In-Depth Analysis of the Rationality of Crinetics Pharmaceuticals (CRNX) IPO Pricing

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Crinetics Pharmaceuticals, Inc. (NASDAQ: CRNX) is a clinical-stage pharmaceutical company focused on endocrine diseases and endocrine-related tumors, headquartered in San Diego, California. The company is committed to the discovery, development, and commercialization of novel small-molecule therapies targeting G protein-coupled receptors (GPCRs) [0][1].

| Product Name | Indication | Development Stage | Key Milestones | Competitive Advantages |

|---|---|---|---|---|

PALSONIFY™ (paltusotine) |

Acromegaly | FDA-Approved |

FDA approval in September 2025 | First oral selective SST2 receptor agonist |

Atumelnant (CRN04894) |

Congenital Adrenal Hyperplasia (CAH) | Phase 3 | First patient enrolled in December 2025 | First small-molecule ACTH receptor antagonist to enter clinical trials; granted FDA Orphan Drug Designation |

CRN09682 |

SST2+ Neuroendocrine Tumors | Phase 1/2 | First patient dosed in Q4 2025 | First drug candidate from the NDC platform |

CRN12755 |

Graves’ Disease | Preclinical | IND-enabling studies | TSHR antagonist candidate |

CRN10329 |

Autosomal Dominant Polycystic Kidney Disease | Preclinical | Lead candidate development stage | SST3 agonist |

Based on the following multi-dimensional analysis, this pricing level has received broad recognition from the market and analysts [0][2]:

| Dimension | Assessment | Explanation |

|---|---|---|

Commercialization Milestones |

⭐⭐⭐⭐⭐ | The company has transitioned from a pure R&D stage to a commercial stage; PALSONIFY™ received FDA approval in September 2025 |

Cash Flow Position |

⭐⭐⭐⭐⭐ | Total current assets of $2.073 billion (including $1.109 billion in cash + $981 million in investment securities), sufficient to support 3-4 years of operations |

Analyst Consensus |

⭐⭐⭐⭐⭐ | 94% of analysts have assigned a Buy rating, with an average target price of $82.00, representing a 78.5% upside potential |

Pipeline Value |

⭐⭐⭐⭐ | Atumelnant has entered Phase 3, with significant first-mover advantage and FDA Orphan Drug Designation |

Market Outlook |

⭐⭐⭐⭐ | The acromegaly treatment market has a CAGR of 8.9%, with an expected size of $2.49 billion by 2032 |

| Dimension | Risk Level | Explanation |

|---|---|---|

Revenue Realization |

Medium-High | No substantial product revenue has been generated yet (Q3 revenue was only $143,000 from licensing fees) |

Valuation Multiples |

High | The P/S ratio is as high as 2840x, with valuation highly dependent on future revenue realization |

Widening Losses |

Medium-High | YTD net loss of $343 million, a 57% increase compared to the same period last year |

| Metric | Value | Industry Comparison |

|---|---|---|

| Cash and Cash Equivalents | $1.109B | Sufficient |

| Investment Securities | $0.981B | Sufficient |

| Total Current Assets | $1.121B | Healthy |

| Current Ratio | 15.12x |

Far exceeds the industry average (typically >1.5x) |

| Total Liabilities | $0.124B | Low debt ratio |

| Shareholders’ Equity | $1.072B | Robust |

- YTD cash outflow from operating activities: $285 million

- YTD R&D expenditure: $247 million (42% year-over-year increase)

- YTD general and administrative expenses: $138 million (92% year-over-year increase)

| Rating Agency | Rating | Target Price | Date |

|---|---|---|---|

| Morgan Stanley | Overweight | - | 2026-01-06 |

| Citizens | Market Outperform | - | 2025-11-07 |

| Oppenheimer | Outperform | - | 2025-09-30 |

| Leerink Partners | Outperform | - | 2025-09-29 |

Consensus Target Price |

Buy (94%) |

$82.00 |

- |

| Target Price Range | - | $36.00 - $143.00 | - |

For biopharmaceutical companies that have not yet generated substantial revenue but have approved products and late-stage pipelines, valuation should take the following factors into comprehensive consideration [4][5]:

Core Valuation = Pipeline Value + Cash Value - Debt - R&D Risk Discount

| Valuation Component | Assessment Method | Value Contribution |

|---|---|---|

| Commercialization Value of PALSONIFY™ | DCF (based on a $1.55 billion market) | High |

| Option Value of Atumelnant | rNPV (Phase 3 success probability ~60%) | Medium-High |

| Early-Stage Pipeline Value | rNPV (Phase 1/2 success probability ~30%) | Medium |

| Cash and Investments | Market Value | $2.09B |

| Company Type | Market Capitalization Range | Revenue Multiple | Development Stage |

|---|---|---|---|

| Crinetics (Approved + Phase 3) | $4.36B | N/A | Commercial |

| Acromegaly Peer Companies | $2.5-8.0B | 8-15x | Commercial/Clinical |

| Average for Rare Disease Biopharmaceuticals | $3.0-10.0B | 12-20x | Clinical Stage |

| Average for Early-Stage Biotechs | $2.0-15.0B | 15-25x | R&D Stage |

- 2024 Market Size: $1.55 billion

- 2032 Projected Market Size: $2.49 billion

- CAGR: 8.9% [6][7]

- Number of Patients in the US: Approximately 36,000 (17,000 undiagnosed)

- Target Patients: 11,500 actively managed patients

- Current treatments are dominated by injectable somatostatin receptor ligands (e.g., octreotide, lanreotide)

- As the first oral selective non-peptide SST2 agonist, PALSONIFY™ has compliance advantages

- Global Patients: Approximately 75,000-80,000

- Limitations of Current Treatments: Long-term glucocorticoid replacement therapy, accompanied by severe side effects

- Advantages of Atumelnant:

- First small-molecule ACTH receptor antagonist to enter clinical trials

- Phase 2 trials showed an average 80% reduction in androstenedione

- Granted FDA Orphan Drug Designation (7 years of market exclusivity)

| Metric | 2024 | 2034 Projection | CAGR |

|---|---|---|---|

| Global Market Size | $195.2B | $587.1B | 11.6% |

| US Market Size | $76.9B | $184.7B | 9.2% |

| North American Market Share | 63% | Maintains dominance | - |

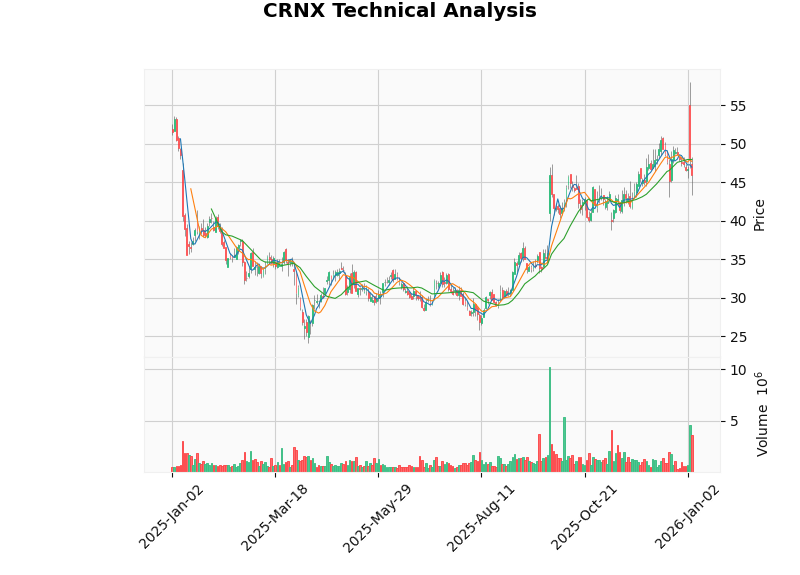

| Indicator | Value | Signal Interpretation |

|---|---|---|

| MACD | No Crossover | Neutral to Weak |

| KDJ | K:33.8, D:46.9, J:7.4 | Sell Signal |

| RSI (14) | Normal Range | No Overbought/Oversold Signal |

| Support Level | $44.61 | Strong short-term support |

| Resistance Level | $47.95 | Short-term resistance level |

| Period | Return Rate |

|---|---|

| 5-Day | -1.44% |

| 1-Month | -1.54% |

| 3-Month | +10.24% |

| 6-Month | +58.12% |

| 1-Year | -8.99% |

| 3-Year | +159.46% |

| Since IPO | +89.92% |

| Assessment Dimension | Weight | Score | Weighted Score |

|---|---|---|---|

| Product Commercialization Progress | 25% | 5.0 | 1.25 |

| Cash Flow Health | 20% | 5.0 | 1.00 |

| Pipeline Value | 25% | 4.0 | 1.00 |

| Market Outlook | 15% | 4.0 | 0.60 |

| Analyst Consensus | 15% | 4.5 | 0.68 |

Comprehensive Score |

100% |

- | 4.53 |

- Entry Timing: The current stock price of $45.95 is close to the technical support level of $44.61, offering a favorable risk-reward ratio

- Target Price: The analyst consensus target of $82.00 represents a 78.5% upside potential

- Investment Logic:

- Short-term: Focus on the commercialization execution of PALSONIFY™ and Q4 financial results

- Medium-term: Focus on Atumelnant Phase 3 trial data (expected in mid-2026)

- Long-term: Focus on European market approval and pipeline expansion

| Risk Type | Specific Risk | Impact Level |

|---|---|---|

Commercialization Risk |

PALSONIFY™ sales fall short of expectations | Medium-High |

Clinical Risk |

Atumelnant Phase 3 failure | High |

Regulatory Risk |

EMA approval delay or rejection | Medium |

Competitive Risk |

Competitors launch superior therapies | Medium-High |

Financing Risk |

Need for additional financing in the future leading to equity dilution | Medium |

Market Risk |

Valuation correction in the biopharmaceutical sector as a whole | Medium |

- Product Commercialization: FDA approval of PALSONIFY™ means the company has completed its strategic transition from the R&D stage to the commercial stage, with the valuation logic shifting from pipeline value method to revenue multiple method

- Sufficient Cash Flow: Current assets of $2.073 billion provide a sufficient safety margin, enough to support the company in completing Atumelnant’s Phase 3 trials and subsequent commercialization preparations

- Differentiated Pipeline Advantage: As the first small-molecule ACTH receptor antagonist to enter clinical trials, Atumelnant has significant first-mover advantage and policy benefits from FDA Orphan Drug Designation

- High Recognition from Analysts: 94% Buy rating and 78.5% average target price upside potential reflect professional investment institutions’ optimistic expectations for the company’s commercialization prospects

- Broad Market Outlook: The 8.9% CAGR of the acromegaly treatment market and the structural growth of the rare disease market provide a solid demand foundation for product sales

[0] Jinling API Data - Company Overview, Financial Data and Technical Analysis of Crinetics Pharmaceuticals

[1] Crinetics Pharmaceuticals Official Website - Company and Pipeline Introduction (https://crinetics.com/pipeline/)

[2] Simply Wall St - CRNX Stock Analysis and Price Target (https://simplywall.st/stocks/us/pharmaceuticals-biotech/nasdaq-crnx/crinetics-pharmaceuticals)

[3] SEC.gov - CRNX 10-Q Filing (November 6, 2025) (https://www.sec.gov/Archives/edgar/data/1658247/000165824725000019/crnx-20250930.htm)

[4] Market Research Future - Biopharmaceutical Valuation Methodology (https://www.biopharmavantage.com/wp-content/uploads/2023/09/Biotech-Comparables-company-valuation-Multiples-Method-BiopharmaVantage-Consulting.png)

[5] Baybridge Bio - Biotech IPO Valuation Analysis (https://www.baybridgebio.com/Images/biotech_ipos_valuation_ye_2023.png)

[6] Market.us - Acromegaly Treatment Market Analysis (https://market.us/wp-content/uploads/2022/06/Acromegaly-Treatment-Market-Size.png)

[7] Credence Research - Acromegaly Treatment Market (https://www.credenceresearch.com/wp-content/uploads/2025/08/Acromegaly-Treatment-Market-Size-and-Segmentation.jpg)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.