Analysis of Investment Value and Valuation Implications of the Securities Industry's Transformation from Labor-Intensive Tactics to High-Quality, High-Efficiency Operations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The following analysis is based on public data, brokerage API information, and the latest industry dynamics, focusing on the systematic impact of the transformation from “labor-intensive tactics to high-quality, high-efficiency operations” on the investment value and valuation of brokerage stocks.

I. Quantification and Trends of Industry Talent Structure (Unified Data Calibration)

- Total Employees: According to statistics from the Securities Association of China/authoritative media, the number of employees in the securities industry was approximately 328,900 at the end of 2025, a decrease of about 7,800 from the end of 2024, continuing the contraction trend that started in 2023 (the industry hit a peak of approximately 354,500 employees in 2022) [1].

- Structural Differentiation (Core Manifestation of High-Quality, High-Efficiency Operations):

- Expansion of Investment Advisors: The number of investment advisors reached approximately 86,100, a new historical high (with about 5,735 new hires in 2025), indicating accelerated development of wealth management and professional service capabilities [1].

- Contraction of Traditional Brokers: The number of securities brokers was approximately 23,700, a decrease of about 36.5% from the approximately 37,300 at the end of 2023, indicating the accelerated exit of the low-value-added, high-cost traditional broker model [1].

- Sponsoring Representatives and Analysts: The scale of sponsoring representatives (recording the first annual decline in 8 years) and analysts remains at a high level, with professional research capabilities relatively stable and slightly improving [1].

- Regional and Entity Differentiation: Internet brokerages (e.g., East Money) are recruiting talent against the trend, while some large and medium-sized brokerages have cut more than 500 employees due to factors such as mergers and acquisitions [1].

II. Financial Transmission Mechanism of Brokerage Profitability (Verifiable Paths)

- Cost Side (Optimization of Personnel Expenses): The contraction of brokers and inefficient outlets, combined with standardization/automation substitution, helps reduce salary and operating expense ratios. As the industry has a high proportion of labor costs, optimizing personnel structure is expected to improve the overall expense ratio and boost net profit margin [1].

- Revenue Side (Structural Upgrading and Efficiency Improvement):

- Advancement of Wealth Management Transformation: The expansion of the investment advisor team, coupled with the development of product and asset allocation capabilities, is driving a fee-based model centered on AUM (with an increasing proportion of management fees/investment advisory fees) to replace the pure commission model. Although the industry’s average commission rate is still on a downward trend, high-value-added investment advisory and asset allocation services are expected to partially offset the decline in commission rates [1].

- Technology and Efficiency Dividends: Technology investment represented by AI, automated operations, and intelligent investment research has significantly improved per-employee output and service coverage radius. Companies such as East Money have improved turnover and net profit margins through high R&D investment (2025 R&D expense ratio target of approximately 8%, far higher than the industry average of approximately 4.5%), forming a cycle of “technology-driven cost reduction → efficiency improvement → profit growth” [2].

- ROE and Profitability Stability: The combined net profit of 43 listed brokerages in the first three quarters increased significantly year-on-year, reflecting a recovery in profitability. The optimization of talent and cost structures, combined with a rebound in market trading activity, improvements in margin balance and IPO/refinancing activities, will help support ROE recovery and enhance profitability stability [1][2].

III. Implications for Valuation and Market Pricing

- Current Valuation Position and Historical Percentile:

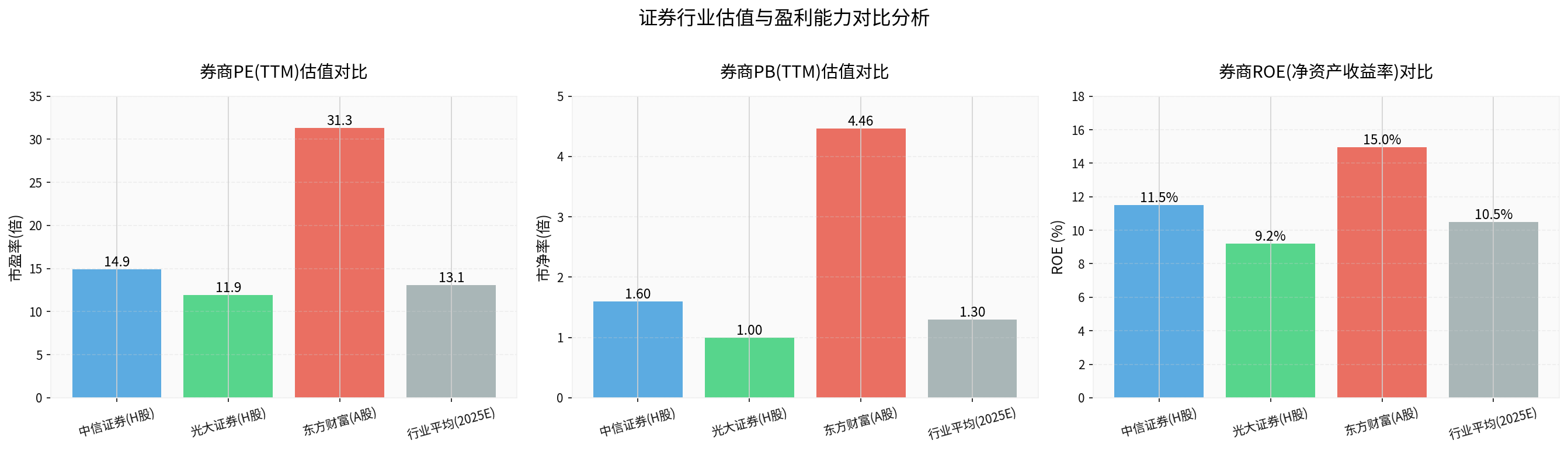

- Industry Averages: PE (TTM) is approximately 13.1x, PB is approximately 1.3x, with a historical percentile of about 12% over the past decade, indicating that the current valuation is in a historically low range [1].

- Leading Traditional Brokerages (referencing H-shares): CITIC Securities (6030.HK) has a PE of approximately 14.92x, Everbright Securities (6178.HK) has a PE of approximately 11.94x [0].

- Internet Brokerages: East Money (300059.SZ) has a PE of approximately 31.33x, PB of approximately 4.46x, and ROE of approximately 14.97%. Its gross profit margin and net profit margin are significantly higher than those of traditional brokerages, reflecting the market’s premium pricing for its “technology + ecosystem + wealth management” model [0].

- Changes in Valuation Logic:

- Shift from “Scale-Oriented (Headcount)” to “Efficiency and Quality-Oriented”: The market now pays more attention to “high-quality indicators” such as ROE, AUM growth, expense ratio improvement, and technology output, rather than pure branch or employee numbers.

- Evolution of Valuation Indicator Weights: P/B is still applicable to capital-intensive businesses; however, as the proportion of wealth management, platform-based, and high-ROE businesses increases, the market is gradually assigning higher weights to P/E and P/AUM.

- Capital and Sentiment: In 2025, the net inflow scale of securities industry ETFs is significant, with capital allocation targeting the non-bank financial sector, which has “sufficient previous corrections, low valuation, and policy and transformation dividends”. The market has formed a consensus on its allocation value [1].

IV. Structural Differentiation of Investment Value and Recommendations

- Large Traditional Brokerages (Low PB, Stable Type): Benefiting from the increase in industry concentration and M&A integration (e.g., the merger of Guotai Junan and Haitong Securities), their capital strength, customer base, and business barriers are strengthened. There is room for medium- to long-term ROE recovery and valuation recovery. It is recommended to select targets based on PB-ROE, business synergy, and M&A progress [1].

- Internet Brokerages (High Valuation, High Growth): Represented by East Money, they rely on technology and ecosystem monetization, leading in ROE and net profit margin. Against the backdrop of bull market expectations and traffic advantages, their performance elasticity and valuation premium coexist, but attention should be paid to market volatility risks and fee rate pressures amid intensified industry competition [2].

- Regional and Characteristic Brokerages: They have alpha opportunities in regional advantages, segmented businesses, or M&A themes, which need to be evaluated in combination with ROE improvement paths and regulatory policy dynamics.

V. Risk Warnings

- Market Volatility Risk: If trading activity, margin balance, and IPO/refinancing pace fall short of expectations, it will directly impact brokerage, capital intermediary, and investment banking business revenues [1][2].

- Industry Competition and Fee Rate Pressure: Digitalization and cross-border competition may continue to reduce commission and agency fee rates, requiring cost reduction hedging through differentiated investment advisory services and technology investment [1].

- Policy and Compliance Risks: Changes in regulatory orientation, capital constraints, and rising compliance costs may affect the profit rhythm of some businesses [1].

VI. Conclusions

- Clear Transformation Direction: The securities industry is transforming from “labor-intensive tactics” to “high-quality, high-efficiency operations”, manifested in total volume optimization and structural upgrading (growth in investment advisors, decline in brokers). This is expected to drive improvements in expense ratios, optimize revenue structure, and repair ROE, enhancing profit quality and stability.

- Significant Valuation Implications: The current industry valuation is at a historically low level. Against the backdrop of combined policy and market recovery, the valuation recovery of traditional brokerages and high-quality growth of internet brokerages are jointly driving an increase in the sector’s allocation value. The market’s recognition of “efficiency, technology, and wealth management” will push the valuation weight to shift from scale to quality [1][2].

(Note: The “industry average” in the chart is for illustrative reference only; specific figures shall be based on the latest disclosures of each brokerage and industry statistics.)

References

[0] Jinling API Data (Real-time market quotes and company indicators for East Money (300059.SZ), CITIC Securities (6030.HK), Everbright Securities (6178.HK), etc.)

[1] Securities Times · Jiemian News, Number of Brokerage Employees Falls Back to 6 Years Ago, “One Decrease, One Increase” Points to Changes in the Industry’s Underlying Logic (2025-12-29), https://www.stcn.com/article/detail/3561959.html

[2] Gelonghui, East Money: One of the Top 10 Core Assets for “Betting on China” in 2026, https://www.gelonghui.com/p/3494160

[3] Hexun.com, New Year Transition: Why the Brokerage Sector Is Worth Watching? (2025-12-23), http://funds.hexun.com/2025-12-23/222901765.html

[4] Jiemian News, High-Low Rotation? Why Securities and Insurance Are Key Focus Areas? (2025-11-19), https://www.jiemian.com/article/13737854.html

[5] Orient Securities Non-Bank Financial Industry Weekly Tracker (Brokerage Valuation and Performance Summary, 2025-12-26), https://pdf.dfcfw.com/pdf/H3_AP202512281809957419_1.pdf

[6] Deloitte China Research, Monthly Economic Overview Issue 101 (Brokerage Sector Outlook), https://www.deloitte.com/cn/zh/our-thinking/research//issue101.html

[7] Southern Plus, Mergers and Acquisitions Surge: Top 10 Brokerage Events of 2025, Who Will Lead the Trillion-Yuan Track? (2025-12-31), https://www.nfnews.com/content/16VLgzxpyr.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.