Analysis of the Commercialization Prospects of Large Models in Medical Surgery and Their Impact on Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and analysis, I present to you an in-depth research report on

The global surgical robot market is in a period of rapid growth. According to Frost & Sullivan’s forecast, the global surgical robot market size will exceed

- 2023: AI-powered surgical robot market size reached USD 5.5 billion, with a growth rate of 12%

- 2024: Market size grew to USD 6.8 billion, with a growth rate of 15%

- 2025: Projected to reach USD 7.7-8.02 billion, with a growth rate of 18%

- 2026: Global surgical robot market is projected to exceed USD 32 billion

- Global installed base of surgical robots is projected to exceed 2,100 units

The Chinese surgical robot market is accelerating its development. From January to November 2025, sales volume of surgical robots in the Chinese market reached approximately

This breakthrough follows a research result published in Science Robotics in July 2025 — the SRT-H surgical robot developed by Johns Hopkins University successfully completed autonomous cholecystectomy without human intervention in animal experiments with a

| Company | Technology Route | Progress | Regulatory Status |

|---|---|---|---|

| Moon Surgical | Maestro Surgical Robot | Treated over 1,100 patients | FDA 510(k) clearance (2024) [3] |

| Intuitive Surgical | AI Upgrade for Da Vinci System | ~76% market share for 5th-generation system | Continuous iteration |

| Medtronic | Hugo Surgical Robot | FDA-cleared | Launched in EU, Japan, and Greater Bay Area of China |

| Zimmer Biomet | Monogram System | AI-navigated knee replacement | Acquired for USD 17.7 billion (2025) [4] |

- Received FDA clearance for its Wi-Fi/5G connectivity and AI-driven ScoPilot program in July 2025

- A Predetermined Change Control Plan (PCCP) allows for faster deployment of software updates in the future

- Enables edge-to-cloud data capture and analysis via Nvidia Holoscan and IGX platforms [3]

2026 will mark a critical window for the

- Guidelines for the Establishment of Medical Service Price Items for Surgical and Therapeutic Auxiliary Operations will be fully implemented in 2026, incorporating 36 auxiliary operation items and clarifying charging standards and reduction rules

- The National Healthcare Security Administration issued a notice in September 2025, promoting classified coding of medical consumables related to surgical robots

- Medical insurance pays for the additional clinical valuecreated by robots (such as precision, recovery speed, reduced complications, etc.) rather than directly paying for the equipment [1]

AI technology is now integrated throughout the entire cycle of “R&D — Training — Clinical Practice”:

- R&D Phase:Johnson & Johnson collaborates with Nvidia to build high-fidelity digital twins using the Nvidia Isaac and Omniverse libraries

- Training Phase:AI builds virtual operating rooms to replicate patient anatomical structures and clinical scenarios

- Clinical Phase:AI algorithms assist surgeons in precise instrument control, supporting single surgeons to perform multiple tasks simultaneously [1]

Evolving from single auxiliary functions to full-process intelligence:

- Remote Surgery: 5G + cloud collaboration enables two-way latency of less than 50 ms for inter-provincial surgeries and less than 150 ms for intercontinental surgeries

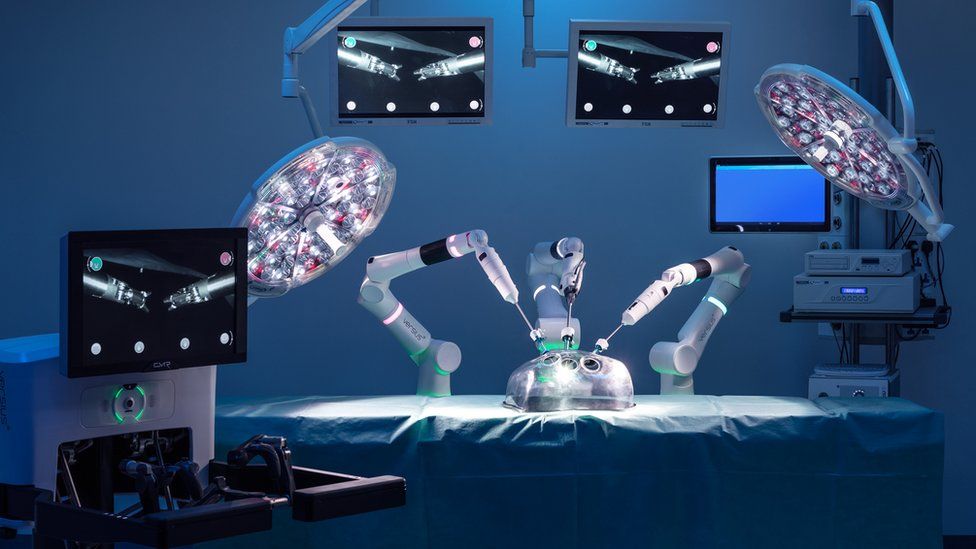

- Digital Ecosystem: Surgical robots have become core hubs for medical data. For example, CMR Surgical’s Versius Connect APP can track equipment usage, case volume, and other data [1]

| Challenge Type | Specific Content | Impact Level |

|---|---|---|

| Regulatory Uncertainty | Regulatory system for AI medical products is still improving | High |

| Long Commercialization Cycle | 3-5 years required from animal experiments to clinical application | High |

| Cost Pressure | High initial investment and maintenance costs for equipment | Medium |

| Talent Gap | High demand for systematic operation training for medical staff | Medium |

| Data Security | Risks of medical AI data leakage need to be prevented | Medium |

- Current Stock Price: HK$25.03, 52-week trading range: HK$8.58-HK$33.70

- 2025 Stock Price Increase: 123%, 1-year price change:169.35%

- Market Capitalization: Approximately HK$25.9 billion, 12-month target price:HK$29.47, potential upside:+17.74%

- 4 analysts gave a “Buy” rating, 0 recommended selling [5]

-

Technological Innovation Premium

- AI autonomous surgery technology represents the next development direction

- Technology-leading enterprises can obtain a 10-30% valuation premium

- Case: MicroPort MedBot’s stock price increased by 123% in 2025 due to breakthroughs in the MicroGenius large model

-

Expanded Market Space

- AI technology lowers surgical thresholds and expands potential surgical volume

- Annual market growth of 25%+ drives valuation increases

- Global market is projected to exceed USD 32 billion by 2026

-

Policy Support

- Dual policies of medical insurance + service pricing are implemented, gradually removing commercialization barriers

- Valuation logic shifts from “expectations” to “performance”

-

Domestic Substitution Opportunities

- In 2025, the NMPA issued nearly 60 registration certificates for surgical robots, with domestic brands dominating

- Increased market share of local enterprises leads to valuation re-rating

- Long Commercialization Cycle:Short-term performance realization is difficult, leading to high valuation volatility

- Regulatory Uncertainty:Compliance costs and uncertainties affect valuation

- Intensified Competition:Giants such as Mindray and United Imaging have entered the market, putting pressure on profit margins

- Insufficient Profitability:Most enterprises are still in a loss-making state, with valuation mainly based on price-to-sales (PS) ratio

| Company | Market Capitalization | Valuation Characteristics | Investment Rating |

|---|---|---|---|

| Intuitive Surgical (ISRG) | Approximately USD 200 billion | Mature profitability, high PE ratio | Fair Valuation ($596) [6] |

| MicroPort MedBot (02252.HK) | Approximately HK$25.9 billion | High growth, loss-making | “Buy” (+17.74% upside) [5] |

| Medtronic (RAS Business) | Approximately USD 15 billion | Steady growth | Watch |

| Stryker | Approximately USD 18 billion | Orthopedics leader | Watch |

| Jingfeng Medical | Upcoming IPO | Third listed in Hong Kong | Observe |

- Technology Leaders:Enterprises mastering core AI autonomous surgery technologies will gain first-mover advantages

- Beneficiaries of Domestic Substitution:Against the backdrop of medical insurance cost control, cost-effective domestic brands will accelerate market penetration

- Platform-Based Enterprises:Enterprises with platform capabilities integrating “equipment + consumables + services” will enjoy higher valuation premiums

- Overseas Expanders:Enterprises successfully entering high-end markets such as Europe, the Middle East, and Latin America will have greater growth potential

| Risk Category | Specific Risk | Response Strategy |

|---|---|---|

| Regulatory Risk | Changes in approval policies for AI medical products | Focus on enterprises with strong compliance capabilities |

| Technological Risk | Uncertainty in technological routes | Diversify investments to avoid concentration |

| Market Risk | Price wars caused by intensified competition | Focus on enterprises with cost advantages |

| Policy Risk | Pressure from medical insurance cost control | Focus on products with clear clinical value |

| Liquidity Risk | High volatility of small-cap companies | Pay attention to position management |

- MicroPort MedBot (02252.HK):Leading in AI autonomous surgery technology, accelerating overseas expansion, 12-month target price: HK$29.47

- Intuitive Surgical (ISRG):Industry leader, continuous innovation in AI and digital tools, fairly valued

- Jingfeng Medical:Upcoming IPO in Hong Kong, leading in single-port surgical robot technology

The commercialization prospects of large models in medical surgery are

- Short-term (2026-2027):Policy breakthroughs will accelerate commercialization, but performance realization still takes time

- Mid-term (2028-2029):Large-scale clinical application will drive rapid penetration rate growth

- Long-term (2030 and beyond):The market will enter a mature stage, and enterprises with advantages in technology, cost, and channels will win out

The impact of AI autonomous surgery technology on the valuation of medical robotics companies presents a

[1] Tencent News, “Dual Policies of Medical Insurance + Service Pricing Implemented, Trillion-Yuan Surgical Robot Track Welcomes New Situation in 2026”, https://news.qq.com/rain/a/20251229A04GDA00

[2] Liv Hospital, “Robots in the Operating Room: 7 Key Facts About AI Surgery Robots in 2025”, https://int.livhospital.com/robots-in-the-operating-room-7-key-facts-about-ai-surgery-robots-in-2025/

[3] Fierce Biotech, “Moon Surgical enters new phase, updating robots with AI”, https://www.fiercebiotech.com/medtech/moons-maestro-surgical-platform-reaches-stars-ai-additions

[4] LinkedIn, “Medical Robotics Review 2025”, https://www.linkedin.com/pulse/medical-robotics-review-2025-stephan-hulsbergen--djcoe

[5] Investing.com, “MicroPort MedBot-B (2252) Latest Stock Price Quote”, https://cn.investing.com/equities/shanghai-microport-medbot

[6] Simply Wall St, “Can Intuitive Surgical’s Robotic Surgery Growth Justify Its Expensive Valuation”, https://simplywall.st/stocks/us/healthcare/nasdaq-isrg/intuitive-surgical/news/can-intuitive-surgicals-robotic-surgery-growth-justify-its-e

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.