In-depth Analysis of AMD's AI Chip Strategy: Performance Goals, Competitive Landscape, and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

AMD’s MI455X GPU released at CES 2026 marks a significant breakthrough in the AI chip field [1][3]:

- Manufacturing Process:The world’s first GPU using TSMC N2 (2nm-class) manufacturing process, achieving significant density and energy efficiency improvements compared to previous 5nm/4nm processes.

- Architecture Design:Based on CDNA 5 architecture,采用 chiplet design, including two large Graphics Compute Dies (GCDs), two Memory Controller Dies (MCDs), and 16 HBM4 memory stacks.

- Memory Configuration:Equipped with HBM4 memory—432GB HBM4 per GPU, and 31TB HBM4 for the entire Helios rack—providing an aggregate memory bandwidth of 1.4 PB/s.

- Computing Scale:A single GPU integrates thousands of compute units; the entire Helios rack contains 18,000 GPU compute units and 4,600 Zen 6 CPU cores.

- 10x performance improvementover MI355X [3].

- A single Helios rack delivers 2.9 exaflops(FP4 precision) AI inference performance and1.4 exaflops(FP8 precision) AI training performance [1][3].

- 43 TB/s expansion bandwidth via NVLink-like technology.

Helios represents AMD’s strategic transition from a chip supplier to an

- 72 MI455X GPUs integrated into one rack.

- EPYC Venice CPU (up to 256 Zen 6 cores) as the main controller.

- Liquid cooling design, total weight ~7,000 pounds (~3.2 tons).

- Total transistor count: 320 billion.

- Large-scale AI model training (e.g., OpenAI’s ChatGPT).

- Enterprise AI inference deployment.

- Scientific computing and high-performance computing (HPC).

AMD plans to launch the MI500 series in 2027, featuring

- 1000x performance improvementin AI chips within 4 years (from 2023’s MI300X to 2027’s MI500).

- Annual product updates to compete with NVIDIA’s “Standard + Ultra” strategy.

| Technology Dimension | 2023 (MI300X) | 2027 (MI500, Target) | Improvement Multiple |

|---|---|---|---|

| Process Technology | 5nm/6nm | 2nm | 3-4x |

| Memory Technology | HBM3 | HBM4E | 2-3x |

| Architecture Optimization | CDNA3 | CDNA6 | 2-3x |

| Chip Scale | Single Chip | Large-Scale Chiplet Integration | 3-4x |

| System Integration | Single Card | Rack-Level Optimization | 2-3x |

- 2nm Yield:TSMC’s 2nm process has not yet mass-produced; yield and capacity are uncertain.

- HBM4 Supply Chain:Whether SK Hynix, Samsung, and Micron can meet demand remains unclear.

- Power Density:Heat dissipation and power management for exaflops-level computing are major challenges.

- Software Ecosystem:Gap in maturity between ROCm stack and NVIDIA’s CUDA ecosystem.

- Execution Timeline:2027 goal risks delays.

- Accelerated Competition:NVIDIA’s Vera Rubin platform (Q4 2026 deployment) increases pressure.

- Customer Stickiness:Cloud service providers heavily rely on NVIDIA’s ecosystem.

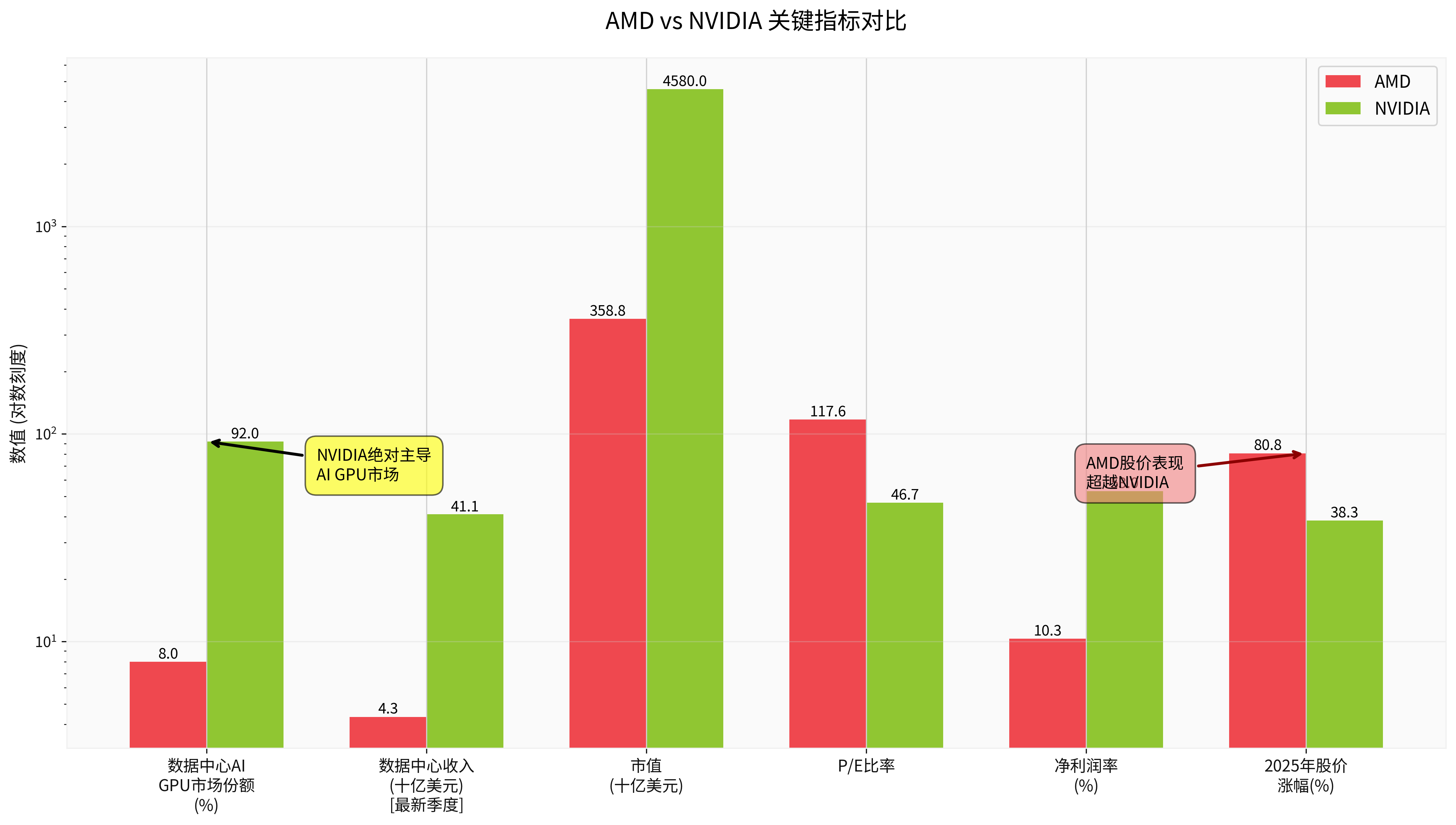

- NVIDIA:92% dominant share in AI data center GPU market [6][10].

- AMD:~8% market share, but growing in inference market.

| Metric | AMD | NVIDIA | Comparison |

|---|---|---|---|

| Data Center Revenue | $4.34B (Q3 FY2025) | $41.10B (Q2 FY2026) | NVIDIA is 9.5x AMD |

| Revenue Share | 47.0% | 87.9% | NVIDIA more focused on AI |

| Market Cap | $358.82B | $4.58T | NVIDIA is 12.8x AMD |

| Net Profit Margin | 10.32% | 53.01% | NVIDIA significantly more profitable |

| P/E Ratio | 117.60x | 46.68x | AMD higher valuation (reflects growth expectations) |

| Metric | AMD Helios | NVIDIA Vera Rubin |

|---|---|---|

| Process | Mixed 2nm/3nm | Unannounced (3nm/2nm estimated) |

| AI Performance | 2.9 exaflops (FP4) | 100 petaflops (single board) |

| Memory | 31TB HBM4 | Unannounced |

| Launch Time | Q4 2026 | Q4 2026 |

| Core Advantage | Open ecosystem, cost-effectiveness | CUDA ecosystem, performance leadership |

- CUDA Ecosystem Monopoly:15 years of software积累, strong developer stickiness.

- NVLink Technology:GPU interconnect bandwidth advantage.

- Product Rhythm:Annual updates, complete product matrix.

- Customer Relationships:Deep ties with OpenAI, Microsoft, Google.

- Open Ecosystem:ROCm open-source to avoid vendor lock-in.

- Cost Advantage:30-50% lower price than NVIDIA.

- Customization Capability:Strong chiplet flexibility.

- Strategic Partnerships:Major $15B collaboration with OpenAI [6].

- AMD 2025 Growth:+83.27% (far exceeding NVIDIA’s +36.01%).

- **AMD Volatility:**60.64% (higher than NVIDIA’s49.45%), reflecting growth stock traits.

- Market Expectations:Analyst consensus target price $300 (+35.7% from current), optimistic about AI growth.

- Catch-up Effect:AMD late to AI market, larger growth space.

- Valuation Repair:Gradual return from undervalued state.

- Catalysts:OpenAI partnership, new product launches.

- Base Effect:Smaller market cap → higher stock elasticity from same growth.

###4.1 AI Chip Market Outlook

- AI chip market to grow from ~$300-400B (2025) to over $1.1T(2035) [10].

- AI inference chip market to reach $167Bby2032 (CAGR28.25%) [10].

- LLM Training:GPT-5, Claude parameter expansion.

- Edge AI Inference:AI PC, AI phone, autonomous driving demand.

- Enterprise AI Deployment:Industry digital transformation.

###4.2 AMD’s Market Opportunities

- OpenAI Partnership:$15B deal provides stable revenue [6].

- Inference Market Penetration:NVIDIA focuses on training; AMD gains in inference.

- Cloud Provider Diversification:Google/AWS/Azure increase AMD purchases to avoid single-vendor risk.

- Regulatory Opportunities:Export controls create space in Chinese market.

- Software Ecosystem Maturity:ROCm improves, reducing migration costs.

- Tech Catch-up:1000x goal may lead to segment leadership over NVIDIA.

- End-to-End Solutions:Full-stack CPU+GPU+FPGA capabilities.

###4.3 Risk Factors

- Execution Risk:Ambitious1000x goal may miss deadlines.

- Intensified Competition:NVIDIA/Intel/Google TPU/AWS Trainium rivalry.

- Customer Concentration:Over-reliance on OpenAI-like clients.

- Geopolitics:US-China tech tensions impact Chinese market.

###4.4 Investment Recommendations

| View | Explanation |

|---|---|

| Long-Term Outlook | Positive: AI is a definite trend; AMD as second player benefits. |

| Short-Term Volatility | High: Affected by product launches, earnings, competition. |

| Valuation Level | 117.6x P/E is high; needs sustained performance. |

| vs NVIDIA | AMD for growth seekers; NVIDIA for conservative investors. |

- MI400 series performance & launch time.

- ROCm progress (developer count, app support).

- Data center revenue growth & share.

- OpenAI client purchases.

- NVIDIA Rubin platform performance.

- Technically Feasible:Hardware+software optimization can reach 800-1000x.

- Execution Critical:Success depends on timely delivery and mass production.

- Competition-Driven:NVIDIA’s roadmap pressures AMD but accelerates innovation.

- NVIDIA Dominates:92% share, CUDA ecosystem, profitability hard to撼动 short-term.

- AMD is Top Challenger:Tech strength, open ecosystem, cost优势 make it credible alternative.

- Non-Zero-Sum:AI market growth allows both to expand.

- Short-Term:AMD accelerates AI chip innovation and cost reduction.

- Mid-Term:Open vs closed ecosystem competition becomes key.

- Long-Term:Possible duopoly like CPU market (Intel vs AMD 2.0).

[0] Gilin API Data (stock prices, financials, market data)

[1] Tom’s Hardware - “AMD CES2026 Keynote Liveblog” (https://www.tomshardware.com/news/live/amd-ces-2026-keynote-ryzen-x3d-gorgon-point)

[2] WCCFtech - “AMD Shows Off World’s First2nm Chips” (https://wccftech.com/amd-shows-off-worlds-first-2nm-venice-zen-6-cpu-instinct-mi455x-gpu-helios-ai-rack/)

[3] WCCFtech - “AMD Confirms Next-Gen MI500 Built On2nm Node” (https://wccftech.com/amd-mi500-an-advanced-2nm-node-cdna-6-architecture-hbm4e-memory/)

[4] Lifehacker - “AMD Shows Off Helios AI Rack at CES2026” (https://lifehacker.com/tech/amd-just-announced-helios-at-ces-2026)

[5] Tom’s Hardware - “AMD Touts Instinct MI400X Series and Helios Rack” (https://www.tomshardware.com/tech-industry/artificial-intelligence/amd-touts-instinct-mi430x-mi440x-and-mi455x-ai-accelerators-and-helios-rack-scale-ai-architecture-at-ces-full-mi400-series-family-fulfills-a-broad-range-of-infrastructure-and-customer-requirements)

[6] TipRanks - “Nvidia vs AMD: Who Takes the Lead in2026?” (https://www.tipranks.com/news/nvidia-vs-amd-who-takes-the-lead-in-the-2026-ai-chip-race)

[7] Motley Fool - “Nvidia vs AMD: Better AI Chip Stock for2026?” (https://www.fool.com/investing/2025/12/07/nvidia-vs-amd-which-is-the-better-ai-chip-stock-fo/)

[8] Investing.com - “Nvidia Accelerates AI Roadmap: Rubin5x Faster” (https://www.investing.com/news/stock-market-news/nvidia-accelerates-ai-roadmap-rubin-superchip-in-full-production-5x-faster-4431180)

[9] IBTimes - “Nvidia Unveils Vera Rubin at CES2026” (https://www.ibtimes.co.uk/nvidia-unveils-vera-rubin-ces-2026-ai-platform-that-could-reshape-work-1768575)

[10] IoT Analytics - “GenAI Market Share2024” (https://iot-analytics.com/wp-content/uploads/2025/03/GenAI-market-share-2024-Datacenter-GPUs-vw.png)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.