Analysis of Material Events in Caterpillar Inc. (CAT)'s January 2025 Form 8-K

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to SEC filing information disclosed on Caterpillar’s official investor relations website, the company submitted a Form 8-K (Filing Number: 18098332) on

| Disclosure Category | Details |

|---|---|

| Retail Sales of Machines | Segmented by region, resources industry, and construction industry |

| Retail Sales of Power Systems | Categorized by primary end use (Energy & Transportation segment) |

| Data Source | Unaudited reports voluntarily provided by independent dealers |

| Nature of Data | For trend reference only; not a substitute for audited financial statements |

| Analysis Dimension | Assessment Result | Explanation |

|---|---|---|

| Financial Stance | Neutral | Accounting practices remain balanced; no extreme operations observed |

| Free Cash Flow | $8.82 Billion | Strong cash flow generation capability |

| Debt Risk | Medium Risk | Leverage level is within a reasonable industry range |

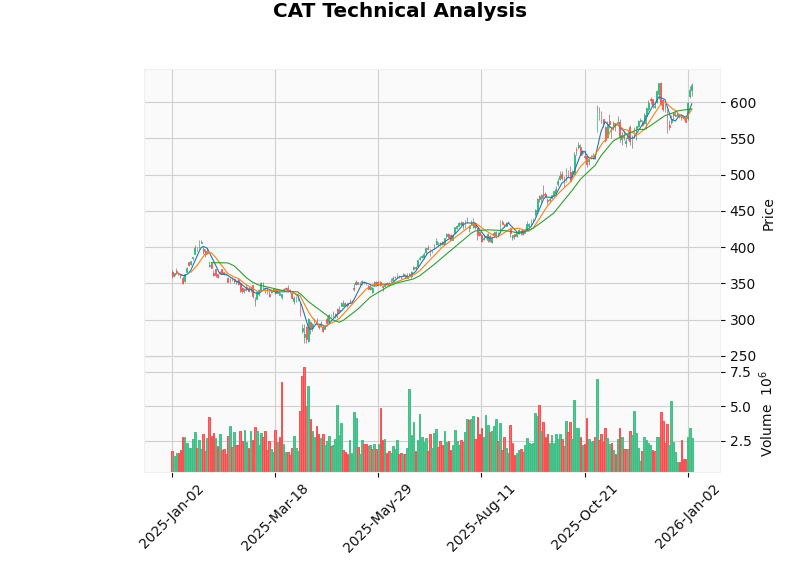

- Price-to-Earnings (P/E) Ratio: 31.52x

- Price-to-Book (P/B) Ratio: 14.13x

- Price-to-Sales (P/S) Ratio: 4.51x

- Market Capitalization: $291.9 Billion

| Indicator | Value |

|---|---|

| Closing Price | $623.09 |

| Intraday Gain | +1.13% (+$6.99) |

| 52-Week Range | $267.30 - $627.50 |

| Trading Volume | 2.67 million shares (slightly below the 2.75 million daily average) |

| Beta Coefficient | 1.57 (relative to the S&P 500 Index) |

| Indicator | Status | Interpretation |

|---|---|---|

| MACD | No Crossover (Bullish) | Mid-term trend is bullish |

| KDJ | Bullish | Sufficient short-term momentum |

| RSI (14) | Overbought Risk | May face a short-term pullback |

| Overall Trend | Sideways Consolidation | Trading Range [$590.52, $630.72] |

| Rating Type | Number of Analysts |

|---|---|

| Buy | 14 |

| Hold | 12 |

| Sell | 2 |

Consensus Rating |

Buy |

Composite Score |

7.6/10 |

| Category | Price Range |

|---|---|

| Median Price Target | $629.70 |

| Highest Price Target | $730.00 |

| Lowest Price Target | $380.00 |

| Current Implicated Upside Potential | +2.2% |

- Citi: Raised price target from $670 to $690 (December 2025) [3]

- Bernstein: Raised price target from $557 to $630, maintained Hold rating (December 2025) [3]

- Morgan Stanley: Maintained Sell rating, raised price target from $380 to $395 [3]

| Sector | Daily Gain | Status |

|---|---|---|

| Healthcare | +2.72% | Top Performer |

Industrials |

+2.21% |

Second Best Performer |

| Materials | +0.88% | Steady |

| Energy | -1.38% | Worst Performer |

| Index | Periodic Gain | Volatility |

|---|---|---|

| S&P 500 | +1.95% | 0.54% |

| Dow Jones Industrial Average | +3.95% | 0.60% |

Since the Form 8-K submitted on January 8 primarily discloses routine retail sales data,

-

Positive Factors:

- The industrials sector has strong overall performance, and the favorable industry environment continues

- The company’s financial condition is robust, with ample free cash flow

- Management has announced plans for leadership transition on May 1, 2025 (COO Joe Creed will succeed as CEO). This is a well-planned management change, and the market has responded positively [4]

-

Risk Factors:

- The current stock price is near the 52-week high ($627.50), with overbought pressure on technical indicators

- The Beta coefficient is relatively high (1.57), leading to greater pullback risk amid market volatility

As the world’s largest manufacturer of construction and mining equipment, Caterpillar has a solid market position in infrastructure construction and resource development. Although the January 2025 Form 8-K does not disclose major strategic changes, the company’s fundamentals remain robust, and analysts generally maintain a Buy rating.

| Assessment Dimension | Conclusion |

|---|---|

Materiality of Form 8-K Event |

Low (only routine retail data disclosure) |

Short-Term Stock Price Impact |

Neutral |

Mid-Term Investment Rating |

Cautious Buy (current price is near the upper end of the range) |

Risk Level |

Medium (β=1.57, higher than the market) |

For long-term investors seeking allocation, it is recommended to consider accumulating on dips when the stock price falls below $600; for short-term traders, it is advised to be cautious about chasing highs in the current overbought environment.

[0] Jinling AI - Real-Time Quotes, Technical Analysis, and Financial Analysis Data for Caterpillar Inc. (January 6, 2026)

[1] Caterpillar Inc. Official Investor Relations Website - SEC Filings (https://investors.caterpillar.com/financials/sec-filings/default.aspx)

[2] TickerNerd - CAT Stock Forecast 2026: Caterpillar Price Targets (https://tickernerd.com/stock/cat-forecast/)

[3] CNN Business - CAT Stock Quote Price and Forecast (https://www.cnn.com/markets/stocks/CAT)

[4] WorkBoat - Caterpillar announces leadership changes (https://www.workboat.com/caterpillar-announces-leadership-changes)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.