Analysis of the Impact of Li Auto's Rapid Expansion of Supercharging Stations on the Competitive Landscape of the New Energy Vehicle Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive data collection and analysis, the following is an in-depth research report on the impact of Li Auto’s supercharging station expansion on the industry’s competitive landscape:

As of December 31, 2025, Li Auto has put into operation

In terms of construction speed, Li Auto adds approximately 4 supercharging stations per day and about 28 supercharging piles per week[3]. This expansion speed makes Li Auto

| Infrastructure Type | Quantity | Coverage |

|---|---|---|

| Retail Centers | 548 | 159 cities |

| After-sales Service Centers | 561 | 224 cities |

| Cumulative Deliveries | 1.54 million units | Historical Milestone |

The competitive logic of the current new energy vehicle market is undergoing a fundamental shift. Industry analysis points out that public charging piles present a

- The focus of industry development has shifted from ‘range competition’ to ‘energy replenishment efficiency competition’

- Megawatt-level supercharging (≥1000kW) has become the key technology to solve the problems of ‘slow charging and long queues’

- The ultimate competition in the industry has evolved into a contest of ‘ecosystem integration capability’

The moat built by Li Auto through its supercharging network has the following characteristics:

- Exclusive Protocol Advantage: High compatibility between vehicles and piles, with higher charging power

- Closed-loop User Experience: Full-process optimization from pile searching, charging to payment

- Increased Brand Loyalty: Exclusive member benefits enhance user stickiness

Automakers’ strategic choices in the energy replenishment field have diverged:

- Heavy Asset Investment Camp: NIO (cumulative investment of nearly RMB 10 billion), Tesla (2024 capital expenditure of over USD 10 billion), Li Auto

- Light Asset Cooperation Camp: Xiaomi, Porsche, Neta, Leapmotor, etc., choose to rely on third-party charging networks

Porsche’s case is a warning: its approximately 200 charging stations have an investment of millions per station, but the utilization rate of exclusive piles is only about 15%-20%, and it will shut down its self-built charging facilities in March 2026 and switch to cooperation with operators[3].

The construction of supercharging networks requires huge capital investment and long-term operational capabilities, which will fundamentally change the industry’s competitive landscape:

- Automakers with weak capital strength will be excluded from supercharging competition

- Enterprises with scale advantages will further consolidate their positions through the Matthew Effect

- The industry will fully upgrade from ‘product competition’ to ‘ecosystem competition’

| Evaluation Dimension | Li Auto’s Performance | Evaluation Conclusion |

|---|---|---|

Coverage Density |

3,907 supercharging stations covering 286 cities | ✅ Industry-leading |

Technological Advancement |

Self-developed 480kW supercharging platform | ✅ Top tier in the industry |

User Stickiness |

Closed-loop energy replenishment experience enhances brand loyalty | ✅ Significant improvement |

Cost Efficiency |

Scale reduces per-station cost | ⚠️ Need continuous verification |

Ecosystem Integration |

Vehicle-Pile-Cloud collaborative service network | ✅ Initially established |

Li Auto has built one of the largest self-operated supercharging networks among automakers in China, and this scale advantage will generate significant

The full-year R&D investment in 2025 is expected to reach

The collaborative layout of the supercharging network, retail centers, and after-sales network has formed a

- 548 retail centers provide sales touchpoints

- 561 after-sales centers ensure service response

- 3,907 supercharging stations address energy replenishment pain points

Supercharging networks are heavy asset investments, which pose a continuous test on cash flow and profitability. Li Auto’s current P/E ratio is 25.99x and P/S ratio is 0.94x[0], and the market has high attention to its profitability.

The emergence of new technologies such as Huawei’s full-liquid-cooled megawatt supercharging and BYD’s megawatt flash charging may expose existing supercharging facilities to

- NIO: Continuous expansion of battery swap station network

- XPeng: Plans to build over 1,000 ultra-fast charging stations in 2026

- Tesla: Global layout of supercharging network

| Indicator | Value | Industry Position |

|---|---|---|

| Market Capitalization | USD 17.15 billion | Mid-sized automaker |

| P/E | 25.99x | Mid-tier in the industry |

| ROE | 6.43% | Medium level |

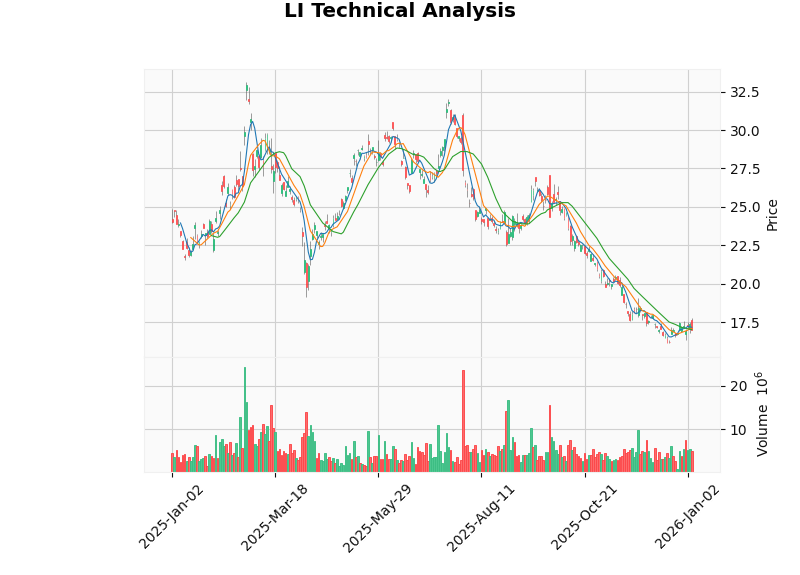

| Current Stock Price | $16.99 | 48.7% below the 52-week high |

- Technical Aspect: Currently in a sideways consolidation pattern ($16.71-$17.27), with no clear trend signal[0]

- Capital Aspect: Down 30.05% in the past 3 months and 36.46% in 6 months, at a relatively low level[0]

- Valuation Aspect: Analyst consensus target price is $22.50, representing a 32.4% upside from the current price[0]

- Clear leading advantage in supercharging network, forming a differentiated competitive barrier

- The 2026 L-series major facelift + M100 chip + i6 capacity ramp-up is expected to push deliveries back to the million-unit level

- AI strategic transformation opens up long-term growth space

- Short-term performance pressure (Q3 EPS $-0.09 vs expected $0.04)

- Pressure on cash flow from continuous investment in supercharging network

- Share erosion due to intensified industry competition

- Industry Level: The construction of supercharging networks is reshaping the competitive landscape of new energy vehicles, upgrading from single product competition to ecosystem competition.

- Company Level: Li Auto’s supercharging network has formedfirst-mover advantage and scale effects, with the potential to become a core competitive advantage, but continuous investment is required to cope with technological iteration and intensified competition.

- Investment Recommendation: The leading advantage of the supercharging network provides long-term strategic value for Li Auto, but the short-term stock price is constrained by performance fluctuations and market sentiment. It is recommended to focus on the volume and price recovery opportunities brought by the 2026 product cycle.

[0] Jinling AI Financial Database - Li Auto (LI) Real-time Quotes, Company Profile, Technical Analysis and Financial Analysis

[1] Eastmoney - “Li Auto Crosses 1.5 Million Unit Delivery Milestone in 2025; Global Market, Charging Network and AI New Products Accelerate Simultaneously” (https://finance.eastmoney.com/a/202601043607827858.html)

[2] Sina Finance - “Li Auto Crosses 1.5 Million Unit Delivery Milestone in 2025” (https://finance.sina.com.cn/stock/zqgd/2026-01-04/doc-inhfcpht8910521.shtml)

[3] 36Kr - “Self-built Charging Piles Exit, Automakers’ ‘Seamless Energy Replenishment’ Becomes New Competition Focus?” (https://eu.36kr.com/zh/p/3617832317486086)

[4] Caifuhao (Eastmoney) - “Li Auto: How Far is It from a Turnaround?” (https://caifuhao.eastmoney.com/news/20251224095353587728270)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.