Analysis of the Impact of AnaptysBio Insider Trading on Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

AnaptysBio, Inc. (NASDAQ: ANAB) has recently seen a concentrated share sale by multiple executives. Chief Legal Officer Eric Loumeau sold approximately

According to SEC Form 4 filings, three core executives of AnaptysBio conducted share sales in mid-December 2025 [1][2]:

| Transaction Date | Number of Shares | Average Transaction Price | Transaction Amount |

|---|---|---|---|

| 2025-12-16 | 8,305 | $44.68 | $371,028 |

| 2025-12-16 | 4,195 | $45.24 | $189,769 |

| 2025-12-17 | 10,000 | $46.00 | $460,000 |

| 2025-12-18 | 141 | $46.99 | $6,626 |

Total |

22,641 |

- | $1,027,423 |

After the sale, Mr. Loumeau directly holds

- Transaction Date: December 16, 2025

- Shares Sold: 15,725

- Average Transaction Price: $44.85

- Proceeds: $705,266

- Remaining Shares Held: 9,401 (a 62.58% decrease) [4]

- Transaction Date: December 22, 2025

- Shares Sold: 1,500

- Average Transaction Price: $50.00

- Proceeds: $75,000

- Remaining Shares Held: 26,967 [5]

Key features of the 10b5-1 plan:

- The plan was established by Mr. Loumeau on April 11, 2025

- Complies with SEC regulations, pre-established when no material non-public information was held

- Has a fixed execution schedule and price conditions

- Designed to avoid suspicion of insider trading

This indicates that this share sale is a

From a traditional investment perspective, insider share sales are typically viewed as a bearish signal:

| Negative Factors | Details |

|---|---|

Concentrated Share Sale |

Three executives sold shares within a similar time window, with total proceeds of approximately $1.8 million |

Proceeds at High Price |

Transactions occurred when the stock price was near its 52-week high (reached $52.00 on December 27) |

Sharp Reduction in Shareholdings |

Loumeau only holds 8,947 shares after the sale, while Mulroy only holds 9,401 shares |

Industry Sensitivity |

Biotechnology companies are highly sensitive to changes in executive confidence |

However, in-depth analysis shows that this transaction may not reflect negative views from management regarding the company:

| Bullish/Neutral Factors | Details |

|---|---|

Pre-Arranged Plan |

The 10b5-1 plan indicates the transaction is part of long-term planning, not an impulsive decision |

Company Share Repurchase |

In November 2025, the company announced a $100 million share repurchase plan, demonstrating management’s confidence in the company’s value [6] |

Financial Health |

Current ratio as high as 8.68, cash reserves expected to reach $300M |

Earnings Beat Expectations |

FY2025 Q3 EPS was $0.52, exceeding expectations by 149% [0] |

Analyst Bullish Sentiment |

65% of analysts have given a Buy rating, with a consensus target price of $55.50 [0] |

Small Proportion of Market Value |

Total proceeds of approximately $1.8 million, accounting for only 1.5% of the company’s market capitalization ($1.22B) |

Based on the latest financial data [0]:

| Financial Indicator | Value | Assessment |

|---|---|---|

| Market Capitalization | $1.22B | Mid-sized biotechnology company |

| Current Ratio | 8.68 | Extremely healthy |

| Current Assets/Short-term Liabilities | 8.68x | Low financial risk |

| P/E | N/A | Not applicable (in R&D phase, not yet profitable) |

| Period | Revenue | EPS | Remarks |

|---|---|---|---|

| Q3 FY2025 | $76.32M | $0.52 | Significantly exceeded expectations |

| Q2 FY2025 | $22.26M | -$1.34 | Incurred a loss |

| Q1 FY2025 | $27.77M | -$1.28 | Incurred a loss |

| Q4 FY2024 | $43.11M | -$0.72 | Incurred a loss |

| Indicator | Value |

|---|---|

| Consensus Target Price | $55.50 |

| Potential Upside | +26.4% |

| Target Price Range | $36.00 - $140.00 |

| Proportion of Buy Ratings | 65% |

| Proportion of Hold Ratings | 35% |

Recent Analyst Actions (November-December 2025):

- Barclays: Maintained Overweight rating [0]

- Stifel: Maintained Buy rating [0]

- HC Wainwright: Maintained Buy rating [0]

- Wedbush: Maintained Outperform rating [0]

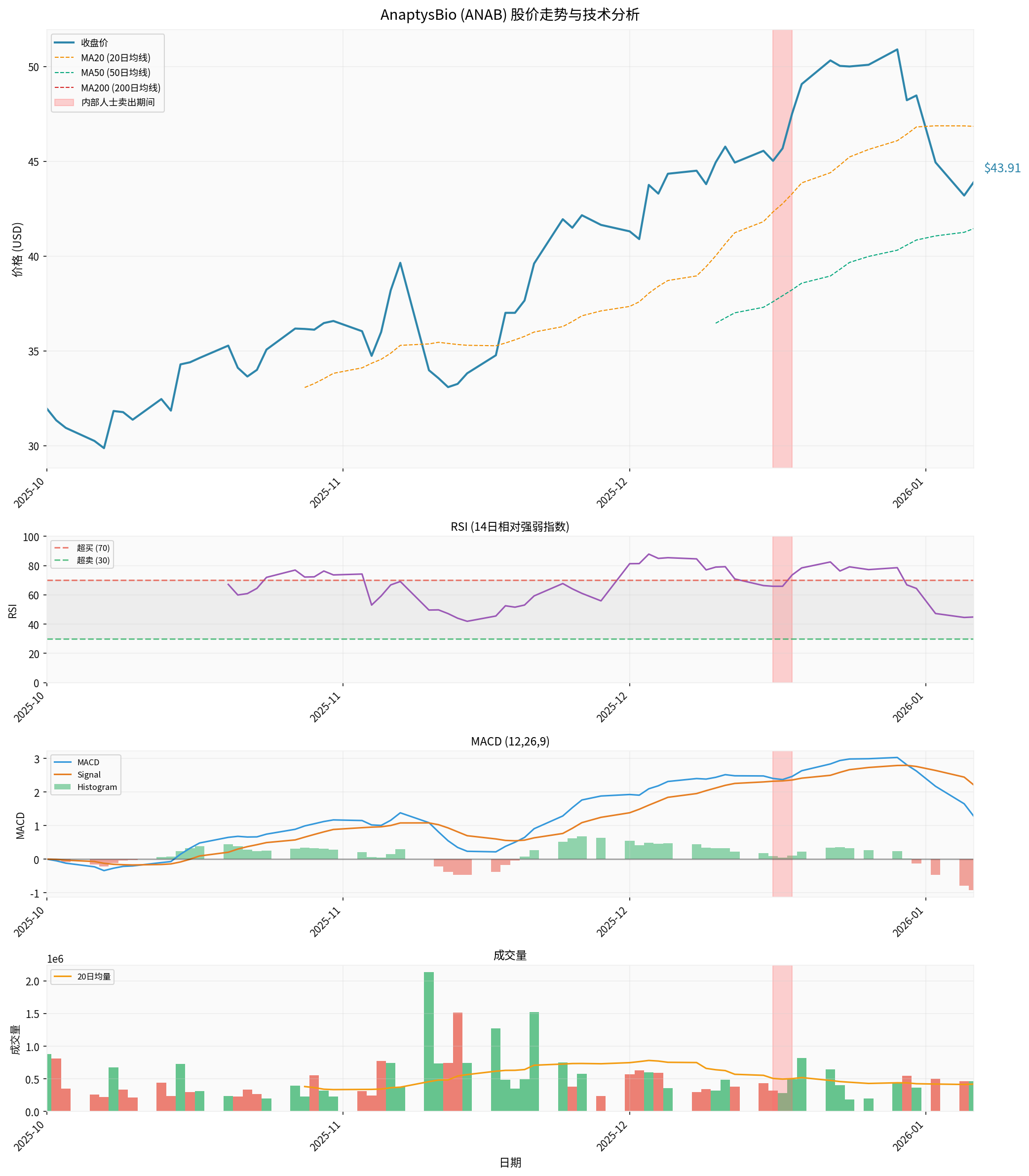

- Current Stock Price: $43.91

- 52-Week High: $52.47

- 52-Week Low: $12.21

- Decline from High: -16.31%

- Increase from Low: +259.6%

- 2025 Increase: +186.99%

- Year-to-Date (as of January 2026): -2.31%

- 3-Month Increase: +45.16%

- 6-Month Increase: +87.25%

| Indicator | Value | Interpretation |

|---|---|---|

| MA20 (20-day Moving Average) | $46.85 | Stock price is below the short-term moving average (-6.28%) |

| MA50 (50-day Moving Average) | $41.46 | Stock price is above the medium-term moving average (+5.91%) |

| RSI (14-day) | 44.83 | Neutral zone, no overbought or oversold conditions |

| MACD | 1.28 | Below the signal line, bearish |

| 20-day Annualized Volatility | 45.62% | High volatility |

As seen from the technical chart:

- During the insider sale period (December 16-18), the stock price was in a short-term correction phase

- Trading volume remained at normal levels, with no abnormal volume spikes

- The stock price began to pull back after hitting the 52-week high of $52.00 on December 29

| Factor | Weight | Direction | Explanation |

|---|---|---|---|

| Execution of 10b5-1 Plan | High | Neutral | Pre-arranged transactions reduce suspicion of insider trading |

| Proportion of Proceeds to Market Value | Low | Neutral | Accounts for only 1.5% of market capitalization |

| Concentrated Share Sale by Executives | Medium | Bearish | May reflect concerns about valuation |

| Company Share Repurchase Plan | High | Bullish | Management supports the stock price through actions |

| Financial Health Status | High | Bullish | Adequate cash reserves, healthy current ratio |

| Performance | Medium | Bullish | Q3 results exceeded expectations |

| Analyst Expectations | Medium | Bullish | 26% upside potential from target price |

| Industry Risk | High | Bearish | Biotechnology R&D risks |

- Compliance of Trading Plan:All transactions are pre-arranged 10b5-1 plan transactions, not impulsive decisions, indicating that management’s share sale is not based on negative information.

- Endorsement via Company Share Repurchase:Management sold shares after the company announced the $100M repurchase plan, which does not directly conflict with the company’s repurchase actions.

- Sound Fundamentals:

- Adequate cash reserves (expected to reach $300M)

- Extremely high current ratio (8.68x)

- Q3 results exceeded expectations

- Potential $75M milestone revenue

- Analyst Confidence:65% Buy ratings and a consensus target price of $55.50 show that professional institutions remain optimistic about the company’s prospects.

- Small-Scale Transaction:Total proceeds of approximately $1.8 million, accounting for an extremely low proportion (1.5%) of the $1.22B market capitalization.

Investors still need to pay attention to the following risks:

- Short Selling Pressure:More than 30% of floating shares are shorted [7], indicating significant market divergence

- High Volatility:Annualized volatility of 45.62%, with sharp stock price fluctuations

- Biotechnology Risks:Uncertainty regarding clinical trial results

- Valuation Pressure:Currently down 16% from the 52-week high; support levels need to be monitored

| Investor Type | Recommendation |

|---|---|

Existing Shareholders |

Hold and monitor; no need to panic sell due to the insider sale |

Potential Investors |

May consider accumulating shares on dips in the $40-42 range |

Risk-Tolerant Investors |

Monitor the upcoming Q4 earnings report (February 26, 2026) |

- Q4 Earnings Report on February 26, 2026:Monitor EPS expectations ($0.89) and revenue guidance

- GSK Milestone Payment:Confirmation timing of the $75M milestone

- Subsequent Insider Trading:Monitor whether more executives sell shares

- Institutional Holding Changes:Monitor changes in positions by large institutional investors

The share sale by AnaptysBio’s executive team may trigger investor concerns in the short term, but from a multi-dimensional analysis, the impact of this transaction on the company’s long-term investment value is limited. The use of a pre-arranged 10b5-1 trading plan, compliant transaction timing, and the company’s own share repurchase plan all indicate that this is more a reflection of the executives’ personal financial planning rather than a negation of the company’s prospects.

Considering the company’s healthy financial status, earnings that exceeded expectations, and positive analyst ratings, investors should view this insider sale as a

[0] Jinling API - AnaptysBio Company Profile and Market Data

[1] SEC Form 4 - Eric Loumeau Transaction Disclosure (https://www.sec.gov/Archives/edgar/data/1239648/000123964825000005/0001239648-25-000005.txt)

[2] TradingView - AnaptysBio Executives Sell Shares (https://www.tradingview.com/news/tradingview:5f854cdf0bfa5:0-anaptysbio-executives-sell-shares/)

[3] WhaleWisdom - Form 4 Insider Filing Concerning ANAB (https://whalewisdom.com/filing/loumeau-eric-j-4-2025-12-18-161404-0500-anab)

[4] InsiderTrades - Dennis Mulroy Sells 15,725 Shares (https://www.insidertrades.com/alerts/nasdaq-anab-insider-buying-and-selling-2025-12-19/)

[5] InsiderTrades - Paul Lizzul Sells 1,500 Shares (https://www.insidertrades.com/alerts/nasdaq-anab-insider-buying-and-selling-2025-12-24/)

[6] AnaptysBio IR - $100 Million Stock Repurchase Plan (https://ir.anaptysbio.com/news-releases/news-release-details/anaptys-announces-100-million-stock-repurchase-plan)

[7] Barchart - This Biotech Stock Has More Than Tripled in 2025 (https://www.barchart.com/story/news/36717167/this-biotech-stock-has-more-than-tripled-in-2025-but-red-flags-are-waving)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.