Analysis of the Impact of GAC Honda's Production Suspension Extension on GAC Group and Semiconductor Supply Chain Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will provide you with a comprehensive analysis of the impact of GAC Honda’s production suspension extension on GAC Group and semiconductor supply chain risks.

According to the latest news, Honda Motor announced on January 5, 2026, that it will extend the production suspension of three joint venture factories in China by two weeks until January 19, 2026 (originally planned to resume production on January 5) [1]. All three factories are jointly operated by GAC Group and Honda Motor. The suspension is due to semiconductor supply shortages, combined with production line technical renovation factors.

Based on historical data and industry experience, the total annual capacity of the three GAC Honda joint venture factories is approximately 600,000-700,000 units. A two-week suspension (10 working days) will result in a production loss of approximately 23,000-27,000 units. Although Honda stated that it expects to recover the lost production throughout the year and not affect customer deliveries [2], it will still cause:

- Short-term Revenue Impact:Based on GAC Honda’s average unit price of 120,000-150,000 yuan, this suspension will lead to a revenue loss of approximately 2.8-4 billion yuan.

- Q1 Performance Pressure:The suspension period exactly covers January 2026, which will directly pressure GAC Group’s Q1 performance.

GAC Honda, as a joint venture between GAC Group and Honda Motor, adopts a 50:50 equity structure (or other agreed ratio). This means:

- GAC Group must bear the corresponding capacity loss.

- Joint venture profits will be directly affected.

- It highlights the risk-sharing mechanism of the supply chain under the joint venture model.

According to brokerage API data [0], GAC Group’s current financial status shows the following characteristics:

| Financial Indicator | Value | Status Assessment |

|---|---|---|

| Net Profit Margin (TTM) | -3.61% | △ Loss Status |

| ROE (TTM) | -3.21% | △ Negative Shareholder Return |

| P/E Ratio | -23.23x | △ Weak Profitability |

| P/B Ratio | 0.76x | ✓ Book Value Support |

| Current Ratio | 1.23 | ✓ Acceptable Short-term Solvency |

- 2026 Q1 Performance Pressure:After consecutive losses, the suspension will lead to further declines in Q1 revenue and profits.

- Full-Year Profit Expectation Downgrade:Although Honda stated that production can be recovered, the high uncertainty of the semiconductor supply chain means that the full-year performance target faces downward revision risks.

- Cash Flow Pressure:Fixed costs continue to incur during the suspension, which will affect operating cash flow.

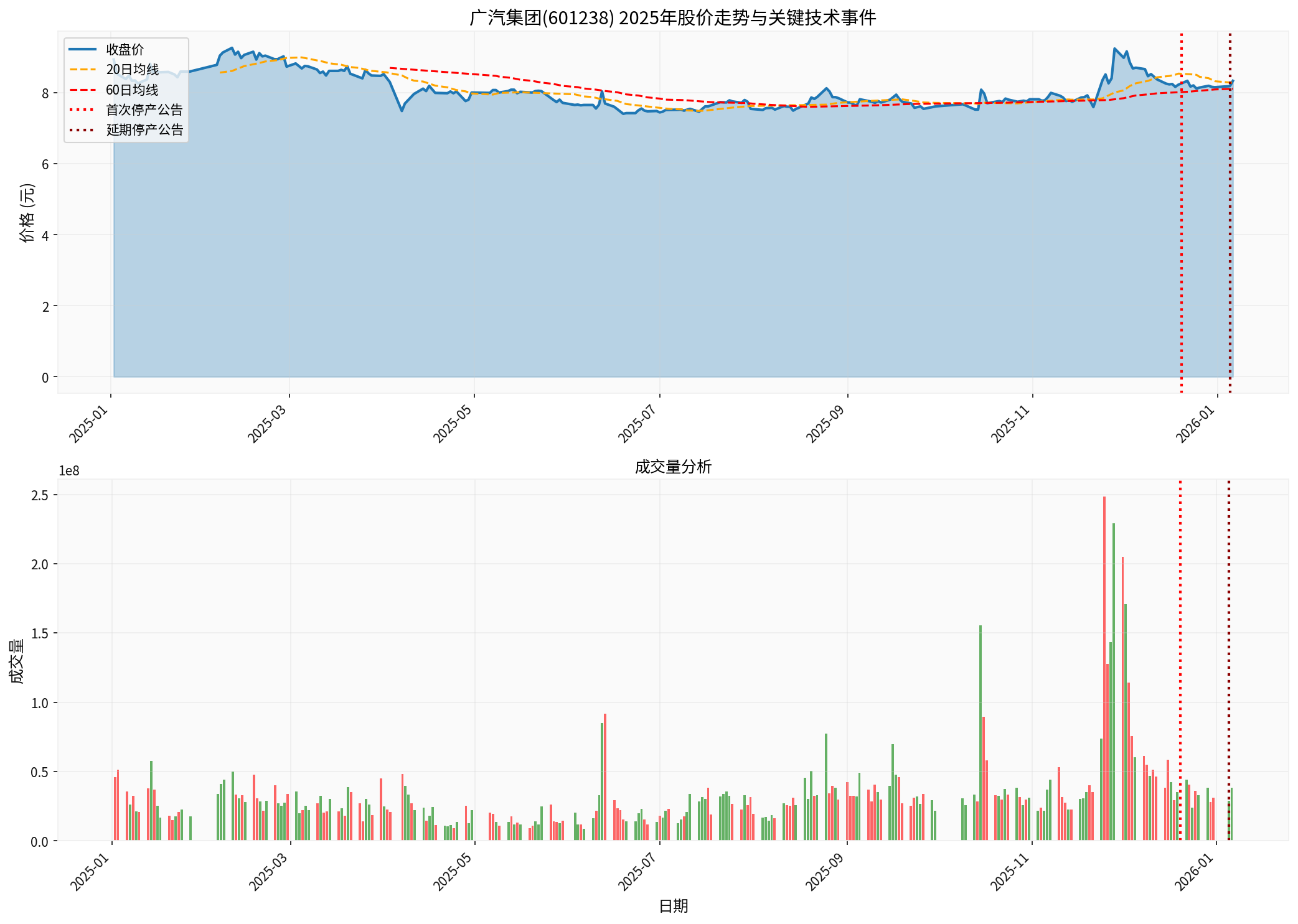

- X-axis: Trading dates from January 2025 to January 2026

- Y-axis (upper chart): Stock price (yuan), showing closing price, 20-day moving average (orange), 60-day moving average (red)

- Y-axis (lower chart): Trading volume, red bars represent down days, green bars represent up days

- Vertical dashed lines: December 20, 2025 (first suspension announcement) and January 5, 2026 (extension announcement)

- Key Observation: The stock price showed volatile trends after the suspension news and is currently in a sideways consolidation phase.

- Absolute Valuation:Market capitalization of 74.88 billion USD (approximately 530 billion yuan), P/B 0.76x.

- Relative Valuation:A 24% discount to book value, reflecting market concerns about its profitability.

- Technical Aspect:Beta coefficient of 0.53, lower than the market benchmark (Shanghai Composite Index 000001.SH), indicating low stock price volatility.

- Trend Judgment:In a sideways consolidation state, with a trading range of [8.25, 8.43] yuan, lacking a clear direction.

- Negative Sentiment Transmission:The extension news may intensify investors’ concerns about the profitability of joint ventures.

- Valuation Pressure:The P/E ratio is already negative, and the suspension will further lower 2026 profit expectations.

- Relative Performance:May underperform industry competitors (such as BYD, Geely Auto and other independent brands).

- Supply Chain Risk Assessment:If semiconductor shortages persist, the market may re-evaluate GAC Group’s profit recovery timeline.

- Re-pricing of Joint Venture Dependence:The market may give lower valuation multiples to companies with high joint venture dependence.

- Transformation Value Discovery:The rapid growth of independent brands (GAC Aion) may partially offset the negative impact of joint ventures.

-

High Concentration of Chip Suppliers:

- Nexperia (a Dutch subsidiary of Wingtech Technology) is an important automotive chip supplier.

- Its delivery delays have caused production cuts for multiple automakers.

- The risk of “single point of failure” in the supply chain is significant.

-

Geopolitical Risks:

- The semiconductor supply chain involves multiple countries and regions.

- Policy changes in the U.S., China, and the EU may affect supply stability.

- Trade barriers and technical export controls increase uncertainty.

-

Structural Imbalance:

- AI chip demand has surged, squeezing automotive chip production capacity.

- Automotive chips have relatively low prices, making wafer fabs prioritize them less.

- The capacity expansion cycle is long (18-24 months), which cannot be resolved in the short term.

- Repeat Suspension Record:This is the latest in multiple production suspensions due to chip shortages (North American factories also suspended production in October-November 2025) [1].

- Global Supply Chain Dependence:Honda is affected by chip shortages globally, indicating weak supply chain risk resistance.

- Joint Venture Model Constraints:Joint ventures have low flexibility in supply chain adjustments and require consensus between both parties.

- Relatively Strong Supply Chain Resilience:Toyota has performed relatively well in the chip crisis through JIT (Just-In-Time) model optimization and supplier diversification management.

- Technical Reserve Advantage:Hybrid technology reduces dependence on advanced process chips.

- But Risks Remain:2025 Q1 financial reports show that Toyota and Honda both expect profit declines due to U.S. tariffs and yen appreciation [4].

- Electrification Transformation Pressure:Nissan lags behind in electrification, and chip demand will increase significantly during the transformation process.

- Brand Power Decline:Competitiveness in the Chinese market has declined, and market share is being squeezed by independent brands.

According to a Goldman Sachs research report [5], the Chinese automotive industry will face:

- The number of new energy vehicle models launched will reach 119, leading to fierce competition.

- Domestic passenger car sales are expected to shift from +4% in 2025 to -2% in 2026.

- New energy vehicle sales growth will slow from 18% to 11%.- Supply Chain Risk Resistance:Independent brands have stronger risk resistance through vertical integration and local supply chain construction.

- Geopolitical Risk Exposure:Japanese joint ventures are highly dependent on Japanese global supply chains, with large geopolitical risk exposure.

- Electrification Transformation Lag:Japanese automakers are more vulnerable under the dual pressure of “growing chip demand + declining traditional model sales” due to their lag in electrification transformation.

| Impact Dimension | Short-term (1-3 Months) | Mid-term (3-12 Months) | Long-term (1-3 Years) |

|---|---|---|---|

Production Volume |

Loss of 23,000-27,000 units | Depends on semiconductor supply recovery | Need to establish a more stable supply chain |

Revenue |

2.8-4 billion yuan loss | Q1 performance pressure, full-year target downgrade risk | Need to rely on independent brand growth to compensate |

Profit |

Q1 loss may expand | Full-year profit forecast downgrade | Need to optimize joint venture structure |

Cash Flow |

Fixed costs continue to outflow | Increased investment in independent brands | Need to improve capital structure |

- Assumption:Semiconductor supply returns to normal in Q2, and the full-year production target is achieved.

- Impact:Stock price remains volatile, valuation stabilizes at current levels (P/B 0.7-0.8x).

- Key Variable:Sales of independent brands (GAC Aion) exceed expectations.

- Assumption:Semiconductor shortages persist until mid-2026, and the full-year sales target is downgraded by 5-10%.-Impact:Stock price is under pressure, valuation is further downgraded to P/B 0.6-0.7x.

- Key Variable:Joint venture market share further declines.

- Assumption:The supply chain crisis persists throughout the year, and similar problems occur in other Japanese joint ventures.

- Impact:Stock price falls sharply, valuation drops below P/B 0.5x.

- Key Variable:Industry competition intensifies leading to price wars, and gross profit margin further deteriorates.

- Rating:Hold/Neutral

- Reasons:

- The short-term negative impact of the suspension event is clear.

- Financial data already shows losses, and Q1 performance may further deteriorate.

- The technical aspect is in sideways consolidation, lacking a clear direction.

- It is recommended to wait for clear signals of semiconductor supply recovery.

- Rating:Conditionally Positive

- Key Observation Indicators:

- Sales growth and profitability of GAC Aion.

- Changes in joint venture market share.

- Progress of semiconductor supply chain recovery.

- Performance recovery in Q2-Q3 2026.

- Rating:Long-term Holding Value

- Investment Logic:

- P/B 0.76x provides a safety margin.

- The success of independent brands (GAC Aion) is key to valuation repair.

- Joint ventures still have profit recovery space if they can optimize the supply chain.

- Semiconductor shortages may persist, leading to further extension of suspension time.

- Other joint ventures may also have similar problems, affecting overall profits.

- Recommendation:Closely monitor supply chain recovery signals and industry dynamics.

- Independent brands (BYD, Geely, Xpeng, etc.) are seizing market share [5].

- New energy vehicle price wars compress profit margins.

- Recommendation:Focus on market share changes of GAC Group and joint ventures.

- Continuous losses lead to cash flow pressure.

- Independent brand R&D and capacity investment require large amounts of capital.

- Recommendation:Focus on the company’s cash flow status and financing needs.

- Adjustments to new energy vehicle subsidy policies.

- Changes in joint venture equity ratio policies.

- Recommendation:Focus on policy trends and their impact on the company.

GAC Honda’s production suspension extension event is a typical case of the impact of the semiconductor supply chain crisis on Japanese joint venture automakers. Although Honda stated that it can recover full-year production, the event exposes the structural weaknesses of joint ventures in supply chain management and risk resistance.

- Clear Short-term Negative Impact:Q1 2026 performance is under pressure, and the stock price may remain volatile.

- High Mid-term Uncertainty:Depends on semiconductor supply recovery; industry dynamics need to be closely monitored.

- Long-term Depends on Transformation:The success of independent brands (GAC Aion) is key to valuation repair.

- Industry Structural Changes:Japanese joint ventures face systematic challenges to their competitiveness in the Chinese market.

[0] Gilin API Data - GAC Group (601238.SS) Financial Data, Market Data, Technical Analysis

[1] Reuters - “Honda extends China plants suspension on chip shortage” (2026-01-05)

https://www.reuters.com/business/autos-transportation/honda-extends-china-plants-suspension-chip-shortage-2026-01-05/

[2] Web Search Results - Reports on GAC Honda’s Production Suspension

[3] Automotive World - “More automotive value chain strain expected in 2026”

https://www.automotiveworld.com/articles/more-automotive-value-chain-strain-expected-in-2026/

[4] Yahoo Finance/Bloomberg - “Toyota, Honda brace for profit falls as US tariffs, strong yen weigh” (2025-08)

https://finance.yahoo.com/news/toyota-honda-brace-profit-falls-032902090.html

[5] Goldman Sachs Research Report - “[Institutional Report] Goldman Sachs Expects Continued Competition in China’s Auto Industry in 2026”

https://hk.finance.yahoo.com/news/goldman-goldman-expects-continued-competition-china-auto-industry-2026-01211-hk-084537211.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.