AI & Tech Market Analysis: CES 2026 Leadership Presentations from Nvidia and AMD

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

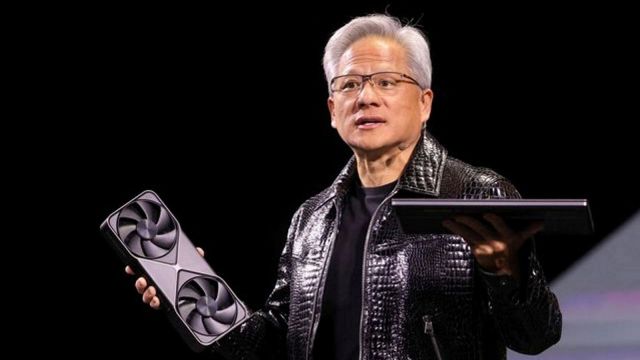

This analysis examines the January 6, 2026 market reaction to major AI chip announcements from Nvidia (NVDA) and AMD (AMD) at CES 2026, set against a backdrop of broad market gains that pushed the Dow Jones Industrial Average above 49,000 points for the first time [0]. Nvidia CEO Jensen Huang unveiled the Rubin platform and autonomous driving initiatives, while AMD CEO Dr. Lisa Su presented the company’s vision for “AI Everywhere, for Everyone” including yotta-scale computing infrastructure [1][2][5][6]. Despite positive product announcements, both stocks experienced after-hours declines—Nvidia down 0.47% and AMD down 3.04%—suggesting investor caution and potential “sell the news” dynamics amid elevated valuations [0].

The Tuesday session demonstrated robust market breadth, with all major indices posting gains. The Dow Jones Industrial Average closed at 49,462.09, representing a 0.97% daily advance that pushed the index above the significant 49,000 psychological milestone [0]. This achievement marks a notable start to 2026, with the index gaining nearly 1,000 points over the first three trading days of the year. The S&P 500 rose 0.53% to close at 6,944.83, while the NASDAQ Composite advanced 0.43% to 23,547.17 [0].

Small-cap stocks led the rally, with the Russell 2000 gaining 1.49%—the strongest daily performance among major indices [0]. This leadership from smaller-capitalization names suggests healthy risk appetite across the market cap spectrum. However, the Technology sector’s relatively modest 0.35% gain ranked only seventh among eleven sectors, trailing Healthcare (+2.72%), Industrials (+2.21%), and Real Estate (+1.67%) [0]. This sector rotation pattern indicates investors may be diversifying beyond pure technology exposure despite the CES spotlight on AI innovation.

Jensen Huang’s CES opening keynote positioned AI as fundamentally reshaping computing infrastructure, with approximately $10 trillion in computing systems being modernized to AI-powered approaches [1][2]. The centerpiece announcement was the

In the autonomous driving domain, Nvidia introduced

Dr. Lisa Su’s keynote emphasized AMD’s transition into “yotta-scale computing” territory, representing a dramatic expansion in AI computational capacity [5][6][7]. The

The AI PC segment received attention through the

The after-hours decline in both stocks despite positive announcements reveals important market dynamics. At current valuation levels, both companies face the challenge of meeting elevated expectations—a challenge more acute for AMD given its substantially higher P/E multiple [0]. The “sell the news” pattern suggests investors may have been expecting more immediate commercial outcomes or were using the announcement as a profit-taking opportunity after recent gains.

The CES announcements are predominantly forward-looking statements involving execution uncertainty across multiple dimensions: manufacturing capacity for the Rubin platform, partner adoption timelines for new architectures, and the complex regulatory and technical requirements for autonomous vehicle deployment [1][5]. Investors should recognize that these announcements represent technology roadmaps rather than guaranteed revenue streams.

The CES presentations underscored the deepening AI infrastructure battle between Nvidia and AMD, with both companies articulating complementary but differentiated strategies. Nvidia’s focus on the complete Rubin platform ecosystem—spanning GPUs, CPUs, networking, and data processing units—reflects an integrated approach targeting hyperscale and enterprise customers seeking comprehensive AI compute solutions [1][3]. AMD’s emphasis on yotta-scale computing and the Helios platform positions the company as an alternative for organizations seeking scalable AI infrastructure with competitive pricing dynamics [5][6].

The autonomous driving announcements represent a significant expansion of the addressable market for both companies. Nvidia’s partnership with Mercedes-Benz and its open Alpamayo/AlpaSim ecosystem, combined with AMD’s cross-industry collaborations, signals AI chipsets moving beyond traditional data center applications into safety-critical transportation systems [1][4][5]. This diversification reduces concentration risk while opening new revenue streams in a sector expected to experience substantial growth through 2030.

The divergence between positive CES announcements and negative stock reactions reveals important market dynamics. At current valuation levels, both companies face the challenge of meeting elevated expectations—a challenge more acute for AMD given its substantially higher P/E multiple [0]. The “sell the news” pattern suggests investors may have been expecting more immediate commercial outcomes or were using the announcement as a profit-taking opportunity after recent gains.

Neither company disclosed direct competitive comparisons with Intel or each other, leaving market share dynamics partially obscured. However, the announcements reveal continued investment in ecosystem development—Nvidia’s expanded partnerships with Siemens, Palantir, ServiceNow, Snowflake, and NetApp, and AMD’s OpenAI relationship alongside its Genesis Mission public-private partnership [1][5][6]. These ecosystem strategies aim to create switching costs and lock-in effects that may prove more durable than raw performance metrics alone.

The January 6, 2026 market session captured the intersection of broad market optimism—evidenced by the Dow closing above 49,000 points—and sector-specific developments in AI semiconductor technology [0]. Nvidia’s CES 2026 keynote introduced the Rubin platform ecosystem, targeting production availability in H2 2026 with claims of one-tenth the cost per AI token compared to previous generations [1][3]. AMD’s presentation emphasized the yotta-scale computing era with the Helios Rack-Scale Platform and expanded AI PC offerings through the Ryzen AI 400 Series [5][6][7].

Both companies demonstrated clear technology leadership positions in an expanding market, with new vertical applications in autonomous driving, healthcare, and robotics expanding addressable markets [1][4][5]. However, after-hours stock declines despite positive announcements (“sell the news” dynamics) and elevated valuations create near-term execution risk [0]. The Technology sector’s modest 0.35% gain compared to stronger performances in Healthcare, Industrials, and Real Estate suggests investors may be practicing sector diversification despite the CES AI focus [0].

Key metrics to monitor include upcoming earnings calls for revenue guidance related to CES announcements, hyperscaler capital expenditure trends, and production timelines for the Rubin platform and AMD MI series products [0][1][5]. The competitive dynamics between Nvidia and AMD, alongside potential threats from custom silicon and other competitors, warrant continued monitoring through 2026 and beyond.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.