Legend Strategy International's Strategic Transformation: HK$22 Million Acquisition of Synthetic Biology Assets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

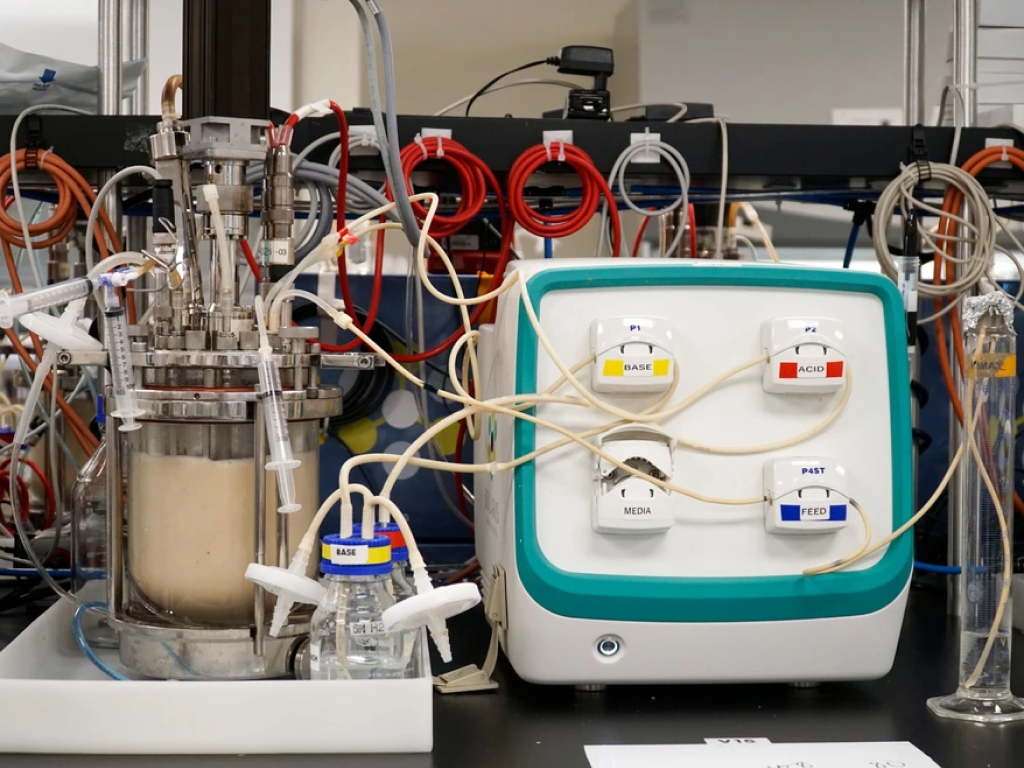

Legend Strategy International Holdings Group Company Limited (Stock Code: 01355.HK) is undergoing a major strategic transformation. According to a December 24, 2025 report from MoneyDJ, the company announced it would spend HK$22 million to acquire 100% equity of Aonuo Hong Kong Limited and the related sales loan [1]. The core asset of this transaction is a 37.5% stake in Besheng Biotechnology Co., Ltd., a synthetic biology infrastructure provider focusing on strain design and fermentation process development, mainly providing technical services and related products for synthetic biology enterprises and biomedical enterprises [1].

This acquisition is regarded as a key strategic move for the company to enter the high-growth synthetic biology sector. As a cutting-edge technology field, synthetic biology is receiving high attention from the capital market, and the company’s transformation into this track aligns with the current rotation trend of market hotspots [1].

In the announcement, the company proposed to change its Chinese name to “Biosysen Engineering Limited”, and its English name from “Legend Strategy International Holdings Group Company Limited” to “Biosysen Limited” [1]. This renaming initiative has far-reaching strategic implications:

First, it marks a fundamental shift in the company’s strategic positioning, fully transforming from the traditional hospitality business to the biotechnology sector. Second, the new name can shape a new corporate image, better reflecting the company’s future business development direction. In addition, the renaming plan requires shareholder approval, which also demonstrates the management’s firm determination for the company’s transformation [1].

From the macro market environment perspective, the Hong Kong stock market performed strongly in early 2026. According to Reuters, on January 2, 2026, the Hang Seng Index rose 2.76%, and the Hang Seng Technology Index rose 4%, with the AI and semiconductor sectors performing prominently [2]. The healthcare sector performed the best in the U.S. market on January 7, 2026, with an increase of +2.72% [3]. This market atmosphere provides a favorable external environment for Legend Strategy International’s transformation.

Synthetic biology, as one of the national strategic emerging industries, is in a stage of rapid development. The capital market’s attention to this field continues to rise, and the company’s choice to enter this track at this time has certain timing advantages.

According to equity disclosure information, Hehui International Development Limited held 48.3 million shares of Legend Strategy International on December 23, 2025, accounting for 4.05% of the issued share capital [5]. This shareholding ratio indicates that long-term institutional investors have already paid attention to the company, showing that the market has a certain degree of recognition for the company’s transformation.

Legend Strategy International’s leap from the hospitality business to the synthetic biology sector reflects a typical path for some traditional enterprises in the Hong Kong stock market to seek business transformation. The key to the success of this transformation lies in:

It is worth noting that Besheng Biotechnology recorded a loss of HK$7.6 million in the first 11 months of 2025 [1]. This financial data indicates that Besheng Biotechnology is still in the investment phase of business development and has not yet achieved profitability. For Legend Strategy International, this means that it may need to bear certain investment losses in the short term, but in the long run, if Besheng Biotechnology’s technical capabilities and market position can continue to improve, the current investment may yield returns in the future.

Investors need to pay attention to: Is Besheng Biotechnology’s loss a normal investment during a period of rapid expansion, or is it due to problems with the business model itself? This requires continuous tracking of the company’s subsequent announcements and financial reports.

According to HKEX announcement records, the company has a history of auditor changes (June 29, 2020) [6]. Although auditor changes are not uncommon among listed companies, combined with the company’s current major transformation, investors should pay attention to the quality of corporate governance to ensure the transparency and accuracy of information disclosure.

Legend Strategy International (01355.HK) is undergoing a major strategic transformation from its traditional hospitality business to the synthetic biology sector. On December 24, 2025, the company announced the acquisition of 100% equity of Aonuo Hong Kong for HK$22 million, obtaining a 37.5% stake in Besheng Biotechnology. Besheng Biotechnology focuses on strain design and fermentation process development, providing technical services for synthetic biology enterprises and biomedical enterprises. The company also announced a proposal to rename its Chinese name to “Biosysen Engineering Limited” (English name: “Biosysen Limited”) to align with its new business development direction.

The acquisition target, Besheng Biotechnology, recorded a loss of HK$7.6 million in the first 11 months of 2025, indicating that the business is still in the investment phase. The company has a history of auditor changes, and investors need to pay attention to the quality of corporate governance. The Hong Kong stock market performed strongly in early 2026, with the healthcare sector favored by the market, providing a favorable external environment for the company’s transformation.

Investors should closely monitor the progress of the renaming, the completion of the acquisition, the progress of Besheng Biotechnology’s business integration, and the company’s subsequent strategic execution.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.