In-depth Analysis of NVIDIA Alpamayo's Launch Reshaping the Autonomous Driving Industry Chain

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

NVIDIA’s Alpamayo series open-source AI models released at CES 2026 mark the entry of autonomous driving technology into a new “reasoning-based” era [1]. Its core breakthroughs include:

- Alpamayo 1 Model: A 10-billion parameter chain-of-thought reasoning visual-language-action (VLA) model that enables autonomous vehicles to think like humans and solve complex edge scenarios (e.g., navigating busy intersections with faulty traffic lights) [1]

- Open-Source Strategy: Code has been made public on the machine learning platform Hugging Face; researchers can access and retrain the model for free [2], which will significantly lower the industry’s R&D threshold

- Simulation Tools and Datasets: The accompanying simulation tools and datasets provide a complete solution for training physical robots and vehicles [1]

NVIDIA announced plans to

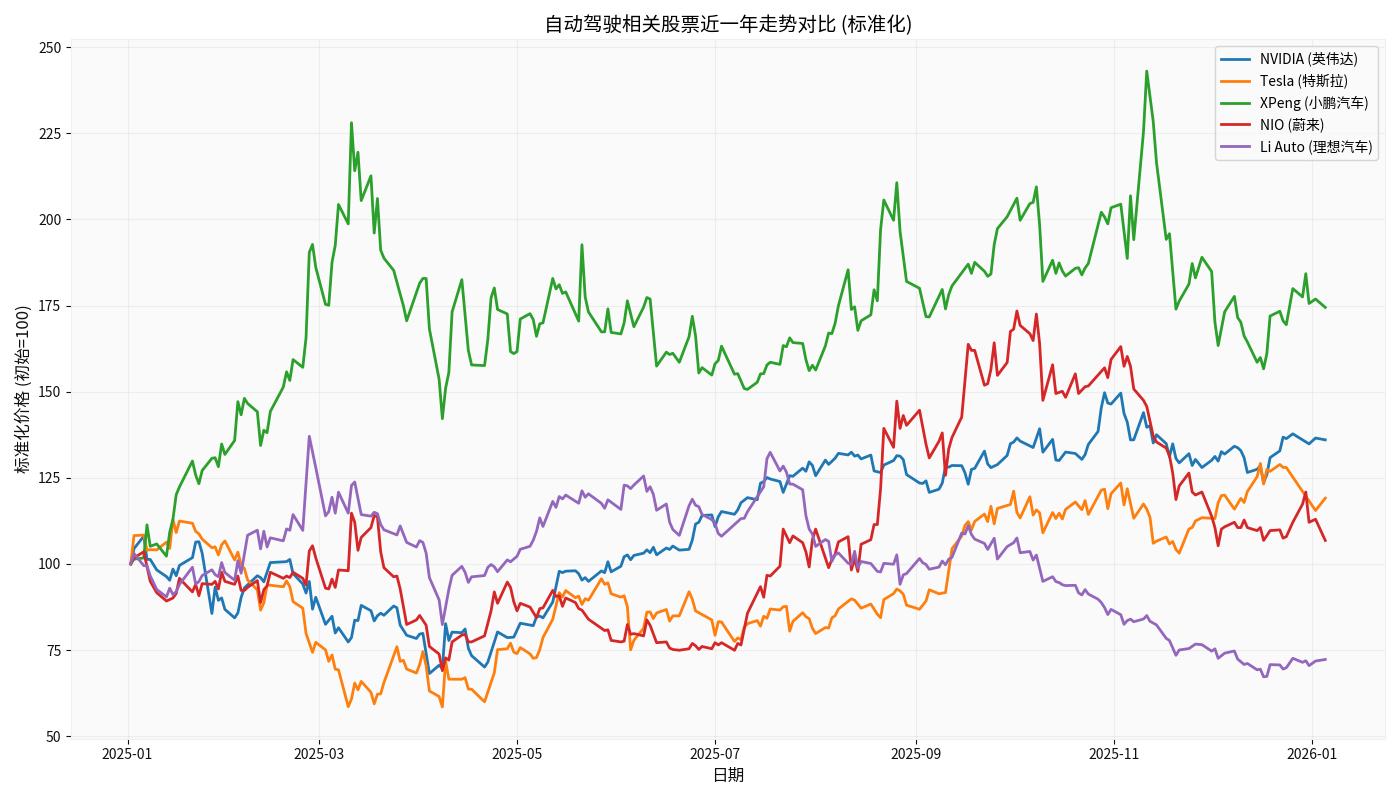

From a market performance perspective, autonomous driving-related stocks have shown significant differentiation over the past year [0]:

| Company | Total Return | Annualized Volatility | Maximum Drawdown |

|---|---|---|---|

| NVIDIA | 36.01% | 49.45% | -36.89% |

| XPeng | 74.46% | 67.14% | -37.66% |

| Tesla | 19.09% | 63.18% | -48.19% |

| NIO | 6.81% | 64.16% | -39.85% |

| Li Auto | -27.73% | 48.86% | -50.94% |

- XPengleads with a 74.46% increase, reflecting market recognition of its autonomous driving technology (XNGP)

- NVIDIA, as an underlying chip supplier, shows a steady 36% increase, reflecting its strong certainty as a “shovel seller”

- Li Auto’s negative growth (-27.73%) indicates market concerns about its autonomous driving technology reserves

-

Tesla: With a market capitalization of $1.45 trillion [0] and a P/E ratio as high as 237.72x, it reflects the market’s high expectations for its FSD (Full Self-Driving) technology. Musk has announced plans to launch Robotaxi services in 2026 [3]

-

XPeng: As the most aggressive company in autonomous driving technology among Chinese new forces, its 74% annual increase indicates market recognition of its technology-first strategy

-

Traditional car companies accelerate transformation: NVIDIA has collaborated with Mercedes-Benz to produce driverless CLA cars [2]; traditional luxury brands quickly fill technical gaps through partnerships

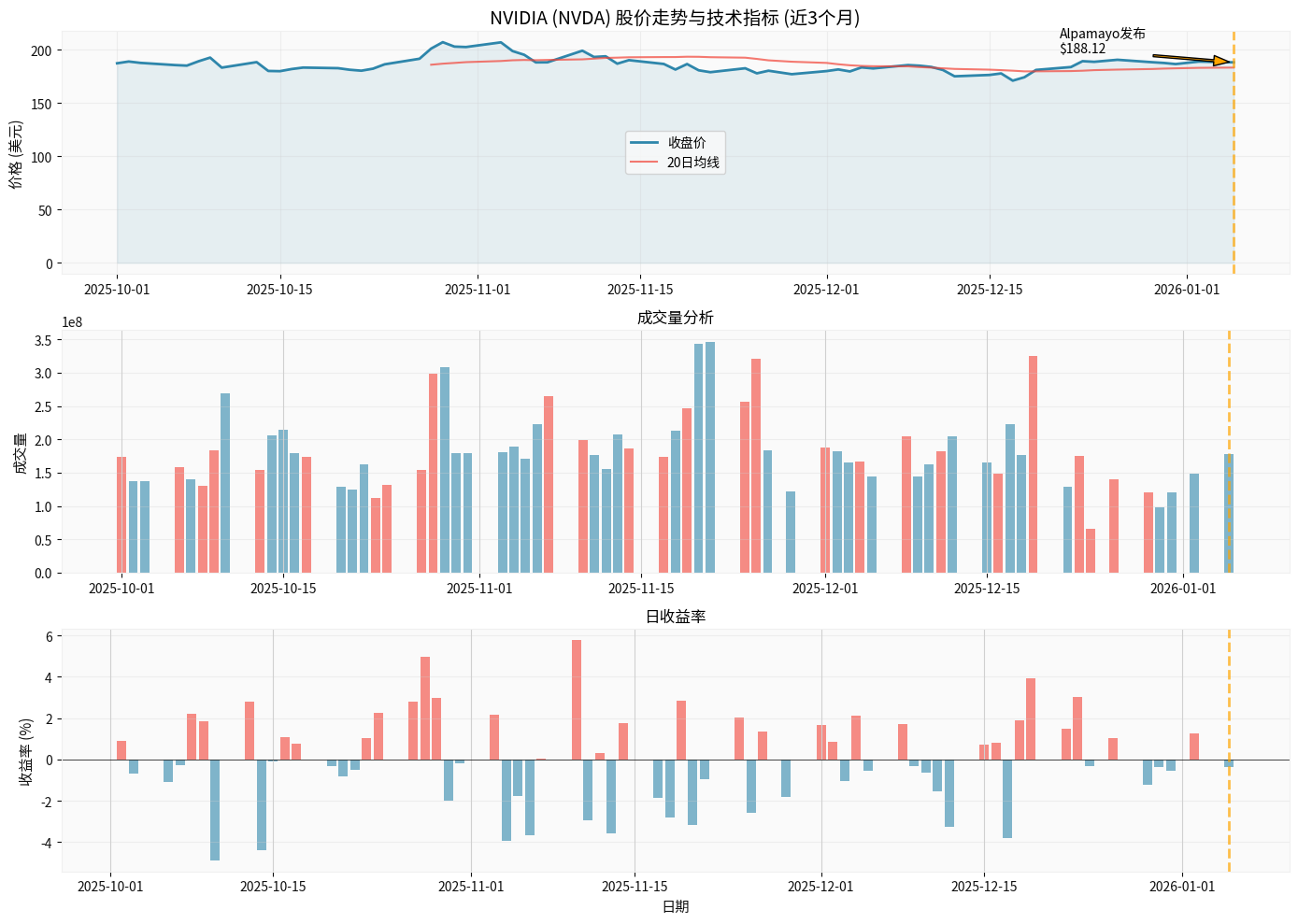

From NVIDIA’s technical analysis over the past 3 months [0]:

- Price operates above the 20-day moving average ($183.20)

- Peaked at $212.19 (52-week high) during the period

- Average trading volume reached 184 million shares, indicating high market attention

- Domain controller suppliers: Smart cockpit and domain controller manufacturers like Desay SV and Huayang Group

- Autonomous driving algorithm developers: Software integrators like Thundersoft

- Simulation testing service providers: Companies providing autonomous driving simulation testing

- High-precision map and positioning service providers: Map data providers necessary for L3/L4 levels

China’s Ministry of Industry and Information Technology has officially announced the

- Changan SC7000AAARBEV: Autonomous driving on highways and urban expressways in congested urban environments (max 50km/h), piloted on sections like Chongqing’s Inner Ring Road

- Arcfox BJ7001A61NBEV: Autonomous driving on highways and urban expressways (max 80km/h), piloted on sections like Beijing Daxing Airport Expressway

Aijian Securities’ research report points out that the

- Legal层面: Accident responsibility shifts from drivers to system suppliers, pushing car companies to strengthen technical reliability

- Business model: Car companies can charge for L3 functions, creating new revenue sources

- Competition pattern: Car companies with strong technical capabilities will form a positive cycle of “technology-market-profit”

- Baidu Apollo Go: Has reached cooperation with Uber and Lyft, planning tolaunch Robotaxi pilot projects in London in the first half of 2026[5]

- Waymo: Already operates Robotaxi services in cities like San Francisco and Phoenix

- Tesla: Plans to launch Robotaxi services in 2026 are highly concerned by the market

- Short-term (2025-2026): Chip suppliers, sensor manufacturers, simulation testing tools

- Mid-term (2026-2027): Domain controllers, autonomous driving algorithms, high-precision maps

- Long-term (2027-2030): Robotaxi operators, mobility service platforms

- Full-stack self-developed type: Tesla, XPeng, etc., which master core algorithms and data closed loops

- Deep cooperation type: Car companies that deeply cooperate with chip giants like NVIDIA and Mobileye

- Technology aggressive type: Car companies that take the lead in deploying L3 functions in mass-produced vehicles

- Brand premium increase: Autonomous driving technology becomes a core selling point for high-endization

- Software revenue growth: Subscription services like FSD/XNGP create recurring revenue

- Cost advantage expansion: Algorithm iteration speed determines the technical cost reduction curve

- Desay SV: Leading enterprise in smart cockpits and domain controllers

- Huayang Group: Automotive electronics system integrator

- Thundersoft: Leading intelligent operating system company

- Computing platforms: NVIDIA (Orin/Thor chips), Qualcomm, Horizon Robotics

- Sensors: Hesai Technology, RoboSense (lidar)

- Algorithms and simulation: Companies deeply integrated with open-source ecosystems like Alpamayo and optimized

- Deterministic market: Underlying chip suppliers like NVIDIA (“shovel sellers”)

- Growth market: Technology-leading new force car companies (XPeng, Tesla)

- Thematic market: Industry chain opportunities in the L3/L4 commercialization process

- 2025-2026: Mass production of L3 models ramps up, Robotaxi pilots expand

- 2027: NVIDIA’s L4 Robotaxi services go online, and the industry enters large-scale commercialization

- Technical risk: System reliability in complex scenarios remains to be verified

- Regulatory risk: Autonomous driving policy progress varies across countries

- Competition risk: Technology iteration speed determines long-term market share

- Valuation risk: Some targets’ valuations already reflect high expectations (e.g., Tesla’s P/E ratio of 237x)

NVIDIA Alpamayo’s release accelerates the paradigm shift of autonomous driving from

- Leading technical advantages: Master core algorithms or deeply bind chip giants

- Data closed-loop capability: Accumulate massive real road data through mass-produced fleets

- Ecosystem integration capability: Quickly integrate open-source models like Alpamayo and optimize

- Commercial landing capability: Quickly seize the market during the L3 access policy window

During the accelerated development period of the Robotaxi industry, investment opportunities will be transmitted step by step along the industry chain of “chip-algorithm-vehicle-operation”, focusing on the key time window from 2025 to 2027.

[0] Gilin AI System Data (stock prices, financial data, technical analysis)

[1] TechCrunch - “Nvidia launches Alpamayo, open AI models that allow autonomous vehicles to ‘think like a human’” (https://techcrunch.com/2026/01/05/nvidia-launches-alpamayo-open-ai-models-that-allow-autonomous-vehicles-to-think-like-a-human/)

[2] CNBC - “Nvidia plans to test a robotaxi service in 2027 in self-driving push” (https://www.cnbc.com/2026/01/05/nvidia-plans-to-test-a-robotaxi-service-in-2027-in-self-driving-push.html)

[3] BBC - “Nvidia unveils ‘reasoning’ AI technology for self-driving cars” (https://www.bbc.com/news/articles/c0jv1vd571wo)

[4] Yahoo Finance Hong Kong - “China’s first batch of L3 autonomous driving vehicle products获得准入许可” (https://hk.finance.yahoo.com/news/中國首扻l3級自動駕駛車型產品獲得准入許可-080609471.html)

[5] Wall Street Journal - “Uber, Lyft Tie Up With Baidu for U.K. Robotaxi Tests Next Year” (https://www.wsj.com/business/autos/uber-lyft-tie-up-with-baidu-for-u-k-robotaxi-tests-next-year-5f093333)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.