Shanghai Electric's Nuclear Fusion Technological Breakthrough Drives Stock Surge; Market Sentiment is Euphoric but Valuation Risks Warrant Caution

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on Sina Hong Kong Hot Hourly Report and multiple financial media reports [1][2][3], focusing on the market performance of Shanghai Electric (02727.HK) on January 7, 2026. On that day, the stock surged over 5% intraday, and as of 12:00, it was quoted at HK$4.32, up 3.35%, with a turnover of HK$163 million. The core driver of the stock surge is the company’s successful development of the world’s largest Toroidal Field (TF) coil box for the national major scientific and technological infrastructure CRAFT project. Its size exceeds similar components of the international ITER project, demonstrating the extreme capabilities of China’s high-end equipment manufacturing. Against the backdrop of the upcoming implementation of the Atomic Energy Law and accelerated investment in the fusion industry, Shanghai Electric, as the leading enterprise with the highest market share in domestic nuclear power equipment, is deeply embedded in the national fusion engineering chain and is entering a peak period for the delivery of core nuclear fusion equipment.

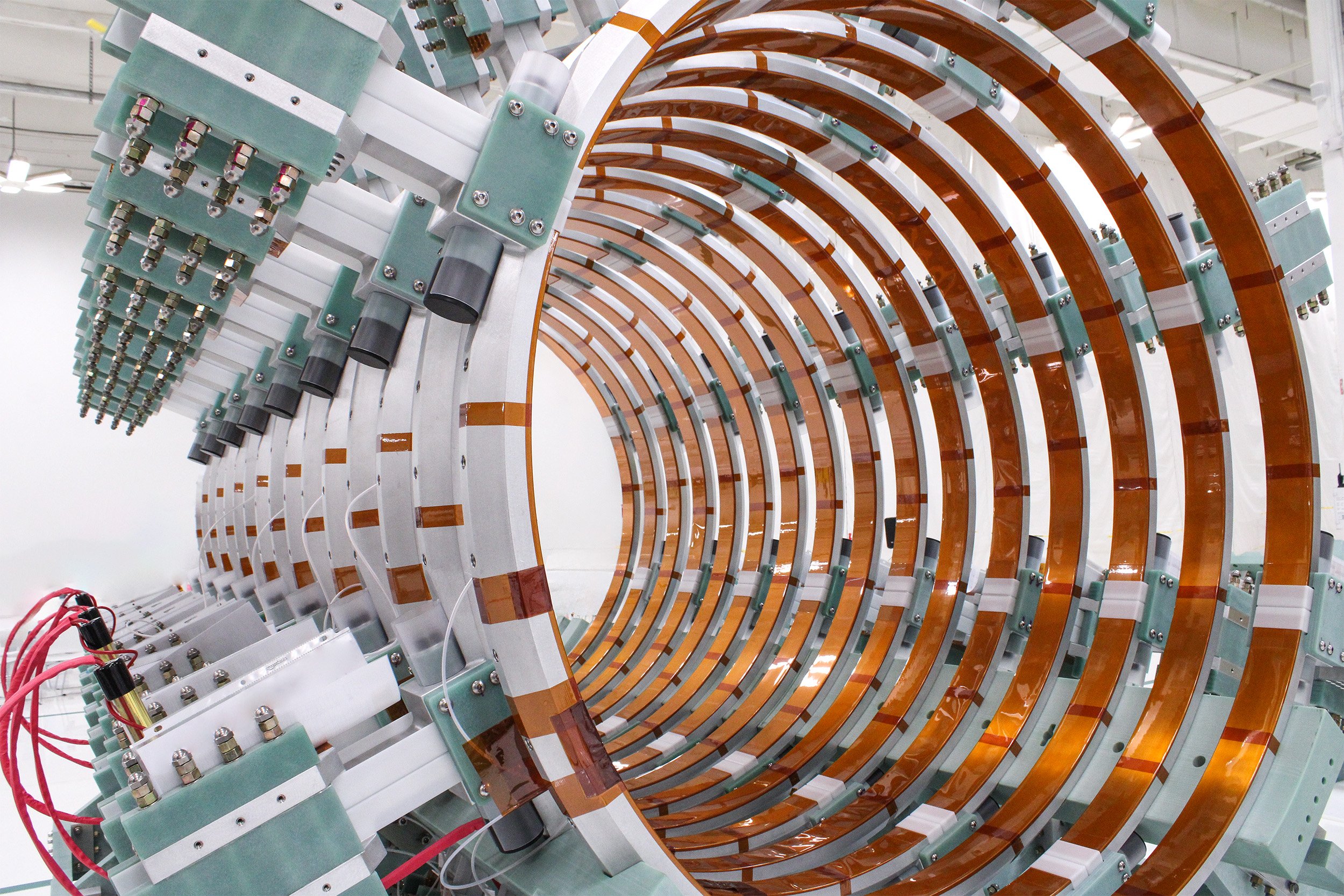

The fundamental reason for Shanghai Electric’s popularity lies in its major technological breakthrough in the field of controlled nuclear fusion. The company successfully developed the world’s largest Toroidal Field (TF) coil box for the national major scientific and technological infrastructure—Comprehensive Research Facility for Fusion Reactor Host Key Systems (CRAFT) [1][2]. This achievement is a milestone: the coil box is 21 meters tall and weighs 400 tons, adopting a 360mm-thick austenitic stainless steel ultra-deep penetration TIG welding process, with welding precision controlled within 2mm, and it can operate stably for a long time at an extremely low temperature of -269℃ [1]. In terms of performance parameters, its overall size is more than 1.2 times that of similar components of the international International Thermonuclear Experimental Reactor (ITER) project, and its weight is about twice that of ITER’s [3]. This breakthrough not only demonstrates the extreme capabilities of China’s high-end manufacturing, but also marks that Shanghai Electric has ranked among the world’s leading players in the field of extreme working condition manufacturing.

From the perspective of industrial chain layout, Shanghai Electric has achieved multiple “from 0 to 1” breakthroughs [2][3]. The company developed a special non-magnetic stainless steel material for the BEST (Compact Fusion Energy Experimental Device) burning plasma experimental device led by the Hefei Institutes of Physical Science, Chinese Academy of Sciences, and completed the full-chain verification from laboratory formula to 5-ton-level industrialization. At the same time, the company also supplies main equipment such as vacuum chambers and low-temperature cold screens to private fusion enterprises such as Energy Singularity and Hebei ENN, demonstrating flexible adaptation capabilities to multiple technical routes such as tokamak and spherical torus. Currently, Shanghai Electric has the manufacturing capacity for a full set of core structural components of tokamak, and since 2025, it has entered a peak period for the delivery of fusion components such as coil boxes, cold screens, and dewars. This boom is expected to continue in 2026 [3].

The current nuclear fusion industry is in a golden development period driven by both policy and capital. The Atomic Energy Law will be officially implemented on January 15, 2026. This is the first time at the national level that the development of fusion energy is explicitly supported at the legal level, providing a solid legal guarantee for the entire industry [4]. Meanwhile, according to industry estimates, the investment scale of domestic fusion projects will reach nearly RMB 60 billion in the three years from 2025 to 2027, and the bidding amount of the BEST device alone exceeded RMB 2 billion last year [4]. This explosive growth in investment scale means that Shanghai Electric, as a core equipment supplier, will directly benefit from industry expansion.

From the perspective of local government layout, Anhui, Sichuan, and Shanghai are competing fiercely to become highlands of the fusion industry [4]. Hefei is betting on the “research-industry” integrated chain, promoting development relying on large devices such as EAST and BEST; Sichuan relies on the technical accumulation of the Southwestern Institute of Physics under China National Nuclear Corporation; Shanghai, with Shanghai Electric as its core manufacturing capacity, is building a complete industrial chain cluster. This situation of local governments competing for layout will further accelerate the industrialization process of nuclear fusion technology, bringing continuous policy dividends and market opportunities for Shanghai Electric.

The controlled nuclear fusion concept has been continuously favored in the capital market. The Wind Controlled Nuclear Fusion Concept Index rose 83.19% cumulatively in 2025, far outperforming the broader market in the same period, reflecting high market recognition of this cutting-edge technology track [4]. Against this background, Shanghai Electric’s technological breakthrough has made it a leading target in the concept sector, attracting the attention of both institutional investors and retail investors.

From a technical analysis perspective, since the successful delivery of the world’s largest TF coil box in October 2025, the market has continued to reprice the company’s leading position in the nuclear fusion field [3]. The volume-driven sharp rise on January 7 indicates that incremental funds have entered the market to scramble for shares, with turnover reaching HK$163 million, showing relatively euphoric market sentiment. This capital support provides short-term momentum for the stock price, but it also means that chasing highs carries risks that need to be watched.

Although the technological breakthrough and concept popularity have driven the stock price up, investors still need to objectively view the company’s fundamental situation. According to Yahoo Finance data [6], the company’s profit margin is only 0.69%, return on assets (ROA) is 0.59%, return on equity (ROE) is 3.23%, and revenue in the past 12 months is RMB 121.87 billion. These data show that the company’s profitability is relatively moderate, and the ROE level is in a low range.

More importantly, controlled nuclear fusion commercialization still requires a long wait. The industry generally expects that the commercialization process may take 20 to 30 years, which means that the current stock price rally is driven more by thematic investment sentiment rather than substantive improvement in short-term performance. The proportion of the company’s nuclear fusion business in overall revenue is still limited, and traditional nuclear power equipment and machinery manufacturing businesses still contribute the main revenue. In the nuclear power equipment field, although the company’s cumulative comprehensive market share ranks first in the industry during the “14th Five-Year Plan” period [2], the overall slowdown in industry growth and intensified competition pose pressure on profit growth.

At the critical stage when the nuclear fusion industry is transitioning from experimental research to engineering application, Shanghai Electric has adopted a unique “shovel-selling” business model. Just as those who sold shovels during the California Gold Rush made more money than the gold prospectors, Shanghai Electric has started to realize value before commercial fusion energy is achieved by providing key equipment and materials such as coils, vacuum chambers, low-temperature cold screens, and dewars required for nuclear fusion devices [3]. The advantage of this model is that the company can generate stable revenue and cash flow without waiting for the commercialization of nuclear power generation, while avoiding the risks of technical route uncertainty. The delivery peak since 2025 and the expected continuous growth in 2026 have proven the feasibility and forward-looking nature of this business model.

Shanghai Electric’s success in the nuclear fusion field is not accidental, but based on long-term technological accumulation and in-depth industrial chain integration. As a leading domestic high-end equipment manufacturer, the company has deepened its presence in the nuclear power equipment field for many years, accumulating rich experience in manufacturing under extreme working conditions. The successful development of the world’s largest TF coil box is not only a product breakthrough, but also an important symbol that China’s high-end manufacturing industry has proven its extreme manufacturing capabilities to the world. The establishment of this technological status has built high competitive barriers for the company: although enterprises such as Dongfang Electric, Western Superconducting Technology, and Advanced Technology & Materials Co., Ltd. are also participating in nuclear fusion supply [4], Shanghai Electric has established an obvious leading advantage in core structural component manufacturing capabilities.

The company will hold an extraordinary general meeting of shareholders on January 26, 2026, to elect members of the 6th Board of Directors [5]. The composition of the new board of directors and its strategic planning will to a certain extent affect the company’s future investment intensity and development direction in the nuclear fusion field. The election results of executive and non-executive directors such as Dr. Wu Lei, Mr. Zhu Zhaokai, Ms. Lu Wen, and Mr. Zhu Jiaqi deserve close attention from investors. The strategic priorities and resource allocation decisions of the new management may have an important impact on the development trajectory of the company’s nuclear fusion business.

Short-term (1-2 weeks): Close attention should be paid to the market reaction after the implementation of the Atomic Energy Law on January 15, as well as the management’s statements at the extraordinary general meeting of shareholders on January 26. Short-term traders can focus on the breakthrough of the two resistance levels of HK$4.50 and HK$4.80 [1].

Medium-term (1-6 months): Key variables affecting the stock price will include the delivery progress of key components for the BEST project, dynamics of nuclear power equipment bidding, and the introduction of supporting policies for the Atomic Energy Law.

Long-term (more than 6 months): The actual implementation of investment scale in the nuclear fusion industry, the continuous consolidation of the company’s technological advantages, and the R&D progress of commercial fusion energy will determine the company’s long-term investment value.

The core driver of Shanghai Electric (02727.HK) becoming a hot stock is its groundbreaking technological achievement in the field of controlled nuclear fusion. The company successfully developed the world’s largest TF coil box, whose size and performance exceed similar components of the international ITER project, and its technological status has been recognized by the market [1][2][3]. The upcoming implementation of the Atomic Energy Law (January 15) and the expected investment of nearly RMB 60 billion in fusion projects from 2025 to 2027 provide a favorable policy environment and market space for the development of the company’s nuclear fusion business [4].

However, investors should note that the current stock price rally is mainly driven by thematic investment sentiment rather than substantive improvement in short-term performance. The company’s profitability is relatively moderate, with an ROE of only 3.23% [6], and the nuclear fusion business contributes limitedly to overall performance in the short term. In investment decision-making, focus should be placed on the follow-up progress of order delivery, the policy catalytic effect after the implementation of the Atomic Energy Law in January 2026, and the management’s strategic direction after the board of directors’ election on January 26. The company’s “shovel-selling” business model enables it to benefit early from the fusion industry investment boom, and the value realization capability of this model deserves continuous tracking and evaluation.

| Market | Ticker | Description |

|---|---|---|

| Hong Kong Stock Exchange | 02727.HK | Listed as H-share |

| Shanghai Stock Exchange | 601727.SS | Listed as A-share |

[1] Sina Hong Kong Hot Hourly Report | 12:00, January 7, 2026

[4] Over RMB 60 Billion in Investment in Three Years! The Atomic Energy Law Takes Effect on January 15

[5] Shanghai Electric (02727): Proxy Form

[6] Shanghai Electric Group Co., Ltd. (SIELY) - Yahoo Finance

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.