelerates the implementation of industrial scenarios

- Develop high-quality industry datasets and formulate scenario maps for digital transformation in key industries

- Establish high-standard digital parks and deepen the special action for digital empowerment of small and medium-sized enterprises (SMEs)

- Promote the new model of “Industry Brain + Future Factory” [2]

| Company | Sub-sector | Investment Logic |

|---|---|---|

Baosight Software (600845) |

Dual leader in industrial software + IDC services | IDC revenue accounts for 30% of total revenue, with synergies from industrial AI solutions [4] |

Orient National Information (300166) |

Industrial internet platform | Deep accumulation of industrial big data technologies |

Supcon Technology (688777) |

Industrial automation | Leading provider of intelligent manufacturing system solutions |

Digiwin Software (300378) |

Industrial software | Core supplier for digital transformation in the manufacturing industry |

Yonyou Network (600588)/Kingdee International (0268.HK) |

Enterprise service SaaS | Main force in digital empowerment of SMEs |

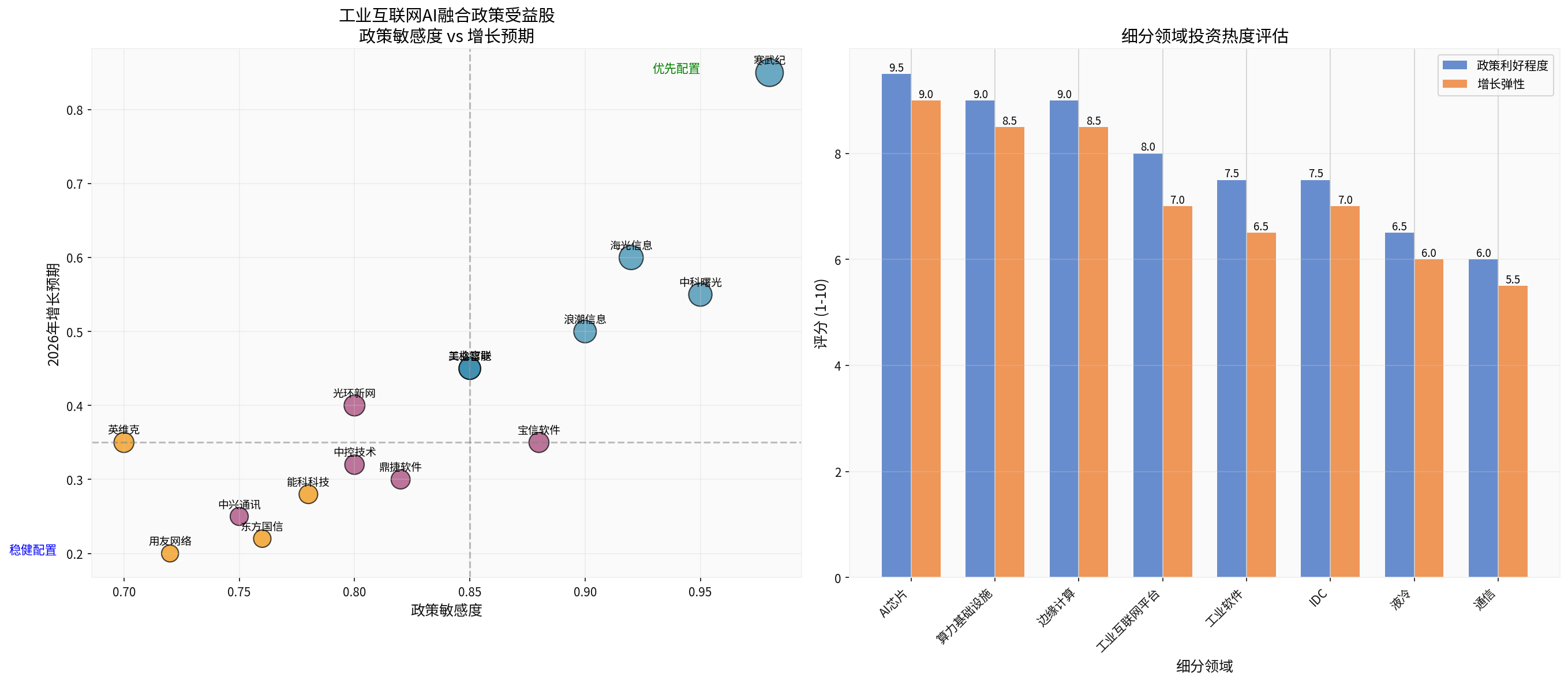

An investment matrix is constructed based on two dimensions: policy sensitivity and growth expectations:

- Cambricon (688256): Leading AI chip designer; revenue in the first three quarters of 2025 surged 2386.38% year-on-year, with net profit attributable to parent company turning from loss to profit [5]

- Sugon (603019): Core supplier of domestic computing power infrastructure, with leading liquid cooling technology

- Hygon Information (688041): Shipments of DCU chips increased by 180%; core domestic chip for AI training and inference

- Inspur Information (000977): Global leader in AI servers, benefiting from the explosive growth of computing power demand

- Foxconn Industrial Internet (601138): Leading foundry for AI servers, with performance consistently exceeding expectations

- Meig Smart (002881): Core target for edge computing power bearing platforms

- Baosight Software (600845): Dual beneficiary of industrial internet platforms and IDC services

- ZTE Corporation (000063): Integrated solution provider for 5G + industrial internet

| Sub-sector | Core Targets | Policy Favorability | Growth Elasticity |

|---|---|---|---|

| Intelligent Computing Centers/General Computing Centers/Supercomputing Centers | Sugon (603019), Inspur Information (000977), Foxconn Industrial Internet (601138), Unisplendour (000938) | ★★★★★ | High |

| Edge Computing Devices | Meig Smart (002881), Fibocom Wireless (300638), Quectel Wireless (603236), Yingxueguang | ★★★★★ | High |

| Industrial AI Chips | Cambricon (688256), Hygon Information (688041), Huawei Ascend | ★★★★★ | High |

| Industrial Internet Platforms | Baosight Software (600845), Orient National Information (300166), Yonyou Network (600588), Kingdee International (0268.HK) | ★★★★☆ | Medium-High |

| Industrial Software/Industrial AI Applications | Digiwin Software (300378), Nengke Technology (603859), Supcon Technology (688777), Sailvan Information (300687) | ★★★★☆ | Medium-High |

| 5G Private Networks/Industrial Communications | ZTE Corporation (000063), Ruijie Networks (301396), Senter Communications (688702), WUS Printed Circuit (002463) | ★★★☆☆ | Medium |

| Data Centers/IDC | Cloudnet (300383), Aofei Data (300738), Runze Technology (301191), KELONG (002335) | ★★★★☆ | Medium-High |

| Liquid Cooling Heat Dissipation Technology | Envicool (002837), Suning Environment (301018), Golandwater (300499) | ★★★☆☆ | Medium |

- Focus on performance certainty: Pay attention to companies in the computing power industry chain whose 2025 annual report forecasts exceed market expectations

- Track marginal changes: Monitor performance guidance released by leading companies such as Foxconn Industrial Internet and Zhongji Xuchuang (300308)

- Allocate along three main lines:

- Domestic Computing Power Chain: Cambricon (688256), Hygon Information (688041), Sugon (603019)

- Edge Computing: Meig Smart (002881), Fibocom Wireless (300638), Yingxueguang

- Industrial Internet Platforms: Baosight Software (600845), Orient National Information (300166)

- Focus on technological iteration: Accelerated commercialization of liquid cooling technology, and performance upgrades of AI chips

- Track application implementation: Commercialization of industry intelligent agents and monetization of AI-native applications

- Monitor policy evolution: Continuous intensification of industrial intelligence policies during the 15th Five-Year Plan period

- AI development falls short of expectations: Slow iteration of large models may dampen demand for computing power

- Computing power demand misses expectations: Corporate capital expenditure may be lower than projected

- Market competition risks: Intensified competition from international chip manufacturers

- Policy implementation risks: Local policy rollout progress may lag behind expectations

[1] MIIT Deploys 10 Key Tasks for 2026, to Cultivate a Batch of Key Industry Intelligent Agents - Securities Times (https://stcn.com/article/detail/3563780.html)

[2] MIIT: Promote “Artificial Intelligence + Manufacturing” Special Action, Cultivate a Batch of Key Industry Intelligent Agents - 21st Century Business Herald (https://www.21jingji.com/article/20251226/herald/f0d81d5598ae532bf73f45cac05d6379.html)

[3] 2026 Economic and Industry Outlook | Deloitte China Research: Monthly Economic Overview Issue 101 (https://www.deloitte.com/cn/zh/our-thinking/research//issue101.html)

[4] The Future is Here, This Sector Gets Policy Boosts! - Eastmoney Wealth Account (https://caifuhao.eastmoney.com/news/20260102111849843032500)

[5] A-share Computing Power in 2025: Industrial Advancement Amid Restructured Capital Narrative - 21st Century Business Herald (https://www.21jingji.com/article/20251226/herald/1578b2ae40c7128bc710d0e2131801a7.html)

[6] Kunlun Core Pursues HK IPO! Full Analysis of Beneficiary Stocks Across Three Echelons - Sina Finance (https://finance.sina.com.cn/roll/2026-01-03/doc-inhezqrp3593950.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.