In-depth Analysis of Chow Sang Sang Gold Jewelry Price Hike on Hong Kong Jewelry Sector and Gold Investment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On January 5, 2026, catalyzed by a sudden geopolitical event (U.S. military action against Venezuela), spot gold prices surged at the opening. As of 16:00, London Spot Gold was quoted at $4,422 per ounce, with a single-day increase of 2.08%[1]. Against this backdrop, Chow Sang Sang announced that starting from January 6, it would adjust prices for some fixed-priced gold jewelry, with increases ranging from 200 yuan to 1,500 yuan[1][2].

- Main Products: Charm beads, fixed-priced co-branded series (e.g., Hello Kitty series), gold-inlaid diamond jewelry

- Reason for Adjustment: Sustained strength in international gold prices

- Adjustment Magnitude: Taking the pure gold Charme Cool Black Series Chinese Zodiac Charm Bead as an example (single product weighs about 1.5 grams), the original price was 3,380 yuan, and the store discount price was 2,974 yuan; the expected increase is between 260-280 yuan[2]

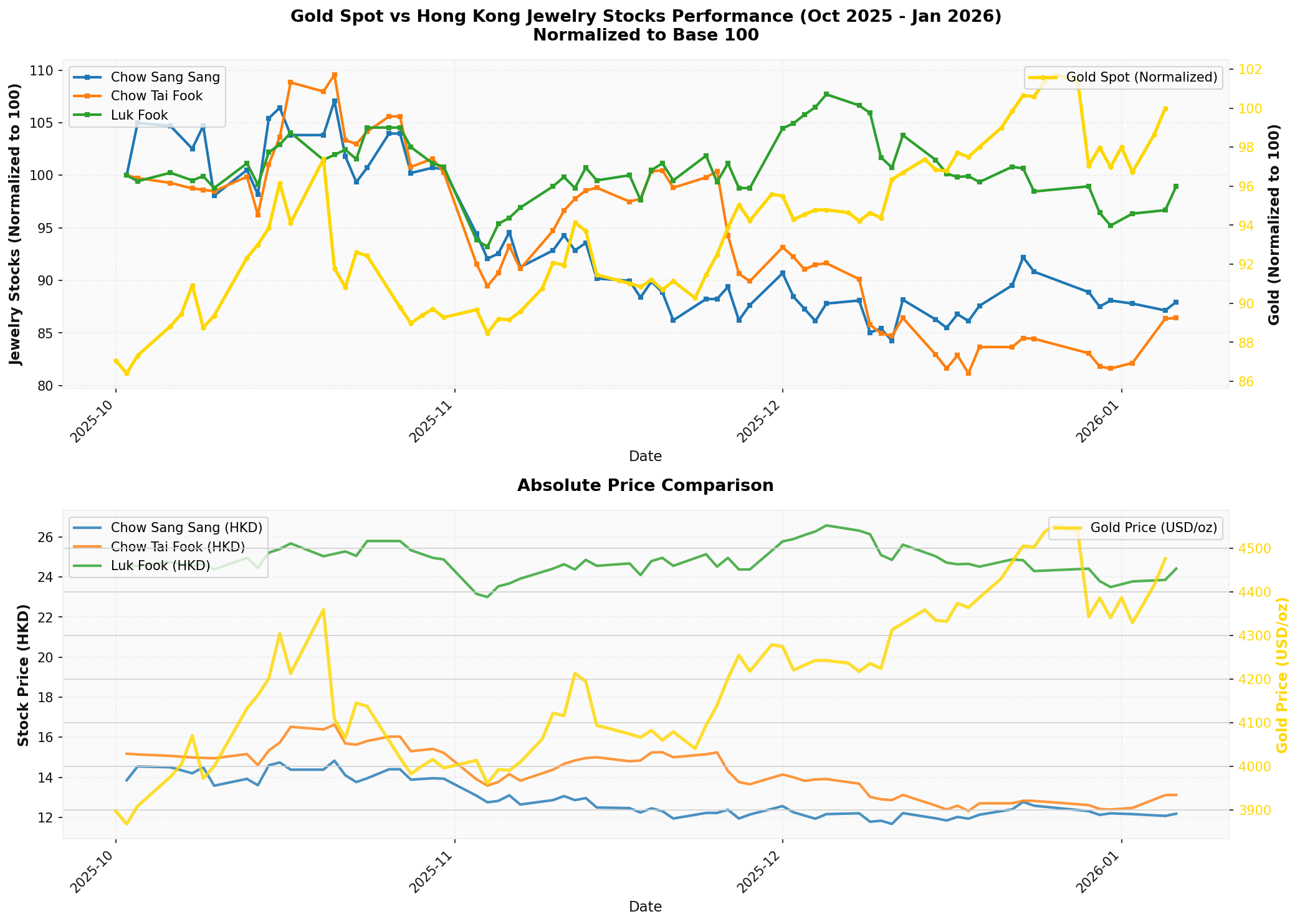

Based on market data from October 1, 2025 to January 6, 2026[0]:

| Asset | Initial Price | Final Price | Change | Period High | Period Low | Daily Volatility |

|---|---|---|---|---|---|---|

| Spot Gold | $4,476.40 | $3,897.50 | -12.93% |

N/A | N/A | N/A |

| Chow Sang Sang (0116.HK) | HK$13.85 | HK$12.18 | -12.06% |

HK$15.00 | HK$11.67 | 2.61% |

| Chow Tai Fook (1929.HK) | HK$15.18 | HK$13.12 | -13.57% |

HK$16.95 | HK$12.22 | 2.61% |

| Lukfook Group (0590.HK) | HK$24.68 | HK$24.42 | -1.05% |

HK$26.80 | HK$22.60 | 1.96% |

- High Correlation:Chow Sang Sang’s stock price is highly correlated with spot gold price trends, with almost the same change (-12.06% vs -12.93%), indicating high sensitivity of its performance to gold prices

- Sector Differentiation:Lukfook Group showed relatively strong resilience (-1.05%), reflecting that its business structure or brand premium has stronger anti-drop capabilities

- Valuation Attractiveness:Chow Sang Sang’s current P/E is only 6.96x and P/B is only 0.59x, significantly lower than the historical average[0]

- Upper Chart (Normalized Comparison): Spot gold and jewelry stocks trends are highly synchronized, with significant corrections in Q4

- Lower Chart (Absolute Price): Gold fell from the high of $4,476 to $3,897, with jewelry stocks adjusting synchronously

- Key Time Point: The correction from late December 2025 to early January 2026 was mainly due to year-end profit-taking and liquidity factors

This price adjustment reflects the

- Upstream Cost-Driven:Rising international gold prices directly push up raw material costs

- Brand Premium Pricing:Fixed-priced gold jewelry (e.g., co-branded series, gold-inlaid diamond types) is more sensitive to gold price fluctuations due to complex craftsmanship and brand premium

- Industry Linkage Effect:As a leading brand, Chow Sang Sang took the lead in adjusting prices; other brands are expected to follow suit

- Consumer End Price Adjustment ≠ Capital Goods Bull Market Continuation:Gold jewelry price adjustment mainly reflects cost transmission and brand pricing strategy, not a direct signal of gold price trend

- Technical Correction Pressure:Last week (December 29,2025 to January2,2026), international spot gold冲高回落, falling 4.40% weekly, ending three consecutive weeks of gains[3]

- Fund Flow Warning:As of the week ending January2, SPDR GOLD TRUST holdings decreased by 6 tons, and CME gold open interest decreased weekly for the first time after continuous increases[3]

Supporting Factors:

- Geopolitical risks (Venezuela situation)[3]

- Federal Reserve rate cut expectations and loose monetary environment[1]

- Continuous gold purchases by global central banks (expected average 70 tons per month)[5]

- De-dollarization trend and safe-haven demand[3]

Risk Factors:

- Institutions like Goldman Sachs and UBS raised target prices to $4,900-$5,000 but warned of short-term volatility risks[1][5]

- World Gold Council warned: If “reflation return” leads to soaring interest rates, gold prices may face a correction pressure of -5% to -20%[5]

###4.1 Valuation and Fundamental Analysis

| Company | P/E | P/B | Market Cap | ROE | Financial Risk | 52-Week Gain |

|---|---|---|---|---|---|---|

| Chow Sang Sang (0116.HK) | 6.96x | 0.59x | HK$8.18B | 9.02% | Low Risk | +89.13%[0] |

| Chow Tai Fook (1929.HK) | 22.24x | N/A | HK$129.43B | N/A | Medium Risk | N/A[0] |

| Lukfook Group (0590.HK) | 11.20x | N/A | HK$14.34B | N/A | N/A | N/A[0] |

-

Chow Sang Sang:Most attractive valuation (P/E6.96x, P/B0.59x), but need to pay attention to:

- Abundant free cash flow (latest FCF HK$1.57B)[0]

- Aggressive accounting attitude, low depreciation/capital expenditure ratio[0]

- High correlation between stock price and gold price, high volatility

-

Chow Tai Fook:Industry leader but relatively high valuation (P/E22.24x):

- Obvious scale advantage (market cap HK$129.43B)

- Strong brand premium ability, but relatively small stock price elasticity

-

Lukfook Group:Strong Defensiveness:

- Best performance in Q4 (-1.05%)

- Lowest daily volatility (1.96%)

###4.2 Industry Trends and Strategic Adjustments

According to market research[5]:

-

Store Strategy Optimization:

- Close underperforming offline stores

- Open flagship stores in core areas of first-tier cities to expand high-end consumer markets

-

Supply Chain Adjustment:

- Due to high gold prices and slow turnover, large gold jewelry merchants significantly reduced bank gold borrowing business

- Gold borrowing turnover cycle extended from 2-3 months, increasing enterprise risk exposure

-

Consumption Upgrade Trend:

- Under the rise of “national tide”, Chinese luxury brands face development opportunities

- After the sharp rise in gold prices, the price of single products is almost the same as that of first-tier luxury goods; high-end路线 is the general trend for gold brands

###5.1 Summary of Institutional Views

| Institution | 2026 Gold Price Target | Core View |

|---|---|---|

| UBS | $5,000/oz | Raised March, June, September target prices from $4,500 to $5,000[1] |

| Goldman Sachs | $4,900/oz | Expected continuous central bank gold purchases, 70 tons/month on average[5] |

| Bank of America | $5,000/oz (Extreme Forecast) | Average target price $4,400, warning of recent pullback risk[2] |

| JPMorgan Chase | $5,055/oz (Q4 2026) | Extreme forecast up to $6,000[2] |

| World Gold Council | +5% to +30% | Scenario analysis: Mild recession to vicious cycle[5] |

###5.2 Strategy Recommendations for Different Investors

- Bank Accumulated Gold:Moderate liquidity, supports monthly fixed investment, extremely low risk, suitable for small batch investment[4]

- Operation Suggestion:Allocate on dips, use fixed investment strategy, avoid chasing highs

- Gold Mining Stocks:Good liquidity, leveraged returns, suitable for high-risk preference investors[4]

- Operation Suggestion:Focus on Hong Kong-listed gold mining stocks (e.g., Zijin Mining, Shandong Gold)

- Low Cost-Effectiveness of Gold Jewelry Investment:Jewelry recycling usually has high depreciation fees and no premium, resulting in poor cash profit effect[4]

- Suggestion:If purchasing gold jewelry, choose simple craftsmanship styles to reduce costs; clarify recycling rules

- Physical Gold(gold bars, silver bars): Provides intuitive holding experience but involves storage and insurance costs, low liquidity[4]

- ETF/Paper Gold:Good liquidity, convenient trading, suitable as a cornerstone of asset allocation

###5.3 Risk Warnings

- Increased Volatility Risk:Analysts warn that the faster the gold price rises, the greater the possibility of sharp corrections[2]

- Federal Reserve Policy Risk:If the Federal Reserve unexpectedly turns hawkish or large-scale redemptions occur in gold ETFs, gold prices may face short-term adjustment pressure[1]

- Technical Resistance:Short-term resistance at $4,400-$4,430/oz area, key resistance at $4,450-$4,480/oz area[3]

- High-Level Chasing Risk:Current gold prices are at historical highs, and consumers are obviously in a wait-and-see attitude[5]

###6.1 Core Conclusions

- Chow Sang Sang’s price hike is an inevitable result of cost transmission, not a signal of bull market continuation

- Adjusted products are mainly concentrated in high-premium categories (co-branded series, gold-inlaid diamonds), reflecting brand strategic adjustment

- Obvious industry linkage effect; other brands are expected to follow suit

- Medium-to-long-term bull market foundation remains unchanged:Core supporting factors like geopolitics, monetary easing, and central bank gold purchases still exist

- Short-term volatility intensifies:Year-end profit-taking, ETF fund outflows, and technical correction pressure need time to digest

- 2026 Outlook:Institutions are generally bullish (target price $4,900-$5,000) but warn of sharp correction risks

- Obvious Valuation Differentiation:Chow Sang Sang has the most attractive valuation (P/E6.96x) but high stock price volatility

- Accelerated Strategic Transformation:Store closure for efficiency, high-end layout, and supply chain optimization have become industry consensus

- Investment Timing:After Q4 adjustment, the sector’s valuation is in a reasonable range, but need to wait for gold price stabilization signals

- Wait and see, wait for gold price stabilization signals (break through $4,450 or pullback to $4,300-$4,250 support area)

- For jewelry stocks, prioritize Lukfook Group (strong defensiveness) and Chow Sang Sang (high elasticity, low valuation)

- Gold Allocation: Maintain 5%-15% gold allocation ratio, adopt fixed investment or dip-buying strategy

- Jewelry Stock Allocation: Layout before Q2-Q3 consumption peak season, focus on Chow Sang Sang (performance elasticity) and Chow Tai Fook (brand leader)

- Gold bull market pattern remains unchanged; the probability of breaking $5,000 in 2026 is high

- The high-end trend of the jewelry industry is established; leading brands will enjoy the dividend of “national tide”

[0] Gilin API Data

[1] 21st Century Business Herald - “Geopolitical Risks Boost International Gold Prices, Chow Sang Sang Fixed-Price Gold Jewelry Price Hike Imminent!” (https://news.qq.com/rain/a/20260105A05AXI00)

[2] The Epoch Times - “Analysts Optimistic About 2026 Gold Trend, Do Not Rule Out Sharp Corrections” (https://www.epochtimes.com/gb/26/1/2/n14667695.htm)

[3] Xinhua Finance - “Gold Time · Weekly Gold Market Review: Precious Metals Face Short-Term Correction, Long-Term Strength Remains” (https://finance.sina.com.cn/money/bond/2026-01-05/doc-inhfhici2031372.shtml)

[4] China New Jingwei - “Two Gold Bracelets Saved 36,000 Yuan in One Year, How to Invest in Gold in 2026?” (https://cj.sina.cn/articles/view/5993531560/1653e08a802001jk3i)

[5] Xinhua Finance/CITIC Taurus - “Gold Market, New Changes!” (https://www.xincai.com/article/nhezuxm3522659)

[6] Consumer Reports - “$7.2/gram Gold Alternative, Young People Despise It While Secretly Buying It Explosively” (http://caifuhao.eastmoney.com/news/20260104194234367024020)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.