Analysis of the Impact of AI Boom-Driven Memory Chip Price Hikes on Samsung Electronics and Industry Cycles

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

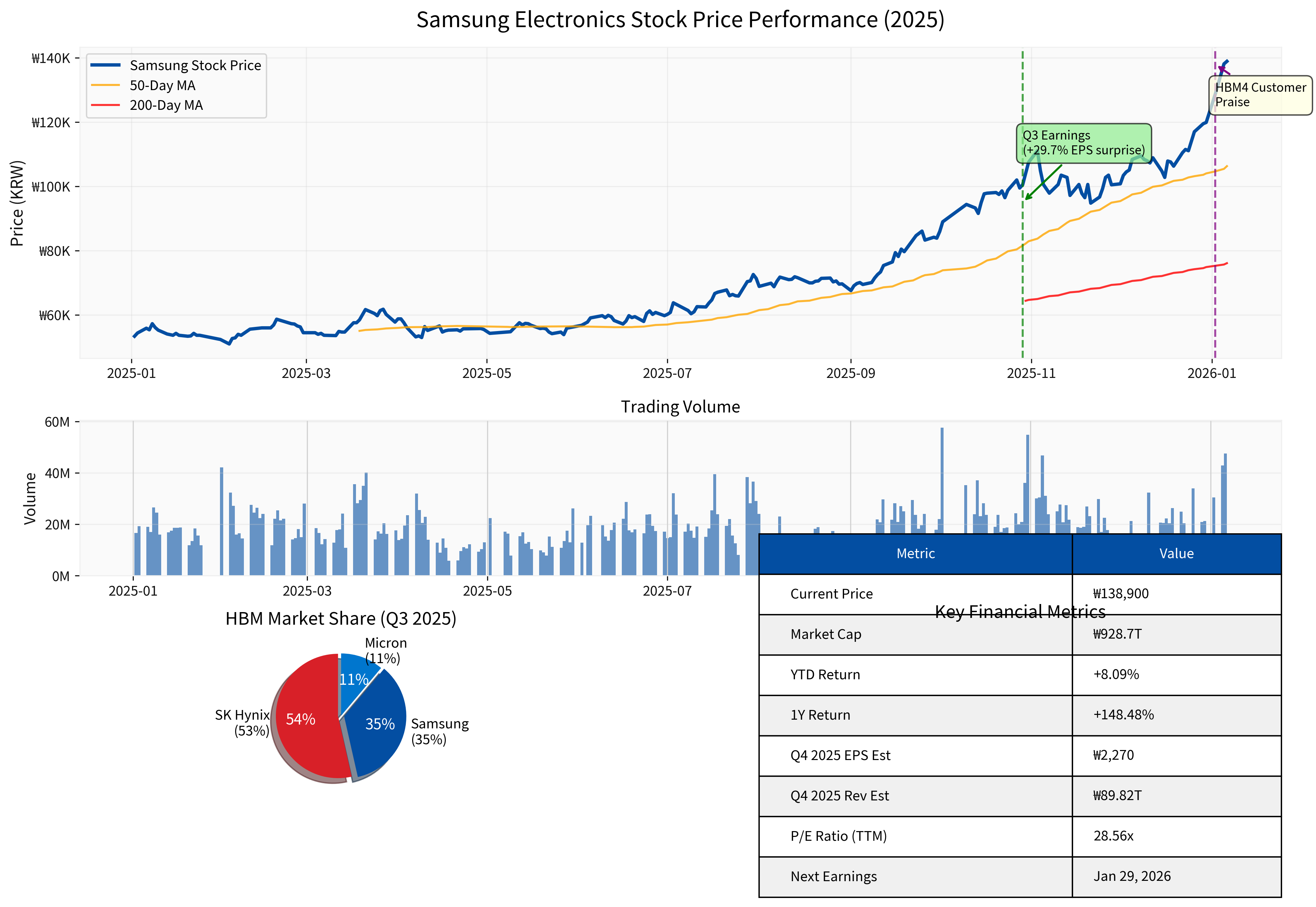

- Samsung Electronics’ current stock price is 138,900 KRW (+0.58%) [0]; market capitalization is approximately 928.7 trillion KRW [0].

- The company will announce its Q4 2025 fiscal year results on January 29, 2026 (previously the market expected an initial release on January 8; subject to official disclosure) [0].

- According to reports, analysts expect Q4 operating profit to increase by approximately 160% year-on-year against the backdrop of AI-driven memory price hikes (subject to official company disclosure) [1].

- Relevant reports indicate that TrendForce predicts the average price of DRAM (including HBM) will rise by 50%-55% in Q4 2025 compared to the previous quarter [2], and some channels also mention obvious upward price pressure.

Figure: Samsung’s 2025 stock price trend, trading volume, key indicators, and HBM market structure (Q3 2025) [0]

- Reports citing Micron’s financial report and industry analysis state that AI servers have strong demand for memory, and some investment banks/institutions mention the risk of a ‘worst-ever shortage’ in 2026 [1].

- HBM Demand and Process Characteristics:

- AI servers have high combined HBM and DRAM configuration per unit (example in reports) [1].

- HBM manufacturing consumes more wafers (reports mention the process and yield background where ‘producing 1GB of HBM sacrifices approximately 3GB of DDR’) [2].

- Pre-order Lock-in and Tight Orders:

- Reports state that Micron publicly said HBM inventory for calendar years 2025 and 2026 is sold out; Samsung and SK Hynix have orders exceeding production capacity [2].

- Other reports indicate that HBM orders for 2026 are fully booked, and 2027 orders are filling up quickly [1].

- DRAM/HBM Prices: TrendForce predicts the average price in Q4 2025 will rise by approximately 50%-55% compared to Q3 [2].

- Consumer Electronics and End Markets:

- Reports say some channels expect memory prices to rise by another 40% in H1 2026, putting pressure on end devices like smartphones; some brands may balance market share and profits [1].

- Institutions like Counterpoint believe that brands with limited resources will face greater cost pressure [1].

- The traditional ‘inventory-price’ cycle is strengthened by high-intensity, long-cycle AI data center demand, significantly extending the time window of tight supply-demand balance [1][2].

- ‘Zero-sum game’ capacity allocation: More wafers are used for high-value HBM, suppressing the growth rate of traditional DDR supply and forming a structural constraint of ‘AI consuming capacity’ [2].

- Q4 2025 Market Consensus Expectations (To Be Verified):

- Revenue: 89.82 trillion KRW; EPS: approximately 2,270 KRW [0].

- Reports say analysts expect operating profit to increase by approximately 160% year-on-year [1].

- Latest Quarter (Q3 2025):

- EPS: 1,826.78 KRW (exceeded expectations by +29.7%); Revenue: 86.06 trillion KRW [0].

- Financial Health:

- P/E: ~28.56x, ROE: ~8.39%, Net Profit Margin: ~10.38%, Current Ratio: 2.51 [0].

- TTM Period Returns: 6 months +119.43%, 1 year +148.48% [0].

- 2025 Full Year (Jan 2, 2025 to Jan 6, 2026) cumulative increase of approximately +163.57% (based on interval price statistics) [0].

- (Note: Daily series for the 12 consecutive months before Jan 6, 2025 not obtained; thus no precise ‘past 12 natural months’ price change statement.)

- HBM Market Share (Q3 2025): SK Hynix ~53%, Samsung ~35%, Micron ~11% [3].

- HBM4 and Technology Progress:

- Reports say Samsung is delivering HBM4 samples to customers and plans to mass-produce in 2026 [3].

- Co-CEO said in an internal speech that customers gave positive feedback on HBM4’s ‘differentiated competitiveness’, and the market interpreted this as ‘Samsung is back’ [4].

- Reports cite industry information that Samsung’s HBM4 performed top in speed in Broadcom’s SiP tests, and its thermal management also received good reviews [5].

- Supply Cooperation with NVIDIA:

- Reports indicate that the two parties are ‘closely negotiating’ HBM4 supply, and customer certification and cooperation progress are continuing [3][4].

- The ‘3-4 year cycle’ previously dominated by consumer electronics, PCs, and mobile phones has been significantly extended and strengthened by long-cycle AI data center demand; capacity rigidity cannot be quickly matched in the short term [1][2].

- The three major manufacturers (Samsung, SK Hynix, Micron) are tilting capital expenditure toward HBM and advanced processes; the transformation and exit of old production lines have slowed the growth rate of traditional DRAM supply [1][2].

- Reports say Micron, Samsung, and SK Hynix are closing or cutting old capacity lines to tilt toward HBM, which has limited effect on alleviating general memory shortages [1].

- Large cloud vendors and NVIDIA, etc., lock in capacity for the next few years through long-term agreements, moving the spot market toward ‘futures-like’, pushing up lock-in premiums and bargaining difficulty [2].

- Smartphone/PC/automobile manufacturers need to accept higher costs or reduce configurations to offset; low-margin brands are under greater pressure [1][2].

- HBM Market Share: Samsung ~35% in Q3 2025, lagging SK Hynix’s 53% [3].

- Main Gap: SK Hynix is relatively leading in mass production and customer certification rhythm; Samsung is catching up in HBM4 and next-generation products [3][4].

- Vertical Integration Capability: IDM model (design-manufacturing-packaging testing) + foundry collaboration, with good conditions for process evolution and yield improvement [3][5].

- Customer Base and Ecosystem:

- Reports say Samsung signed a relevant $16.5 billion cooperation with Tesla in 2025; HBM4 cooperation with NVIDIA continues to advance [3][4].

- Technology and Products:

- Reports indicate that Samsung’s HBM4 has outstanding speed and thermal performance in third-party tests [5].

- Continuing to advance HBM4 mass production planning for 2026 [3][4].

- Competitor Rhythm: SK Hynix still has first-mover advantages in customer certification and mass production rhythm; Micron is also accelerating and has obtained NVIDIA’s partial platform certification [1].

- Yield and Capacity Ramp-Up: HBM4 has more stacking layers and higher complexity; yield is still in the ramp-up stage, and there are uncertainties in expansion costs and time cycles [2].

- Market Expectations and Volatility: Current valuations already reflect high growth expectations; if customer adoption rhythm or capacity release is lower than expected, stock price volatility may increase [0].

- Neutral Scenario (High Probability):

- HBM4 mass-produced as scheduled in 2026; customer certification progresses smoothly; HBM share gradually moves from ~35% to 40%+.

- Memory prices remain high or continue to rise in 2026; profits and cash flow improve.

- Optimistic Scenario:

- HBM4 performance and yield exceed expectations; obtain larger share orders from NVIDIA/Google/hyper-scale cloud vendors, etc.

- Memory prices continue to rise beyond expectations; profit elasticity is further released.

- Downside Risks:

- AI capital expenditure rhythm slows or capacity ramp-up is lower than expected; prices and orders are under pressure.

- Geopolitical/competition/exchange rate and other factors drag down profit margins and order fulfillment.

- AI-driven high-value demand is reshaping the memory cycle: longer cycle, higher price volatility, clearer tight supply-demand balance [1][2].

- Price center shifts upward in 2025-2026; consumer electronics and end devices rebalance between cost and pricing [1][2].

- Sectors and Market: Technology sector fell slightly (-0.31%) on the day; industrials and finance led gains [0]; valuation differentiation of tech stocks intensified.

- Advantages: IDM comprehensive strength, HBM4 technology progress, customer base, and capital expenditure tilt [3][4][5].

- Risks: Competitive rhythm, yield and capacity ramp-up, valuation and expectation management [2][5].

- Observation Points:

- Q4 results on Jan 29, 2026 and 2026 guidance (capital expenditure, HBM4 roadmap).

- Order and certification progress from NVIDIA and hyper-scale cloud vendors.

- Traditional DRAM supply-demand and price trends.

- Short-term: Performance and guidance are key verifications; if they meet or exceed expectations, they will support the market’s pricing of ‘AI memory leader’s comeback’.

- Mid-term: HBM4 mass production and share increase are core indicators; the trinity of technology/yield/customer determines whether it can move from ‘second’ to ‘on par with first’.

- Risk Control: Pay attention to valuation and expectation gaps, AI capital expenditure rhythm, geopolitical and competitive trends.

[0] Jinling API Data (real-time quotes, company overview, price history, market capitalization data, etc.)

[1] Micron Financial Report Warns: Worst-Ever Shortage May Erupt in 2026, AI Boosts Memory Chip Demand. Yahoo Finance HK. https://hk.finance.yahoo.com/news/美光財報爆表示警-2026年恐爆發史上最嚴重短缺-ai推升記憶體晶片需求-052002064.html

[2] Graphics Cards Soared to 28,000 Overnight! AI Drains Global Chip Capacity, 2026 Global Consumption… NetEase. https://www.163.com/dy/article/KIBB18AQ0511ABV6.html

[3] Samsung Electronics Says Customers Praise Competitiveness of HBM4 Chips. Sina Finance. https://finance.sina.com.cn/stock/usstock/c/2026-01-02/doc-inhewkev3881646.shtml

[4] Samsung Electronics says customers praised… Yahoo Finance. https://finance.yahoo.com/news/samsung-electronics-highlights-progress-hbm4-000428574.html

[5] HBM4, Samsung’s Counterattack? Sohu. https://m.sohu.com/a/971781618_121948415

[6] These 2 South Korean stocks will ‘win AI supercycle’: analyst. Yahoo Finance. https://finance.yahoo.com/news/2-south-korean-stocks-win-153759554.html

[7] Micron Technology: The Stakes for Wednesday’s Earnings… Yahoo Finance. https://finance.yahoo.com/news/micron-technology-stakes-wednesday-earnings-140700703.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.