Bamboos Healthcare (02293.HK) Hot Stock Analysis: Won Industry Award but Trades Near 52-Week Low

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on Yahoo Finance stock price data[1] and multiple financial media reports[2][3][4]. Bamboos Healthcare Holdings Limited (Stock Code: 02293.HK) has recently become a hot target in the Hong Kong stock market. On December 11, 2025, the company won the 2025 Listed Company of the Year Award from the Hong Kong Society of Financial Analysts[2][3]. Coupled with multiple catalysts including growing healthcare demand driven by Hong Kong’s population aging, a high dividend yield of up to 8%, and business transformation into the smart elderly care sector, it has attracted market attention. However, the current share price is trading near its 52-week low, its year-to-date performance lags the Hang Seng Index by approximately 3 percentage points, and the liquidity risk of this micro-cap stock with a market capitalization of only about HK$200 million also requires careful evaluation.

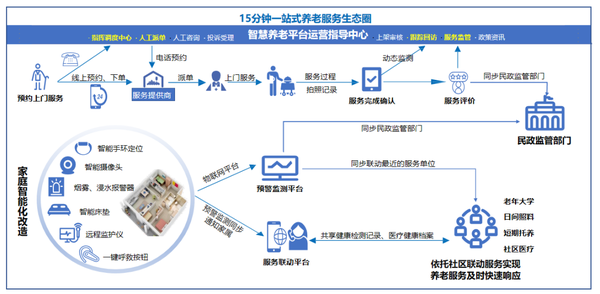

Bamboos Healthcare Holdings Limited is a Hong Kong-based enterprise focused on healthcare staffing solutions. Its core businesses include outreach case assessment services and vaccination services, and in recent years, it has actively expanded into the fields of smart elderly care and age-friendly living solutions[1][4]. According to public information, the company has established a service network covering over 3,500 elderly homes, rehabilitation centers, and clinics, with more than 32,000 healthcare professionals registered on its platform. Its customer base includes diverse institutions such as social welfare organizations, clinics, research medical institutions, the Hospital Authority, and private hospitals[4].

In terms of business structure, the company is undergoing a strategic transformation from a traditional healthcare staffing agency to an integrated healthcare platform. In 2025, the company opened a physical space named “HealthHub” in a self-owned property of approximately 22,000 square feet in Mong Kok, integrating three service segments: preventive medicine, Chinese and Western medicine healthcare, smart elderly care, and age-friendly living solutions[4]. This transformation marks the company’s expansion from a pure staffing service provider to an integrated health service provider covering the entire life cycle of “prevention-treatment-rehabilitation-care”.

There are multiple driving factors behind Bamboos Healthcare becoming a hot market stock, which are intertwined and form dual support for the company’s short-term market attention and long-term investment value.

From a multi-dimensional perspective of Bamboos Healthcare’s stock price performance, it can be seen that although the company has the aura of an industry award, its secondary market performance shows a relatively weak pattern.

Bamboos Healthcare’s current price-to-earnings ratio is between 11.44 and 12.25 times[1]. Compared horizontally with Hong Kong’s staffing service industry and the overall healthcare sector, this valuation multiple is in the lower end of the reasonable range. Considering the company’s 8% dividend rate, its valuation seems to fully reflect the market’s cautious attitude towards its business prospects.

Notably, the company’s share price did not show a significant positive reaction after winning the 2025 Listed Company of the Year Award[2][3]. This may indicate three things: first, the honorary effect of the award is difficult to be immediately converted into a valuation increase; second, the market sentiment towards micro-cap stocks is still weak; third, investors are waiting to see the actual results of the company’s transformation into the smart elderly care sector. The award recognizes corporate governance and innovation capabilities, while market pricing depends more on short-term financial performance and cash flow expectations, and there is a time lag between the two.

The company’s transformation from a traditional healthcare staffing solutions provider to a smart health technology platform is both an opportunity and a challenge. The opportunity is that if the transformation is successful, the company is expected to break through the valuation ceiling of the traditional staffing agency business and obtain a higher valuation premium similar to technology stocks. The challenge is that the smart elderly care market is highly competitive, with both traditional medical institutions undergoing digital transformation and technology giants making cross-border layouts. As a micro-enterprise, the company is relatively limited in terms of resource investment and technological research and development.

The launch of the “HealthHub” platform and the operation of the Mong Kok physical space show that the company is seriously implementing its transformation strategy[4]. However, it usually takes a long incubation period from the announcement of a strategy to generating substantial revenue contributions, and investors need to be prepared for short-term performance pressure.

Bamboos Healthcare, with a market capitalization of only about HK$200 million, is a typical micro-cap stock. Its liquidity characteristics include: low average daily trading volume, large transactions may have a significant impact on prices, and the bid-ask spread may be large. These characteristics mean that institutional investors usually find it difficult to build large positions, while individual investors have to bear higher transaction costs and execution risks when buying or selling. For investors pursuing liquidity, such stocks may not be suitable as core holdings.

Based on a comprehensive assessment, Bamboos Healthcare’s risk-return characteristics are characterized by the coexistence of high dividends and high volatility. For investors who can bear liquidity risks, are optimistic about the long-term theme of Hong Kong’s aging population, and pursue dividend income, the company may have certain allocation value. However, for investors with high liquidity needs, who cannot bear stock price fluctuations, or who lack research experience in micro-cap stocks, the current price and weak pattern may not be an ideal entry opportunity.

Bamboos Healthcare (02293.HK) is a healthcare staffing solutions provider that benefits from Hong Kong’s population aging trend, and has recently gained market attention for winning the 2025 Listed Company of the Year Award. The company’s current share price is HK$0.490, trading near its 52-week low, its year-to-date performance lags the Hang Seng Index by approximately 3 percentage points, and its dividend rate of around 8% has certain attractiveness to income-oriented investors. The main risks to pay attention to when investing include the inherent liquidity constraints of micro-cap stocks, the downside risk brought by weak stock prices, and the execution uncertainty of business transformation. The company is transitioning from a traditional staffing agency to a smart elderly care platform, and its long-term development space depends on the success of the transformation.

This report is for informational reference only and does not constitute a recommendation to buy, sell, or hold any securities. Investors should make independent investment decisions based on their own risk tolerance and investment objectives.

[1] Yahoo Finance - Bamboos Healthcare (02293.HK) Stock Price, News, Quotes

[5] [Jinling Analysis Tools - Market Sector Performance Data]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.