Analysis of the Impact of National Standards in the Data Field on the Digital Economy Industry Chain and AI Enterprise Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the collected information, I will compile a systematic and comprehensive investment impact analysis report for you.

According to information released by CCTV News and the National Data Administration, China will launch

| Feature Dimension | Specific Performance |

|---|---|

Cutting-Edge Focus |

Layout data standards in cutting-edge directions such as intelligent agents and embodied intelligence |

Urgency-Driven |

Accelerate the introduction of urgently needed standards for public data, high-quality datasets, data infrastructure, etc. |

Strategic Orientation |

Prioritize the development of strategic standards for city-wide digital transformation, national integrated computing networks, etc. |

The National Technical Committee on Data Standardization states that, leveraging advantages in massive data volumes and large-scale market applications, China has

The 2026 national standards in the data field will focus on eight coverage areas:

┌─────────────────────────────────────────────────────────────────┐

│ Over 30 National Standards Coverage Areas │

├─────────────┬─────────────┬─────────────┬───────────────────────┤

│ Intelligent Agents │ Embodied Intelligence │ Public Data │ High-Quality Datasets │

│ Cutting-Edge Technologies │ Robot Data │ Government Data │ Core AI Training Resources │

├─────────────┼─────────────┼─────────────┼───────────────────────┤

│ Data Infrastructure │ Urban Digital Transformation │ National Integrated Computing Network │ Critical Data Identification Catalog │

│ Underlying Support │ Transformation Standards │ │ Industry Data Classification │

└─────────────┴─────────────┴─────────────┴───────────────────────┘

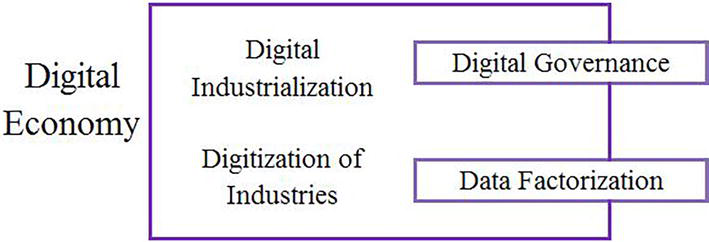

The introduction of national standards in the data field will reshape the investment landscape of the digital economy industry chain, forming

┌─────────────────────┐

│ Digital Economy Industry Chain │

│ Investment Opportunity Matrix │

└──────────┬──────────┘

│

┌────────────────────────┼────────────────────────┐

│ │ │

▼ ▼ ▼

┌───────────┐ ┌───────────┐ ┌───────────┐

│ Infrastructure Layer │ │ Data Service Layer │ │ Application Scenario Layer │

├───────────┤ ├───────────┤ ├───────────┤

│ Computing Power Centers │ │ Data Annotation │ │ Urban Intelligent Agents │

│ ·10,000-card-level │ │ ·High-Quality │ │ ·Smart City │

│ Intelligent Computing Centers │ │ Datasets │ │ Solutions │

│ ·Domestic Chips │ │ ·Data Cleansing │ │ ·Embodied Intelligence │

│ ·Network Facilities │ │ ·Data Synthesis │ │ Applications │

├───────────┤ ├───────────┤ ├───────────┤

│ Storage Facilities │ │ Data Governance │ │ Vertical AI Applications │

│ ·High-Efficiency Storage │ │ ·Standard System │ │ ·Industrial Manufacturing │

│ ·Data Security │ │ ·Quality Assessment │ │ ·Healthcare │

│ ·Transmission Equipment │ │ ·Compliance Management │ │ ·Financial Services │

└───────────┘ └───────────┘ └───────────┘

According to industry research institutions, the following sub-tracks will see significant investment opportunities:

According to the China Academy of Information and Communications Technology’s Research Report on AI Computing Infrastructure Empowerment (2025), as of the end of June 2025, the total scale of in-use computing center racks in China reached

- Beijing added 8620 PFlops of computing power in 2024, with cumulative intelligent computing power exceeding 33 EFLOPS

- As of July 2025, Shanghai’s intelligent computing power scale reached 100 EFLOPS[3]

- Shenzhen’s built and under-construction intelligent computing power scale exceeds 62 EFLOPS

- China’s intelligent computing power market size reached 19 billion USDin 2024, with a year-on-year growth of 86.9% [3]

The National Data Administration has selected

- Data Annotation Industry:The National Annotation Base in Baoding, Hebei, has gathered 138 annotation enterprises, driving related industry output value of1.12 billion yuan[5]

- Data Synthesis Technology:Enterprises such as Bodeng Intelligence have completed 100-million-yuan Series A financing, focusing on unstructured data processing [6]

- Industry Dataset Construction:Alibaba released a Chinese question-and-answer dataset, and the Zhiyuan Research Institute released 3.4TB of open-source industry pre-trained data [4]

According to the China Development Report 2025 released by the Development Research Center of the State Council,

- CloudMinds completed a over 500 million yuan Series C financing, co-led by CMBI and China Asset Management [8]

- Anhui Lingdong General Robot completed a 100-million-yuan angel round financing [7]

- The Saitz Industry Research Institute points out that the upstream (AI chips, computer vision, lidar) and downstream (system integrators, application software developers) segments of the industry chain will face huge market opportunities [7]

The country will support qualified regions in building “urban intelligent agents” to achieve automated urban governance with the support of large models [9]. This will drive investment booms in related fields such as smart cities, industrial internet, and digital twins.

The introduction of national standards in the data field will improve the development environment of AI enterprises from

| Impact Dimension | Specific Changes | Investment Implications |

|---|---|---|

Data Access |

Accelerated opening of public data, improved accessibility of high-quality datasets | Reduced data acquisition costs |

Compliance Costs |

Unified standards reduce repeated investment by enterprises | Improved R&D efficiency |

Market Access |

Standard certification becomes a market access threshold | Beneficial for leading compliant enterprises |

Financing Environment |

Investment logic shifts from “storytelling” to “value creation” | Focus on profitability |

According to Xinhua Finance, 2026 will become

Li Feng, founding partner of FreeS Fund, pointed out that AI investment will enter the “third phase” in 2026—investing in applications that truly land and generate profits [10]:

Investment Stage Evolution:

┌────────────────────────────────────────────────────────────┐

│ Phase 1 (2022-2023): Basic Model Investment │

│ → Focus: Large model parameter scale, computing power investment │

│ → Features: Burn cash for growth, weak profitability │

├────────────────────────────────────────────────────────────┤

│ Phase 2 (2024-2025): Application Exploration Investment │

│ → Focus: Application scenario implementation, user retention │

│ → Features: Exploring commercialization paths, unproven profit model │

├────────────────────────────────────────────────────────────┤

│ Phase 3 (2026-): Value Creation Investment │

│ → Focus: Real industrial value, financial returns, profitability │

│ → Features: Focus on application scenarios with quantifiable benefits │

└────────────────────────────────────────────────────────────┘

- AI Chips:Focus on domestic substitution progress of Huawei Ascend, Baidu Kunlun, Cambricon, etc.

- Servers:Demand for AI servers is booming, and the global server market is in a phase of “rising volume and price” [11]

- Storage and Network:AI data centers bring incremental demand for storage and high-speed networks

- Education:Intelligent Q&A, personalized learning

- Psychological Counseling:AI-assisted mental health services

- Financial Services:Intelligent risk control, robo-advisors

- Industrial Manufacturing:Intelligent quality inspection, predictive maintenance

- Embodied Intelligence Market Size Forecast:Expected to reach 400 billion yuan by 2030 and exceed 1 trillion yuan by 2035, with a compound annual growth rate of over 20%

- National Standards Coverage Areas:Balanced layout across eight directions, reflecting systematic governance thinking

- Investment Opportunity Assessment:Computing infrastructure (95 points), intelligent agents/embodied intelligence (92 points), and AI chips (90 points) rank top three

- Industry Chain Development Forecast:After policy implementation, the number of enterprises will grow from 120 to over 600

| Priority | Track | Rationale | Target Enterprise Types |

|---|---|---|---|

First Echelon |

Computing Infrastructure | Highest certainty, strong policy support | Three major operators, Huawei ecosystem enterprises |

Second Echelon |

High-Quality Datasets | Core demand for AI development, large supply gap | Data annotation, synthetic data enterprises |

Third Echelon |

Embodied Intelligence | Trillion-yuan market space, high capital heat | Robot, sensor, AI chip enterprises |

Fourth Echelon |

Urban Intelligent Agents | Policy-driven, high order certainty | Smart city solution providers |

- Short-Term (2025-2026):Standard formulation period, focus on leading enterprises participating in standard-setting

- Medium-Term (2026-2027):Pilot verification period, focus on technology-leading enterprises with large-scale capabilities

- Long-Term (2027+):Mature application period, focus on enterprises with commercial monetization capabilities

- Standard implementation progress may fall short of expectations

- Local implementation intensity varies

- AI technology evolution may render existing investments invalid

- Intensified international technological competition may affect industry chain security

- Leading enterprises may squeeze the living space of small and medium-sized enterprises through scale effects

- Homogeneous competition may lead to price wars

- Enterprise IT expenditure may be affected by economic cycles

- Changes in the financing environment may affect the survival of startups

-

Significant Policy Significance:The introduction of over 30 national standards marks China’s entry into a phase of systematic and standardized data governance, laying a solid institutional foundation for the development of the digital economy.

-

Whole Industry Chain Benefits:Opportunities will emerge across the entire industry chain, from computing infrastructure to data services and application scenarios. Among them, computing infrastructure, high-quality datasets, and embodied intelligence are the most valuable investment tracks.

-

Increasing Differentiation of AI Enterprises:Standardization will accelerate industry reshuffling, and enterprises with compliance capabilities, data resources, and technological advantages will gain larger market shares.

-

Reshaped Investment Logic:Shift from chasing concepts to pursuing value creation, with profitability becoming the core evaluation indicator.

Looking ahead to 2035, with the continuous improvement and implementation of national standards in the data field, China’s digital economy will present the following development trends:

- Computing Power as a New Type of Infrastructure:The scale of intelligent computing power will reach thousands of EFLOPS, and universal access to computing power will be basically realized

- Full Release of Data Element Value:High-quality datasets will cover major industries, and the public data opening system will mature

- In-Depth Penetration of AI Applications:Embodied intelligence will be applied on a large scale in urban governance, industrial manufacturing, healthcare, and other fields

- Restructured Industry Chain Value:A number of listed enterprises will emerge in segments such as data annotation, data governance, and data services

[1] CCTV News - “China to Launch Over 30 National Standards in the Data Field in 2026” (https://news.cctv.cn/2026/01/06/ARTIVYAoTi6MspGhT8mnbwGO260106.shtml)

[2] 36氪 - “China to Launch Over 30 National Standards in the Data Field in 2026” (https://www.36kr.com/newsflashes/3627854802093060)

[3] China Academy of Information and Communications Technology - “Research Report on AI Computing Infrastructure Empowerment (2025)” (https://www.caict.ac.cn/kxyj/qwfb/ztbg/202511/P020251106555844142999.pdf)

[4] National Data Administration - “Guidelines for High-Quality Dataset Construction” (https://www.nda.gov.cn/sjj/ywpd/sjzg/0922/ff808081-96b466bd-0199-6f6bd7d3-1bad.pdf)

[5] People’s Daily - “Accelerate the Construction of Digital China and Promote High-Quality Development” (https://www.peopleapp.com/column/30049655450-500006374766)

[6] CSDN - “Supported by 100-Million-Yuan Series A Financing! This Company Leads the New Track of AI Data Annotation and Intelligent Agent Collaboration” (https://blog.csdn.net/cv_autobot/article/details/148409001)

[7] Xinhua News Agency - “Touching the Pulse of the 14th Five-Year Plan Industries | Technological Breakthroughs in New Scenarios, Embodied Intelligence Opens Up a Trillion-Yuan Market Space” (http://www.news.cn/fortune/20251124/5a19337f6b124f2789d7e1568cc99aff/c.html)

[8] Securities Times - “Capital Continuously Flows into the Embodied Intelligence Track to Accelerate Development” (https://www.stcn.com/article/detail/3536579.html)

[9] National Data Administration - “New Policies for Digital China Construction Are Coming! In 2026, in the Digital Economy Track” (https://www.nda.gov.cn/sjj/swdt/mtsy/1231/20251231202822574635016_pc.html)

[10] Xinhua Finance - “2026 May Be the Inflection Point for Large-Scale Application of AI Large Models, Investment Logic Will Focus on ‘Value Creation’” (https://m.cnfin.com/yw-lb//zixun/20260105/4360750_1.html)

[11] SPD Bank International - “2026 Technology Industry Outlook: AI Algorithm Iteration Expands Computing Power Infrastructure” (https://www.spdbi.com/getfile/index/action/images/name/科技行业2026年展望:AI算法迭代扩容算力底座_浦银国际研究.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.