AMD's AI Competition Strategy and Its Impact on Industry Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Analysis of AMD’s Competitive Strategy in the AI Wave and Its Impact on Industry Valuation

- AMD’s AI Strategic Layout: From Follower to Strong Competitor

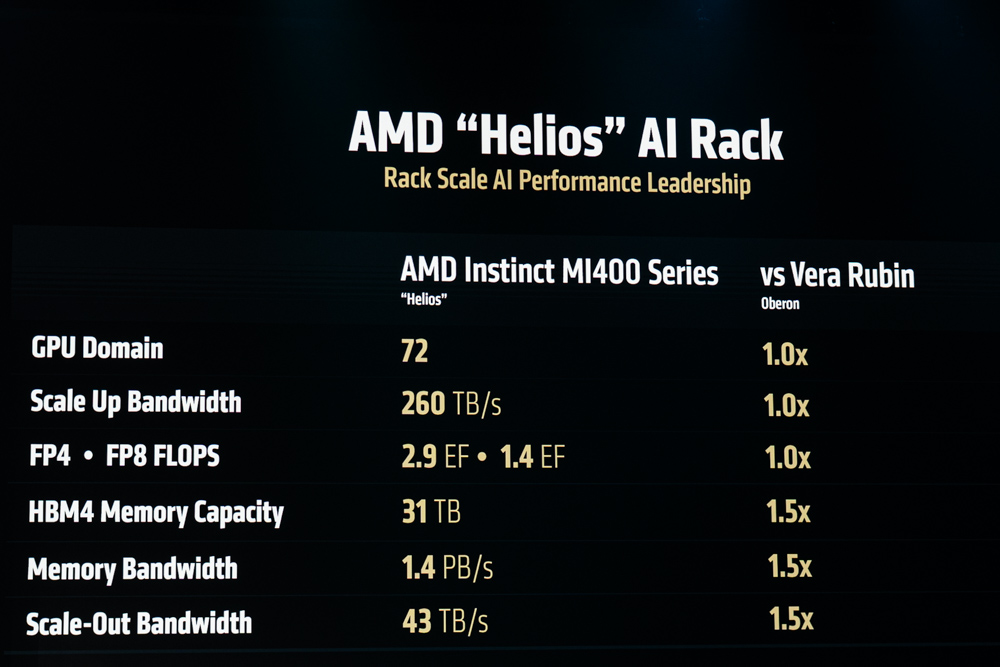

1.1 Technical Advantages of the Helios Platform and Next-Generation Chips

AMD’s Helios platform, showcased at the 2026 CES exhibition, represents a major breakthrough in the field of AI infrastructure. This rack-level solution is based on the MI400 series GPUs and aims to provide high-performance hardware support for large-scale AI training and inference [1]. AMD’s product roadmap indicates that the MI450 GPU and Helios system are expected to be officially deployed in the second half of 2026, with early partners including OpenAI (planning to deploy 6GW of computing capacity) and Oracle (committing to deploy 50,000 MI450 GPUs) [1].

Differentiated Positioning vs. NVIDIA:

-

Cost Efficiency Advantage: AMD is attempting to break NVIDIA’s monopoly in the AI accelerator market through an open architecture and more competitive pricing strategy. Analysts point out that the ‘cost and efficiency’ advantages of AMD’s AI chips in large-scale deployments are attracting cloud service providers looking for alternatives to NVIDIA [1].

-

Software Ecosystem Challenge: NVIDIA’s CUDA ecosystem forms a strong moat, which is the biggest challenge AMD faces. Forbes analysis notes that ‘software has long been a drag on AMD’s valuation’, and NVIDIA’s CUDA solidifies its dominance through high switching costs and customer dependence [1].

-

Performance Comparison: According to public reports, the Helios platform shows certain advantages over competitors in terms of GPU domain, bandwidth, FP8 computing power, memory capacity, and expansion bandwidth, but specific performance benchmark data has not been disclosed, and related charts only show the specifications claimed by the manufacturer [1].

1.2 End-to-End AI Strategy: From Cloud to Edge

AMD’s new generation of Ryzen AI processors announced at CES 2026 (including the 300 and 400 series mobile processors, as well as the Ryzen 7 9850X3D desktop processor) embody its ‘AI for everyone’ vision [2,3]. These processors integrate the XDNA 2 architecture, with AI computing power of up to 50 TOPS, aiming to extend AI capabilities from data centers to personal computers and edge devices [3].

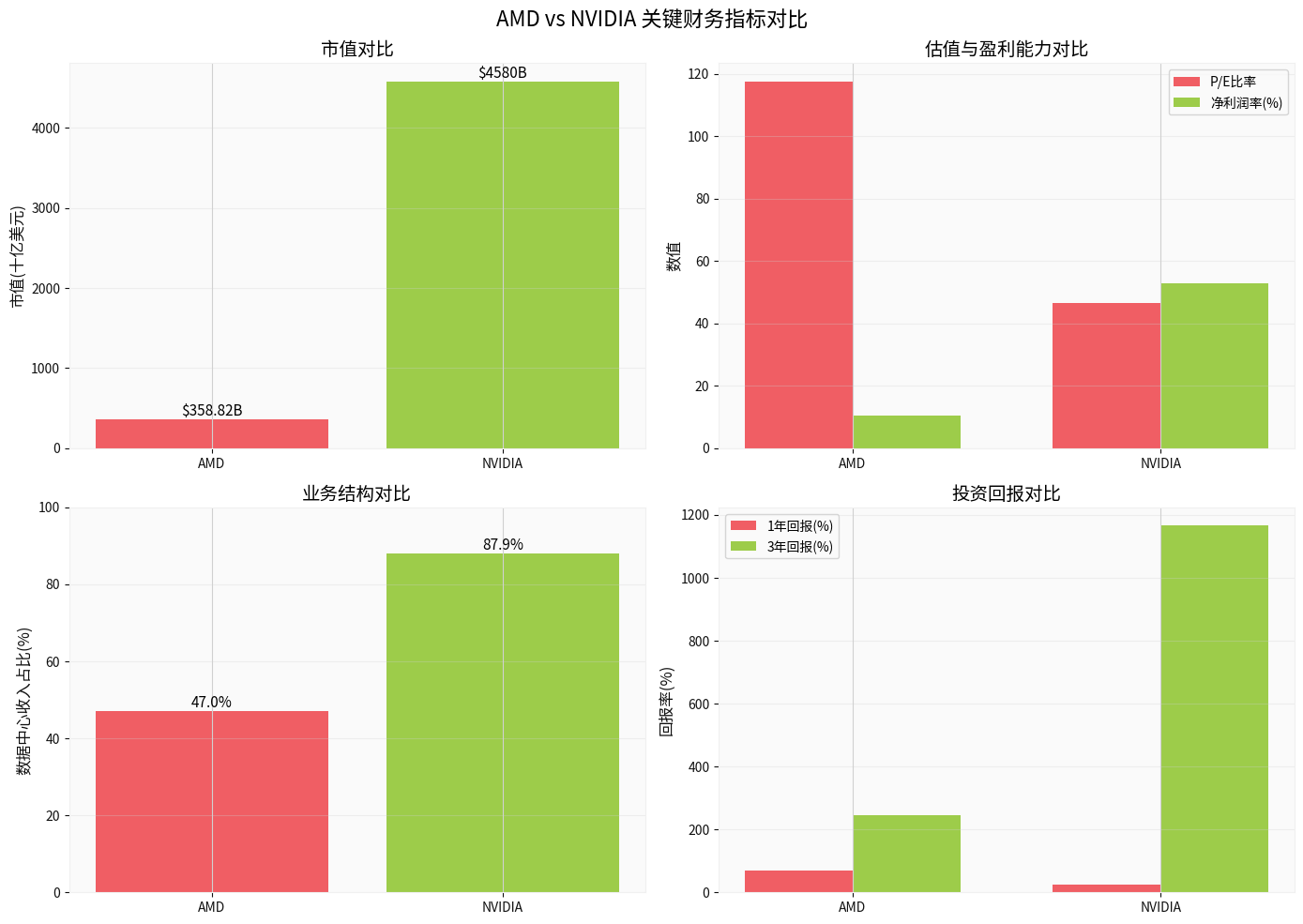

Business Structure Comparison (Based on Latest Quarterly Data) [0]:

| Indicator | AMD | NVIDIA |

|---|---|---|

| Data Center Revenue Share | 47.0% | 87.9% |

| Latest Quarterly Data Center Revenue | $4.34B | $41.10B |

| AI-Related Products as % of Total Revenue | ~21% | Core Business |

| Net Profit Margin | 10.32% | 53.01% |

AMD’s diversified business structure (47% data center, 43.8% client and gaming, 9.3% embedded) [0] is both an advantage and a challenge. The advantage is that business diversification reduces reliance on a single market, but the challenge is that its AI business scale is far smaller than NVIDIA’s, which has fully shifted its focus to AI data centers.

Chart 1: Comprehensive comparison between AMD and NVIDIA in terms of market capitalization, valuation, profitability, and business structure. Data shows that NVIDIA has significant advantages in market capitalization ($4.58T vs $359B), profitability (net profit margin 53% vs 10%), and data center business concentration (87.9% vs 47%) [0].

- AMD vs NVIDIA: In-depth Analysis of Competitive Landscape

2.1 Market Position and Valuation Comparison

Market Capitalization and Valuation (January 2026 Data) [0]:

- NVIDIA: Market cap $4.58 trillion, P/E ratio 46.68, 3-year return +1,165.95%

- AMD: Market cap $358.8 billion, P/E ratio 117.60, 3-year return +245.65%

AMD’s high P/E ratio (117.60 vs NVIDIA’s 46.68) reflects the market’s high expectations for its AI business growth, but it also brings valuation risks. Although NVIDIA has a higher market cap, its valuation is relatively more reasonable based on its realized profitability (net profit margin of 53.01%) [0].

Income Scale Gap:

NVIDIA’s latest quarterly data center revenue reached $57.01B, while AMD’s total revenue in the same period was $9.25B, with $4.34B from the data center segment [0]. This shows that NVIDIA’s leading position in the AI chip market remains solid, but its growth also faces challenges from the base effect.

2.2 Technology Roadmap and Ecosystem Competition

NVIDIA’s Advantages:

- Strong network effects formed by the CUDA ecosystem

- Continuous iteration of the Blackwell platform, with data center revenue expected to reach $190 billion in FY2026 (65% YoY growth) [1]

- Absolute dominance in the high-end AI training market

AMD’s Opportunities:

- Customers seeking ‘second suppliers’ to reduce reliance on NVIDIA

- Appeal of open standards (such as ROCm) to some developers

- Growth potential in the AI inference and edge computing markets

Key Competition Nodes:

2026 will be a critical year for AMD. Customers like Oracle are building AI superclusters based on AMD’s Helios platform, deploying 50,000 MI450 GPUs [1]. If these deployments can successfully prove the feasibility and cost advantages of AMD’s solutions, it may accelerate the customer diversification process.

- Lisa Su’s Predictions: Optimistic Expectations and Their Impact on Industry Valuation

3.1 AI User Scale Prediction: From 1 Billion to 5 Billion

Lisa Su stated in her keynote speech at CES 2026 that since the launch of ChatGPT, AI users have grown from 1 million to more than 1 billion active users, and predicted that this number will grow to 5 billion in the next 5 years [2]. This prediction implies huge market opportunities:

Current vs Predicted Comparison:

- Current active AI users: ~1 billion (2025)

- 5-year prediction:5 billion (2030)

- Growth multiple:5x

- CAGR: ~38%

This growth expectation is consistent with Bank of America’s prediction. BofA predicts that the total addressable market (TAM) for AI data center systems will exceed $1.2 trillion by 2030, with a CAGR of 38% [4]. If this prediction comes true, it will mean an unprecedented growth opportunity for the semiconductor industry.

Chart2: The left side shows AMD’s AI product roadmap (MI300→MI400→MI500 series and Helios platform), and the right side shows the global AI user scale growth prediction. Lisa Su predicts that AI users will grow from the current 1 billion to 5 billion in 5 years, and this expectation supports the long-term growth narrative of the semiconductor industry [2,4].

3.2 10 YottaFLOPS Computing Vision: Scale and Significance

Important Note: The statement about ‘10 YottaFLOPS’ computing power comes from visionary statements in media reports and promotional materials, not from strictly verified industry consensus or achieved performance goals. Relevant figures may relate to self-claims by different manufacturers or theoretical peaks in specific scenarios, and there is still significant uncertainty in actual implementation and commercial deployment.

Background Explanation: YottaFLOPS (10^24 FLOPS) is an order of magnitude far exceeding the computing power of current TOP500 high-performance computing supercomputer systems (usually at the ExaFLOPS level, i.e.,10^18 FLOPS). No system close to this magnitude has yet appeared in public supercomputer rankings; any statement claiming to be close to this computing power should be regarded as a theoretical vision or unverified prediction and treated with caution.

If this vision becomes a reality in the next 5-10 years, it means:

- A huge leap in the total global computing power from the current ExaFLOPS level to the YottaFLOPS level (theoretical magnitude leap)

- A surge in demand for large-scale expansion and energy efficiency optimization of computing infrastructure

- New challenges for chip design and manufacturing, interconnection, network, and power supply infrastructure

Impact Logic on Industry Valuation:

- Market Expansion Logic: If AI users grow from 1 billion to 5 billion, the demand for data center computing power will rise accordingly, which will enhance long-term growth expectations for manufacturers like AMD/NVIDIA

- Infrastructure Investment Logic: To achieve such a theoretical computing power target, cloud service providers and enterprise customers will significantly increase purchases of AI accelerators, networks, and power supply systems, which is beneficial to the order visibility of relevant suppliers

- Hardware Iteration Logic: To achieve higher computing power and better energy efficiency, process evolution, architecture innovation, and packaging upgrades will accelerate, thereby raising the value of semiconductor equipment, materials, and design services

3.3 Valuation Risk and Rationality Judgment

Current Valuation Status (Based on Tool Data and Public Reports):

- AMD P/E:117.60 (market incorporates high growth expectations) [0]

- NVIDIA P/E:46.68 (strong profitability but high base) [0]

- Semiconductor sector overall: Industry spending is expected to reach $1 trillion in 2026 [4], and valuation levels are relatively high

Two Perspectives on Valuation Logic:

-

Optimistic Perspective (Supports Current Valuation):

- 5x growth in AI users brings structural demand for computing power

- AMD’s room for share growth in the AI chip market (currently relatively small, some analysts believe it can reach more than 10%) [1]

- Large-scale deployment of the Helios platform may start to deliver results in the second half of 2026

-

Cautious Perspective (Valuation Risks):

- Statements like Lisa Su’s ‘10 YottaFLOPS’ are visionary predictions with significant uncertainty

- If actual progress is slower than expected, the market may revise down growth assumptions

- AMD’s high P/E (117.60) already incorporates optimistic scenarios; if execution falls short of expectations, there is pressure for valuation correction

- Although NVIDIA has strong profitability, the base effect may lead to slower growth, and its P/E of 46.68 is also vulnerable when growth peaks

Key Observation Points for Valuation Rationality:

- Can AMD achieve analysts’ expectations of ‘AI chip share reaching more than 10%’ in 2026 [1]

- Whether the large-scale deployment of the Helios platform progresses smoothly and generates meaningful revenue contributions

- Sustainability of AI user growth: from 1 billion to 5 billion depends on the synergy of application implementation, infrastructure improvement, and cost reduction

- Whether visions like ‘10 YottaFLOPS’ can gain industry consensus and technical path verification, and be transformed into actual purchases and deployments

- Investment Recommendations and Risk Warnings

4.1 AMD’s Investment Logic

Positive Factors:

- Large Growth Space: AI business accounts for only about 21%, with huge room for improvement [1]

- Customer Diversification Trend: Large cloud service providers seek ‘second suppliers’ to reduce supply chain risks

- Product Execution: Clear roadmap for MI400/500 series and Helios platform [1]

- Relatively Reasonable Valuation: Compared with NVIDIA, AMD has a smaller market cap base and higher growth elasticity

Risk Factors:

- Execution Risk: Whether high-performance AI chips can be delivered as planned and run stably still needs to be verified

- Software Ecosystem: Uncertainty about whether the ROCm ecosystem can challenge CUDA’s dominance

- Competitive Pressure: Continuous innovation by NVIDIA and the entry of other manufacturers (such as Intel) intensify competition

- Valuation Volatility: High P/E makes the requirements for growth speed and sustainability extremely high

4.2 Industry-Level Impact

Lisa Su’s predictions provide support for the long-term narrative of the semiconductor industry. If AI users do reach 5 billion in 5 years, and computing power approaches or partially achieves actual deployment close to the YottaFLOPS level (Note: Currently, publicly available systems and rankings in the industry are far from reaching this magnitude; relevant statements are visionary predictions), it will bring:

- Market Scale Expansion: BofA predicts that AI data center TAM will exceed $1.2 trillion by 2030 [4]

- Comprehensive Benefits for the Industry Chain: Demand growth from chip design, manufacturing, packaging to equipment and materials

- Valuation Reshaping: The semiconductor sector may evolve from a cyclical industry to a growth industry valuation system

4.3 Key Observation Nodes

2026 Key Milestones:

- Q1-Q2: Ryzen AI 300/400 series processors launch to verify edge AI demand

- Q3-Q4: Large-scale deployment of MI450 and Helios platform starts to test data center competitiveness

- Full Year: Whether AI revenue share can significantly increase from 21%

Success Indicators:

- Smooth deployment of 50,000 MI450 GPUs by Oracle [1]

- Steady progress of OpenAI’s 6GW computing capacity project [1]

- Market share in AI accelerator market reaches double digits (some analysts’ expectations) [1]

- Improvement in free cash flow to support R&D investment

- Conclusion: An Era of Coexisting Opportunities and Challenges

AMD is transforming from a follower to a strong competitor in the AI wave with its Helios platform and MI400/500 series chips. Lisa Su’s optimistic expectations for AI user scale (growing from 1 billion to 5 billion in 5 years) and computing power vision (mentioning 10 YottaFLOPS, but it is an unverified prediction) provide a strong long-term growth narrative for the semiconductor industry.

Core Impact on Valuation:

- Short Term: AMD’s high P/E (117.60) needs strong execution of AI business in 2026 to support it, otherwise there is a risk of valuation correction

- Medium Term: If AMD can achieve more than 10% AI chip market share [1], its valuation has further upside potential

- Long Term: The growth of AI users to 5 billion and the large-scale expansion of computing infrastructure will reshape the valuation system of the semiconductor industry

Key Points for Investors:

- Actual deployment of MI450 and Helios platform in 2026 (from key customers like Oracle and OpenAI)

- Changes in AMD’s market share in the AI accelerator market (current base is low, with both room for improvement and uncertainty)

- Dynamic evolution of CUDA vs ROCm ecosystem competition

- Impact of macro environment on AI investment rhythm

Ultimately, whether AMD can truly narrow the gap with NVIDIA depends not only on hardware performance but also on software ecosystem construction, customer relationship maintenance, and supply chain execution. In the wave of AI changing the world, AMD has proven itself to be a participant that cannot be ignored, but to become a leader, it still needs to deliver a convincing answer in 2026.

References

[0] Jinling API Data — AMD, NVIDIA real-time quotes, company overview, financial indicators, technical analysis and market index data (including market capitalization, P/E, revenue structure, net profit margin, analyst consensus and product roadmap information)

[1] Yahoo Finance / Forbes / TechCrunch — AMD Helios platform launch and customer deployment progress (Oracle 50,000 MI450 GPUs, OpenAI 6GW computing capacity), AI chip market forecast and competitive situation analysis; The statement about ‘10 YottaFLOPS’ comes from visionary predictions in media reports and promotional materials, not strictly verified industry consensus or achieved performance goals

[2] TechCrunch — Lisa Su’s CES 2026 keynote speech and ‘AI for everyone’ vision, prediction of AI user scale growing from current ~1 billion to 5 billion in 5 years

[3] CNET / TechCrunch — AMD launched Ryzen AI 300/400 series processors and Ryzen 7 9850X3D at CES 2026, XDNA 2 architecture provides up to 50 TOPS AI computing power

[4] Yahoo Finance — BofA predicts that the total addressable market for AI data center systems will exceed $1.2 trillion by 2030, with a CAGR of ~38%; Semiconductor industry spending is expected to reach $1 trillion in 2026

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.