Treasury Market Analysis: Pre-CPI Investor Anxiety During Government Shutdown

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the MarketWatch report [1] published on October 22, 2025, which detailed investor nervousness ahead of the crucial CPI inflation report during an unprecedented government shutdown.

The bond market exhibited strong risk-off behavior on October 22, 2025, as investors sought the relative security of U.S. government debt amid significant economic uncertainty. The 10-year Treasury yield declined to 3.952%, marking its lowest level since October 3, 2024, while the 2-year yield fell to 3.444% [1]. This yield compression reflected multiple converging concerns: a severe data vacuum due to the government shutdown, ongoing regional banking stress, and broader uncertainty about the U.S. economy’s prospects for achieving a “soft landing” [1].

The market’s jittery sentiment was particularly pronounced because the CPI report, originally scheduled for October 15, represented the only official economic data available before the Federal Reserve’s upcoming interest rate decision. The report received special permission for release because the Social Security Administration requires it for calculating cost-of-living adjustments (COLAs) [1]. As George Catrambone, head of fixed income at DWS Group, noted, “The market is jittery in the absence of hard data” that typically provides guidance on the U.S. economy’s direction [1].

Equity markets demonstrated clear defensive positioning with broad-based declines across major indices [0]:

- S&P 500: Declined 0.62% to 6,699.41

- NASDAQ Composite: Dropped 0.87% to 22,740.40

- Dow Jones Industrial Average: Fell 0.75% to 46,590.42

- Russell 2000: Decreased 1.28% to 2,451.55

Sector performance revealed a pronounced risk aversion pattern, with traditional defensive sectors outperforming while growth-oriented areas struggled [0]. Energy (+2.81%) emerged as the strongest performer, followed by Financial Services (+1.38%), Real Estate (+1.77%), and Communication Services (+1.15%). In contrast, Technology (-1.74%) and Utilities (-2.00%) posted the weakest performances, indicating investors were rotating away from growth and high-yield sectors toward more defensive positioning.

The unprecedented government shutdown, which began October 1, 2025, created a critical information void for market participants. The suspension of data collection meant not only delayed reports but also that future economic indicators would be compromised, as government workers weren’t gathering new information for October’s employment data [1]. This data deprivation was particularly damaging because it occurred during a period of elevated market sensitivity to inflation and economic growth indicators.

The missing September jobs report and lack of October employment data collection created significant blind spots for investors and policymakers alike. This information gap forced market participants to rely heavily on the delayed CPI report as the primary gauge of economic health, amplifying its market impact potential.

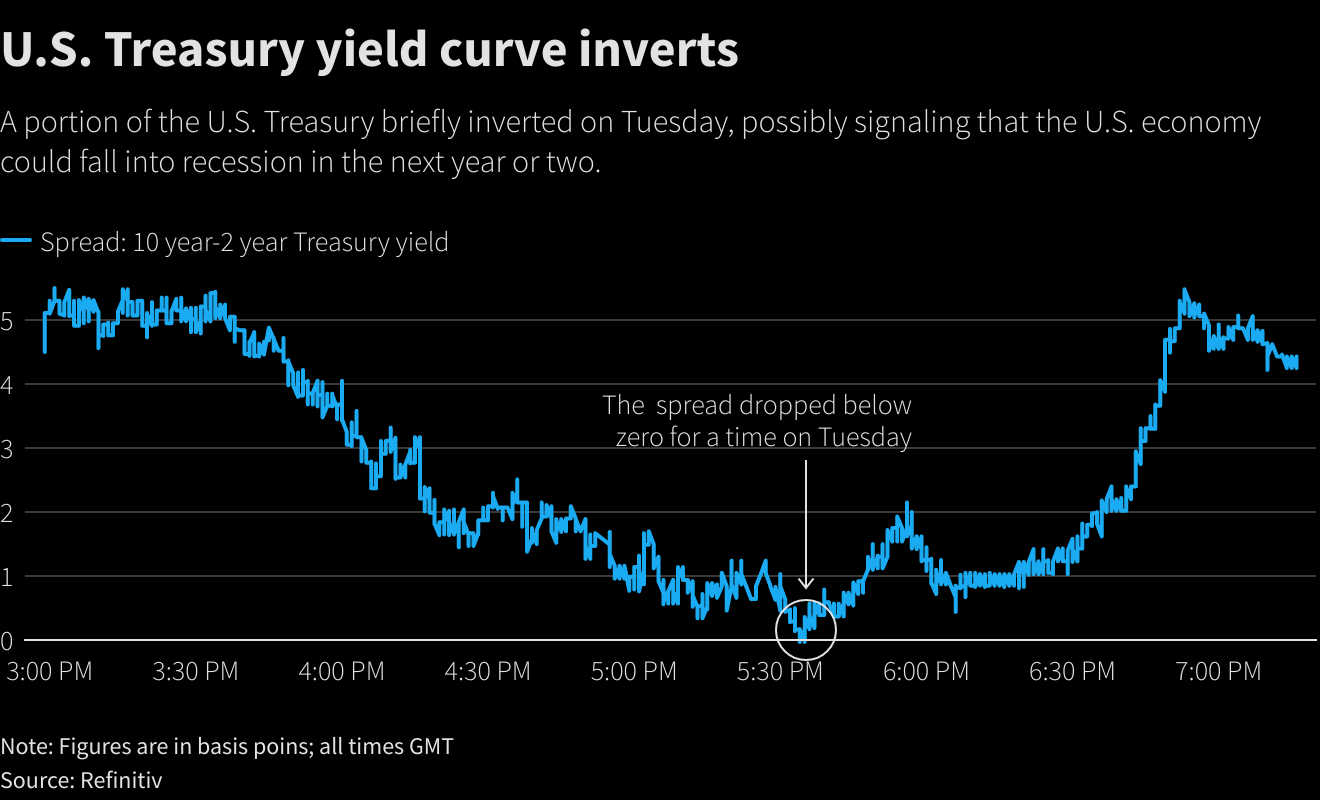

The Treasury market’s yield curve dynamics revealed nuanced investor expectations. While long-end yields declined due to flight-to-safety flows and growth concerns, short-end yields remained relatively anchored around Federal Reserve policy expectations [1]. This divergence suggested that while investors were increasingly concerned about economic growth, they still anticipated Fed rate cuts despite inflation remaining above the 2% target.

Catrambone identified a critical psychological threshold, noting that a 10-year yield drop below 3.75% would indicate investors questioning the prospects for a U.S. economic soft landing [1]. The current level at 3.952% positioned the market near this tipping point, where further yield declines could signal deteriorating growth expectations.

Economists at Goldman Sachs projected the delayed September CPI would show a 0.33% monthly increase in headline inflation (3.02% year-over-year) and 0.25% monthly increase in core inflation (3.05% year-over-year) [1]. These projections were crucial because, as BMO’s Ian Lyngen emphasized, the CPI release represented a “near-term event risk” that could significantly impact market positioning [1].

The market’s pre-CPI positioning reflected a delicate balance between inflation concerns and growth worries. Recent labor market slowdown had already prompted the Fed to cut rates in September despite elevated inflation, creating an unusual policy environment where traditional inflation-growth tradeoffs were complicated by the data vacuum.

The current situation paralleled previous government shutdowns but was unique in its timing relative to crucial Fed decision-making and already elevated uncertainty about economic trajectory. The combination of data deprivation and heightened market sensitivity to inflation created a particularly challenging environment for risk assessment and portfolio management.

The October 22, 2025 market environment was characterized by unprecedented uncertainty driven by government shutdown-induced data deprivation. Treasury yields fell to near-year lows as investors sought safety ahead of the delayed CPI report, while equity markets reflected defensive positioning with growth sectors underperforming [0, 1].

The 10-year Treasury yield at 3.952% approached a critical psychological level that could indicate growing doubts about economic soft landing prospects if breached [1.]. The market’s heavy reliance on a single data point—the delayed CPI report—created elevated event risk and potential for outsized volatility.

Investors should monitor the CPI report details, Fed communications, shutdown resolution timeline, and banking sector developments closely. The information vacuum is expected to persist until normal government operations resume, potentially extending the period of elevated market uncertainty and reliance on limited data sources for decision-making.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.