Analysis of the Impact of Siyuan Electric's 50GWh Energy Storage Order from CATL on Its 2026 Performance

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On December 25, 2025, Siyuan Electric and CATL signed a three-year energy storage cooperation memorandum, with a target cooperation capacity of

Siyuan Electric (Stock Code: 002028.SZ) is an enterprise focusing on technological R&D, equipment manufacturing, and engineering services in the power sector[4]. The company’s main products include GIS and GIL of 750kV and below, substation relay protection equipment and monitoring systems of 1000kV and below, dynamic reactive power compensation systems, high-voltage active power filter systems, power station-level energy storage systems, etc.[5]

| Indicator | Value | YoY Change |

|---|---|---|

| Operating Revenue | RMB 15.458 billion | +24.06% |

| Net Profit Attributable to Shareholders | RMB 2.049 billion | +31.42% |

| Gross Profit Margin | 31.25% | +1.75pct |

| Net Profit Margin Attributable to Shareholders | 13.3% | +0.7pct |

| Newly Signed Contracts | RMB 21.457 billion | +30% |

| Order-to-Revenue Ratio | 1.39 | - |

The company exceeded its 2024 operating targets, with 103% of revenue target achieved and 104% of newly signed contracts target achieved, demonstrating strong growth momentum[6].

Based on the current energy storage market conditions and the cooperation model between the two parties, we calculate the value of the 50GWh energy storage order as follows:

| Calculation Parameter | Value | Explanation |

|---|---|---|

| Energy Storage Cell Price | RMB 0.32/Wh | 2025 Q4 average market price range: RMB 0.28-0.35/Wh[7][8] |

| System Integration Premium Coefficient | 1.6x | Including supporting equipment such as PCS, BMS, EMS, and containers |

| Cooperation Period | 3 years | 2025-2027 |

| Siyuan Electric’s Revenue Share | 35% | Estimated value proportion in system integration |

| Item | Value |

|---|---|

| Value per GWh System | RMB 512 million |

| Total System Value for 3 Years | RMB 25.6 billion |

| Annual Average System Value | RMB 8.53 billion |

| Annual Average Revenue Contribution from Siyuan Electric | RMB 2.99 billion |

| Annual Average Gross Profit Contribution from Siyuan Electric | RMB 840 million (calculated based on 28% gross profit margin) |

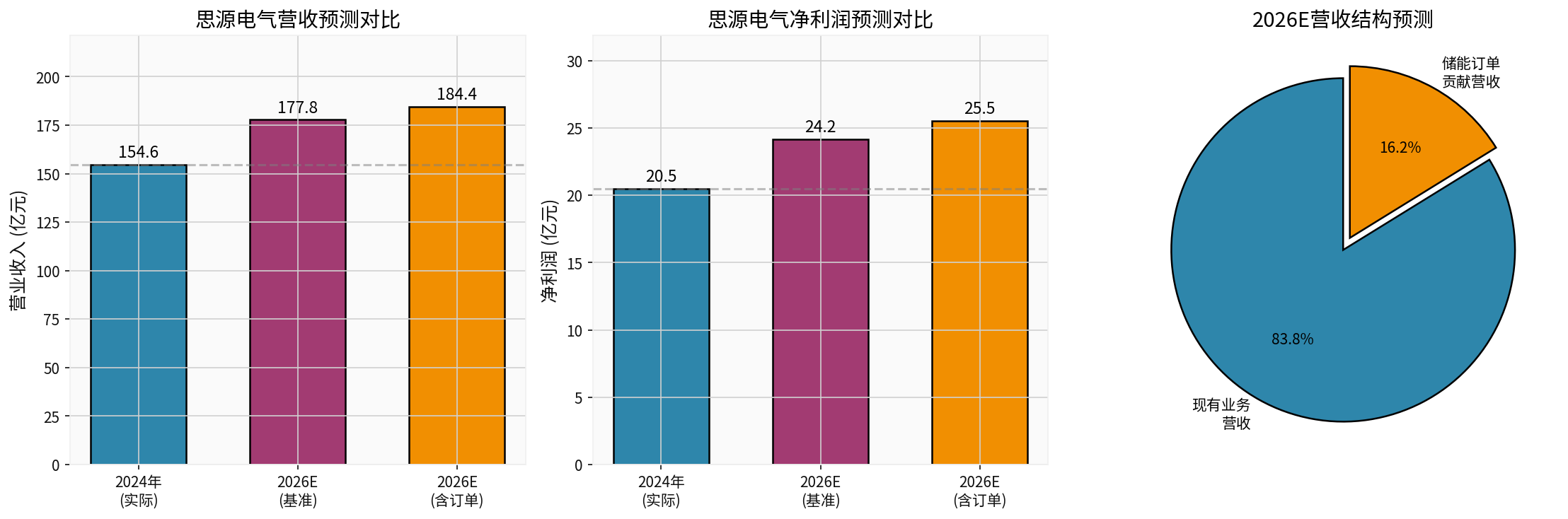

Based on the above calculation, we predict the impact of the 50GWh energy storage order on Siyuan Electric’s 2026 performance as follows:

- 2024 Actual Revenue: RMB 15.458 billion

- 2026E Revenue Increment (from the order): Approximately +RMB 2.99 billion

- 2026E Expected Revenue: Approximately RMB 18.45 billion (including contribution from the order)

- Revenue Increment Ratio:+19.3%

- 2024 Actual Net Profit: RMB 2.049 billion

- 2026E Net Profit Increment (Estimated): Approximately +RMB 500 million (calculated as 60% of gross profit contribution)

- 2026E Expected Net Profit: Approximately RMB 2.55 billion

- Net Profit Increment Ratio:+24.5%

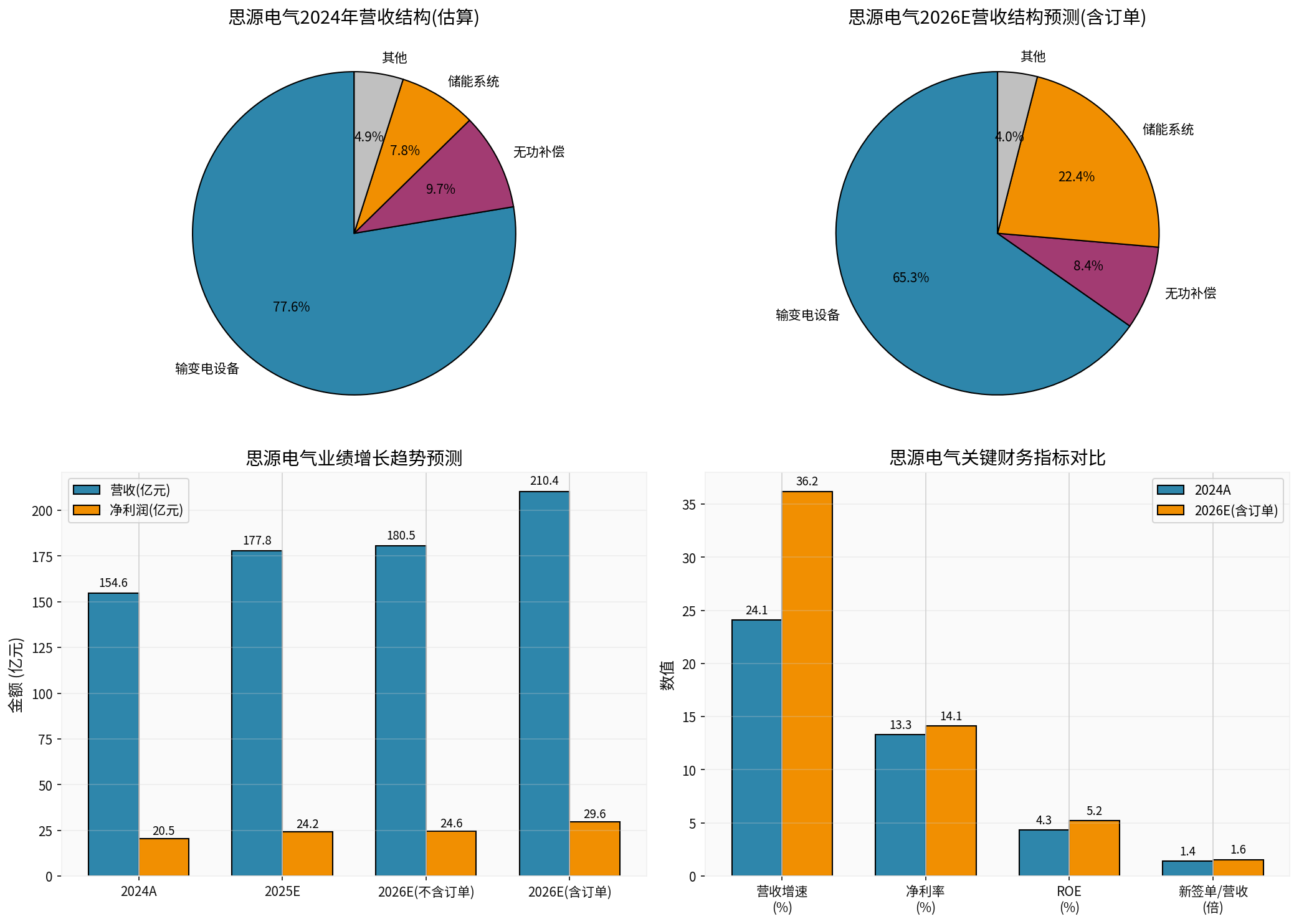

| Indicator | 2024A | 2026E (including order) | Change |

|---|---|---|---|

| Revenue Growth Rate | 24.1% | 36.2% | +12.1pct |

| Net Profit Margin | 13.3% | 13.8% | +0.5pct |

| ROE | 4.34% | 5.2% | +0.86pct |

| Energy Storage Business Proportion | ~8% | ~23% | +15pct |

In recent years, Siyuan Electric has actively laid out its energy storage business, and this in-depth cooperation with CATL will significantly enhance its competitiveness in the energy storage field. The company can leverage CATL’s battery technology advantages to build more competitive energy storage system solutions[1][2].

The “market-oriented dual-procurement model for energy storage” promoted by the two parties will achieve two-way collaboration across the industrial chain upstream and downstream, optimize overall solution capabilities, improve project delivery efficiency and reliability, and accelerate the large-scale application of energy storage systems in new power networks[3].

According to CNESA DataLink data, from January to June 2025, the new overseas order volume of Chinese energy storage enterprises reached 163GWh, a year-on-year increase of 246%[7]. The domestic energy storage market also maintains rapid growth, and Siyuan Electric’s acquisition of this large order comes at the right time.

The 50GWh is the target cooperation capacity for three years, and the actual execution volume may be affected by factors such as market demand, production capacity supply, and project implementation, with uncertainties existing.

Energy storage cell prices continue to be under pressure. In 2025, the winning bid prices of some centralized procurement projects have dropped to RMB 0.28-0.29/Wh[8], which may compress the profit margins of system integrators.

Competition in the energy storage market is becoming increasingly fierce. Enterprises such as EVE Energy and Envision Energy Storage are accelerating their layout, and industry competition may further intensify.

The payment collection cycle of energy storage projects is relatively long, which may exert certain pressure on the company’s cash flow.

[1] CATL Official Website - “3-Year 50GWh: CATL and Siyuan Electric Sign Energy Storage Cooperation Memorandum” (https://www.catl.com/news/9504.html)

[2] Sina Finance - “3-Year 50GWh: Siyuan Electric and CATL Sign Cooperation Memorandum” (https://finance.sina.com.cn/roll/2025-12-25/doc-inhczhsi3492160.shtml)

[3] NE Time - “3-Year 50GWh Energy Storage Order Finalized! CATL Deepens Cooperation with Siyuan Electric” (https://ne-time.cn/web/article/37538)

[4] Siyuan Electric 2024 Annual Report Summary (http://static.cninfo.com.cn/finalpage/2025-04-19/1223145418.PDF)

[5] Dongfang Fortune Securities Research Report - “Review of Siyuan Electric’s 2024 Annual Report” (https://pdf.dfcfw.com/pdf/H3_AP202504201659364128_1.pdf)

[6] Jinling API Market Data

[7] Time Weekly - “Energy Storage Order Boom Shockwave: Cell Prices Rise by Nearly 20%, Some Factories Have Orders Scheduled to the End of the Year” (https://time-weekly.com/post/323971)

[8] Battery China Network - “Energy Storage Cells: ‘Price War’ and ‘Price Hike Wave’ Coexist” (http://www.cbea.com/djgc/202512/804611.html)

This chart shows the forecasted impact of the 50GWh energy storage order on Siyuan Electric’s 2026 revenue and net profit, including changes in revenue structure, performance growth trends, and comparisons of key financial indicators.

This chart details Siyuan Electric’s 2024 revenue structure, 2026E revenue structure forecast, performance growth trends, and pre- and post-order comparisons of key financial indicators.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.