Impact Analysis of the Rapid Growth of Douyin's AI Content Ecosystem

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

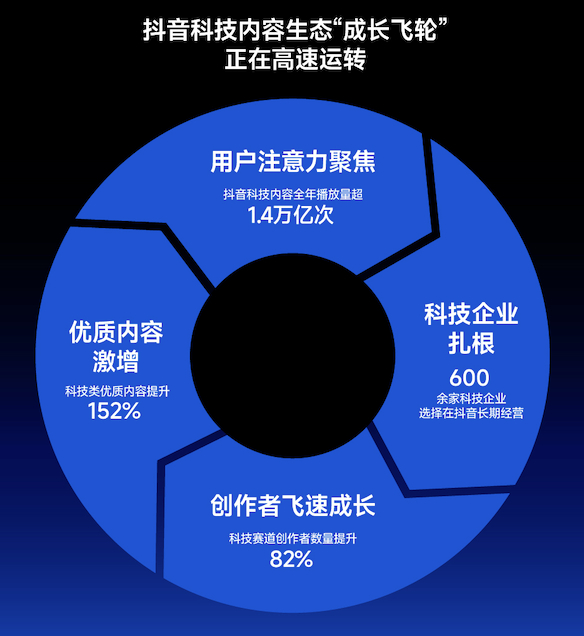

According to the 2025 Douyin Tech Content Ecosystem Report and media reports, key data of Douyin in the AI and tech content ecosystem include [1][2]:

- Annual views of tech content exceeded 1.4 trillion, meaning each user entering Douyin watches about 6 or more tech content videos per day on average.

- The number of AI-interested users increased by 105% year-on-year.

- Views of AI learning content increased by 200% year-on-year.

- 17.48 million users published nearly 50 million AI-related content pieces on the platform.

- The number of content created via AI and their views increased by 185% and 199% year-on-year, respectively.

- The number of medium-to-long videos (over 30 minutes) increased by 298%, reflecting the rise in demand for deep content consumption.

- Over 10 million users learned AI skills on the platform; over 600 tech enterprises have settled on Douyin for communication and content dissemination [1][2].

The above indicators show: Douyin is becoming a high-density gathering place for “AI interest and learning”, and the rapid expansion of medium-to-long videos marks the trend of deepening and systematization of “AI + knowledge/popular science” content [1][2].

-

Product and Traffic Synergy: Douyin’s massive content consumption and AI creation ecosystem form a traffic-computing power closed loop with Volcano Engine/Doubao large model. Doubao’s DAU exceeding 100 million and the rapid growth of daily Token calls (media reports say it has the “domestic first” call volume and nearly 60% market share) [7][8] mean ByteDance has a large-scale foundation in both ToC AI entry and ToB cloud services.

-

Clearer Monetization Path: High stickiness and longer duration brought by AI content provide richer monetization scenarios for advertising, knowledge payment, tool subscription, and e-commerce conversion. Media points out that Internet platforms are taking “AI-native advertising” as the direction for率先回本 and rapid monetization (such as AI material generation, fully automatic delivery, etc.) [5]; Douyin has a stronger content and user foundation in this direction.

-

Strengthened Creator Ecosystem: Deep tech content and the popularization of AI tools significantly lower the creation threshold, forming a positive feedback loop of “tool—creation—distribution”. 17.48 million AI content publishers and nearly 50 million content pieces [1][2] are important manifestations of the ecosystem’s depth and activity.

Based on disclosed cooperation and business directions, the impacts on some “ByteDance系” or related targets are summarized as follows [3][6]:

-

Hand Information: Media reports that it helps many enterprises with digital transformation, connects to ByteDance’s OceanEngine and other marketing ecosystems, and involves using AI to optimize enterprises’ operations and marketing effects on Douyin/Toutiao [3]. If ByteDance’s marketing and AI commercialization speed up, its related businesses are expected to benefit.

-

Visual China: Has copyright content cooperation and distribution with multiple content platforms under ByteDance; one of the main application and distribution scenarios of its AI generation tools is ByteDance’s content ecosystem [3]. With the expansion of the AI content ecosystem, the demand for copyright compliance and content supply may increase simultaneously.

-

Cloud Infrastructure and Computing Power Industry Chain: Media reports that ByteDance has significantly purchased Huawei Ascend chips [6]. As Doubao and Douyin’s AI ecosystem continue to grow in demand for computing power, the domestic AI computing power chain (CPO, optical communication, computing power leasing, etc.) is expected to receive order support (belonging to the industry chain benefit logic).

-

Marketing and Advertising Technology Service Providers: Media says Kuaishou’s Q3 AIGC marketing material service consumption exceeded 3 billion yuan, and the penetration rate of fully automatic delivery increased rapidly [5]. This indicates that the industry-wide “AI-native advertising” is accelerating its implementation, and related delivery optimization and creative generation service providers may迎来 opportunities.

-

Differences in User Usage Duration and Structure: QuestMobile data shows that in October 2025, the proportion of users under 30 years old on Weibo, Xiaohongshu, and Bilibili was 58.6%, 54.2%, and 66.5% respectively, while the proportion of users aged 51 and above on Douyin and Kuaishou reached 22.2% and 22.6%, reflecting the differentiation of platform population structure [3].

-

Pressure Faced by Kuaishou and Its Bet on AI: Media reports that Kuaishou’s advertising business growth has slowed down, and user growth and duration are under pressure; it continues to invest in AI video generation tools (Keling); Keling spread rapidly overseas in December 2025 [4]. Its AI video direction focuses on “audio-visual co-generation” and “Motion Control” [4], which is one of the differences.

-

AI Tool and Ecosystem Synergy: Kuaishou’s Keling competes with multiple domestic AI video models; media reports that ByteDance has Seedance (multi-lens text-to-video/image-to-video) and collaborates with Douyin’s ecosystem [4]. Douyin’s massive content ecosystem and consumption scenarios provide richer landing spaces for AI tools.

-

“Mental Partition” of AI Content Consumption: QuestMobile points out that different platforms have formed clear “mental partitions”, and users project different needs onto different platforms; AI content has become an important growth pole on Douyin [3].

-

Responses from Vertical Platforms: Media points out that platforms like Bilibili and Xiaohongshu are “breaking circles” from vertical communities, Weibo is extending from “watching hotspots” to “living life”, and Douyin and Kuaishou are deepening from universal applications to “precision farming”, with the common direction of building a more vibrant and sustainable content + business ecosystem [3].

-

User Penetration and Tool Popularization: QuestMobile data shows that in October 2025, the penetration rate of AI-related content users increased by 9.9 percentage points year-on-year, and deep interest users showed年轻化 and slightly more male characteristics; the monthly active user scale of AI plug-ins exceeded 30 million (total of platforms like Douyin, Weibo, Kuaishou, etc.) [3]. AI tools are evolving from early “cool functions” to “basic capabilities” for creation and operation.

-

Content Deepening: Long video platforms use AI tools to improve production efficiency and content supply (such as the application of AI scripts and production tools by iQIYI, etc.) [5]. This indicates that the entire industry is using AI to shorten the production cycle and reduce trial-and-error costs.

-

Regulation and Compliance: AI content generation involves copyright, data compliance, and content review; platforms need to balance rapid expansion and compliance.

-

Verification of Monetization Efficiency: The traffic and stickiness of the AI content ecosystem have been shown, but the direct pull on advertising conversion rate, paid subscription, and e-commerce GMV still needs time to verify.

-

Technology and Ecosystem Competition: Keling, Seedance, multiple domestic models, and overseas products are iterating rapidly in the AI video/creation tool track; Douyin’s ecosystem advantages need to be continuously transformed into technical and product barriers.

-

The rapid expansion of Douyin’s AI content ecosystem strengthens the closed-loop advantage of “ByteDance系” in “AI traffic entry—content—cloud service—commercialization”, providing continuous user and data feedback for Volcano Engine/Doubao [1][2][7][8].

-

The impact on “ByteDance系” or related targets is more of a structural opportunity: enterprises deeply cooperating with ByteDance’s marketing/advertising ecosystem (such as Hand Information, etc.), content copyright and distribution partners (such as Visual China, etc.), and the domestic computing power/optical communication industry chain have potential linkage opportunities in orders and business [3][6].

-

Industry Level: AI has evolved from “new theme” to “new infrastructure”, reshaping the efficiency of content production, distribution, and operation. Platforms like Douyin, Kuaishou, Bilibili, Xiaohongshu, and Weibo are making differentiated layouts around AI content consumption and tool supply; the competition dimension has shifted from “traffic scale” to “quality and efficiency”. In the short term, Douyin has a first-mover advantage in AI content consumption and deep content forms; in the medium and long term, Kuaishou’s Keling, multiple domestic models, and overseas products are still iterating rapidly, and the pattern is not yet determined [3][4][5].

[1] Zhiwei Wang/Sina Finance: 2025 Douyin Tech Content Ecosystem Report Released——Tech Content Views Exceed 1.4 Trillion, AI Interest Users Double. https://finance.sina.com.cn/tech/roll/2026-01-05/doc-inhffwpr8179575.shtml

[2] Sina Tech: 2025 Douyin Tech Content Ecosystem Report——AI Interest Users Increase by 105% YoY, AI Learning Content Views Increase by 200% YoY, Over 600 Tech Enterprises Settle. https://tech.sina.cn/2026-01-05/detail-inhffwpr8179575.d.html

[3] QuestMobile: 2025 New Media Ecosystem Inventory——Five Platforms Have 1.149 Billion Monthly Active Users, AI Penetrates from “New Theme” to “New Infrastructure”. https://m.36kr.com/p/3597577937502473

[4] NetEase/OFweek: Kuaishou’s AI Tool for the Future——Keling 2.6 Becomes Popular Overseas, Competition in the AI Video Generation Tool Track Intensifies. https://www.163.com/dy/article/KIHNF73J0556HU1K.html;https://m.ofweek.com/ai/2026-01/ART-201700-8420-30678285.html

[5] 36Kr: Preventing Internet Advertising Decline, All Relying on AI?——Kuaishou’s Q3 AIGC Marketing Material Consumption Exceeds 3 Billion Yuan, Fully Automatic Delivery Penetration Rate Increases Rapidly. https://m.36kr.com/p/3592356479123458

[6] Caifuhao/East Money: ByteDance Buys a Lot of Huawei Ascend Chips——Domestic AI Computing Power Demand Is Strong. https://caifuhao.eastmoney.com/news/20260104141635645496000?from=guba&name=6JOd6Imy5YWJ5qCH5ZCn

[7] Huxiu: ByteDance Wins Again——Doubao DAU Exceeds 100 Million, Daily Token Calls Exceed 50 Trillion, Volcano Engine Ranks First in China’s Public Cloud Large Model Service Calls. https://www.huxiu.com/article/4821029.html

[8] InfoQ: Behind Doubao’s 50 Trillion Tokens——Volcano Engine Fully Turns to Agent Implementation; Doubao’s Daily Token Calls Have Exceeded 50 Trillion (Increased by 200% in Half a Year), with a Market Share of About 59.2%. https://www.infoq.cn/article/x9LH3s9HG77m2HiyvJvv

Note: This analysis cites public online reports and third-party机构 data, and is only used for trend and logic judgment, not as investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.