Analysis of the Impact of Slowing Growth in Japan's Services Sector on the Economy and Stock Market Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Let me present the complete analysis report for you now:

According to the latest December 2025 data from S&P Global, Japan’s Services Purchasing Managers’ Index (PMI) fell from

| Indicator | November | December | Change |

|---|---|---|---|

| Manufacturing PMI | 48.7 | 49.7 | +1.0 (Contraction for 6 consecutive months, but pace slowed) |

| Services PMI | 53.2 | 52.5 | -0.7 (Growth momentum weakened) |

| Composite PMI | 52.0 | 51.5 | -0.5 (Approaching the expansion threshold) |

Annabel Fiddes, Associate Director of Economics at S&P Global Market Intelligence, noted that growth remains concentrated in the services sector, but manufacturing production and sales have weakened further[2].

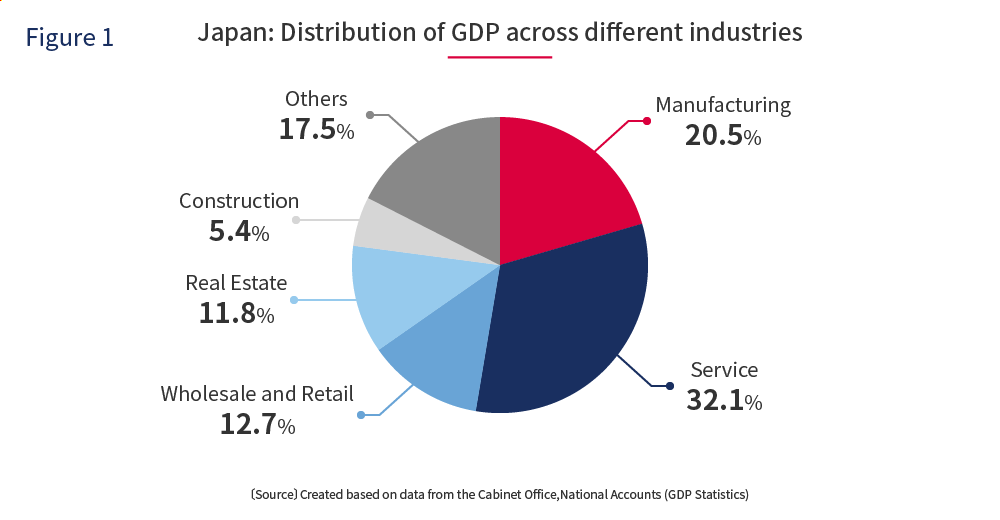

The services sector accounts for approximately 70% of Japan’s GDP and is the main driver of economic growth. The decline in the services PMI indicates:

- Contraction in Consumer Demand: The slowdown in services growth directly reflects reduced consumer spending willingness

- Slowdown in Employment Growth: Although employment growth hit a new high since May 2024, its sustainability is in doubt

- Rising Inflationary Pressures: Surveys show that the inflation rate has risen to an 8-month high, and companies are generally raising prices[2]

According to forecasts from the Organization for Economic Co-operation and Development (OECD), Japan’s real GDP growth in 2025 is 1.3%, but it is projected to slow to 0.9% in 2026-27[3]. Domestic demand remains the main driver of growth, while external demand (especially U.S. tariff policies) may pose a drag.

The Bank of Japan raised interest rates to

- Japan’s inflation has remained above the 2% target for nearly four consecutive years

- Labor shortages have pushed up wages, forming a “wage-inflation” cycle

However, the coexistence of slowing services growth and a sluggish manufacturing recovery has left the central bank facing a difficult balance between continuing tightening and supporting growth.

Despite signs of slowdown in economic data, Japan’s stock market delivered strong performance in 2025:

| Indicator | Figure | Explanation |

|---|---|---|

| Nikkei 225 (End of 2025) | 50,000+ | Rose approximately 19% for the year, the highest annual gain on record |

| Nikkei 225 (Jan 6, 2026) | 52,518 points | Hit an all-time high |

| TOPIX Index (Jan 6, 2026) | 3,538 points | Broke the 3,500-point mark for the first time, hitting an all-time high |

| Current P/E (Jan 2, 2026) | 16.36 |

Above the 5-year average of 14.84 |

Japan’s stock market valuation rose from a forward P/E ratio of around 13x in April 2025 to 22x, supported mainly by the following factors[5]:

- Improved corporate governance (share buybacks, increased dividends, reduced cross-shareholdings)

- AI-related investment boom driving tech stock gains

- Sustained inflows from overseas investors

- Expectations of new government stimulus policies

2026 target forecasts for Japanese stocks from major financial institutions:

| Institution | Nikkei 225 Target (End of 2026) | Core Logic |

|---|---|---|

| Daiwa Securities | 62,000 points | Improved corporate performance is the main driver |

| Citi | 55,000 points | Sustained improvement in corporate earnings |

| Capital Economics | TOPIX 3,400 points | Valuations still have room to rise |

However, some institutions have warned of risks: Oxford Economics estimates that if the yen falls below 155, the Bank of Japan may raise interest rates by another 50 basis points before Q3 2026, which could bring 10%-15% correction pressure on Japanese stocks[6].

| Industry | Impact Degree | Analysis of Causes |

|---|---|---|

| Tourism | -72% | Risk of declining spending by international tourists |

| Retail | -58% | Tightening consumer spending |

| Real Estate | -45% | Slowing demand for commercial real estate |

| Financial Services | -38% | Declining demand for consumer credit |

- Semiconductors/Tech: The AI investment boom continues, with related companies performing strongly

- Defense/Machinery: Increased government defense budget and capital expenditure

- Banking: Benefiting from the interest rate hike cycle, stock prices have performed well

| Risk | Probability | Impact Degree | Risk Level |

|---|---|---|---|

| Further slowdown in economic growth | 75% | 80% | High |

| Significant decline in consumer spending | 70% | 75% | High |

| Corporate earnings falling short of expectations | 65% | 70% | Medium-High |

| Sharp fluctuations in the yen | 60% | 85% | High |

| Stock market valuation correction | 55% | 65% | Medium |

- Valuation Perspective: The current P/E ratio is above the historical average; it is recommended to focus on whether corporate earnings can support valuations

- Allocation Recommendations:

- Moderately reduce allocations to sectors with high exposure to the services industry

- Increase allocations to structurally growing sectors such as technology, semiconductors, and defense

- Focus on high-quality enterprises with pricing power

- Risk Management: Set stop-loss levels, monitor changes in the yen exchange rate and central bank policy signals

The impact of slowing growth in Japan’s services sector on the economy and stock market valuations shows a

- Economic Dimension: Coupled with the sluggish recovery of the manufacturing sector, the slowdown in the services sector is expected to pull economic growth down to 0.8%-0.9% in 2026, putting pressure on consumption and tourism.

- Stock Market Dimension: Despite elevated valuations, improved corporate earnings, the AI investment boom, and expectations of government stimulus policies continue to support market sentiment. Both the Nikkei 225 and TOPIX have hit all-time highs, but correction risks are accumulating.

- Policy Impact: The Bank of Japan’s continued interest rate hikes (to 0.75%) conflict with the slowdown in the services sector, requiring monetary policy to strike a balance between fighting inflation and stabilizing growth.

[1] Angel One - “Japan Manufacturing Contraction Eases as Services Slow in December” (https://www.angelone.in/news/global-market/japan-manufacturing-contraction-eases-as-services-slow-in-december)

[2] Sina Finance - “The Yen’s 30-Year Turning Point: Bank of Japan Raises Interest Rates to 0.75%, Era of Loose Policy Officially Ends” (https://finance.sina.com.cn/money/forex/forexinfo/2025-12-17/doc-inhazyax7586024.shtml)

[3] OECD - “OECD Economic Outlook, Volume 2025 Issue 2 - Japan” (https://www.oecd.org/en/publications/oecd-economic-outlook-volume-2025-issue-2_9f653ca1-en/full-report/japan_ea7efd0c.html)

[4] World P/E Ratio - “Japan Stock Market: current P/E Ratio” (https://worldperatio.com/area/japan/)

[5] IG - “Asia stock markets outlook for 2026: Hang Seng and Nikkei forecasts” (https://www.ig.com/uk/news-and-trade-ideas/Asia-stock-market-outlook-for-2026-251209)

[6] CME Group - “Two Ends of a Seesaw: Decoding the Divergent Trends of Japanese Stocks and the Yen” (https://www.cmegroup.com/cn-s/education/7he/2025-10-24.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.