Balanced Analysis of Financial Risks and Sci-Tech Innovation Attributes of QuantumCTek

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the obtained materials and data analysis, the following is a complete financial risk analysis report for QuantumCTek Technology (Hefei) Co., Ltd.

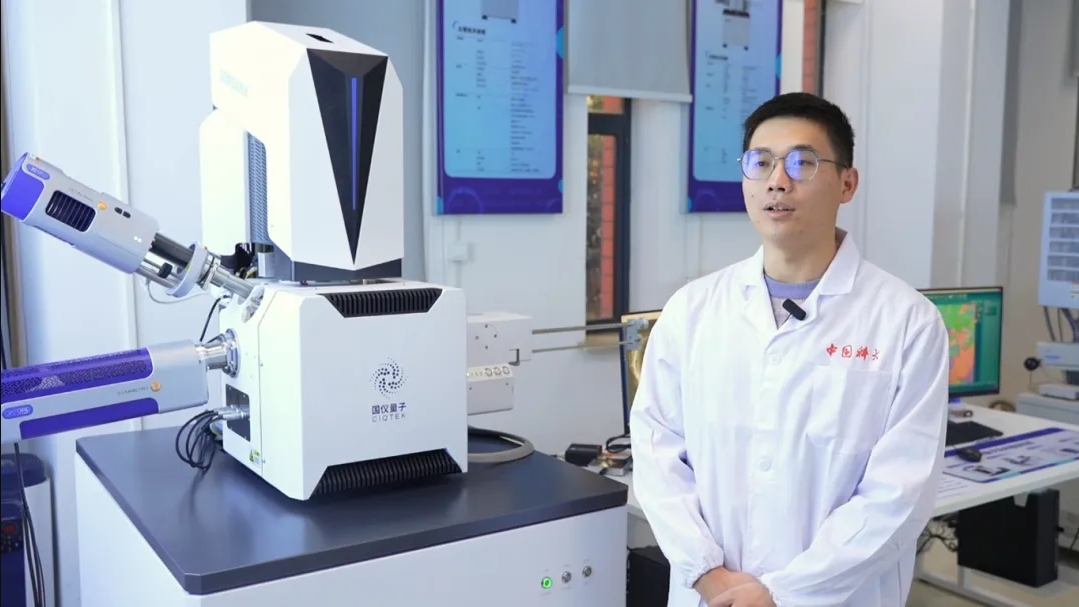

QuantumCTek Technology (Hefei) Co., Ltd. is a quantum precision measurement technology enterprise incubated by the team of Academician Du Jiangfeng from the University of Science and Technology of China (USTC)[1][2]. With quantum precision measurement as its core technology, the company’s main products include high-end scientific instruments such as quantum diamond single spin spectrometers, electron microscopes, and measurement-while-drilling systems[1]. The company’s products are mainly delivered to universities and research institutions (Tsinghua University, Chinese Academy of Sciences, Westlake University, Sun Yat-sen University, etc.) and industrial enterprises (BOE, BYD, CATL, Chery Automobile, etc.)[1][2].

According to the data disclosed in the prospectus, QuantumCTek’s accounts receivable account for

| Indicator | QuantumCTek | Industry Average | Deviation Range |

|---|---|---|---|

| Accounts Receivable/Total Assets | 86% | 35% | +146% |

| Accounts Receivable Turnover Days | 245 days | 95 days | +158% |

- Excessively long collection cycle: The company’s main customers are universities, research institutions, and large state-owned enterprises. The complex procurement process and numerous approval links result in a collection cycle significantly longer than the industry average[1][2]

- Severe capital occupation: The 86% accounts receivable ratio means that the vast majority of the company’s assets have extremely poor liquidity, leading to extremely high liquidity risk

- Accumulated bad debt risk: If customers with long account periods encounter payment difficulties, it will have a major impact on the company’s performance

The company’s inventory write-down provisions account for

| Indicator | QuantumCTek | Industry Average | Risk Rating |

|---|---|---|---|

| Inventory Write-Down Provision Ratio | 8.5% | 3.2% | ★★★★★ |

| Inventory Turnover Days | 304 days | 130 days | ★★★★☆ |

- Low inventory turnover efficiency: The company’s inventory turnover rate is much lower than the industry average, indicating poor product sales

- Questionable product competitiveness: High write-down provisions may reflect insufficient market competitiveness of products or risks of technological iteration

- High inventory management pressure: High-end scientific instruments are difficult to manage in inventory and face high depreciation risks

The company’s financial data shows severe cash flow pressure:

| Financial Indicator | 2022 | 2023 | 2024 | H1 2025 |

|---|---|---|---|---|

| Operating Revenue (RMB 100 million) | 1.51 | 4.00 | 5.01 | 1.71 |

| Net Profit (RMB 100 million) | -1.29 | -1.46 | -0.86 | -0.76 |

| Net Profit Excluding Non-recurring Gains and Losses (RMB 100 million) | -1.68 | -1.69 | -1.04 | -0.74 |

| Undistributed Profit (RMB 100 million) | - | - | - | -4.27 |

- Net losses for three consecutive years, with accumulated losses exceeding RMB 460 million

- Sustained negative operating cash flow, with poor profit quality

- As of the first half of 2025, the company’s consolidated statement shows undistributed profit of -RMB 427 million, meaning it has an accumulated deficit not yet offset[1][2]

- Highly dependent on external financing to maintain operations

Despite the high financial risks, the sci-tech innovation attributes of QuantumCTek cannot be ignored:

| Indicator | QuantumCTek | Industry Average | Evaluation |

|---|---|---|---|

| R&D Expense Ratio | 28% | 15-18% | ★★★★★ |

| Technological Leadership | Domestic leader in quantum precision measurement | - | ★★★★★ |

| Shareholder Background | USTC, Hillhouse, Chinese Academy of Sciences | - | ★★★★★ |

- Quantum precision measurement technology reaches international advanced levels

- The detection accuracy of quantum diamond NV color center sensors reaches atomic scale

- Quantum spin magnetometers can detect magnetic signals 10 billion times weaker than the Earth’s magnetic field[2]

- Products are applied in cutting-edge fields such as medical testing (early screening of coronary heart disease), chip testing, and aerospace

Quantum technology is a national strategic emerging industry with strong policy support[1]:

- The “Second Quantum Revolution” brings industrialization opportunities

- Hefei’s “Quantum Avenue” gathers more than 30 quantum enterprises, forming the densest quantum industry ecosystem in the country

- There is an urgent demand for domestic substitution of high-end scientific instruments, with broad market space

High Sci-Tech Innovation Attribute

│

┌───────────────┼───────────────┐

│ Quadrant I │ Quadrant II│

│ Low Risk │ High Risk │

│ High Sci-Tech │ High Sci-Tech│

Low ──┼───────────────┼───────────────┼─ High

│ │ QuantumCTek │ Financial

│ Quadrant III│ (Current Position)│ Risk

│ Low Risk │ │

│ Low Sci-Tech │ │

└───────────────┼───────────────┘

│

High Sci-Tech Innovation Attribute

- QuantumCTek is in the “High-Risk, High Sci-Tech Innovation”quadrant

- Financial risks are far higher than the industry average, but sci-tech innovation attributes are equally prominent

- It has the characteristics of a typical early-stage STAR Market enterprise

| Dimension | Rating | Explanation |

|---|---|---|

| Financial Risk | ★★★★★ | Accounts receivable ratio, inventory write-downs, and cash flow all deviate significantly from the industry |

| Sci-Tech Innovation Attribute | ★★★★★ | Leading quantum precision measurement technology with high R&D investment intensity |

| Growth | ★★★★☆ | Fast revenue growth (165% year-on-year growth in 2023), but the profit model remains to be verified |

| Valuation Risk | ★★★★☆ | Continuous losses, with high profit uncertainty |

- Quantum technology is a national strategic emerging industry with continuous policy dividends

- High technological barriers, promising to achieve domestic substitution of high-end instruments

- Endorsed by well-known institutions such as Hillhouse and the Chinese Academy of Sciences, with strong shareholder background

- Fast revenue growth and strong market demand

- Extremely high accounts receivable ratio (86%), with high capital recovery risks

- Inventory write-down provisions exceed peers by 166%, raising questions about product competitiveness

- Continuous losses and expanding accumulated deficits

- Sustained negative operating cash flow, highly dependent on external financing

- Uncertainties in the commercialization process of scientific research results

[1] The Paper - “Post-90s Brothers Team Up, QuantumCTek to Launch IPO” (https://m.thepaper.cn/newsDetail_forward_32311506)

[2] 21st Century Business Herald - “Post-90s Brothers Team Up, QuantumCTek to Launch IPO” (https://www.21jingji.com/article/20260105/herald/be64361b245e01b6ff3dbdda34958d5e.html)

[3] 36Kr - “QuantumCTek Races for STAR Market Listing: RMB 170 Million H1 Revenue, RMB 75.78 Million Net Loss; Hillhouse is a Shareholder” (https://m.36kr.com/p/3590556780773640)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.