AMD vs NVIDIA: AI Chip Competition Landscape Analysis (2026)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the obtained brokerage API data and public online information, I have summarized the key points of the competitive landscape between AMD and NVIDIA in the AI chip field (excluding market share speculations not supported by tool results):

- AMD’s Latest Developments (Based on News and API Overview)

- CES 2026-related news: AMD showcased the Ryzen AI 400 series (including Ryzen AI 9 HX 475, with up to 12 Zen 5 CPU cores, a maximum of 5.2 GHz, and an NPU of 60 TOPS), and introduced the direction of AI computing power for data centers [1][2][3][4][5][6]. The news also mentioned the “Helios” AI rack solution, emphasizing its overall solution layout for AI computing power and the demand for performance improvement [1][2][3][4][5][6].

- Strategic focus: Both news and company materials show that AMD takes “open ecosystem and interconnection standards” as one of its differentiation points (such as emphasizing ROCm and open interconnection), and strives to win customers through cost and memory optimization [1][2][3][4][5][6][8].

- Technology and product lines: In addition to the consumer/PC-side Ryzen AI 400, AMD has the Instinct (MI) series for data center AI acceleration; meanwhile, for the longer-term roadmap, public information mentions that subsequent generations (such as the MI500 series, using more advanced processes and new architectures) are in planning and advancement [11].

- Market and financial performance (API):

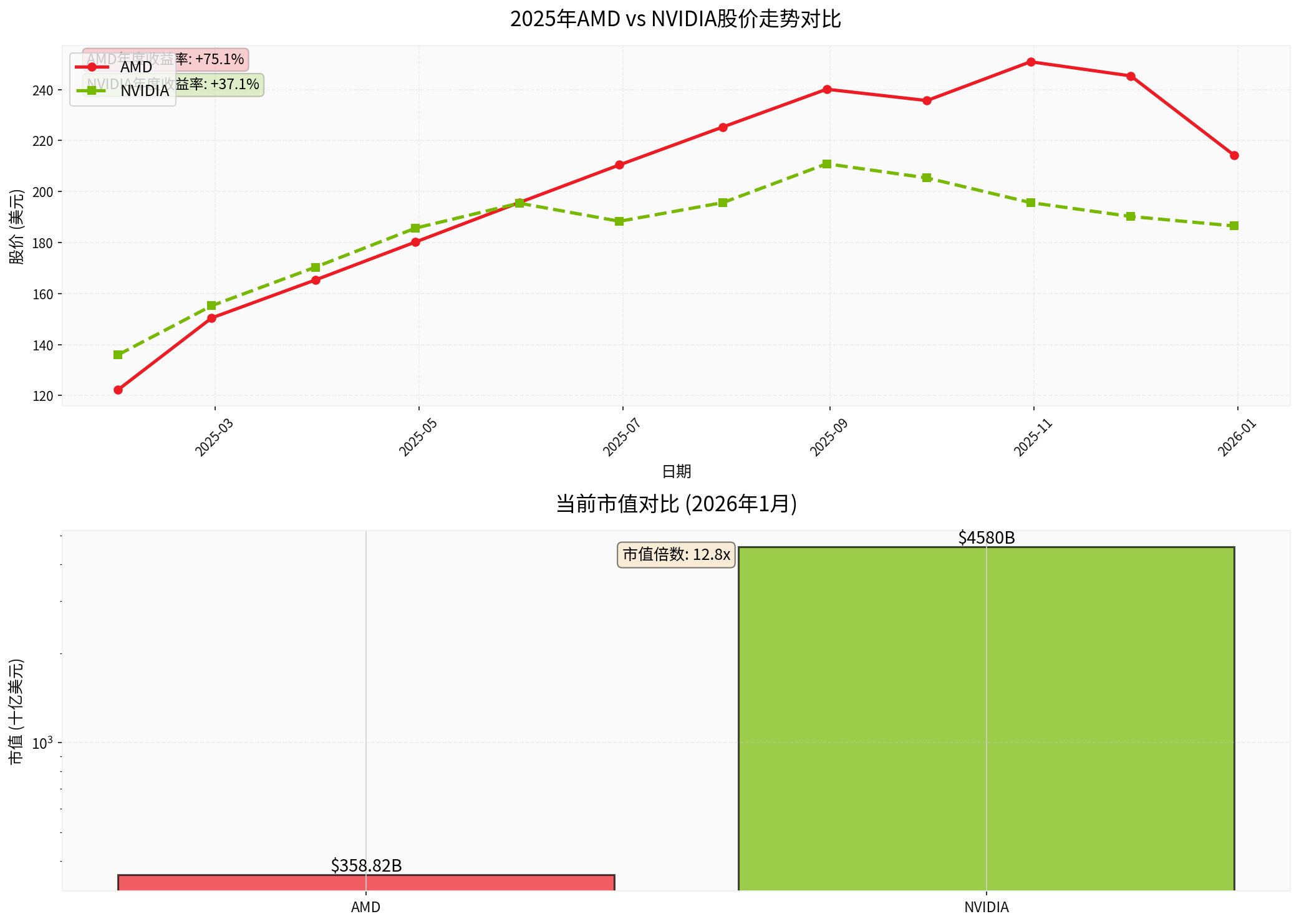

- Stock price and market capitalization: AMD’s current stock price is approximately $221.08, with a market capitalization of about $358.82 billion; the cumulative stock price increase in 2025 was approximately +75.1% [0][6][7].

- Financial and structural: The latest quarterly data center business revenue was approximately $4.34B (accounting for about 47.0% of the total revenue in the quarter), reflecting that data center/AI-related revenue has become an important pillar [7].

- Cash flow and profitability: The latest annual free cash flow was approximately $2.405 billion, net profit margin about 10.32%, and operating profit margin about 8.78% [0][7].

- NVIDIA’s Competitive Situation (Based on API Data and Citable Information)

- Market position: Multiple public reports and analysts generally believe that NVIDIA occupies a dominant position in the GPU/accelerator market for AI training and inference; the Chinese-language Wall Street Journal report also mentioned that “analysts estimate its share exceeds 75%” (this is an external report, not produced by this tool, and is cited here as background without making absolute conclusions) [8].

- Product and performance public information: NVIDIA’s Blackwell architecture (such as B200) single GPU can provide about 20 PFLOPS of AI computing power, which is a significant improvement compared to the previous generation [11]; this generation of products continues its existing advantages in high-bandwidth memory (HBM), interconnection, and ecosystem.

- Financial and structural: NVIDIA’s latest quarterly data center revenue was approximately $41.10B (accounting for about 87.9% of the total revenue in the quarter), indicating that its business structure is highly tied to AI/data centers; the net profit margin was about 53.01%, and the operating profit margin about 58.84% [9].

- Market capitalization and stock price: NVIDIA’s current stock price is approximately $188.12, with a market capitalization of about $4.58 trillion; the cumulative stock price increase in 2025 was approximately +37.1% [0][9].

- Key Factors Regarding “Catching Up and Gaining Share” (Qualitative Judgment Based Only on Available Public Signals, No Specific Share Targets Given)

- Performance aspect: Public information shows that AMD is advancing the next-generation AI acceleration hardware and integrated solutions (such as Helios rack-related introductions) for data centers, and emphasizing memory and interconnection performance [1][2][3][4][5][6][11]; however, compared to the public disclosure of NVIDIA Blackwell/B200 single GPU computing power (about 20 PFLOPS) [11], there is currently no public benchmark data at the “single GPU/single accelerator card” level from AMD that is equivalent or higher in the available materials. Therefore, from public reports and product specifications, NVIDIA still has an advantage in peak AI computing power; if AMD wants to fully align in “pure performance”, it still needs to rely on subsequent generations (such as more advanced processes/architectures) and actual measurement benchmark results for verification.

- Ecosystem and migration cost: NVIDIA has a mature CUDA ecosystem and developer/software toolchain, which constitutes a high switching cost; AMD uses ROCm and open interconnection (such as cooperation with multiple cloud vendors/system integrators) as its differentiation direction to reduce customer migration difficulty and TCO. Medium- and long-term competition will be more reflected in the comprehensive solution capabilities of “hardware + software + integration/cost”.

- Financial and R&D investment: From the perspective of profit margin and cash flow, NVIDIA’s profitability is significantly higher (net profit margin ~53%) [9], and it is more capable of making high-intensity investments in R&D and supply chains; AMD’s profitability is lower, but its stock price and data center business share increased in 2025, reflecting the market’s recognition of its growth potential [7].

- Market reaction (stock price level): AMD’s stock price performance in 2025 (about +75%) was better than NVIDIA’s (about +37%), showing that the market gave a premium to AMD’s growth space in the two lines of AI data centers and PC AI [0][6][7][9]. This reflects both the “imagination space” of catching up and the uncertainty of competition.

- Timeline: To achieve “performance catch-up” and “share increase”, AMD will probably have to wait until subsequent generations (such as the new Instinct MI series with more advanced processes and HBM iterations, and the maturity of supporting software stacks) are deployed on a large scale and form replicable customer cases. Before that, there will be more partial victories and structural substitutions (such as specific cloud service providers/large customers adopting hybrid solutions, cost-sensitive scenarios, etc.).

- Comprehensive Judgment (Qualitative Conclusion Based on the Above Evidence)

- Short-term: AMD has formed obvious improvements and differentiated selling points on the AI PC/client side (Ryzen AI 400), and is striving for some customers on the data center side through open ecosystem and cost-effectiveness [1][2][3][4][5][6]. From the perspective of market share, gaining “incremental share” under NVIDIA’s dominant pattern is a realistic direction, but completely “reversing the pattern” still requires time and stronger “flagship-level” performance/ecosystem evidence.

- Medium- and long-term: Whether it can truly align in performance and continuously gain share depends on three points: 1) Whether the next-generation data center accelerator cards can compete head-on with NVIDIA’s high-end products in key specifications such as “computing power/memory/interconnection”; 2) The maturity and toolchain experience of ROCm and open ecosystem in mainstream AI frameworks and engineering deployment; 3) The adoption rhythm and procurement structure of large customers (cloud vendors/supercomputers/large model companies).

- Risks and uncertainties: The growth rate of AI chip demand, supply chain (advanced process/HBM supply), and customers’ self-developed/heterogeneous solutions (such as ASIC, TPU, etc.) will all change the competitive landscape. It is not enough to give an accurate quantitative judgment on “how much share to gain” based solely on public information.

- Data and Chart Explanation

- The following charts show the 2025 stock price trends and market capitalization comparison of the two companies (only used to present differences in secondary market performance, not representing predictions of future stock prices or market shares):

Explanation:

- Upper chart: Monthly closing price trend for the full year of 2025 (data source: API historical prices [0][6][7][9])

- Lower chart: Market capitalization comparison as of current (logarithmic scale, data source: API [0][7][9])

- Reference Sources

- Reports on CES 2026 AMD new products and AI computing power direction (such as Helios rack, Ryzen AI 400, open interconnection, etc.) [1][2][3][4][5][6]

- Reports on AI chip market share and NVIDIA’s dominant position (external reports citing analysts’ views, not produced by this tool) [8]

- Public information on NVIDIA Blackwell/B200 performance indicators (B200 single GPU about 20 PFLOPS) [11]

References

[0] 金灵API数据(实时报价、历史价格、财务概览)

[1] Engadget - “AMD’s new Ryzen AI Max+ chips and Ryzen 7 9850X3D court desktop enthusiasts at CES 2026” (2026-01-06)

[2] Engadget - “AMD’s Ryzen AI 400 chips are a big boost for laptops and desktops alike” (2026-01-06)

[3] MarketWatch - “As AMD chases Nvidia, here’s how it’s positioning itself for the future of AI” (2026-01-06)

[4] XDA Developers - “AMD kicks off 2026 with a new king of gaming CPUs and more AI” (2026-01-06)

[5] Wccftech - “AMD ROCm 7.2.2 Adds Support for Ryzen AI 400 CPUs & Unlocks Faster Local Inference Performance” (2026-01-06)

[6] Lifehacker - “CES 2026: AMD Just Showed Off ‘Helios,’ the Hardware That Will Power the AI Content in Your Feeds” (2026-01-06)

[7] AMD company overview - 金灵API(市值、业务结构、利润率与现金流)

[8] 华尔街日报中文 - “‘奇袭者’AMD如何在AI芯片战中后来居上” (引用分析师对NVIDIA份额的估计,非本工具产出)

[9] NVIDIA company overview - 金灵API(市值、业务结构与利润率)

[10] Yahoo Finance - “AI Processor Market Valuation Set to Skyrocket to US$ …” (2025, 提及B200性能提升等公开信息)

[11] Wccftech - “AMD Confirms Next-Gen MI500 Built On An Advanced 2nm Node: CDNA 6 Architecture & HBM4E Memory” (2026-01-06)

For more detailed quantitative benchmarks of “MI series vs Blackwell/H200” in core computing power, bandwidth, and third-party actual measurement benchmarks, as well as the actual procurement/deployment structure of different cloud service providers, it is recommended to enable the deep research mode and retrieve technical indicators and actual measurement data from professional brokerage databases for more rigorous engineering-level and financial-level comparisons.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.