Benchmark's Analysis of a Cautious Stance on Old Dominion Freight Line (ODFL)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- P/E Ratio:33.31x (TTM), significantly higher than the industry average [0]

- P/B Ratio:8.26x, reflecting the market’s high recognition of the company’s quality [0]

- P/S Ratio:6.26x, indicating the market has priced in significant growth expectations [0]

The current stock price is close to the upper end of the analyst target range ($143-$190), implying limited upside potential. At the current price ($166.83), the downside from the consensus target price ($165) is only about -1.1%, indicating analysts believe the valuation fully reflects fundamentals [0].

- Unit sales have declined by an average of 3.2% over the past two years, reflecting sustained contraction in core business volumes [0]

- Unit sales fell to 2.83 million in Q3 2025, showing a clear year-over-year downward trend [0]

About two-thirds of LTL industry revenue comes from industrial freight, but the ISM Manufacturing Index has been in contraction territory (<50) for 23 out of the past 26 months [1]. This is the most prolonged manufacturing downturn in decades, far exceeding the typically short and self-correcting cyclical patterns in history.

- EPS has declined by 5.8% over the past two years, a drop exceeding revenue decline, indicating the company is under margin pressure amid shrinking demand [0]

- While net profit margin remains high (18.97%), growth momentum has weakened [0]

Return on invested capital has declined significantly, indicating new investments have failed to generate returns comparable to historical levels. This suggests the company faces the challenge of reduced opportunities for high profit growth [0].

Yellow (once the third-largest LTL carrier, accounting for 10% of industry volume) filed for bankruptcy protection in August 2023. Other carriers initially masked the weak freight cycle by absorbing Yellow’s volumes, but this one-time dividend effect is gradually fading [1].

- The top 10 LTL carriers account for about 75% of industry revenue (~$50 billion market) [1]

- Assets after Yellow’s bankruptcy were reallocated: XPO spent $918M to acquire 28 terminals, Estes spent $490M to acquire 52 terminals, SAIA spent $244M to acquire 28 terminals [1]

ODFL attempted to acquire all of Yellow’s service centers at a low price but was outpaced by competitors and ultimately failed to acquire any assets [1]. This may limit its ability to benefit from industry consolidation.

- Prolonged De-stocking Cycle:Enterprises continue to digest excess inventory accumulated during the pandemic

- Inflation Pressure:Raises operating costs and squeezes margins

- Tariff Impact:Trade policy uncertainty affects cross-border freight demand

- Shift from Goods to Services Consumption:Structural change reduces demand for goods transportation [1]

Port of Los Angeles Executive Director Gene Seroka warned that import volumes may see a “single-digit decline” in 2026, mainly due to still-high national inventory levels [0].

Although LTL revenue per hundredweight has increased, pricing power is limited amid weak demand. A 10.0% decline in freight volumes was only partially offset by revenue growth, indicating limited price elasticity [0].

- ArcBest (ARCB):Actively sacrificed transactional freight (usually heavier than contract freight) through repricing, leading to accelerated loss of freight volumes [1]

- Saia (SAIA), XPO:Expanded network coverage and enhanced density advantages by acquiring Yellow’s assets [1]

ODFL still maintains industry-leading service quality and operational efficiency, but its relatively conservative approach to network expansion may affect its market share growth potential.

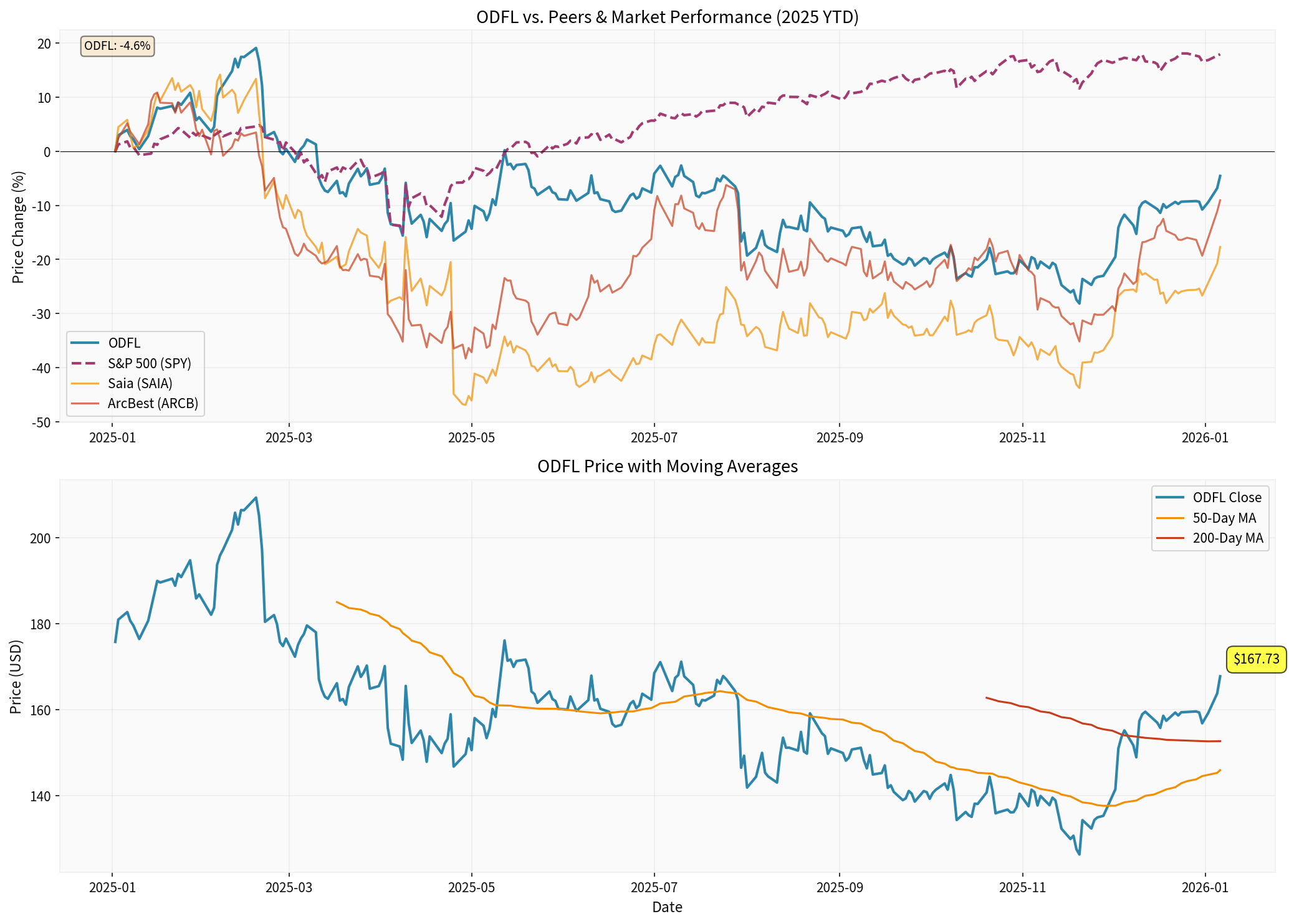

- Latest Close:$167.73 (2026-01-06) [0]

- Trend Status:Uptrend (pending confirmation), buy signal triggered on January 5 [0]

- Key Levels:Support at $160.31, resistance at $167.78, next target at $171.97 [0]

- MACD:Golden Cross (bullish) [0]

- KDJ:Bullish [0]

- RSI:Overbought risk [0]

- Beta:1.28 (vs. SPY), high volatility [0]

- Short Interest as a percentage of float decreased by 9.06% to 12.65M shares (7.63%) [0]

- Days to cover: 4.22 days [0]

This indicates some short sellers are closing positions, possibly reflecting a correction of overly pessimistic sentiment in the market.

| Indicator | Value | Evaluation |

|---|---|---|

| Net Profit Margin | 18.97% | Excellent Profitability |

| Operating Margin | 24.95% | Industry Leading |

| ROE | 24.92% | Excellent Capital Return |

| Current Ratio | 1.20 | Good Liquidity |

| Quick Ratio | 1.20 | Good Short-Term Solvency |

The company’s financial attitude is classified as “conservative”, showing conservative accounting policies and high depreciation/capital expenditure ratios [0]. This means there is still room for profit improvement as investments mature.

- Signs of Demand Recovery:If the ISM Manufacturing Index returns to expansion territory (>50), it will significantly boost LTL demand

- Capacity Rationalization:The focus for transport stocks in 2026 may shift to supply rationalization and cost-driven self-improvement [0]

- B2B Momentum:The recovery in B2B momentum reported by FedEx may spill over to the LTL sector

- Sustained Manufacturing Contraction:If the ISM Index continues to be under pressure, freight volumes will struggle to recover effectively

- Increased Competition:Peers enhancing density through Yellow asset acquisitions may squeeze ODFL’s market share

- Macroeconomic Slowdown:Consumer spending shifts to services rather than goods, structurally suppressing freight demand

- Oil Price Volatility:Rising fuel costs may squeeze margins

At high valuations of 33x P/E and 8x P/B, even if ODFL maintains its industry-leading position, there is limited room for valuation expansion in the short term. The Hold rating reflects a cautious judgment of “good company but not cheap price”.

Trends such as continuous decline in freight volumes, stagnant EPS growth, and deteriorating ROIC indicate that ODFL is at a cyclical bottom, with high uncertainty in the demand recovery outlook.

- Upside Potential:Limited (close to target price)

- Downside Risk:If demand recovery is less than expected or competition intensifies, there is a risk of valuation multiple compression

- Volatility:Beta of 1.28, higher than market average

- Continuous quarterly positive growth in freight volumes

- ISM Manufacturing Index consistently above 50

- ROIC trend stabilizes and rebounds

- Operational efficiency improvement from network density enhancement

- Freight volumes continue to shrink

- Valuation multiples further expand away from fundamentals

- Market share loss due to aggressive pricing by competitors

ODFL remains the highest-quality LTL carrier with excellent operational metrics and service quality. Although the current valuation is expensive, holding it for a 3-5 year cycle and waiting for cyclical demand recovery may yield substantial returns.

Given the unclear demand outlook and valuation that fully reflects optimistic expectations, the stock price may face volatility in the short term. It is recommended to wait for clearer recovery signals or valuation pullbacks before building positions.

Benchmark’s Hold rating reflects a balanced judgment between a high-quality company and expensive valuation. Maintaining a cautious stance is a reasonable risk management strategy until signs of LTL demand recovery become clearer [0][1].

[0] Gilin API Data (Company Overview, Real-Time Quotes, Financial Analysis, Technical Analysis, Stock Price Data, Analyst Ratings)

[1] Substack - “the LTL carriers are going to be ok” (https://scuttleblurb.substack.com/p/ltl) - LTL Industry Analysis, Impact of Yellow Bankruptcy, Industry Concentration, Freight Volume Trends

[2] Yahoo Finance - “Old Dominion price target raised to $173 from $160 at Stifel” (https://finance.yahoo.com/news/old-dominion-price-target-raised-122025836.html) - Stifel Analyst Views, 2026 Outlook

[3] Yahoo Finance - “Port Of Los Angeles ‘Feeling OK’ About 2026” (https://finance.yahoo.com/m/66fa4248-dbea-3768-8fe7-88865eb09fd0/port-of-los-angeles-'feeling.html) - Port Trade Outlook, 2026 Import Volume Forecast

[4] StockStory - “3 Reasons ODFL is Risky” (https://stockstory.org/us/stocks/nasdaq/odfl/news/buy-or-sell/3-reasons-odfl-is-risky-and-1-stock-to-buy-instead-2) - Analysis of Declining Sales Volume, EPS Drop, and ROIC Deterioration

[5] Benzinga - “How Do Investors Really Feel About ODFL?” (https://www.benzinga.com/insights/short-sellers/26/01/49675274/how-do-investors-really-feel-about-old-dominion-freight-line-inc) - Short Interest Data

[6] Yahoo Finance - “Here’s Why Investors Should Give ODFL a Miss Now” (https://finance.yahoo.com/news/heres-why-investors-old-dominion-170400110.html) - Valuation Concerns, Profit Expectation Downgrades

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.