Impact Analysis of Morgan Stanley's Cryptocurrency ETF Applications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On January 6, 2026, Wall Street giant Morgan Stanley formally submitted an application to the U.S. Securities and Exchange Commission (SEC) to launch

- This is Morgan Stanley’s first simultaneous application for two types of cryptocurrency ETFs: Bitcoin and Solana

- Asset management firm T. Rowe Price submitted its first cryptocurrency ETF application last year[2]

- The Trump administration’s regulatory clarity policy has encouraged mainstream financial firms to embrace digital assets[2]

| Metric | Bitcoin (BTC) | Solana (SOL) |

|---|---|---|

| Current Price | $93,794.00 | $141.79 |

| Market Capitalization | ~$1.85 trillion | ~$66 billion |

| 52-Week Range | $74,436 - $126,198 | $96.59 - $294.33 |

| Daily Volatility | -0.07% | +2.77%[0] |

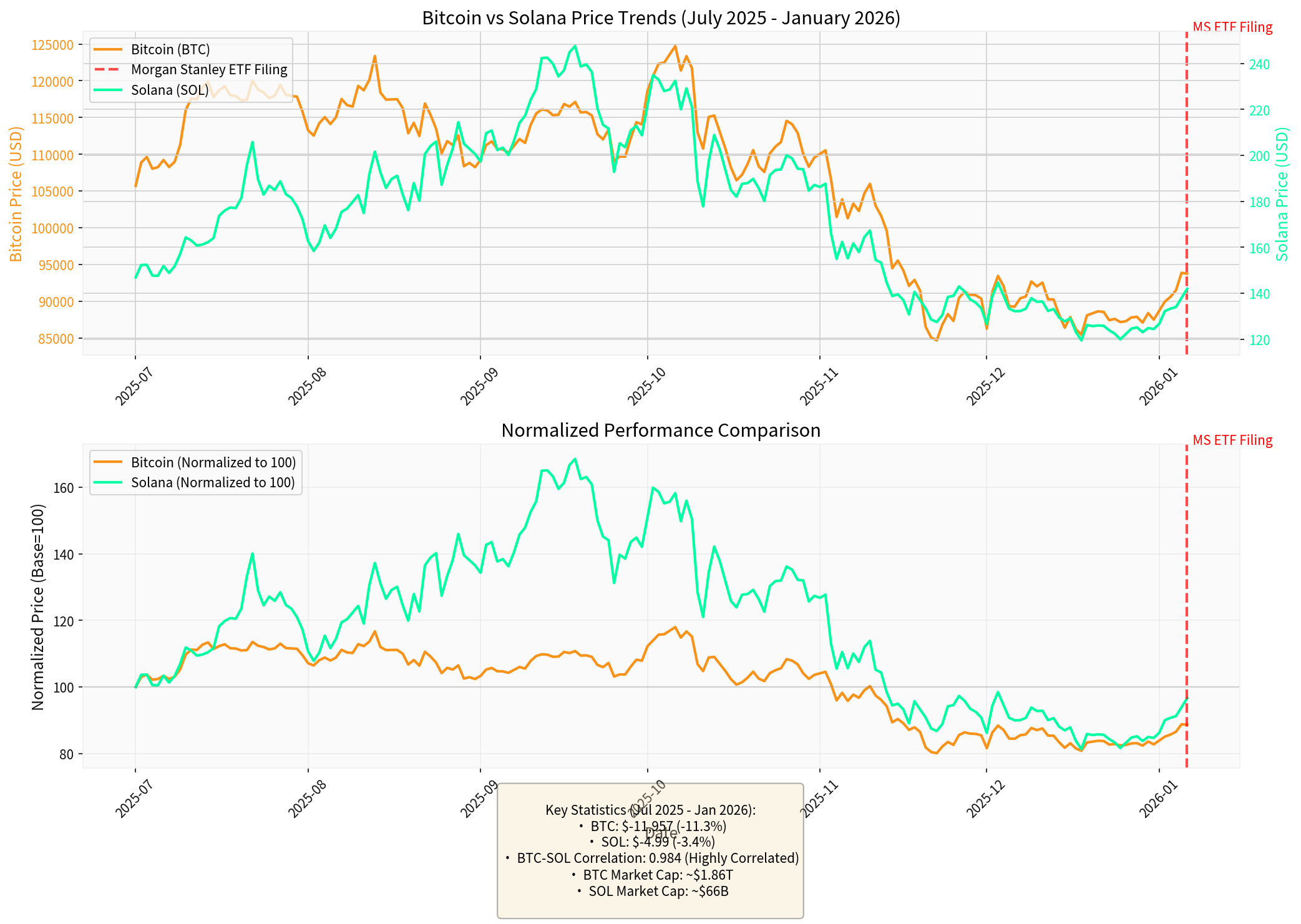

According to market data analysis, the cryptocurrency market has undergone a significant correction in the past few months:

- Bitcoin: Fell from $118,660 in early October to the current $93,794, representing a decline of approximately20.87%over the period

- Solana: Fell from $222.15 in early October to the current $141.79, representing a decline of approximately36.11%over the period

- Correlation Analysis: The price correlation between BTC and SOL is as high as0.9841, showing highly synchronized fluctuations[0]

- Volatility Comparison: Solana’s 30-day volatility (2.30%) is significantly higher than Bitcoin’s (1.39%), reflecting its higher risk profile

Chart shows: Price trends of Bitcoin (orange) and Solana (green) from July 2025 to January 2026, with the red dashed line marking the date of Morgan Stanley’s ETF application

Morgan Stanley’s ETF applications will further drive the institutional adoption of cryptocurrencies:

- 76%of global investors plan to increase their allocation to digital assets in 2026

- 60%of investors expect to allocate more than5%of their assets under management (AUM) to cryptocurrencies[3]

- As of Q3 2025, 172public companies hold Bitcoin, representing a 40% increase from the previous quarter, with a total holding of approximately1 million BTC(accounting for about 5% of circulating supply)[3]

- Net inflows into spot Bitcoin ETFs reached $23 billionin 2025

- Total inflows into ETFs (including other crypto products) are estimated to have reached $50 billionin 2025[4]

- Bloomberg Intelligence analysts predict that ETF inflows could reach a conservative estimate of $15 billionin 2026, potentially hitting$40 billionin an optimistic scenario[3]

- Enhanced Mainstream Recognition: Morgan Stanley’s entry as a top investment bank provides “institutional endorsement” for Bitcoin

- Expanded Investment Channels: ETF products allow traditional investors to invest in Bitcoin without directly holding private keys

- Regulatory Compliance Path: The SEC-approved ETF framework provides a compliant entry channel for institutional investors

- Price Support Effect: Long-term institutional capital inflows are expected to provide stable support for Bitcoin’s price

- Bitcoin’s price has experienced a correction from late 2025 to early 2026 (currently down approximately 25.7% from its all-time high of $126,198)[0]

- Attention should be paid to whether the SEC approves the Solana ETF (the SEC has previously adopted a cautious stance on cryptocurrencies other than Bitcoin and Ethereum)

Morgan Stanley’s simultaneous application for a Solana ETF carries important symbolic significance:

- Solana is the 7th largest cryptocurrency by market capitalization[1], with a market cap of approximately $66 billion[0]

- This is the first time a mainstream Wall Street financial institution has sought to launch an ETF directly linked to a non-Bitcoin/Ethereumcryptocurrency

- This could pave the way for ETF products linked to other mainstream cryptocurrencies (such as ADA, AVAX, etc.)

- Diversified Institutional Allocation: Provides institutional investors with an alternative crypto asset allocation option beyond Bitcoin

- Recognition for Smart Contract Platforms: Indicates that institutional investors are beginning to focus on the utility and ecosystem value of cryptocurrencies

- Boost to Market Sentiment: Helps alleviate the pressure from Solana’s recent sharp decline (36.11% drop since October 2025)[0]

Morgan Stanley’s move reflects a broader industry trend:

- T. Rowe Price(a leading U.S. asset management firm) submitted its first cryptocurrency ETF application in 2025[2]

- Institutions such as Harvard Management CompanyandMubadala(Abu Dhabi’s sovereign wealth fund) have already adopted crypto ETPs in their portfolios[5]

- More institutions are completing due diligence to include cryptocurrencies in their model portfolios[5]

Cryptocurrencies are shifting from “speculative assets” to “alternative portfolio allocations”:

- Deepened Wealth Management Channels: Morgan Stanley has a massive wealth management business, and its ETF products can reach millions of high-net-worth clients

- Improved Compliance Framework: The ETF structure provides custody, auditing, and compliance solutions for regulated financial institutions

- Risk Management Tools: Traditional institutions’ risk management frameworks and KYC/AML procedures are gradually being applied to crypto assets

The current regulatory environment creates favorable conditions for institutional adoption:

- Stablecoin Legislation Enacted: Provides a clear regulatory framework for stablecoins[3]

- Enhanced Regulatory Clarity from the SEC: The Trump administration’s policy stance has encouraged mainstream finance to embrace digital assets[2]

- Deepened Integration with Traditional Finance: Cryptocurrencies are increasingly correlated with traditional financial markets and macroeconomic factors (such as interest rates, liquidity)[4]

- 2026: The First Year of Institutionalization: A Grayscale research report indicates that 2026 will be the “dawn of the institutional era for digital assets”[5]

- Potential for New Highs: With supportive macroeconomic conditions, the crypto asset class may hit new highs in 2026[5]

- Mature Infrastructure: Regulated trading platforms and applications continue to grow, preparing for institutional capital inflows[5]

- Uncertainty in SEC Approval: There remains uncertainty as to whether the Solana ETF will be approved by the SEC

- Market Volatility: The high volatility characteristic of the cryptocurrency market remains unchanged (Solana’s 30-day volatility is 2.30%)[0]

- Changes in Regulatory Policies: U.S. regulatory policies may adjust with changes in the political environment

- Increased Competition: The simultaneous launch of similar products by multiple institutions may lead to fee competition and margin compression

Morgan Stanley’s simultaneous applications for Bitcoin and Solana ETFs are a

- Boost market sentiment and provide price support for Bitcoin and Solana

- Send a signal of confidence in crypto assets from traditional financial institutions to the market

- Potentially stimulate other financial institutions to accelerate the launch of similar products

- Deepen the integration of cryptocurrencies with traditional finance

- Drive institutional investors to include crypto assets in their long-term asset allocations

- Promote the maturation and standardization of the entire cryptocurrency market

According to a research report from Coinpedia, the crypto market has entered a critical turning point in 2026 — no longer driven by speculative hype, but by

[0] Gilin API Data - Real-Time Cryptocurrency Quotes and Historical Price Data (BTCUSD, SOLUSD)

[1] Reuters - “Morgan Stanley files for bitcoin, solana ETFs in digital assets push” (January 6, 2026) - https://www.reuters.com/business/morgan-stanley-files-bitcoin-etf-2026-01-06/

[2] Yahoo Finance - “Morgan Stanley files for bitcoin, solana ETFs in digital assets push” (January 6, 2026) - https://finance.yahoo.com/news/morgan-stanley-files-bitcoin-solana-111504913.html

[3] Coinpedia Research - “Exclusive Report: Crypto Market Predictions 2026” - https://coinpedia.org/research-report/exclusive-report-crypto-market-predictions-2026/

[4] Algorand Foundation CEO Staci Warden - “ETF Inflows, Stablecoin Expansion, and Quantum Security” (YouTube, 2026) - https://www.youtube.com/watch?v=6pZKSCmCLGg

[5] Grayscale Research - “2026 Digital Asset Outlook: Dawn of the Institutional Era” - https://research.grayscale.com/reports/2026-digital-asset-outlook-dawn-of-the-institutional-era

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.