In-Depth Analysis of Barclays' Overweight Rating on Ryman Hospitality Properties (RHP)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and analysis, here is an in-depth analysis of Barclays’ overweight rating on Ryman Hospitality Properties (RHP):

Although Barclays’ specific rating report was not directly obtained, the following key factors can be inferred based on RHP’s business model, financial performance, and industry trends:

- Return on Equity (ROE) of 34.37%, ranking top in the REIT industry [0]

- Net profit margin of 9.26%and operating profit margin of 18.68%, significantly outperforming most hotel REITs [0]

- Stable growth in Adjusted Funds from Operations (AFFO): Q3 2025 EPS was $1.63, exceeding expectations by 2.52% [0]

- Median analyst target price of $108, representing a 15% upside from the current price of $93.89 [0]

- P/E ratio of 25.06x, which is reasonable considering the ROE level [0]

- DCF intrinsic value analysisshows that even under conservative assumptions, intrinsic value is significantly higher than the current market price [2]

Colin Reed, the company’s chairman, bought 8,993 shares at $92.16 per share in November 2025, with a total value of approximately $829,000 [1]. Large-scale insider buying is usually regarded as a positive signal that management is optimistic about the company’s prospects.

RHP’s case shows that REITs

| Business Model | Features | Investment Value |

|---|---|---|

Convention Center Resort (e.g., RHP) |

Capital-intensive, high entry barrier, high group business share | Strong pricing power, large RevPAR growth potential |

Full-Service Hotel |

Comprehensive services, reliant on business and leisure travel | High cyclicality but strong recovery elasticity |

Select-Service Hotel (e.g., APLE) |

Lower cost, high operational efficiency, strong anti-cyclical ability | Stable returns but limited growth |

RHP’s dual model of “convention center + entertainment” gives it

- Focus on companies with high group business share: RHP derives nearly 50% of its revenue from group business, making it the biggest beneficiary of this trend

- Value convention centers and event venues: Hotels with large convention facilities can achieve excess returns when group demand is strong

- Location selection is crucial: RevPAR in convention hotspots like Las Vegas grew by 44.6% in 2025 [1], showing the importance of geographic location

RHP’s

- Prioritize hotel REITs with ROE exceeding 20% and consistent dividends

- Focus on companies with debt risk ratings of “moderate” or lower

- Value the stability of Adjusted Funds from Operations (AFFO) growth

RHP currently has a

- Seek “undervalued high-quality assets”: RHP has fallen by 10.44% in one year [0], but its fundamentals remain strong

- Pay attention to insider trading signals: Management buying is often a leading indicator of value discovery

- Balance short-term performance fluctuations and long-term growth potential: Seasonal fluctuations in group business may affect short-term performance, but the long-term trend is upward

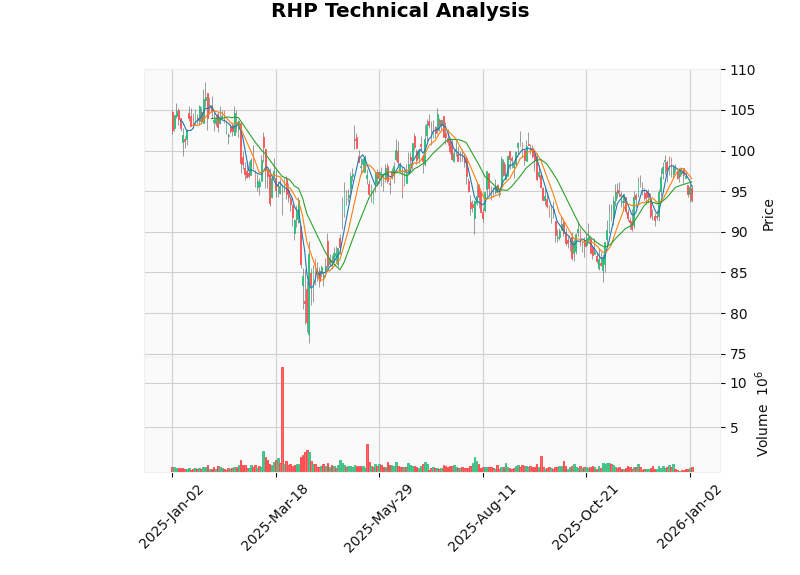

Technical analysis shows that RHP is currently in a

Although Barclays gave an overweight rating, investors still need to pay attention to the following risks:

- Economic cycle risk: Group business travel is highly correlated with the macroeconomy; economic recession may lead to enterprises cutting travel budgets

- Increased competition risk: New high-end hotels may divert part of the convention business

- Interest rate risk: As a high-dividend REIT, RHP is relatively sensitive to interest rate changes

- Overvaluation risk: Despite strong fundamentals, the current stock price has already reflected some optimistic expectations

The core logic behind Barclays’ overweight rating on RHP is:

The core implication of this rating for hotel REIT investment is:

Chart shows RHP is currently in a sideways consolidation phase, with support at $92.90 and resistance at $96.13 [2]

[0] Jinling API Data - RHP Company Profile, Financial Data, Analyst Ratings

[1] Web Search Data - RHP Related News Reports, Industry Trend Analysis

[2] Jinling API Data - RHP Technical Analysis, DCF Valuation Analysis

[3] MMCGI Investment Report - US Hospitality Market Outlook 2025 (https://www.mmcginvest.com/post/us-hospitality-market-outlook-2025-performance-investment-trends-and-opportunities)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.