Analysis of the Impact of Institutional Investors' Large Transaction Disclosures on Biopharmaceutical Stock Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Avadel Pharmaceuticals (AVDL), a biopharmaceutical company focused on developing innovative therapies for sleep disorders, faced transaction disclosures by major institutional investors in December 2025. Morgan Stanley Capital Services and Morgan Stanley Europe SE disclosed their AVDL position trading activities in accordance with SEC requirements [1]. This case provides an excellent observation window for us to analyze the impact of institutional disclosures on biopharmaceutical stock valuations.

| Indicator | Current Value |

|---|---|

| Current Stock Price | $21.50 |

| Market Capitalization | $2.08 billion |

| Institutional Ownership Ratio | 87.49% |

| 52-Week Range | $6.38 - $23.57 |

| 1-Year Return | +101.12% |

| 3-Year Return | +213.87% |

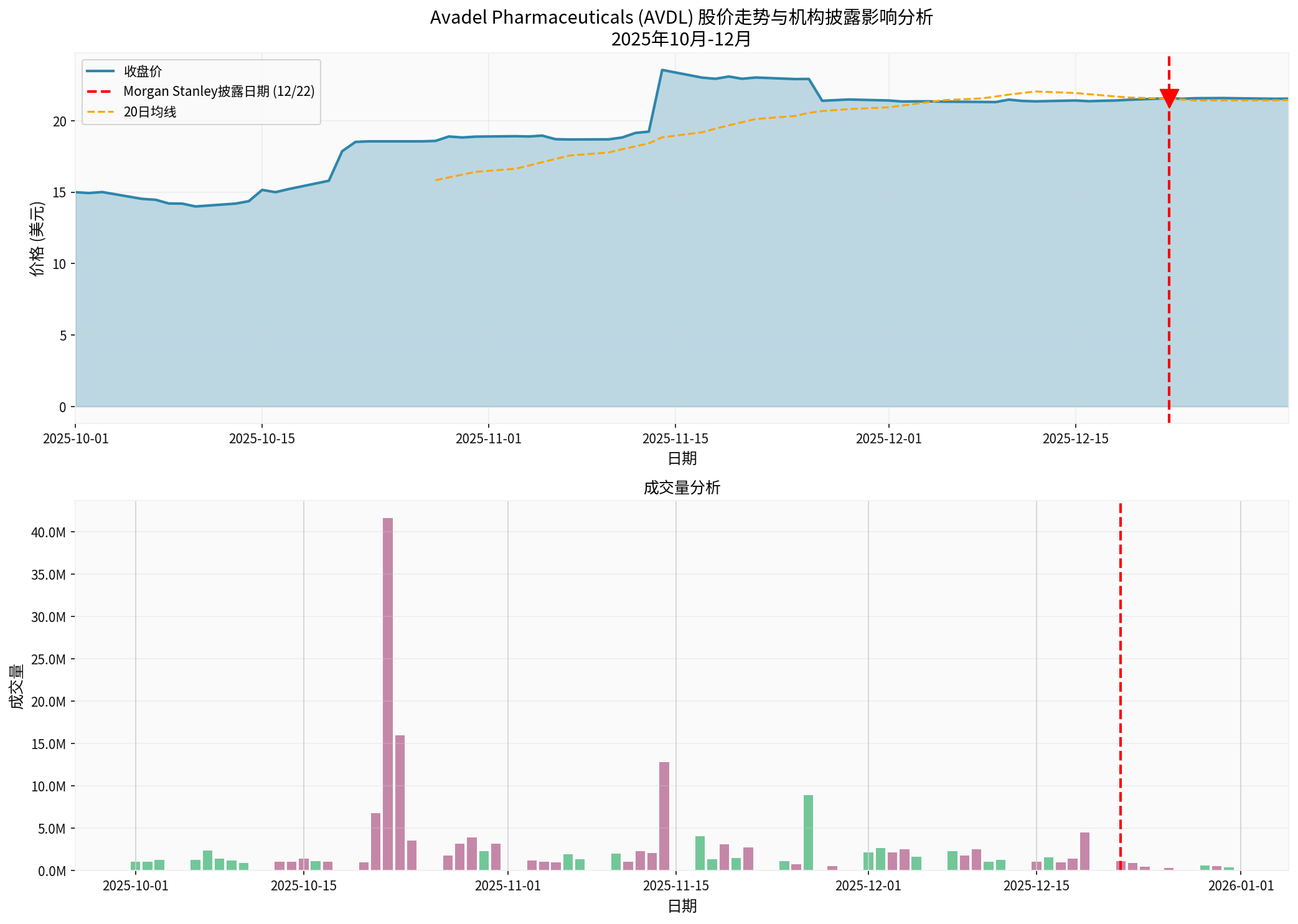

The chart shows AVDL’s stock price trend from October to December 2025, with the red dashed line marking the Morgan Stanley disclosure date (December 22)

- Advantage:Provides stable liquidity support and reduces retail trading costs

- Risk:If institutions reduce positions simultaneously, it may trigger a liquidity crisis

- Institutions may have completed position adjustments

- Reduction in remaining tradable shares leads to wider bid-ask spreads

- Subsequent trading costs may increase

- Early evaluation of clinical trial data

- Internal predictions of regulatory approval progress

- Tracking and analysis of competitor dynamics

- Disclosed transactions may have occurred 1-2 months ago

- The market has partially digested this information

- Current prices may already reflect changes in institutional positions

- UBS downgraded AVDL to Neutral on October 28 [0]

- HC Wainwright & Co. and Leerink Partners simultaneously downgraded their ratings on October 23 [0]

- The median analyst target price of $20.00 is already below the current stock price of $21.50 [0]

| Valuation Indicator | AVDL Value | Biopharmaceutical Industry Characteristics |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | -711.46x | Common for unprofitable companies, relying on DCF or PS valuation |

| Price-to-Book Ratio (P/B) | 22.93x | R&D asset value is difficult to evaluate, premium reflects future potential |

| Enterprise Value/Operating Cash Flow | 370.48x | Typical high-growth biopharmaceutical characteristic |

- High institutional ownership usually supports higher valuation multiples (professional investor recognition)

- But excessive concentration (>85%) may increase stock price volatility and downside risk

- The AVDL case shows that after institutional disclosure, the market entered an observation period, and the stock price consolidated sideways [0]

| Indicator | Before Disclosure (Oct 1 - Dec 19) | After Disclosure (Dec 22 - Dec 31) | Change |

|---|---|---|---|

| Trading Days | 57 days | 7 days | - |

| Price Performance | +43.13% | -0.14% | Sharp Slowdown |

| Average Trading Volume | 3.14M | 0.61M | -80.59% |

| Daily Volatility | 3.79% | 0.15% | -96.0% |

-

Strong Rise Before Disclosure:The 43.13% increase and average daily trading volume of 3.14 million shares [0] may reflect the institutional position building process and high market attention to the stock.

-

Momentum Fade After Disclosure:The stock price entered a sideways trend, trading volume shrank by more than 80%, and volatility dropped to near zero [0], indicating:

- Institutions may have completed major position adjustments

- The market entered a wait-and-see state, waiting for new catalysts

- Significant decline in liquidity may increase future trading costs

-

Valuation and Fundamental Divergence:

- The stock price rose by 101% from the beginning of the year, but EPS remains negative (-0.02) [0]

- The analyst target price ($20) is lower than the current price ($21.50) [0], indicating that some institutions believe the valuation is already high

- Recently, multiple institutions downgraded their ratings [0], which may reflect a cautious attitude towards short-term upside potential

The value of biopharmaceutical companies is highly dependent on clinical trial results and regulatory approvals:

- Positive results can attract institutional position increases and push up valuations

- Negative results may trigger concentrated institutional position reductions and cause liquidity crises

- AVDL focuses on sleep disorder treatment, and the launch progress of its product FT218 will be a key catalyst [1]

In addition to 13F, institutions may also influence the market through the following methods:

- Form 4:Insider Trading Disclosure (especially important for biopharmaceutical companies)

- 13D/G:Activist investors disclose holdings exceeding 5% (may trigger corporate governance changes)

- Schedule 13E3:Privatization or other major transactions (rare but impactful)

- Diversify Disclosure Timing:Avoid concentrated position adjustments at the end of the same quarter to reduce market impact

- Proactive Communication:Communicate appropriately with the market during sensitive position adjustments to manage expectations

- Long-Term Perspective:Focus on company fundamentals rather than short-term disclosure pressure

-

Rationally View Institutional Disclosures:

- Institutional positions are important references but not the only basis for investment decisions

- Focus on the trend of institutional position changes rather than single-point data

- Note the time lag of 13F disclosures

-

Combine with Fundamental Analysis:

- AVDL’s current P/E ratio is -711x [0], so it is necessary to pay attention to its product commercialization progress

- Q2 EPS exceeded expectations by 400% [0], showing operational improvement, but revenue is still below expectations

- Cash ratio of 2.38 [0] provides a certain margin of safety

-

Monitor Liquidity Risk:

- Institutional ownership of 87.49% [0] means limited retail tradable shares

- Trading volume shrinkage may increase trading costs and price volatility

- It is recommended to set stop-loss levels to deal with sudden liquidity declines

The impact of institutional investors’ large transaction disclosures on biopharmaceutical stock valuations is multi-dimensional:

- The strong rise before institutional disclosure (43%) reflects positive signals from the position building process [0]

- The sharp 80% drop in trading volume after disclosure indicates that institutions have completed major position adjustments and the market has entered an observation period [0]

- Analyst target prices are lower than current prices and multiple institutions have downgraded their ratings [0], suggesting limited short-term upside potential

- High institutional ownership ratio (87.49%) is a double-edged sword—providing liquidity support while increasing the risk of concentrated position reductions [0]

[0] Gilin Data API - Avadel Pharmaceuticals (AVDL) Stock Price, Trading Volume, Institutional Ownership Ratio, Financial Data and Analyst Ratings

[1] Investing.com - “Morgan Stanley Capital Services discloses Avadel Pharmaceuticals trades” (2025-12-22)

https://www.investing.com/news/company-news/morgan-stanley-capital-services-discloses-avadel-pharmaceuticals-trades-93CH-4418511

[2] Investing.com - “Morgan Stanley Europe SE reports Avadel Pharmaceuticals dealings” (2025-12-24)

https://www.investing.com/news/company-news/morgan-stanley-europe-se-reports-avadel-pharmaceuticals-dealings-93CH-4422331

[3] NewsDaemon - “The key reasons why Avadel Pharmaceuticals plc (AVDL) is -8.44% away from 52-week high?” (2025-12-25)

https://newsdaemon.com/2025/12/25/the-key-reasons-why-avadel-pharmaceuticals-plc-avdl-is-8-44-away-from-52-week-high/

[4] Yahoo Finance - “Assessing Avadel Pharmaceuticals (AVDL) Valuation After Strong 1-Year Share Price Performance” (2025-12-20)

https://finance.yahoo.com/news/assessing-avadel-pharmaceuticals-avdl-valuation-160731744.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.