Analysis of BrainCo's RMB 2 Billion Financing Event and Investment Insights for China's Brain-Computer Interface Industry Chain

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will provide a comprehensive analysis of BrainCo’s RMB 2 billion financing event and its implications for investment in China’s brain-computer interface industry chain.

BrainCo has completed a financing round of approximately

- Financial Investment Institutions: IDG Capital, Walden International (founded by Lip-Bu Tan, CEO of Intel)

- Industrial Capital: Lens Technology, Lingyi iTech (a “Apple Supply Chain” giant), Will Semiconductor

- Strategic Investors: ZRUN Technology, Huazhu Group, TAL Education Group

- Top Family Offices: Leading family offices from Hong Kong, China and the United States

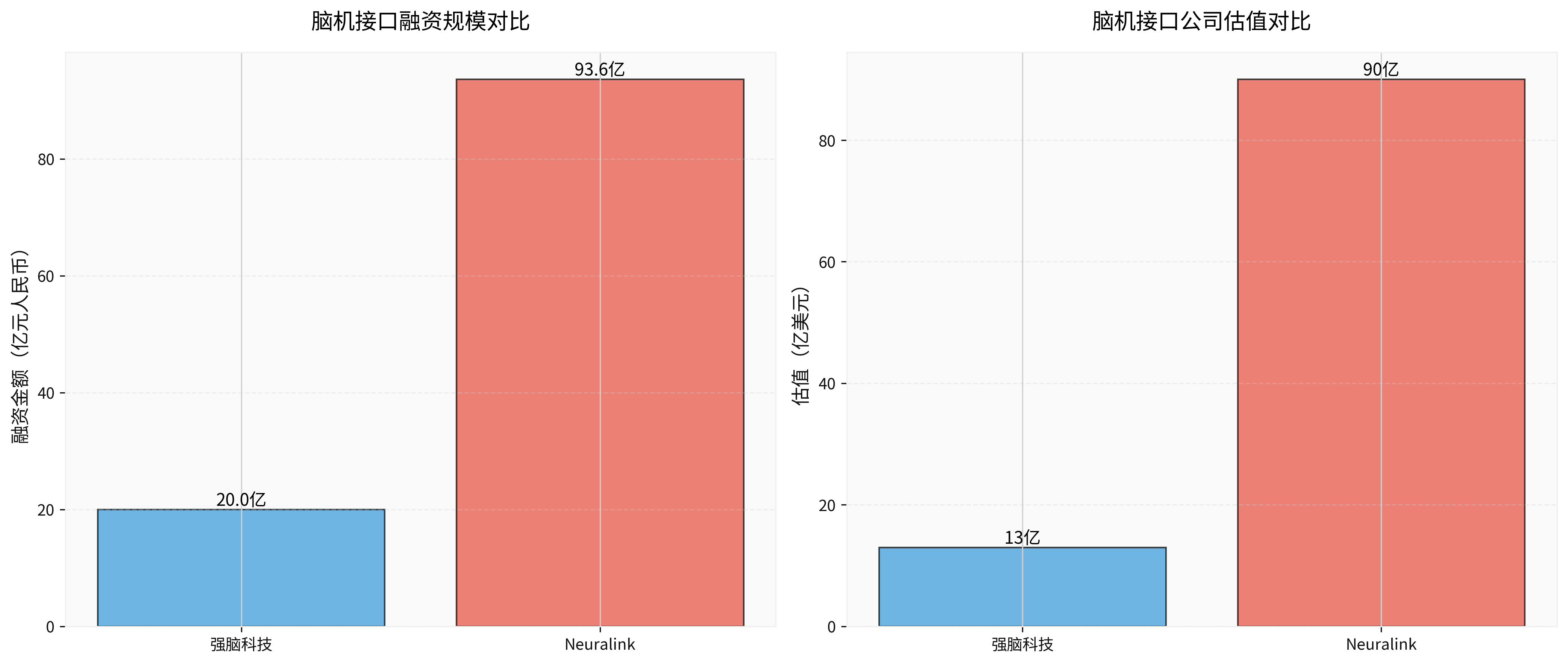

- Financing Scale: Neuralink has raised over USD 1.3 billion (approximately RMB 9.36 billion) cumulatively, 4.7 times that of BrainCo

- Valuation Level: Neuralink has a valuation of USD 9 billion, while BrainCo’s valuation is USD 1.3 billion

- Technology Route: Neuralink focuses on invasive technology, while BrainCo focuses on non-invasive technology

- Commercialization Progress: Neuralink has implanted devices in 12 patients and plans to launch mass production in 2026; BrainCo has launched products such as intelligent bionic limbs and BCI-enabled smart sleep monitors, which have obtained US FDA certification and European CE certification

- Strategic Investor Role: Exclusively undertakes mass production of BrainCo’s core hardware modules

- Supply Chain Integration: In November 2025, the two parties jointly donated intelligent bionic limbs to the Hunan Provincial Disabled Persons’ Federation, with all core modules produced by Lens Technology’s production lines

- Technology Accumulation: Leveraging mass production experience and precision manufacturing capabilities accumulated from projects such as BrainCo, it is actively seeking cooperation with a major North American client (potentially referring to Neuralink)

- Stock Price Performance: From December 1, 2025 to January 6, 2026, the stock price rose from RMB 27.66 to RMB 33.93, representing an increase of22.67%[0]

Different investors have their own strategic considerations:

- Optimistic about the potential of BCI as the next-generation human-computer interaction platform

- Leverage precision manufacturing capabilities to enter emerging tracks

- Diversify risks of over-reliance on consumer electronics business

- Lay out the BCI-specific chip market

- Utilize technological advantages in sensors and signal processing

- Expand the second growth curve beyond CIS sensors

- Explore the application of BCI in hotel services and education scenarios

- Pre-deploy future user entrances and data assets

According to online search results [1][3], the three BCI technology routes show obvious differentiation:

| Technology Route | Representative Enterprises | Financing Popularity | Commercialization Progress | Application Scenarios |

|---|---|---|---|---|

Non-Invasive |

BrainCo, Shenzong Technology | ★★★★☆ | Commercialized |

Sleep monitoring, concentration improvement, rehabilitation training |

Semi-Invasive |

Xinzhida (Beinao-1) | ★★★☆☆ | Clinical Trial Phase | Chronic pain management, neuromodulation |

Invasive |

Jieti Medical, Boruikang Technology, Brain Tiger Technology | ★★★★★ | Clinical Validation Phase | Motor function reconstruction, language decoding |

- Non-invasive technologyhas lower approval thresholds and clear consumer scenarios, enablingfaster achievement of large-scale revenue. BrainCo’s polysomnography monitors have been deployed in over 1,000 hospitals [3]

- Invasive technologyhas the largest imagination space, but it needs to overcome hurdles such as clinical trials and Class III medical device registration, with a commercialization cycle of 5-10 years [3]

- EEG Acquisition Chips: Opportunities for chip manufacturers such as Will Semiconductor

- High-Precision Electrodes: Need to overcome challenges in materials and manufacturing processes

- Signal Processing Algorithms: Opportunity area for AI companies

- Hardware Integration: Precision manufacturing enterprises such as Lens Technology

- Software Platforms: Algorithm and operating system development

- Medical Rigid Demand: Medical institutions and diagnostic companies such as Sanbo Brain Hospital, YHLO Biotech

- Consumer-Grade Applications: Consumer scenarios such as sleep, concentration, and rehabilitation

Driven by BrainCo’s financing and news of Neuralink’s mass production,

- Consecutive Limit-Ups: Multiple stocks such as Innovcare Medical, Aimenn Medical, Xiangyu Medical, Yanshan Technology, and Medlander have achieved two consecutive limit-ups

- 20% Limit-Ups (20CM Limit-Ups): Sino Medical, Crown Bioscience, Meihao Medical, Lepu Medical, etc.

- Sector Volatility: Haige Communications (002465.SZ) saw its stock price rise from RMB 12.12 to RMB 19.06 from December 1, 2025 to January 6, 2026, representing an increase of57.26%[0]

According to an in-depth analysis by Huxiu [3],

- In 2025, the number of financing rounds in China’s BCI sector reached 24, with the actual financing scale likely to exceed RMB 5 billion

- However, only 1 BCI product has actually been launched on the market: the DBS deep brain stimulation system by Jingyu Medical

- BrainCo’s valuation of USD 1.3 billion is already more than 3 times that of domestic peers, which needs to be supported by performance realization

- Clinical trials are only in the initial stage, and it will take “at least 5-10 years” to reach the brain-computer integration depicted in science fiction movies [4]

- Need to overcome technical bottlenecks such as materials science, biocompatibility, and long-term stability

- Class III medical device registration and approval have a long cycle and high thresholds

- Limited signal acquisition accuracy, restricted application scenarios

- User stickiness and repurchase rates of consumer-grade products remain to be verified

- Obvious growth ceiling, limited market scale

- Regulatory Framework: In September 2025, the National Medical Products Administration (NMPA) issued “Terms for Medical Devices Using Brain-Computer Interface Technology”, which officially took effect on January 1, 2026, marking the entry of the industry into a stage of “having standards to follow” [4]

- Ethical Review: BCI involves complex issues such as brain privacy, data security, and ethical review

- Policy Risks: Technological development may outpace the regulatory framework, leading to policy uncertainty

- Non-Invasive Leader: BrainCo (already commercialized, products used in thousands of hospitals)

- Supply Chain Beneficiaries: Precision manufacturing enterprises such as Lens Technology, Lingyi iTech

- Medical Application Scenarios: Diagnostic companies with hospital channels such as YHLO Biotech (has signed a strategic cooperation agreement with BCI Star Chain [6])

- Invasive Technology Leaders: Jieti Medical, Boruikang Technology, Brain Tiger Technology (already in clinical phase)

- Core Component Suppliers: Enterprises of high-precision electrodes and EEG acquisition chips

- Algorithms and Software Platforms: Enterprises with core AI algorithms and data processing capabilities

Drawing on the Lens Technology model, seek investment opportunities with

- Technology Party: Possesses core algorithms and clinical resources

- Manufacturing Party: Precision manufacturing and mass production capabilities

- Channel Party: Hospital network and sales capabilities

- Diversified Investment: Cover multiple technology routes to reduce the risk of failure of a single technical path

- Phased Investment: Focus on team and technology reserves for early-stage projects; focus on commercialization implementation for growth-stage projects

- Long-Term Perspective: BCI is a long-track sector that requires a 5-10 year incubation period, making it unsuitable for short-term speculation

- Policy Tracking: Pay close attention to changes in medical device regulatory policies and ethical review policies

BrainCo’s RMB 2 billion financing event marks that

- Obvious Technology Route Differentiation: Non-invasive technology takes the lead in commercialization, while invasive technology has larger long-term space but higher risks

- In-Depth Participation of Industrial Capital: Enterprises such as Lens Technology realize industrial chain collaboration through the “Capital + Manufacturing” model

- Commercialization Verification is Key: Beware of valuation bubbles and focus on actual product sales and clinical data

- Gradually Improved Policy Regulation: The regulatory framework is gradually established, and the industry has entered a standardized development stage

- 5-10 Year Long Cycle: BCI is a long-track sector that requires long-term patience and continuous investment

[0] Jinling API Data - Stock price data of Lens Technology (300433.SZ) and Haige Communications (002465.SZ)

[1] Science and Technology Innovation Board Daily - “BCI Becomes Capital’s ‘Darling’: BrainCo Completes RMB 2 Billion Financing, Second Only to Neuralink in Scale” (https://m.cls.cn/detail/2249578)

[2] Wall Street CN - “BCI ‘Unicorn’ BrainCo Completes RMB 2 Billion Financing, Second Only to Musk’s Neuralink in Scale” (https://wallstreetcn.com/articles/3762662)

[3] Huxiu - “Financing Trap of BCI: The Paradox of RMB 5 Billion Financing vs. Zero Listed Products” (https://www.huxiu.com/article/4823816.html)

[4] Securities Times - “Big News Breaks in BCI Track!” (http://www.stcn.com/article/detail/3568009.html)

[5] NetEase Finance - “Lens Technology: Strategic Investor of BrainCo, Actively Seeking Cooperation with Major North American Client” (https://www.163.com/dy/article/KIJEQ6U405568W0A.html)

[6] Eastmoney - “YHLO Biotech Signs Strategic Cooperation Framework Agreement with BCI Star Chain to Expand BCI Sector” (https://finance.eastmoney.com/a/202601063610347635.html)

[7] Securities Times - “BCI Commercialization Process Accelerates” (https://www.stcn.com/article/detail/3572478.html)

[8] Chinaventure - “Musk Shouts ‘Mass Production’, Domestic BCI Concept Stocks Surge in Response” (https://www.chinaventure.com.cn/news/111-20260106-389642.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.