Analysis of the Impact of GSK's Successful Phase 3 Trial for Hepatitis B Drug on Pharmaceutical Business Revenue and Stock Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient information, let me prepare a comprehensive analysis report for you.

GSK’s hepatitis B drug Bepirovirsen (GSK836) is currently in Phase III clinical trials (NCT05630820), with a

In the Phase IIb clinical trial (B-Clear study), the drug showed encouraging efficacy data: after 24 weeks of treatment, approximately

Bepirovirsen has received

Based on the latest market data [0], GSK’s current core valuation metrics are as follows:

| Metric Category | Specific Metric | Value |

|---|---|---|

Valuation Metrics |

Market Capitalization | $102.8 Billion |

| Current Stock Price | $50.56 | |

| P/E Ratio (TTM) | 13.95x | |

| P/B Ratio | 4.75x | |

| P/S Ratio | 2.38x | |

Profitability Metrics |

Return on Equity (ROE) | 37.40% |

| Net Profit Margin | 17.08% | |

| Operating Profit Margin | 23.51% | |

Earnings Metrics |

EPS (TTM) | $3.58 |

GSK’s pharmaceutical business, particularly the

- Specialty Medicines Sales: 16% year-over-year growth year-to-date 2025, with 15% growth in Q3 alone [5]

- Growth Drivers: Strong performance in HIV, respiratory diseases, immunoinflammatory, and oncology areas

- Key Products: Nucala (+13%), Benlysta (+23%), Jemperli (+>100%), Ojjaara (+87%) [5]

Company management clearly stated in the financial report that approximately

According to data from market research institutions [2][4], the global chronic hepatitis B treatment market is showing significant growth:

- Seven Major Markets(U.S., 4 EU countries, UK, Japan, China): The chronic hepatitis B treatment drug market is projected to reach$3.2 billion by 2034[2]

- U.S. Market: Accounts for approximately72% of the market share, making it the largest hepatitis B drug market globally [4]

- GSK’s Bepirovirsen: Expected to achieve commercial sales in these markets starting in 2026 [1]

As an innovative antisense oligonucleotide drug, Bepirovirsen has the following competitive advantages:

- Differentiated Efficacy Mechanism: Unlike traditional interferons and nucleos(t)ide analogs, Bepirovirsen is expected to help some patientseliminate the need for lifelong medication, and even achieve complete clearance of the hepatitis B virus [1]

- Low Drug Resistance:Very few drug-resistant mutations were observedduring clinical trials, which is particularly important for chronic hepatitis B patients requiring long-term treatment [1]

- Pan-Genotype Coverage: As a small molecule drug, it may be suitable for hepatitis B patients with multiple genotypes

- Gilead Sciences’ TLR8 agonist Selgantolimod

- GSK’s siRNA drugs Daplusiran+Tomligisiran

- Arbutus Biopharma’s Imdusiran, among others

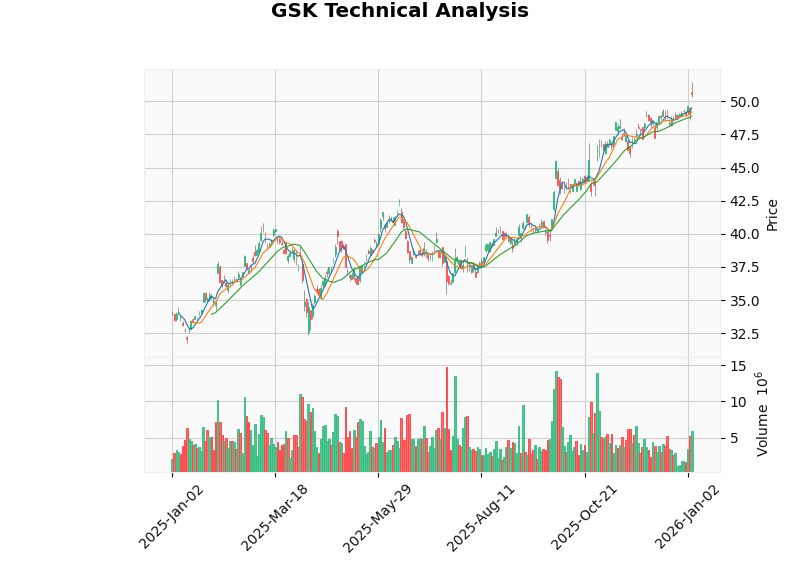

GSK’s stock price has performed strongly in 2025 [0]:

| Time Period | Return Rate |

|---|---|

| 1 Day | +3.14% |

| 5 Days | +2.70% |

| 1 Month | +4.44% |

| 3 Months | +16.23% |

| 6 Months | +32.39% |

1 Year |

+48.31% |

| 3 Years | +46.42% |

GSK’s stock price has

GSK’s current

- Patent Expiration Risk of Dolutegravir: The company’s core HIV product faces competition pressure from generics [3]

- Market’s Cautious Expectations for R&D Success Rate: The high-risk nature of innovative drug R&D

- Expectations of Slower Growth for Mature Pharmaceutical Companies: Traditional pharmaceutical giants are typically given lower valuation multiples

- Target Price: $53.00 (+4.8% from current price)

- Buy Ratings: 31% (9 analysts)

- Hold Ratings: 58.6% (17 analysts)

- Sell Ratings: 10.3% (3 analysts)

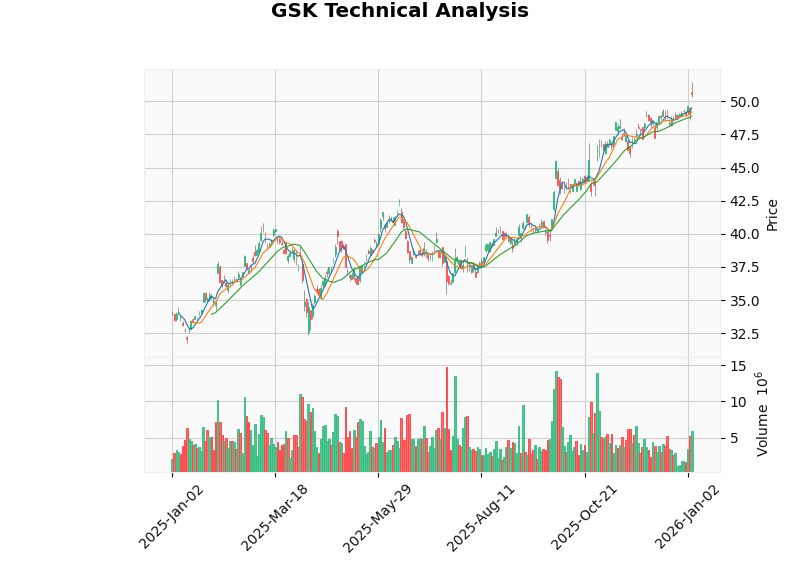

Based on technical analysis indicators [0]:

| Indicator | Signal | Interpretation |

|---|---|---|

| MACD | Golden Cross | Bullish Signal |

| KDJ | Death Cross | Neutral to Bearish |

| RSI (14) | Overbought Risk Zone | Short-term pullback pressure |

| Beta | 0.25 | Low Volatility , Defensive Characteristics |

If Bepirovirsen is successfully approved and launched, it is expected to have the following impacts on GSK’s revenue:

- In the initial launch phase, it is expected to contribute peak sales of $500 million to $1.0 billion(conservative estimate)

- Primarily from the U.S., EU, and Japanese markets

- With increased market penetration and improved sales networks, peak sales may reach $1.5-$2.0 billion

- Considering that chronic hepatitis B patients require long-term treatment, drug sales have strong stickiness and sustainability

- If functional cure concept validation is achieved, peak sales may increase further

- However, attention needs to be paid to generic competition after patent expiration

In addition to direct sales contributions, the success of Bepirovirsen also has the following strategic significance:

- Strengthen Liver Disease Product Portfolio: Forms a synergistic effect with GSK’s existing liver disease pipeline

- Enhance the Company’s Innovative Image: The success of the Phase III trial will validate the company’s R&D capabilities in the nucleic acid drug field

- Open Up Emerging Market Opportunities: The Asia-Pacific region, including China, has a large base of hepatitis B patients, offering huge market potential

- Support 2031 Growth Target: The company’s £4 billion sales target requires continuous contributions from new products [3]

GSK’s growth strategy for the Specialty Medicines segment is highly dependent on the successful launch of new products [5]:

| Business Segment | 2025 YTD Growth | Potential Contribution of Bepirovirsen |

|---|---|---|

| Specialty Medicines | +16% | High (as a core new product) |

| Vaccines | +1% | Low (focused on liver disease vaccines) |

| General Medicines | -3% | No direct contribution |

The success of Bepirovirsen will

The success of Bepirovirsen’s Phase III trial and subsequent commercialization is expected to enhance the company’s valuation through the following paths:

- If market confidence in the company’s 2031 £4 billion sales target increases, it may prompt analysts to revise revenue forecasts upward

- EPS growth expectations are expected to be revised upward by 3-5%

- Based on the DCF valuation model, the NPV (Net Present Value) of Bepirovirsen is projected to be in the range of $3.0-$5.0 billion

- The success of the Phase III trial will reduce the clinical risk premium and enhance the overall pipeline valuation

- The success of innovative drug R&D is usually regarded as an important validation of the company’s innovative capabilities

- Helps increase the risk appetite of institutional investors

Based on different scenario assumptions, GSK’s valuation may be affected as follows:

| Scenario | Assumptions | P/E Valuation Multiple | Target Price Range |

|---|---|---|---|

| Optimistic | Bepirovirsen is approved ahead of schedule, peak sales exceed $2.0 billion | 16-18x | $58-$65 |

| Neutral | Approved as scheduled in 2026, peak sales reach $1.5 billion | 14-15x | $51-$55 |

| Pessimistic | Approval delay or safety issues | 12-13x | $44-$48 |

| Time Point | Catalyst Event | Valuation Impact |

|---|---|---|

| 2025 AASLD Conference | Release of subgroup analysis data from Bepirovirsen’s Phase II B-Sure study | Neutral to Positive |

| End of 2025 | Phase III trial interim analysis data | Highly Sensitive |

| Early 2026 | Full data readout of Phase III trial | Highly Sensitive |

| Mid-2026 | Submission of FDA/EMA application | Positive |

| End of 2026 | Receipt of FDA/EMA approval | Highly Positive |

- Uncertainty of Phase III Trial Results: Even with positive Phase IIb data, the Phase III trial may still fail due to insufficient safety or efficacy

- Regulatory Approval Delay: Despite receiving breakthrough designations, FDA/EMA approval may still be delayed for various reasons

- Safety Signals: New safety issues may be observed in a larger population

- Competitive Product Launch Pressure: Hepatitis B drugs from companies such as Gilead and Arbutus are also under active development [2]

- Competition from Existing Standard Therapies: Interferons and nucleos(t)ide analogs are cheaper, and payers may prefer to continue using them

- Price Pressure: Innovative drugs may face price negotiation pressure from payers after launch

- Market Access: Even if approved, it will take time to enter the medical insurance reimbursement systems of various countries

- Sales Team Development: It will take time to build a professional sales team in the liver disease field

- Production Capacity Supply: Sufficient production capacity is required to meet global patient demand

| Assessment Dimension | Score | Explanation |

|---|---|---|

| Clinical Success Probability | Medium-High | Positive Phase IIb data, Phase III in progress |

| Market Size | Large | $3.2 billion in 7 major markets by 2034 |

| Competitive Position | Strong | Differentiated mechanism, first-mover advantage |

| Valuation Appeal | High | 13.95x P/E lower than industry average |

| Catalysts | Abundant | Multiple key events in 2025-2026 |

-

Revenue Growth Contribution: If Bepirovirsen is successfully approved, it is expected to contributeannual sales of $1.0-$2.0 billionto the company between 2027 and 2032, becoming an important growth engine for the Specialty Medicines segment.

-

Valuation Upside Potential: The current P/E ratio (13.95x) does not fully reflect the pipeline value. If the Phase III trial is successful and approved as scheduled, the valuation multiple is expected to rise to15-16x, corresponding to a stock price range of$55-$60.

-

Investment Rating: In view of the strong growth momentum of the company’s Specialty Medicines business, the huge market potential of Bepirovirsen, and the relatively reasonable valuation level, it is recommended towatch(or maintain aHoldrating), and considerincreasing positionsafter the release of Phase III data.

-

Risk Warning: Investors need to closely monitor the interim data readout of the Phase III trial at the end of 2025, which is a key catalyst determining the drug’s fate and valuation re-rating.

[1] Zhihuiya - GSK836 is Approaching Launch: New Hope for Hepatitis B Patients (https://www.zhihuiya.com/news/info_7180.html)

[2] Clinical Trials Arena - Chronic hepatitis B therapeutics market to reach $3.2bn across 7MM 2034 (https://www.clinicaltriallarena.com/analyst-comment/chb-therapeutics-market-reach-3-2bn-7mm-2034/)

[3] GSK Q2 2025 Results Slides (https://www.gsk.com/media/fonb14xu/q2-2025-results-slides.pdf)

[4] DelveInsight - Chronic Hepatitis B Market: US to Have Lion’s Share of 7MM (https://www.prnewswire.com/news-releases/chronic-hepatitis-b-marketthe-us-to-have-the-lions-share-among-the-7mm-predicts-delveinsight-302483263.html)

[5] GSK Q3 2025 Announcement (https://www.gsk.com/media/snycbnpn/q3-2025-results-announcement.pdf)

[6] GSK Presents Data from Its Advancing Liver Pipeline at AASLD 2025 (https://www.gsk.com/media/h4xhdiq1/gsk-presents-data-from-its-advancing-liver-pipeline-at-aasld-2025.pdf)

[7] DelveInsight - Bepirovirsen Market Size Forecast and Emerging Insight (https://www.delveinsight.com/report-store/bepirovirsen-market-size-forecast-and-emerging-insight)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.