In-Depth Analysis of the Performance Outlook of Bank of Guizhou After the "One President, Five Vice Presidents" Executive Structure Adjustment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I have collected sufficient data, let me compile a systematic and comprehensive analysis report for you.

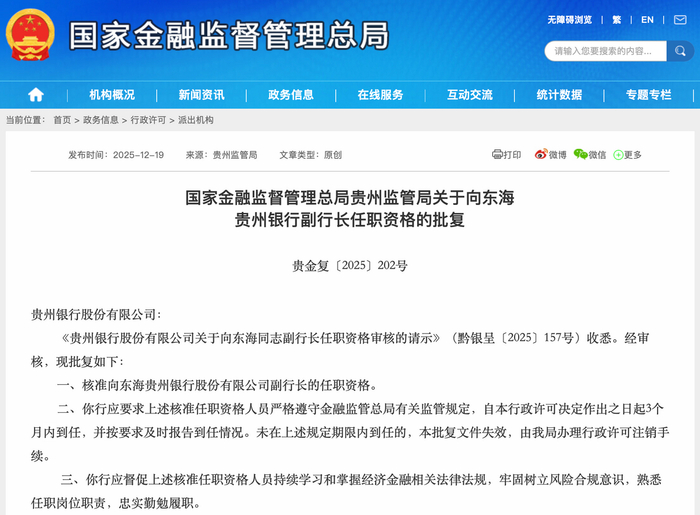

According to the latest regulatory approval, Bank of Guizhou has formed a “one president, five vice presidents” president structure [1][2]:

| Position | Name | Background Characteristics | Approval Time of Qualification for Office |

|---|---|---|---|

| President | Wu Fan | First female president, worked at China Construction Bank for over 20 years, joined Bank of Guizhou in 2013 | February 2025 |

| Vice President | Hu Liangpin | Reappointed | — |

| Vice President | An Peng | Reappointed | — |

| Vice President | Qin Wei | Reappointed | — |

| Vice President | Li Jian | Newly Appointed | February 2025 |

| Vice President | Xiang Donghai | From the Agricultural Bank of China system, former Vice President of Bijie Branch, General Manager of International Finance Department of Guizhou Provincial Branch | December 2025 |

The newly appointed Vice President Xiang Donghai, 51 years old, has rich management experience in large state-owned banks, and his qualification for office was officially approved by regulators in late December 2025 [1][2]. This marks the completion of the comprehensive restructuring of core executives at Bank of Guizhou in 2025.

It is worth noting that Li Zhiming, the former chairman of Bank of Guizhou, was sentenced to 16 years and 6 months in imprisonment with a fine of RMB 2.7 million by the Intermediate People’s Court of Liupanshui City, Guizhou Province in early December 2025. The judgment shows that he illegally lent over RMB 300 million during his tenure [1][2]. This legacy issue poses a continuous challenge to the new management.

According to the data in Bank of Guizhou’s 2025 Half-Year Report [0][1]:

| Indicator | Value | YoY Change | Industry Comparison |

|---|---|---|---|

| Operating Income | 6.102 billion yuan | +2.26% | Average of city commercial banks is about 5% |

| Net Profit | 2.129 billion yuan | +0.31% |

Average of city commercial banks is about 6-7% |

| Total Assets | 615.629 billion yuan (end of Q3) | Steady growth | Upper-mid tier among city commercial banks |

The biggest challenge faced by Bank of Guizhou lies in

| Loan Category | Non-Performing Loan Ratio | Industry Average | Gap |

|---|---|---|---|

| Real Estate Loans | 9.8% |

About 3-4% | +5.8 percentage points |

| Personal Loans | 5.47% |

About 2-3% | +2.5 percentage points |

| Corporate Loans | 1.12% | About 1.5% | Relatively controllable |

| Overall Non-Performing Loan Ratio | 1.69% | 1.76% (average of city commercial banks) | Slightly better than the industry |

The non-performing loan ratio of real estate loans is as high as 9.8%, significantly higher than the industry average, which is the core factor dragging down the net profit growth rate.

Bank of Guizhou’s business structure has obvious problems of

| Business Type | Proportion | Industry Characteristics |

|---|---|---|

| Corporate Loans | 83.88% | City commercial banks generally have over 70% |

| Personal Loans | 13.72% |

Leading city commercial banks generally have over 30% |

| Proportion of Retail Deposits | Low | Deposit stability needs to be improved |

After President Wu Fan took office,

- Electronic Banking Platform Upgrade: In November 2025, two bidding announcements were released to launch the construction of the “New Electronic Banking Platform” [1][2]

- Transformation of Existing Platforms: The existing electronic banking platform has been in operation for over 10 years, and there is an urgent need to improve R&D and operation integration (DevOps) capabilities [1]

- Launch of HarmonyOS Version of Mobile Banking: Deepen cooperation with Huawei to promote digital upgrading [3]

According to public information, the new management team has launched the following strategic initiatives [3]:

| Strategic Direction | Specific Measures | Expected Effect |

|---|---|---|

Large-Scale Inclusive Finance |

Promote online products such as “Tax Easy Loan” and “Business Express Loan” | Expand the customer base of small and micro enterprises |

Deeply Cultivate Guizhou’s Characteristic Industries |

Financing for liquor dealers, digital platform for tea industry | Leverage shareholder resources from Moutai |

Green Finance Innovation |

Establish a dual-track model of “green credit + transition finance” | Seize policy opportunities |

Enhancement of Intermediary Business |

Wealth management, settlement fees, scenario-based services of “Bank-School Treasure” | Increase the proportion of non-interest income |

Expansion of Financial Market Business |

Expand the scale of bond investment and interbank business | Enhance revenue stability |

Reduction of Non-Performing Loans |

Technology empowerment + mechanism constraints + capital supplementation | Improve asset quality |

- Existing Risks Are Still Exposed: The 9.8% non-performing loan ratio of real estate loans takes time to digest

- Net Interest Margin Continues to Be Under Pressure: The net interest margin of city commercial banks is about 1.37%, which has dropped significantly from the previous high [4]

- Increased Compliance Costs: Received two fines in December 2025, with a total fine of 800,000 yuan [1]

- High Volatility of Non-Interest Income: Net non-interest income in the first half of 2025 decreased by 2.23% YoY [3]

| Positive Factor | Specific Performance |

|---|---|

| Marginal Improvement in Asset Quality | The overall non-performing loan ratio has dropped from 1.72% at the end of 2024 to 1.69% [0] |

| Increase in the Proportion of Non-Interest Income | The proportion of non-interest income increased from 22.87% to 26.22% in 2024 [3] |

| Accelerated Layout of Retail Business | The scale of inclusive finance and small and micro loans continues to grow |

| New Executive Team Has Rich Experience | Wu Fan’s 20 years of experience at China Construction Bank + Xiang Donghai’s background at Agricultural Bank of China |

| Indicator | Bank of Guizhou | Leading City Commercial Banks (e.g., Bank of Jiangsu, Bank of Ningbo) |

|---|---|---|

| Asset Scale | 615.6 billion yuan | 3-4 trillion yuan |

| Operating Income Growth Rate | 2.26% | 6-8% |

| Net Profit Growth Rate | 0.31% | 6-10% |

| Proportion of Personal Loans | 13.72% | 30-38% |

| Digitalization Level | Initial Stage | Leading Level |

As a

- Major Shareholder Resources: China Kweichow Moutai Group is the largest shareholder, enabling the expansion of liquor industry chain finance

- Deep Regional Cultivation: Rooted in Guizhou, aligned with the “Four News and Four Modernizations” (New Industrialization, New Urbanization, Agricultural Modernization, Tourism Industrialization) strategy

- Policy Support: As a provincial-level legal person bank, it has an important position in the local financial system

| Risk Type | Specific Content | Risk Level |

|---|---|---|

Real Estate Risk |

9.8% non-performing loan ratio, existing risks will be exposed for a long time | ★★★★★ |

Compliance Risk |

Aftermath of the former chairman’s case, regulatory fines | ★★★★☆ |

Profit Pressure |

Narrowing net interest margin, volatility of non-interest income | ★★★☆☆ |

Interbank Competition |

Leading city commercial banks squeeze market space | ★★★☆☆ |

| Catalyst | Expected Time | Potential Impact |

|---|---|---|

| Effects of Digital Transformation Become Evident | 1-2 years | Improve operational efficiency and reduce costs |

| Real Estate Risks Are Cleared | 2-3 years | Pressure for provisioning is relieved |

| Increase in the Proportion of Retail Business | 1-3 years | Revenue structure is optimized |

| Synergy Effect of New Management Team | 1-2 years | Strategic execution capability is enhanced |

- Legacy Issues Still Need to Be Resolved: High non-performing loan ratio of real estate loans, impact of the former chairman’s case

- Strategic Transformation Takes Time to Show Results: Digital transformation and retail business expansion are medium-to-long-term projects

- Industry Environment Is Under Pressure: Narrowing net interest margin, intensified interbank competition

- Asset quality gradually stabilizes (marginal improvement in non-performing loan ratio has emerged)

- Revenue structure continues to be optimized (proportion of non-interest income increases)

- Digital transformation improves operational efficiency

- Deeply cultivate Guizhou’s characteristic industries to form differentiated competitive advantages

[1] Bullet Finance “Bank of Guizhou’s Executive Restructuring: The New Pattern of ‘One President, Five Vice Presidents’, How to Resolve the Former Chairman’s Downfall and Fines?” (https://news.qq.com/rain/a/20260101A05B1T00)

[2] Sina Finance “Bank of Guizhou’s Executive Restructuring: The New Pattern of ‘One President, Five Vice Presidents’, How to Resolve the Former Chairman’s Downfall and Fines?” (https://finance.sina.com.cn/wm/2026-01-01/doc-inheuffs8580226.shtml)

[3] Zhengjing Society “After Almost Five Years, Bank of Guizhou Still Hasn’t Shaken Off That Bunch of Burdens” (https://m.sohu.com/a/964471818_120258424)

[4] 36Kr “In the First Half of 2025, Banks’ Net Profit Reached 1.2 Trillion Yuan” (https://m.36kr.com/p/3429141104171143)

[5] Hexun.com “Digital Transformation Continues to Empower, Bank of Guizhou’s 2025 Half-Year Report Sees Double Growth in Operating Income and Net Profit” (https://bank.hexun.com/2025-09-23/221504599.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.