Apple Hospitality REIT (APLE) Investment Value Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on a comprehensive analysis of Apple Hospitality REIT (APLE), in the current economic environment, this stock presents a

- High Dividend Yield: Monthly dividend of $0.08, annualized yield of approximately7.8%[0]

- Valuation Appeal: P/B ratio of only0.89x, below book value [0]

- Analyst Bullishness: Consensus target price of $13.50 (+13%), rated BUY [0]

- Financial Stability: Current ratio of 1.62, net profit margin of 12.37% [0]

- Relative Resilience: Outperformed most peers in the hotel REIT sector [0]

Apple Hospitality REIT, Inc. (NYSE: APLE) is a real estate investment trust focused on the hotel industry, holding and managing a diversified portfolio of hotels [0]. As of January 6, 2026:

| Indicator | Value |

|---|---|

| Current Stock Price | $11.95 |

| Market Capitalization | $2.83 billion |

| 52-Week Range | $10.44 - $16.02 |

| Beta Coefficient | 0.85 (lower than market volatility) [0] |

- Earnings Per Share (EPS): $0.42, beating expectations by 5% (expected $0.40) [0]

- Operating Revenue: $374 million, exceeding expectations by 15.85% (expected $323 million) [0]

- Operating Revenue Composition:

- Room Revenue: 90.9%

- Other Hotel Revenue: 4.9%

- Food and Beverage Revenue: 4.2%

| Indicator | Value |

|---|---|

| P/E Ratio | 16.14x |

| P/B Ratio | 0.89x (below book value, indicating market undervaluation) [0] |

| ROE (Return on Equity) | 5.46% |

| Net Profit Margin | 12.37% |

| Operating Margin | 18.19% |

| Current Ratio | 1.62 (good liquidity) [0] |

Based on discounted cash flow (DCF) model analysis, APLE’s intrinsic value is far higher than its current market price:

| Scenario | Fair Value | Premium Over Current Stock Price |

|---|---|---|

| Conservative | $62.89 | +426.3% |

| Baseline | $79.65 | +566.5% |

| Optimistic | $134.10 | +1022.2% |

This huge valuation gap indicates that the market may have excessive pessimism towards the hotel REIT industry.

| Indicator | APLE | Industry Average |

|---|---|---|

| P/B Ratio | 0.89x | Usually >1.0x |

| Dividend Yield | 7.8% | REIT average:4-6% |

- Consensus Target Price: $13.50 (13% upside from current price)

- Rating Distribution:

- Buy:50% (8 analysts)

- Hold:43.8% (7 analysts)

- Sell:6.2% (1 analyst)

- Overall Consensus: BUY

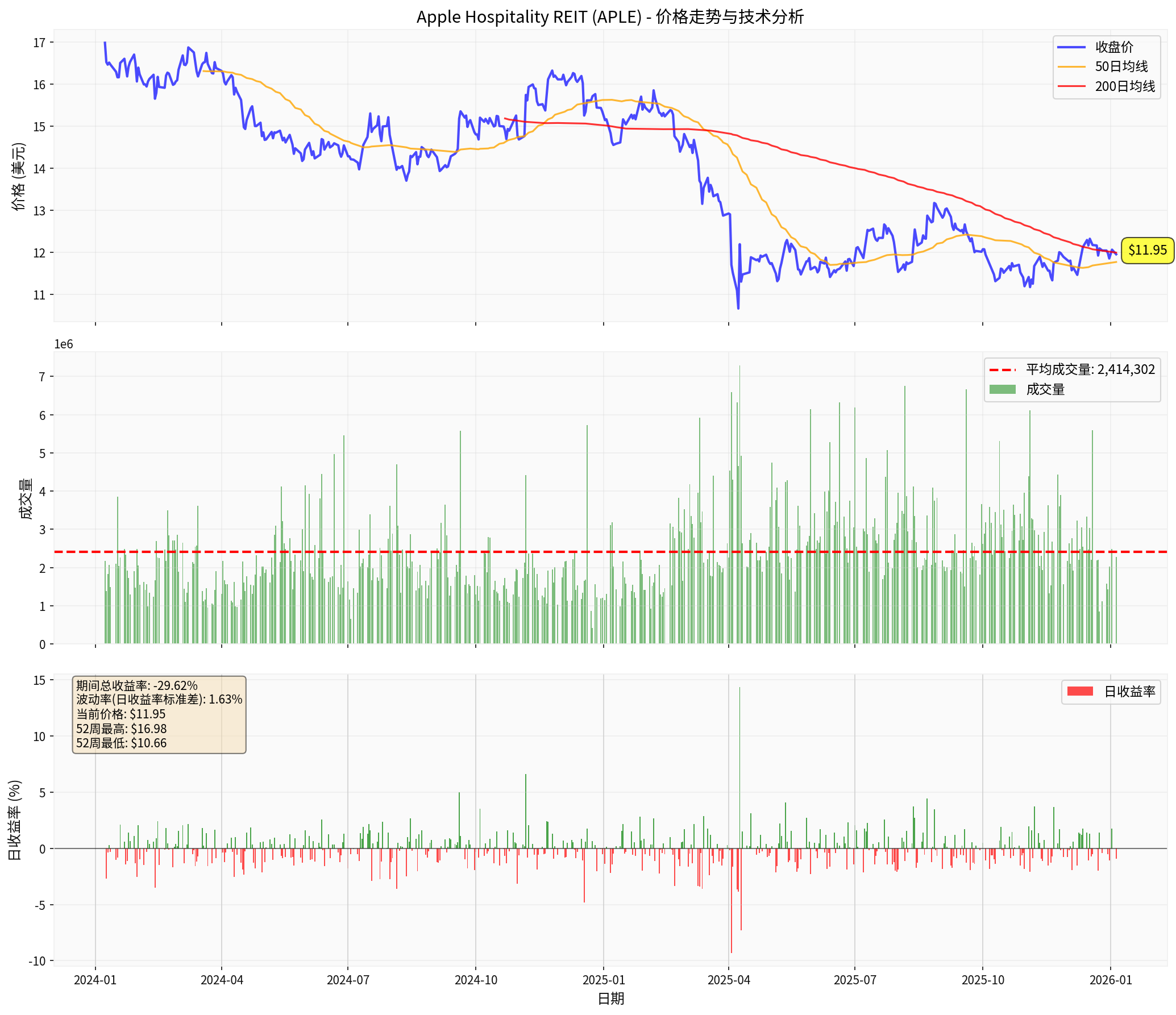

- Trend: Sideways consolidation, trading range [$11.84, $12.06]

- Support Level: $11.84

- Resistance Level: $12.06

- 50-Day Moving Average: $11.77

- 200-Day Moving Average: $11.99

- MACD: No crossover signal, bearish bias

- KDJ: Bullish signal

- RSI: Normal range (not overbought or oversold)

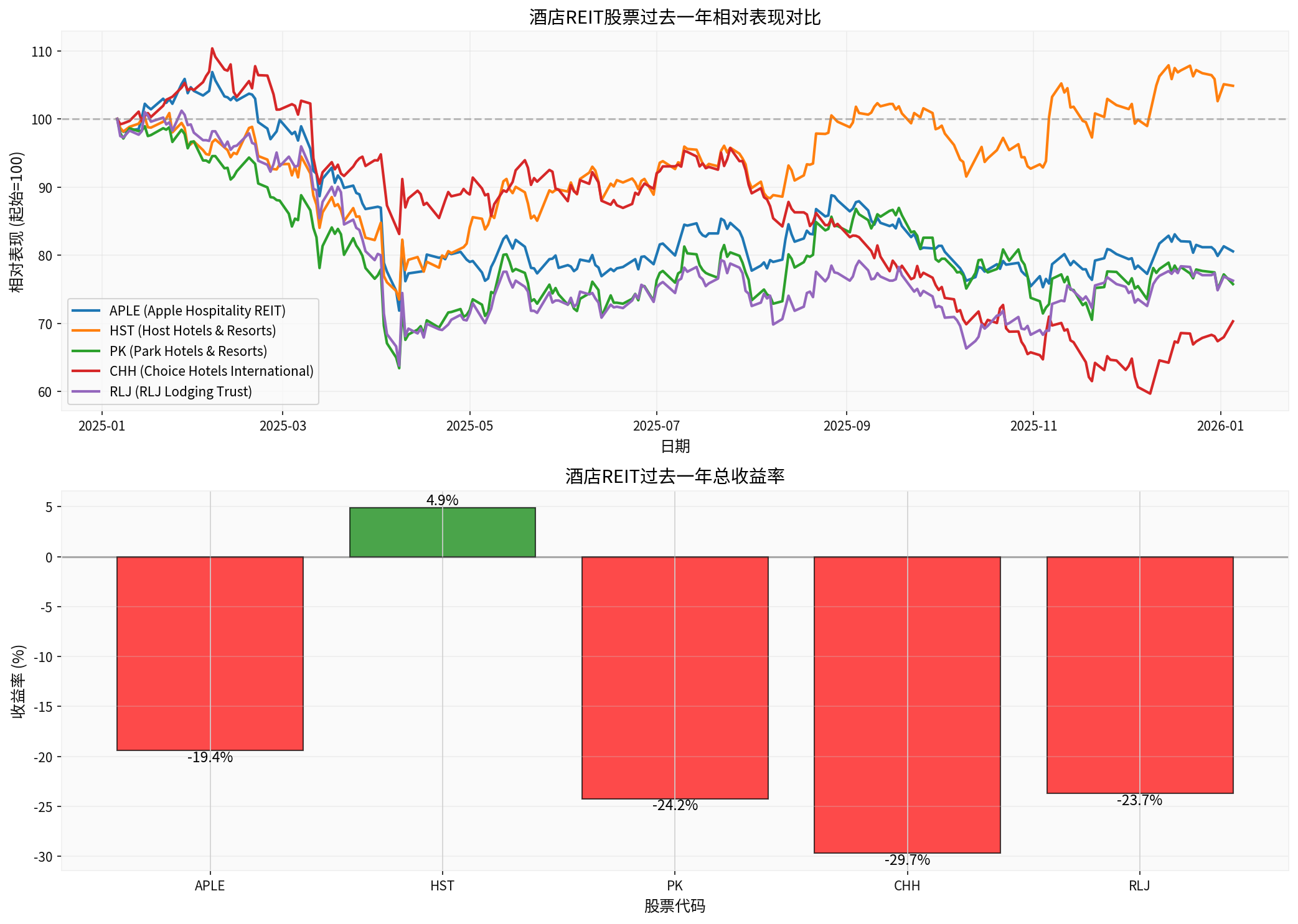

##5. Industry Comparison Analysis

###5.1 Hotel REIT Peer Performance Comparison (Past Year) [0]

| Ticker | Company Name | 1-Year Return |

|---|---|---|

| HST | Host Hotels & Resorts | +4.86% |

| APLE | Apple Hospitality REIT | -19.42% |

| RLJ | RLJ Lodging Trust | -23.72% |

| PK | Park Hotels & Resorts | -24.23% |

| CHH | Choice Hotels International | -29.69% |

- APLE performed relatively resilientlyamong peers, with only HST achieving positive returns

- The entire hotel REIT sector is under pressure, indicating this is an industry-wide challenge rather than a company-specific issue

- APLE’s relative strength reflects the stability of its asset quality and management

###5.2 Macroeconomic Environment

- Real Estate Sector: +1.23%

- Financial Services Sector: +2.21%

- Consumer Cyclical Sector: +1.78%

- S&P 500: +4.00%

- Nasdaq: +4.06%

- Dow Jones: +5.62%

##6. Hotel REIT Industry Recovery Prospects Analysis

###6.1 Current Challenges

According to the latest industry data, the U.S. hotel industry is facing ongoing pressure:

- Occupancy rate has declined for 9 consecutive months: The latest data is 57.9%, down 2.8% year-over-year [1]

- RevPAR (Revenue Per Available Room) continues to decline, extending a challenging year [1]

###6.2 Recovery Drivers

-

Expectations of Improved Interest Rate Environment

- The market generally expects the Federal Reserve to continue cutting interest rates

- Lowering financing costs will directly benefit REITs

- Interest-sensitive sectors such as real estate are expected to benefit

-

Business Travel Recovery

- Corporate travel demand is gradually recovering

- MICE (Meetings, Incentives, Conferences, Exhibitions) activities are increasing

-

Strong Leisure Travel

- Consumer travel willingness remains high

- Domestic travel demand is stable

-

APLE’s Strategic Initiatives

- Recently acquired the 260-room Motto by Hilton hotel in Nashville for $98.2 million[0]

- Expanding presence in high-demand geographic locations

- Stable monthly dividend policy demonstrates financial strength

- Recently acquired the 260-room Motto by Hilton hotel in Nashville for

###6.3 Industry Outlook

Despite short-term occupancy rate pressure, in the medium to long term:

- 2026 Expectations: With monetary policy easing and continued recovery of travel demand, hotel REITs are expected to see valuation repair

- M&A Opportunities: Industry consolidation may create acquisition opportunities for high-quality REITs

- Asset Quality: APLE’s portfolio of high-end brand hotels has strong risk resistance capabilities

##7. Risk Factor Analysis

###7.1 Key Risks

| Risk Category | Specific Performance |

|---|---|

Macroeconomic Risk |

Economic recession may weaken business and leisure travel demand |

Interest Rate Risk |

Although interest rate cuts are expected, if interest rates remain high, financing costs will increase |

Industry Competition |

Short-term rental platforms like Airbnb continue to divert demand from traditional hotels |

Operating Costs |

Rising labor costs and energy prices compress profit margins |

Valuation Risk |

DCF model assumptions may be overly optimistic; need to be cautious about valuation gaps of +500% or more |

###7.2 Company-Specific Risks

- Geographic Concentration: The hotel portfolio is distributed in specific U.S. markets, which may be affected by regional economic fluctuations

- Brand Dependence: Relies on the renewal and reputation of franchised brands (such as Hilton, Marriott)

- Capital Expenditure: Continuous capital investment is needed to maintain property competitiveness

##8. Investment Recommendations

###8.1 Comprehensive Assessment:

Based on the following core logic:

-

Extremely Attractive Valuation

- P/B ratio of 0.89x, trading price below net assets

- DCF analysis shows potential upside of over 500%

- The market may be pricing in excessive pessimism

-

Stable Cash Flow and Dividends

- A 7.8% dividend yield is highly competitive in the current low-interest-rate environment

- Monthly dividends show management’s confidence in cash flow

- Positive free cash flow (FCF), stable free cash flow [0]

-

Relative Industry Advantages

- Relatively resilient performance among peers

- Healthy balance sheet (current ratio of1.62)

- Active asset portfolio optimization (Nashville acquisition)

-

Macroeconomic Tailwinds

- Expected interest rate declines will benefit the entire REIT sector

- Long-term growth trend of travel demand remains unchanged

- Short-Term Catalyst: Q4 earnings report (February23,2026) [0], focus on occupancy rate and RevPAR trends

- Technical Aspect: Breaking through the $12.06 resistance level will open up upside space

- Industry Observation: Focus on business travel recovery data and industry consolidation dynamics

###8.2 Target Price and Timeframe

- Target Price: $13.50 (analyst consensus expectation)

- Potential Target Price: $15-16 (based on valuation repair)

- Timeframe:12-18 months

- Total Return Potential:13% stock price increase +7.8% dividend =approximately 20% annualized return

###8.3 Suitable Investor Types

- Income Investors: Seek stable dividend income

- Value Investors: Optimistic about the value repair of undervalued assets

- Long-Term Investors: Willing to wait for industry recovery

- Risk Tolerance: Medium

##9. Conclusion

Apple Hospitality REIT has

Barclays’ Overweight rating is consistent with our analysis conclusions [0]. For investors seeking high returns and value investments, APLE provides a strategic opportunity to position at a low level before the industry recovery.

- Conservative: Build positions in batches, gradually increase positions using the technical support level ($11.84)

- Aggressive: Establish a core position at the current price, add positions after breaking through $12.06

- Holding Period: At least12-18 months to fully benefit from valuation repair and industry recovery

- Quarterly occupancy rate and RevPAR data

- Changes in interest rate policy

- Progress of M&A activities

- Sustainability of dividend payments

[0] Gilin API Data - Including company overview, financial data, technical analysis, price data, analyst ratings, etc.

[1] Yahoo Finance - “US hotel occupancy fell for 9th consecutive month” (https://finance.yahoo.com/news/us-hotel-occupancy-fell-9th-090829864.html)

[2] Yahoo Finance - “Is Apple Hospitality REIT Now a Value Opportunity After Recent Share Price Weakness?” (https://finance.yahoo.com/news/apple-hospitality-reit-now-value-141008086.html)

[3] Yahoo Finance - “Apple Hospitality REIT (APLE) Announces $0.08 Monthly Dividend” (https://www.marketbeat.com/instant-alerts/apple-hospitality-reit-inc-nyseaple-announces-008-monthly-dividend-2025-12-18/)

[4] Business Wire - “Apple Hospitality REIT Acquires the Motto by Hilton Nashville Downtown” (http://www.businesswire.com/news/home/20251221231048/en/Apple-Hospitality-REIT-Acquires-the-Motto-by-Hilton-Nashville-Downtown/)

[5] SEC 10-Q Filing - Apple Hospitality REIT (https://www.sec.gov/Archives/edgar/data/1418121/000119312525262579/aple-20250930.htm)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.