Asset Quality Analysis Report of Hua Xia Bank

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data and market information, I will conduct a systematic analysis of the asset quality status of Hua Xia Bank.

As of the end of Q3 2025, Hua Xia Bank’s NPL ratio was

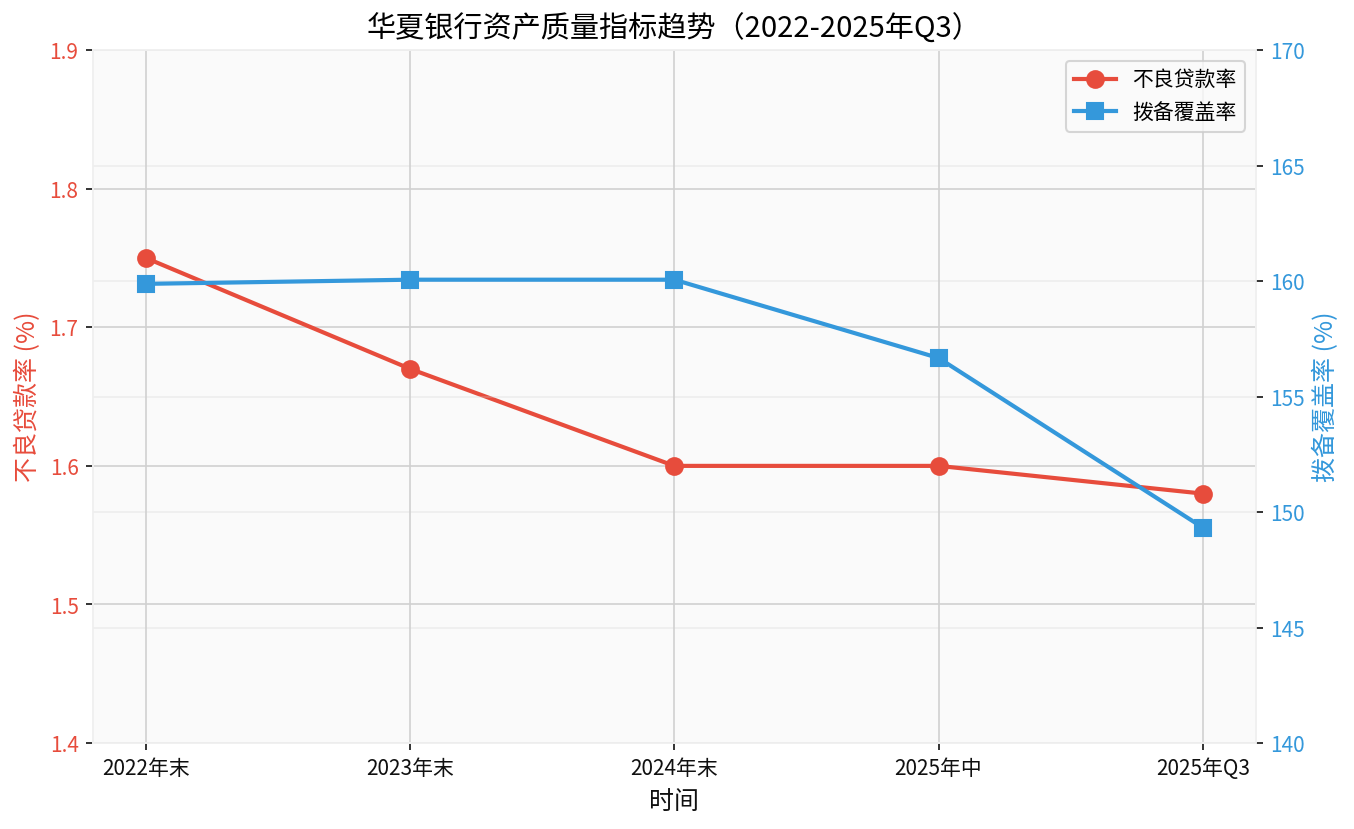

| Time Point | NPL Ratio | Change from Previous Period |

|---|---|---|

| End of 2022 | 1.75% | - |

| End of 2023 | 1.67% | Down 0.08 percentage points |

| End of 2024 | 1.60% | Down 0.07 percentage points |

| Mid-2025 | 1.60% | Flat |

| Q3 2025 | 1.58% | Down 0.02 percentage points |

As of the end of H1 2025, Hua Xia Bank’s loan classification structure is as follows [0]:

- Normal Loans: RMB 2,317.395 billion, accounting for 95.88%

- Special Mention Loans: RMB 61.03 billion, accounting for 2.52%

- Total Non-Performing Loans: RMB 38.67 billion, accounting for 1.60%

- Corporate Loans: NPL balance of RMB 22.435 billion, NPL ratio of1.36%,down 0.23 percentage pointsfrom the end of last year

- Retail Loans: NPL balance of RMB 16.235 billion, NPL ratio of2.27%,up 0.47 percentage pointsfrom the end of last year

The deterioration of retail loan asset quality is the main source of pressure facing Hua Xia Bank currently, mainly affected by external risk conditions, with some debtors experiencing declining income levels and repayment ability [0].

High-risk industries include [0]:

- Wholesale and Retail Trade: NPL ratio of 2.61%

- Real Estate Industry: NPL ratio of 2.53%

- Construction Industry: NPL ratio of 2.37%

- Manufacturing Industry: NPL ratio of 1.81%

| Time Point | Provision Coverage Ratio | Change from Previous Period |

|---|---|---|

| End of 2022 | 159.88% | - |

| End of 2023 | 160.06% | Up 0.18 percentage points |

| End of 2024 | 160.06% | Flat |

| Mid-2025 | 156.67% | Down 5.22 percentage points |

| Q3 2025 | 149.33% | Down 12.56 percentage points |

The significant decline in the provision coverage ratio has attracted market attention. Qu Gang, President of Hua Xia Bank, stated at the Q3 2025 results briefing that the main reason is

According to the assessment of financial analysis tools, Hua Xia Bank’s debt risk is classified as

- Continuous downward trend of NPL ratio: From 1.75% at the end of 2022 to 1.58% in Q3 2025, a cumulative decrease of 0.17 percentage points

- Improved quality of corporate loans: The NPL ratio of corporate loans has dropped to 1.36%, with obvious effects of risk clearance

- Increased capital adequacy ratio: Core Tier 1 capital adequacy ratio of 9.24%, capital adequacy ratio of 13.27%, with enhanced risk offset capacity [0]

- Rising risk of retail loans: The NPL ratio of retail loans has been rising continuously, reaching 2.27% at the end of H1 2025

- Provision coverage ratio approaching regulatory red line: Although 149.33% is higher than the regulatory requirement of 150%, the safety margin continues to narrow

- Pressure from special mention loans: The ratio of special mention loans to NPLs is approximately 161%, and subsequent migration pressure remains [0]

- Decline in net profit: Net profit in H1 2025 was RMB 11.745 billion, a year-on-year decrease of RMB 0.971 billion, down 7.64% [0]

Based on comprehensive analysis, Hua Xia Bank’s asset quality

- Short-term (1-2 quarters): The NPL ratio may remain in the range of 1.55%-1.60%

- Medium-term (2026): If retail loan risks are effectively controlled, the NPL ratio is expected to drop below 1.5%

- Key variables: Strength of macroeconomic recovery, evolution of real estate industry risks, recovery of repayment ability of retail customers

- PB ratio is only 0.36x, at a historical low [0]

- Strong shareholder background, with continued support from strategic investors

- Asset quality improvement lags behind peers

- Continuous decline in provision coverage ratio may affect profit growth

- The risk exposure cycle of retail business may be longer than expected

[0] Jinling API Data (Hua Xia Bank’s financial statements and operating data)

[1] 21st Century Business Herald - “Hua Xia Bank’s First Three-Quarter Revenue Reaches RMB 64.9 Billion; President Says Dividend Policy Continuity Will Be Maintained” (https://m.21jingji.com/article/20251024/herald/aba80d066abb761aeae6d418bef3673e_zaker.html)

[2] Hua Xia Bank 2025 Interim Report Summary (https://www.hxb.com.cn/images/jrhx/tzzgx/xxpl/dqbg/2025/12/18/4FCB642E94777652386E60DE47232679.pdf)

[3] 2025 Annual Follow-Up Rating Report of Hua Xia Bank Co., Ltd. - China Money Network (https://www.chinamoney.org.cn/dqs/cm-s-notice-query/fileDownLoad.do?contentId=3172958&priority=0&mode=save)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.