In-Depth Analysis of Topgolf Callaway Brands (MODG) Reaching a New 52-Week High

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

As of January 6, 2026, MODG closed at

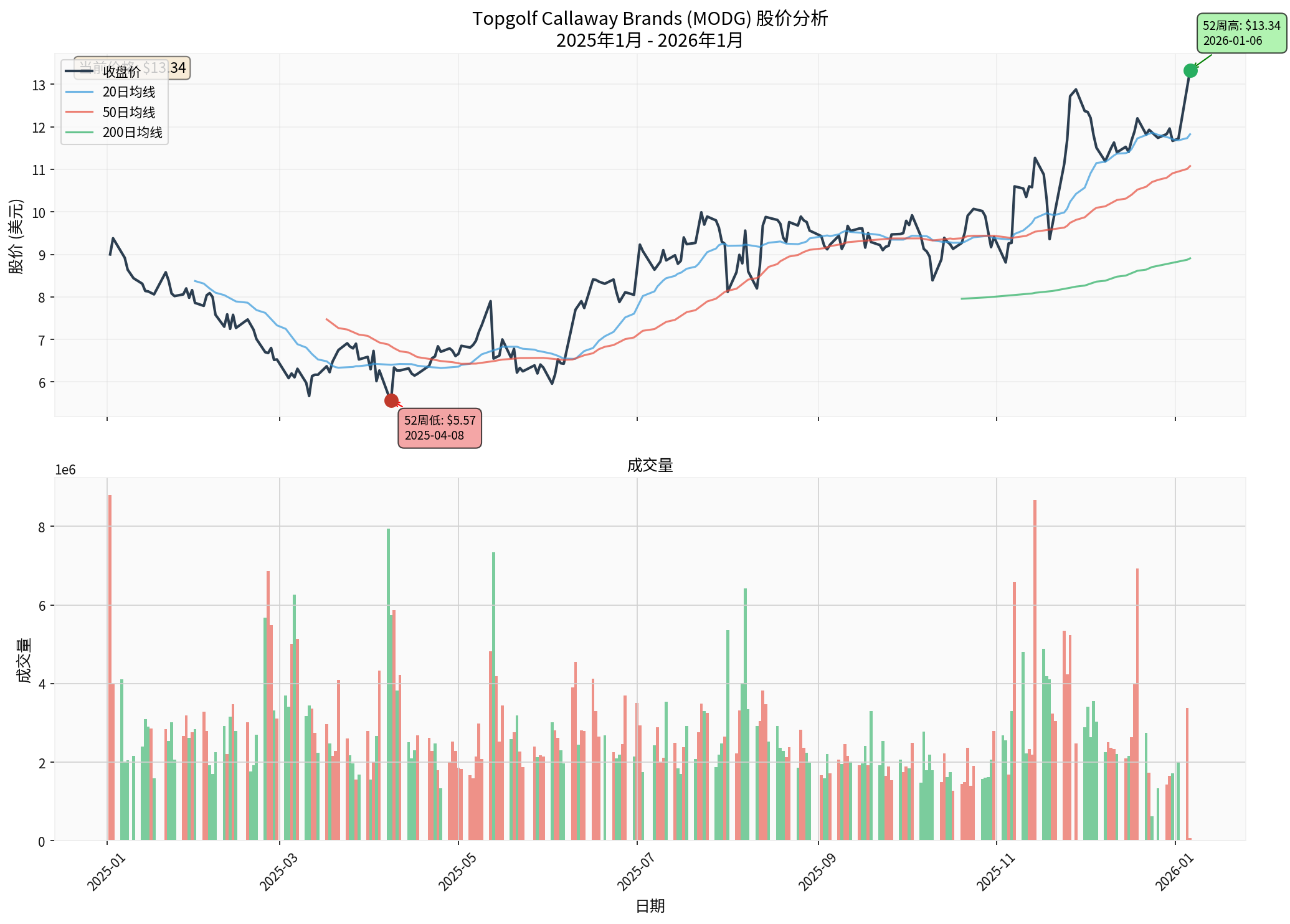

- X-axis: Dates from January 2025 to January 2026

- Y-axis (Top): Stock price (USD), showing closing prices and 20/50/200-day moving averages

- Y-axis (Bottom): Trading volume, red for down days, green for up days

- Key Annotations: Specific positions and dates of the 52-week high ($13.34) and 52-week low ($5.42)

The

| Dimension | Impact |

|---|---|

Balance Sheet |

Received $800 million in cash, significantly improving liquidity for debt repayment and share buybacks |

Business Focus |

Refocused on high-margin golf equipment manufacturing core business |

Profit Improvement |

Divested the continuously loss-making entertainment venue business, expected to significantly improve net profit margin |

Company Renaming |

Will be renamed Callaway Golf Company effective January 16, 2026, with ticker symbol changed to CALY [1] |

The company’s Q3 2025 results far exceeded expectations, showing strong recovery momentum [0]:

- EPS: -$0.05 vs expected -$0.21 (76.19% above expectation)

- Revenue: $934 million vs expected $786 million (18.77% above expectation)

Loss narrowed significantly from -$0.33 in the same period last year to -$0.05, with revenue growing significantly year-over-year.

Before the sale, Topgolf had shown clear signs of improvement [2]:

- Core Customer Traffic: 1-2 bay consumers (accounting for 80% of revenue) achievedhigh double-digit traffic growth

- Same-Store Sales: Returned topositive growthfor the first time in several quarters

- Operational Optimization: Introduced Toast POS system to increase per-customer spending

- Value Strategy: Balanced foot traffic and profitability through value-oriented pricing strategies

- Technical Pattern: Broke through 20-day, 50-day, and 200-day moving averages, forming a bullish alignment [0]

- Relative Strength: Beta value of 0.94, slightly below the market, indicating controllable volatility [0]

- Institutional Sentiment: 47.8% of analyst ratings are “Buy”, only 4.3% are “Sell” [0]

| Business Segment | Revenue | Proportion | Profit Margin Characteristics |

|---|---|---|---|

Service Business (Topgolf Venues) |

$468.7 million | 50.2% | Low profit margin, capital-intensive |

Product Business (Golf Equipment) |

$465.3 million | 49.8% | High profit margin, brand-driven |

- Vertical Integration Advantage: Equipment manufacturer + venue operation form a closed-loop ecosystem

- Brand Exposure: Topgolf venues provide a natural display platform for Callaway products

- Data Value: Consumer data collected by Toptracer feeds back into product development

- ✅ Retained a minority stakein Topgolf, continuing to benefit from its growth

- ✅ Maintained supply chain relationships (Topgolf will remain a customer of Callaway products)

- ✅ Completely transferred heavy asset operation risks to private equity firms

- ✅ Obtained large amounts of cash for core business investment and debt optimization

| Metric | Value | Evaluation |

|---|---|---|

| Market Cap | $2.45 billion | - |

| P/E Ratio (TTM) | -1.63x | Negative (due to net loss) |

| P/B Ratio | 0.99x | Close to Book Value |

| P/S Ratio (TTM) | 0.60x | Below Industry Average [2] |

| EV/OCF | 19.27x | High operating cash flow multiple |

| Current Ratio | 1.87 | Healthy liquidity [0] |

Based on 5-year historical financial data and analyst consensus, DCF three-scenario valuation shows

| Scenario | Fair Value | vs Current Price |

|---|---|---|

Conservative |

$21.14 | +58.7% |

Base |

$24.92 | +87.1% |

Optimistic |

$29.35 | +120.3% |

- Revenue Growth Rate: 27.8% (based on historical CAGR)

- EBITDA Margin:3.5%

- WACC:6.9%

- Terminal Growth Rate:2.5%

- Consensus Target Price: $11.50 (vs current price -13.7%) [0]

- Target Range: $9.00 - $17.50

- Rating Distribution:47.8% Buy /47.8% Hold /4.3% Sell

- ✅ P/B only 0.99x: Close to book value, limited downside risk

- ✅ $800 million cash injection: Significantly improved balance sheet

- ✅ Divested loss-making business: Expected to quickly turn net profit positive

- ✅ DCF upside potential 58-120%: Attractive valuation if assumptions hold

- ⚠️ Severe historical net loss: TTM net profit margin -37% [0]

- ⚠️ Negative ROE: -61.44%, poor shareholder returns [0]

- ⚠️ Analyst Divergence: Nearly half of analysts give “Hold” ratings [0]

- ⚠️ Renaming Uncertainty: The market needs time to validate the positioning of the new Callaway Golf Company

- Strategic Reshaping: From “loss-making entertainment + profitable equipment” dual-wheel to “focus on high-margin manufacturing + minority equity income” model

- Financial Health: $800 million cash can be used to repay convertible bonds (interest pressure) and repurchase shares

- Brand Value: Callaway is a leading golf equipment brand with strong pricing power and customer loyalty

- Industry Trend: Golf participation continues to rise, especially among young groups exposed to golf through Topgolf

| Risk Type | Specific Description |

|---|---|

Execution Risk |

Uncertainty about whether the new management team can successfully integrate businesses and achieve synergies |

Macroeconomy |

Slowdown in consumer spending may affect demand for high-end golf equipment |

Increased Competition |

Competitors like TaylorMade and Ping continue to innovate |

Interest Rate Risk |

High interest rate environment increases capital costs |

Topgolf Dependence |

Despite selling a majority stake, still dependent on its revenue |

- Q4 FY2025 Earnings Report(February 23, 2026): Focus on the trend of narrowing losses and improvement in free cash flow

- Share Repurchase Plan: Scale and execution speed of the company’s announced repurchase

- Convertible Bond Repayment: How much of the $800 million is used for debt repayment

- Topgolf Minority Equity Income: Whether it can continue to contribute positive income

MODG’s new high is

| Evaluation Dimension | Conclusion |

|---|---|

Short-Term (3-6 months) |

⚠️ Cautious : Current price already reflects transaction benefits; technical indicators show overbought risk |

Mid-Term (12 months) |

✅ Optimistic : If financial improvement is realized, DCF shows 50-90% upside potential |

Long-Term (24+ months) |

🤔 To Be Observed : Need to verify strategic execution effect of the new Callaway Golf Company |

The support of current valuation at $13.32 depends on:

- Whether Q4 earnings can continue the trend of narrowing losses

- Allocation of $800 million funds (debt vs repurchase)

- Whether the renamed company can regain market recognition in 2026

[0] Jinling API Data - MODG Real-Time Quotes, Company Profile, Financial Analysis, Technical Analysis, DCF Valuation, Historical Stock Price Data (2025-2026)

[1] PEHub - “Leonard Green completes buyout of Topgolf Callaway Brands’ Topgolf and Toptracer biz for $800m”

https://www.pehub.com/leonard-green-completes-buyout-of-topgolf-callaway-brands-topgolf-and-toptracer-biz-for-800m/

[2] Yahoo Finance - “Topgolf Traffic Surges: Does Its Value Strategy Have…”

https://finance.yahoo.com/news/topgolf-traffic-surges-does-value-153900582.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.