Morgan Stanley's Optimistic Assessment of AI Demand at CES 2026 and Investment Strategy Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Morgan Stanley’s research report released ahead of CES 2026 expresses a

- Hyperscale enterprises (Microsoft, Meta, Alphabet, etc.) are expected to invest over $500 billion in building AI infrastructure in 2026, including data centers, networks, and computing power facilities [1]

- Data center M&A transactions reached approximately $70 billion in 2025, with half allocated to short-term assets (GPUs, CPUs) and half to long-term assets (land, power, cooling systems) [6]

- Alphabet has raised its 2025 capital expenditure forecast to $85 billion and expects it to climb further in 2026 [6]

Morgan Stanley strategist Andrew Sheets specifically noted that

- Chip costs and power costs continue to rise

- The huge demand for energy and advanced chips from large tech companies is pushing up project costs

- Memory chip cost inflation will drive up AI product prices, potentially reducing investor returns and affecting capital inflows [1]

According to the analysis by the Consumer Technology Association (CTA), CES 2026 demonstrated the following

| Trend | Core Content | Investment Opportunities |

|---|---|---|

Intelligent Transformation |

AI is no longer just an overlay, but infrastructure embedded in manufacturing, logistics, healthcare, and urban systems | Industrial automation, AI-optimized systems, intelligent logistics |

Physical AI |

Robots, autonomous vehicles, and industrial machines move from prototypes to actual operations | Robotics technology, autonomous driving, sensors |

AI Everywhere |

AI is embedded in all industries from smart manufacturing to personalized healthcare | Vertical industry AI applications, AI+SaaS |

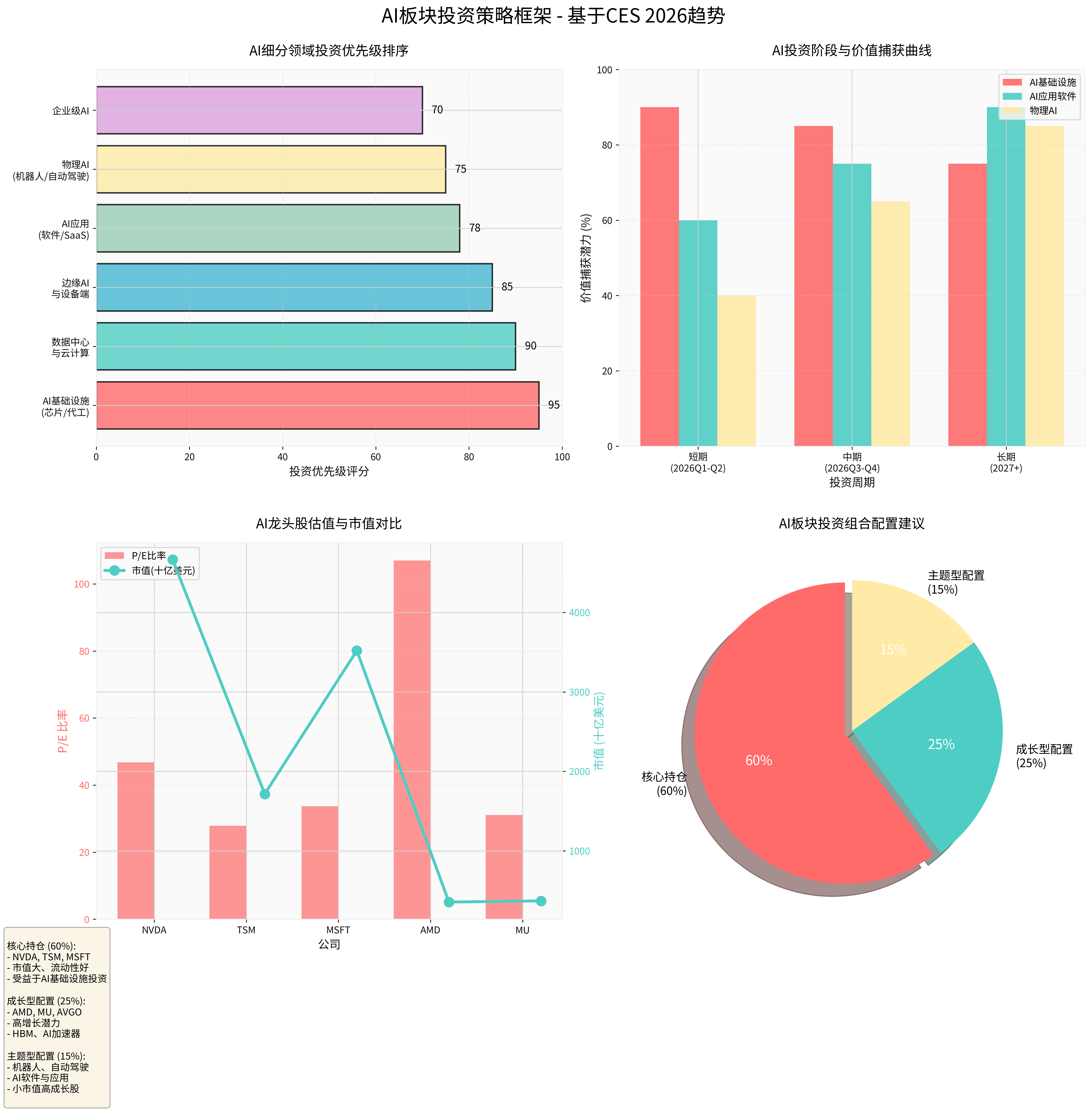

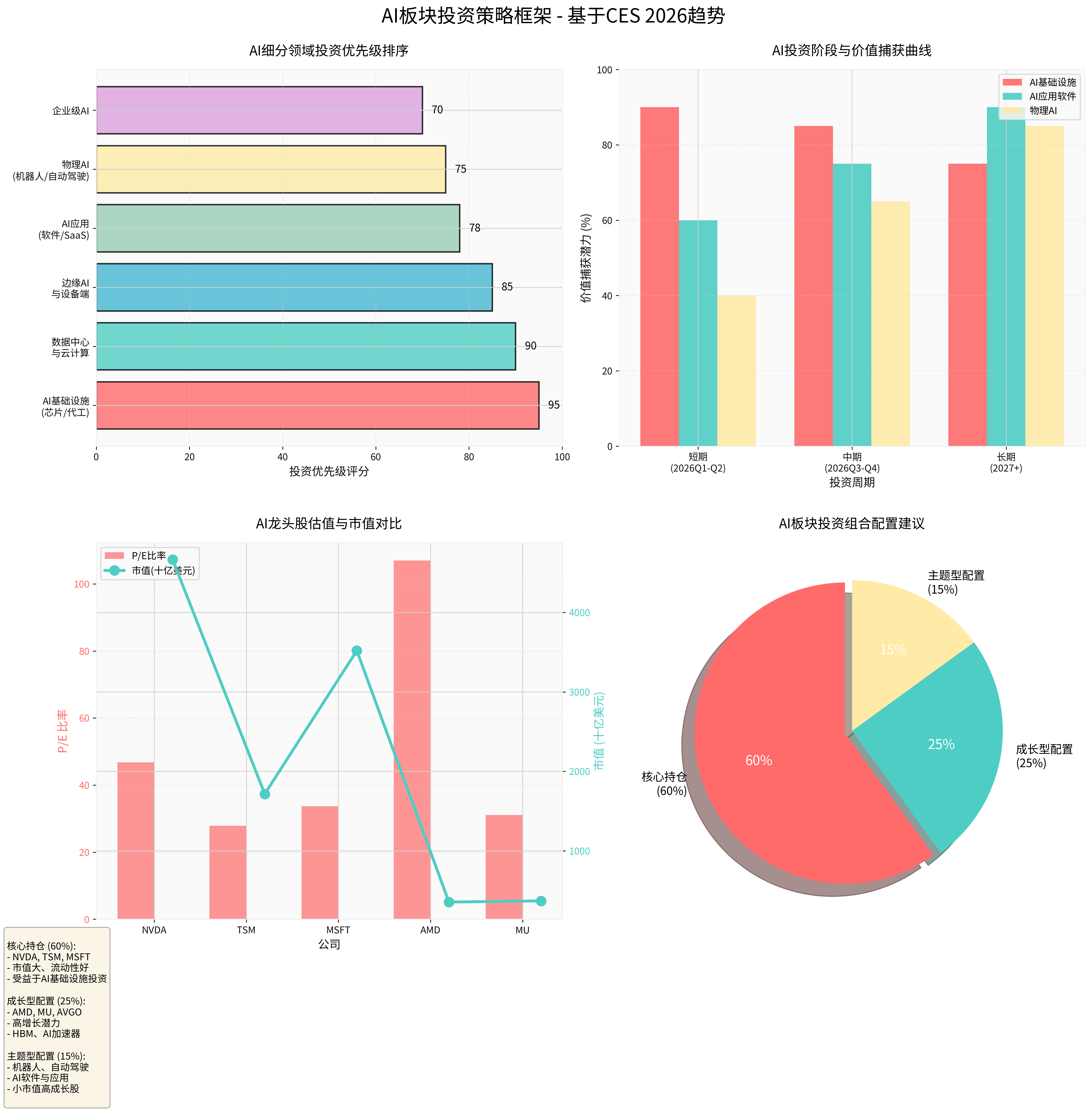

The chart shows the investment priority of AI sub-sectors, value capture across investment cycles, valuation comparison of leading stocks, and portfolio allocation recommendations [0]

Based on CES 2026 trends and Morgan Stanley’s analysis, I have constructed the following

-

AI Chips & Foundry

- TSM (Taiwan Semiconductor Manufacturing Company): Morgan Stanley analyst Charlie Chan expects that if TSMC guides for 25% YoY revenue growth in 2026 and increases the CAGR of AI semiconductor foundry revenue (2024-2029) to 60%, its stock price may approach the target price of NT$1,888 (current $330.14) [0]. A more optimistic scenario is an AI semiconductor CAGR of 75% and revenue growth of 30% [0]

- NVDA (NVIDIA): Current market capitalization of $4.66 trillion, data center business accounts for 87.9% [0], BofA calls it “best positioned” as it optimizes the entire AI stack from networks to GPU workload management [7]

- AMD: Data center business accounts for 47.0% [0], target price of $300 (37.5% upside potential) [0]

-

High Bandwidth Memory (HBM)

- MU (Micron): Stock price rose 5.53% today to $329.40, up 72.50% in 3 months and 231.86% in 1 year [0], benefiting from the urgent demand for HBM in AI data centers

- BofA is bullish on HBM, advanced logic chips, and supporting infrastructure as main growth engines [4]

- Short-term (2026Q1-Q2): Focus on AI chips and foundry, value capture potential of 90% [0]

- Mid-term (2026Q3-Q4): Value capture potential drops to 85%, need to pay attention to valuation pressure [0]

-

Hyperscale Cloud Service Providers:

- MSFT (Microsoft): Market capitalization of $3.52 trillion, P/E ratio of 33.70x [0], OpenAI partner, building its own data centers and developing its own chips [5]

-

Data Center Infrastructure:

- Power, cooling, network equipment suppliers (e.g., Amphenol, APH) [4]

- Data center REITs and related utility stocks benefit from AI data center demand [6]

- Edge AI Chips: Companies like Intel (Panther Lake) are trying to integrate real AI hardware at every layer of the device stack [7]

- AI-Driven Consumer Electronics: AI processors in smartphones, PCs, wearable devices

- Network Infrastructure: 5G/6G, edge computing nodes

- Mid-term (2026Q3-Q4): Value capture potential rises to 75% [0]

- Long-term (2027+): Continues to benefit, value capture potential of 75% [0]

- Enterprise AI Applications: AI-driven productivity tools, customer service automation

- Vertical Industry AI: Healthcare AI, financial AI, legal AI

- AI Agents: Intelligent agents that can autonomously plan and execute tasks [5]

- Mid-term (2026Q3-Q4): Value capture potential of75% [0]

- Long-term (2027+): Value capture potential of90%, becoming the main growth engine [0]

###3.5 Fifth Tier: Physical AI (Investment Priority:75 Points)

- Autonomous Driving: L4/L5 technologies from Tesla, Waymo, etc.

- Industrial Robots: AI-driven smart manufacturing and logistics robots

- Humanoid Robots: Tesla Optimus, Figure AI, etc.

- Mid-term (2026Q3-Q4): Value capture potential of65% [0]

- Long-term (2027+): Value capture potential of85%, needs more time to mature [0]

###4.1 Core Principles

According to BofA’s analysis,

- Utilization Level: Actual utilization rate of data centers and GPUs

- Cloud Free Cash Flow Buffer: Financial health of Big Tech

- AI Adoption Trends: Rather than “bubble noise, LLM commoditization, reduced training costs, Chinese competition” [7]

###4.2 Portfolio Allocation Recommendations

- NVDA(25%): Data center accounts for 87.9% [0], analyst target price of $257.50 (34.5% upside potential) [0], 73.4% of analysts give “Buy” rating [0]

- TSM(20%): AI semiconductor foundry leader, Morgan Stanley is bullish on 25-30% growth in2026 [0]

- MSFT(15%): OpenAI ecosystem, AI application and cloud service leader

- MU(10%): Explosive demand for HBM, up72.50% in3 months [0], 80.6% of analysts give “Buy” rating [0]

- AMD(10%): Data center business accounts for 47% [0], target price of $300 (37.5% upside potential) [0]

- AVGO(5%): Network infrastructure and AI accelerators

- Robotics/Autonomous Driving(8%): TSLA, GOOGL Waymo

- AI Software & Applications(5%): CRM, SNOW and other AI+SaaS

- Small-Cap High-Growth Stocks(2%): EVLV, SOUN, etc. [4]

###4.3 Risk Management & Hedging

Based on Morgan Stanley’s inflation warning, investors need to manage the following risks:

| Risk Type | Hedging Strategy |

|---|---|

AI-Driven Inflation |

Allocate some defensive assets (utilities, consumer staples) [1] |

Valuation Correction |

Build positions in batches, avoid chasing highs, focus on targets with PEG ratio <1.5x [7] |

Geopolitical Risk |

Diversify supply chain risks, focus on targets outside the US and Taiwan |

Technology Route Failure |

Do not over-concentrate bets on a single technology route |

###5.1 Core Insights from Morgan Stanley’s Assessment

Morgan Stanley’s optimistic assessment of AI demand at CES2026 reveals the

- Demand Side: AI demand is “soaring”, as evidenced by the $500 billion investment plan of hyperscale enterprises [1]

- Cost Side: Chip and power cost inflation has become an unavoidable resistance, which may squeeze profit margins [1]

This contradiction actually

###5.2 Next-Stage Investment Themes (By Priority)

- AI Infrastructure(NVDA, TSM, MU): Directly benefits from the implementation of the $500 billion investment plan

- Data Center REITs and Utilities: Rising demand for power and cooling [6]

- Edge AI & Device-Side AI: Technologies demonstrated at CES2026 begin to commercialize [7]

- AI Application Software: As infrastructure improves, the application layer begins to deliver value

- Physical AI(Robotics, Autonomous Driving): Moves from prototypes to large-scale deployment

- AI Agents: Redefines productivity tools [5]

###5.3 Actionable Investment Recommendations

| Investor Type | Recommended Strategy | Key Targets |

|---|---|---|

Conservative |

Focus on core infrastructure, 70% allocation to NVDA, TSM, MSFT | NVDA, TSM, MSFT |

Balanced |

60% core +25% growth +15% thematic | NVDA, TSM, MU, AMD |

Aggressive |

40% core +40% growth +20% thematic (including small-caps) | MU, AMD, EVLV, SOUN |

- Data center and GPU utilization rates

- Cloud free cash flow

- AI adoption rate (rather than publicity)

- Impact of inflation on cost structure

[0] Gilin API Data - Company Overview, Real-Time Quotes, Technical Analysis of NVDA, TSM, MSFT, AMD, MU and AI Investment Strategy Framework Charts

[1] Reuters - “AI-driven inflation is 2026’s most overlooked risk, investors say” (https://www.reuters.com/world/asia-pacific/ai-driven-inflation-is-2026s-most-overlooked-risk-investors-say-2026-01-05/)

[2] The Drum - “CES 2026: The 3 megatrends set to define this year’s show, according to CTA” (https://www.thedrum.com/news/ces-2026-the-three-megatrends-set-to-define-this-year-s-show-according-to-cta)

[3] China Daily - “AI-driven innovation to transform manufacturing, health and mobility” (https://www.chinadaily.com.cn/a/202601/05/WS695b8686a310d6866eb320fc.html)

[4] Yahoo Finance - “3 Semiconductor Stocks Well-Poised for a Comeback in 2026” (https://finance.yahoo.com/news/3-semiconductor-stocks-well-poised-124000935.html)

[5] Forbes - “10 AI Predictions For 2026” (https://www.forbes.com/sites/robtoews/2025/12/22/10-ai-predictions-for-2026/)

[6] Yahoo Finance - “AI spending is surging, but a hidden risk is getting overlooked” (https://finance.yahoo.com/news/ai-spending-surging-hidden-risk-013700158.html)

[7] Yahoo Finance - “BofA says these are the best 7 AI chip stocks to own in 2026” (https://finance.yahoo.com/news/bofa-says-best-7-ai-161543499.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.