Analysis of the Impact of Solvonis' U.S. Patent Allowance on PTSD Drug Development and Company Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the information retrieved, I will provide a comprehensive analysis of the impact of Solvonis’ U.S. patent allowance on its PTSD drug development plan and company valuation.

Solvonis Therapeutics plc (London Stock Exchange ticker: SVNS) is a clinical-stage biopharmaceutical company focused on developing innovative drugs for addiction and mental health disorders. The company has received a Notice of Allowance issued by the U.S. Patent and Trademark Office (USPTO) for a key patent in its central nervous system (CNS) drug discovery platform [1][2].

- Patent Application Number: U.S. No. 18/838,986

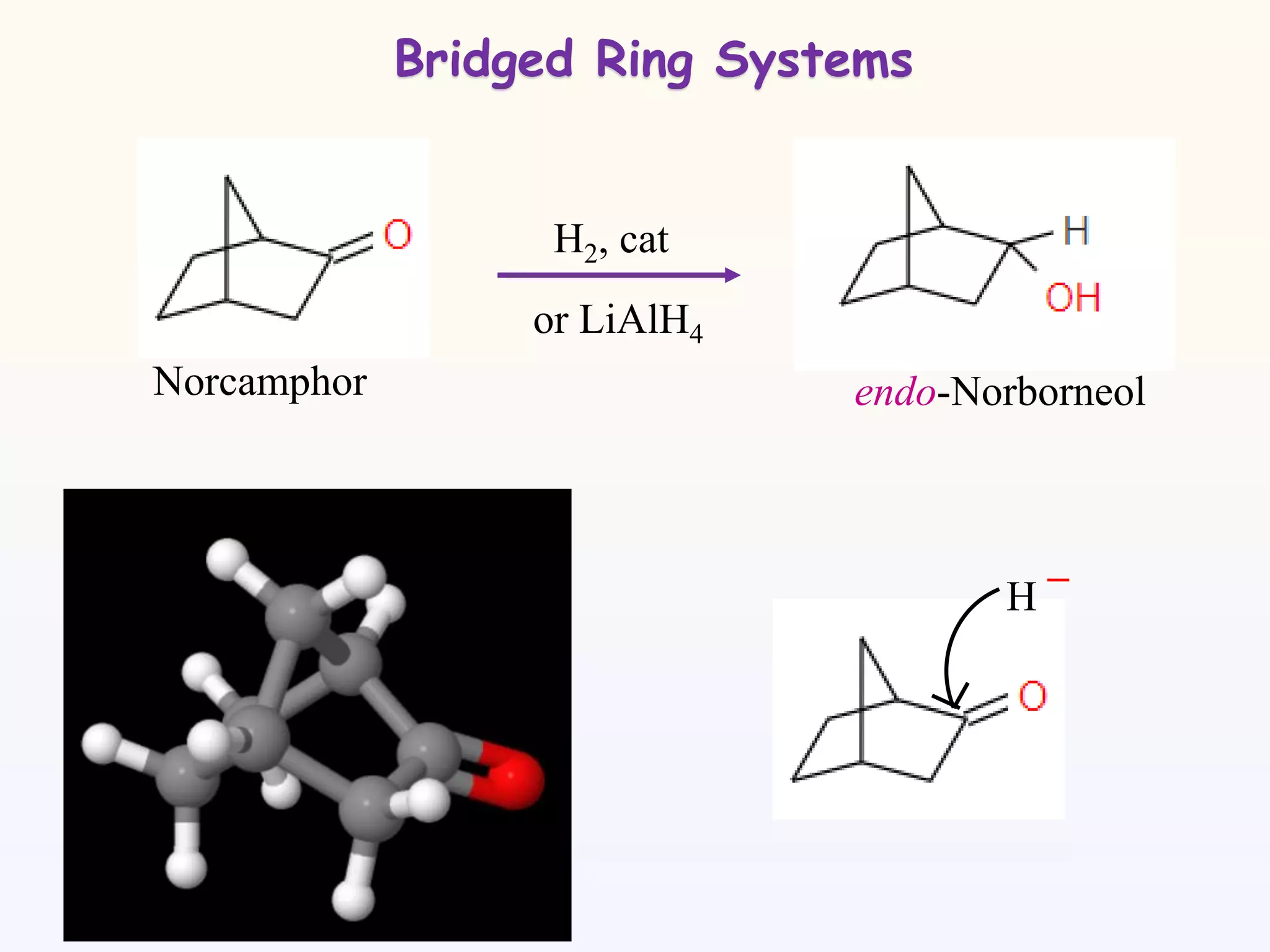

- Patent Title: “Bridged Ring Compounds and Their Therapeutic Use as CNS Agents”

- Coverage: Protects the composition of matter and methods of use for a class of novel morpholine compounds

- Expected Term of Validity: Upon approval, it will provide U.S. market exclusivity toat least 2043[2]

This patent allowance plays a critical role in intellectual property protection during the key phase of advancing the SVN-SDN-14 program to candidate selection. USPTO examiners determined that no existing patents or publications disclose or suggest the compounds covered by this patent, confirming its innovativeness and novelty [1].

- One compound in this series is being evaluated alongside other drug candidates

- A lead candidate is expected to be selected in Q1 2026

- The patent allowance provides a solid legal and technical foundation for this R&D timeline [1]

The compounds covered by the patent aim to address long-standing core challenges in PTSD therapy development:

| Technical Challenge | Solution |

|---|---|

| Duration of action control | Achieve stronger pharmacological control through predictable metabolic inactivation |

| Variability in patient response | Reduce inter-patient response variability |

| Clinical compatibility | Improve accessibility and compatibility in real-world clinical settings |

| Balance between safety and efficacy | Enhance dosing flexibility, safety margin, and clinical applicability [1] |

The compounds support prosocial engagement in PTSD patients by regulating three major neurotransmitter pathways (serotonin, dopamine, and norepinephrine), thereby enhancing the effectiveness of psychotherapy [1][3].

According to public market data, Solvonis currently has a market capitalization of

| Valuation Factor | Impact Analysis |

|---|---|

Exclusivity Term |

U.S. market exclusivity until 2043 provides investors with a clear timeline for value realization |

Pipeline Value Enhancement |

Enhances the commercial value of early-stage innovative assets acquired from Awakn Life Sciences |

Platform Value Validation |

Validates the reliability of the company’s AI-enabled drug discovery platform, supporting the long-term value of its early-stage pipeline |

Competitive Barriers |

Strengthens the company’s competitive position in the field of neuropsychiatric drug research and development [2] |

As a core component of the company’s CNS compound library, this patent forms strategic complementarity with other pipeline programs:

- SVN-001/002: Targeting alcohol use disorder (AUD)

- SVN-015: Targeting methamphetamine and cocaine addiction (funded by the U.S. National Institute on Drug Abuse, NIDA)

- SVN-SDN-14: Targeting post-traumatic stress disorder (PTSD) [1][2]

- Patent protection until 2043 provides a sufficient time window for long-term commercialization

- The USPTO’s “Notice of Allowance” confirms the novelty of the compounds, which usually signals a clear path to patent issuance

- The company’s diversified pipeline layout in the CNS field mitigates single-program risks

- Collaborations with authoritative institutions such as the U.S. National Institute on Drug Abuse (NIDA) enhance R&D credibility

- The company is still in the preclinical/early clinical stage, so the commercialization timeline is uncertain

- Small-cap companies (with a £21.78 million market cap) typically exhibit high volatility

- The PTSD drug market is highly competitive, and subsequent clinical trial progress requires close attention

The U.S. patent allowance brings

- R&D Perspective: Lays a solid intellectual property foundation and provides clear technical solutions for the PTSD drug development program

- Commercial Perspective: U.S. market exclusivity until 2043 significantly enhances the long-term commercial value of the company’s pipeline

- Capital Market Perspective: As a key milestone event, the patent allowance strengthens investor confidence and valuation expectations for the company

Overall, this patent allowance is a significant milestone in Solvonis’ development, which not only reinforces the technical foundation of its PTSD drug development plan but also establishes a more solid competitive barrier for the company in the highly competitive CNS drug market.

[1] Investegate - “US Patent allowance for PTSD discovery programme” (https://www.investegate.co.uk/announcement/rns/solvonis-therapeutics-plc--svns/us-patent-allowance-for-ptsd-discovery-programme-/9337656)

[2] Solvonis Therapeutics Official Website - “Allowance of U.S. patent covering AI-supported CNS discovery programme compounds” (https://solvonis.com/news/allowance-of-u-s-patent-covering-ai-supported-cns-discovery-programme-compounds)

[3] Investing.com - “U.S. Patent Allowance Strengthens Solvonis’ PTSD Drug Development Program” (https://cn.investing.com/news/company-news/article-93CH-3153877)

[4] Yahoo Finance - “Solvonis Therapeutics plc (SVNS.L) Valuation Measures” (https://finance.yahoo.com/quote/SVNS.L/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.