Impact Analysis of Prudential (2378.HK)'s $1.2 Billion Share Repurchase Program

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest announcement, Prudential plc has launched a

| Repurchase Element | Details |

|---|---|

Repurchase Scale |

$1.2 billion (approximately HK$9.34 billion) |

Completion Deadline |

Before December 18, 2026 |

Funding Source |

$500 million from regular capital returns + $700 million from net proceeds of ICICI Prudential Asset Management’s IPO |

Repurchase Proportion |

Approximately 3% of issued share capital |

Program Background |

Part of the August 2024 capital management plan (return over $5 billion to shareholders by 2027) |

The news was met with a strong positive market response [1][2]:

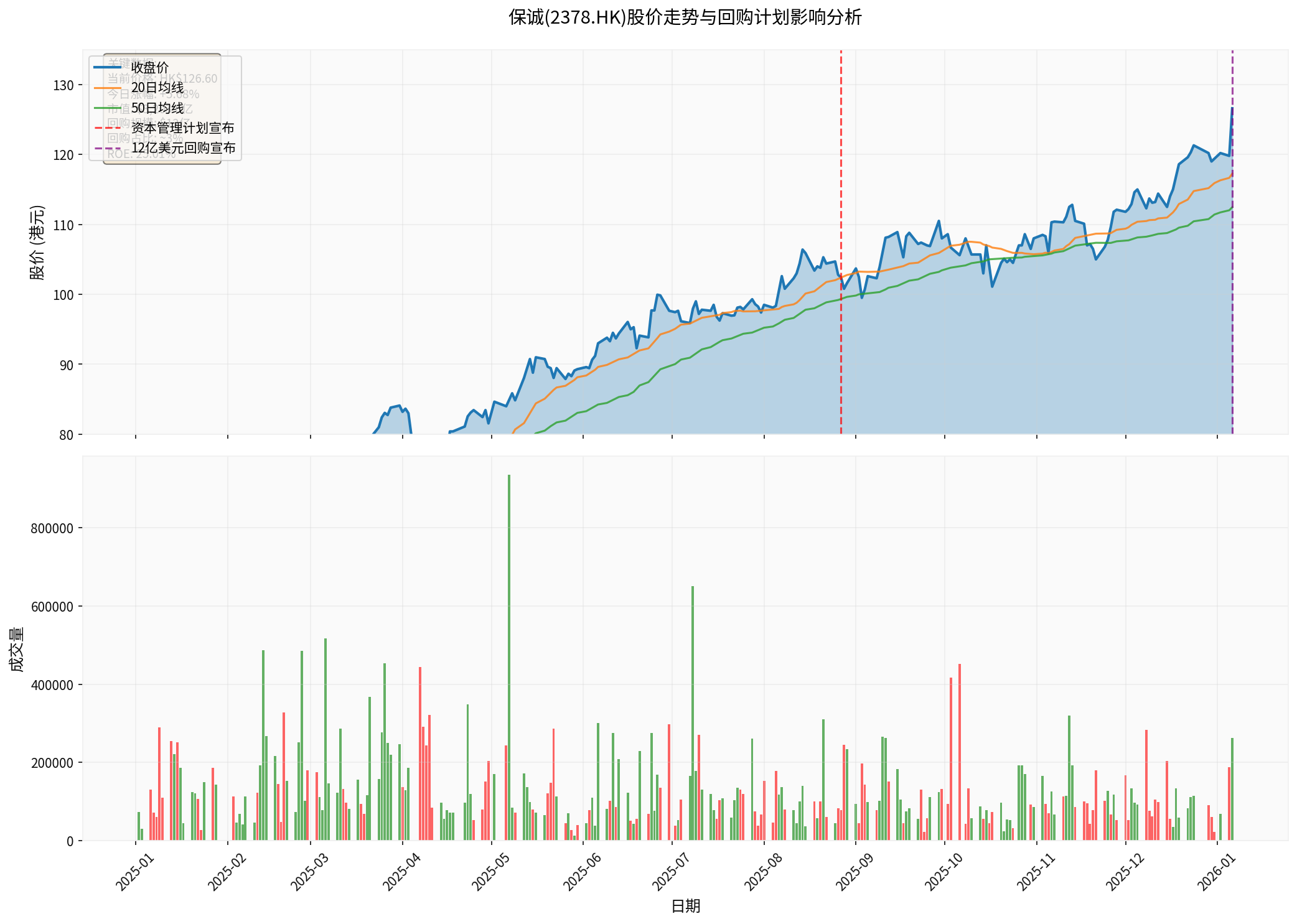

- Stock Price Increase: +5.68% (HK$126.60)

- Trading Volume: 263,486 shares (surge of 165% compared to the average of 99,325 shares)

- 52-Week High: HK$127.10 (reaching the historical high range)

- Market Capitalization: HK$320.36 billion

Chart shows: Prudential’s stock price has risen strongly by 104.69% in the past year, from HK$61.80 to the current HK$126.60. After announcing the capital management plan on August 27, 2025, the stock price began to accelerate upward; after the $1.2 billion repurchase program was announced on January 6, 2026, the stock price gapped up and hit a 52-week high.

Share repurchases directly boost EPS by reducing the number of outstanding shares:

- Current EPS (TTM): $10.01 [0]

- Repurchase Proportion: Approximately 3%

- Expected EPS Increase: Approximately 3.1% (assuming unchanged profits)

- Prudential’s ROE is as high as 25.01% [0], the cost of capital for repurchasing shares is lower than ROE, creating a positive leverage effect

- After reducing share capital, the profit allocated per share will increase

- Improve financial efficiency indicators (e.g., book value per share)

| Valuation Metric | Current Value | Expected Change After Repurchase |

|---|---|---|

P/E Ratio |

19.45x [0] | Slightly rise in the short term (due to stock price increase), but EPS improvement will partially offset this |

P/B Ratio |

2,350.44x [0] | Decrease (book value per share increases) |

Market Cap/Free Cash Flow |

15.55x [0] | Remain stable (cash flow unaffected) |

###3.3 Impact on Enterprise Value

- Equity Value: Decrease by $1.2 billion

- Debt: Unchanged

- Enterprise Value: Corresponding decrease by $1.2 billion

- Enterprise value multiples (e.g., EV/EBITDA): Expected to improve, enhancing valuation attractiveness

###4.1 Sources of Shareholder Returns

Share repurchases create a triple return mechanism:

- Directly increase intrinsic value per share

- The market usually views repurchases as a positive signal that the stock price is undervalued

- Prudential’s stock price has risen 108.40% in the past year [0], and the repurchase program will continue this upward trend

- Reduce outstanding shares by 3%, EPS will automatically increase by approximately 3%

- Coupled with business growth, EPS growth may reach double digits

- $1.2 billion repurchase funds come from IPO proceeds, which do not affect the cash flow of the core business

- Return over $5 billion in total by 2027 [2], continuously creating shareholder value

###4.2 Advantages Compared to Cash Dividends

| Aspect | Share Repurchase | Cash Dividend |

|---|---|---|

Tax Efficiency |

Shareholders can choose not to realize capital gains | Dividends require immediate tax payment |

Flexibility |

Can adjust repurchase pace | Pressure to commit to continuous payments |

Signaling Effect |

Stronger indication of management confidence | Stable but not necessarily reflecting valuation |

Impact on EPS |

Directly boost EPS | No impact on EPS |

Prudential’s choice of repurchase over increasing dividends indicates that management believes the current stock price is undervalued and that repurchases can more effectively enhance shareholder value.

###5.1 Capital Adequacy

According to financial analysis [0]:

- Cash Flow: Free cash flow of $3.508 billion (sufficient to support repurchases)

- Solvency: Current ratio of 1.05, quick ratio of 1.05 (normal short-term solvency)

- Financial Risk: Medium risk (reasonable financial leverage)

###5.2 Sustainability of Repurchase Funds

The $1.2 billion repurchase comes from:

- $500 million from regular capital returns: From operating cash flow

- $700 million from IPO proceeds: From the listing of ICICI Prudential Asset Management

This means that the repurchase does not affect the operating funds of the core business, and financial health will not be impaired.

Prudential’s previously completed $2 billion repurchase program had significant effects [2]:

- August 2024 to December 2025: Stock price rose by over 100%

- ROE increased from a low base to 25.01%

- Market confidence significantly enhanced

This $1.2 billion repurchase will further consolidate this trend.

###7.1 Positive Factors

✅

✅

✅

✅

✅

###7.2 Risk Factors

⚠️

⚠️

⚠️

⚠️

###7.3 Comprehensive Assessment

- Short-term (1-3 months): Stimulated by the repurchase news, the stock price may continue to rise, with a target price of HK$135-140

- Mid-term (6-12 months): Focus on business growth and repurchase execution progress; EPS improvement will support valuation

- Long-term (1-3 years): Asian market expansion and capital return plans will drive continuous value creation

Prudential’s $1.2 billion share repurchase program is a strong shareholder value creation initiative, affecting valuation and shareholder returns through the following ways:

- EPS Improvement: Reduce 3% of outstanding shares, expected EPS increase of over 3%

- Valuation Improvement: P/B ratio decreases, intrinsic value increases

- Enhanced Shareholder Returns: Capital appreciation + efficiency improvement + continuous return

- Market Confidence: Strong management confidence, stock price hits 52-week high

Combined with Prudential’s strong fundamentals (high ROE, sufficient cash flow, Asian market opportunities), this repurchase program further strengthens the company’s investment attractiveness and creates considerable value for shareholders.

[0] Jinling API Data - Prudential (2378.HK) real-time quotes, company overview, financial analysis, historical price data

[1] Lianhe Zaobao - “Prudential Announces $1.2 Billion Share Repurchase” (https://www.zaobao.com.sg/finance/singapore/story20260106-8059830)

[2] Forecastock - “Insurance Giant Prudential Announces $1.2 Billion Share Repurchase Program, Returning to Shareholder Capital!” (https://www.forecastock.tw/article/cmoneyairesearcher-296dd35a-eaeb-11f0-b43a-dcb0f5410050)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.