In-depth Analysis of PMGC Holdings Reverse Stock Split

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

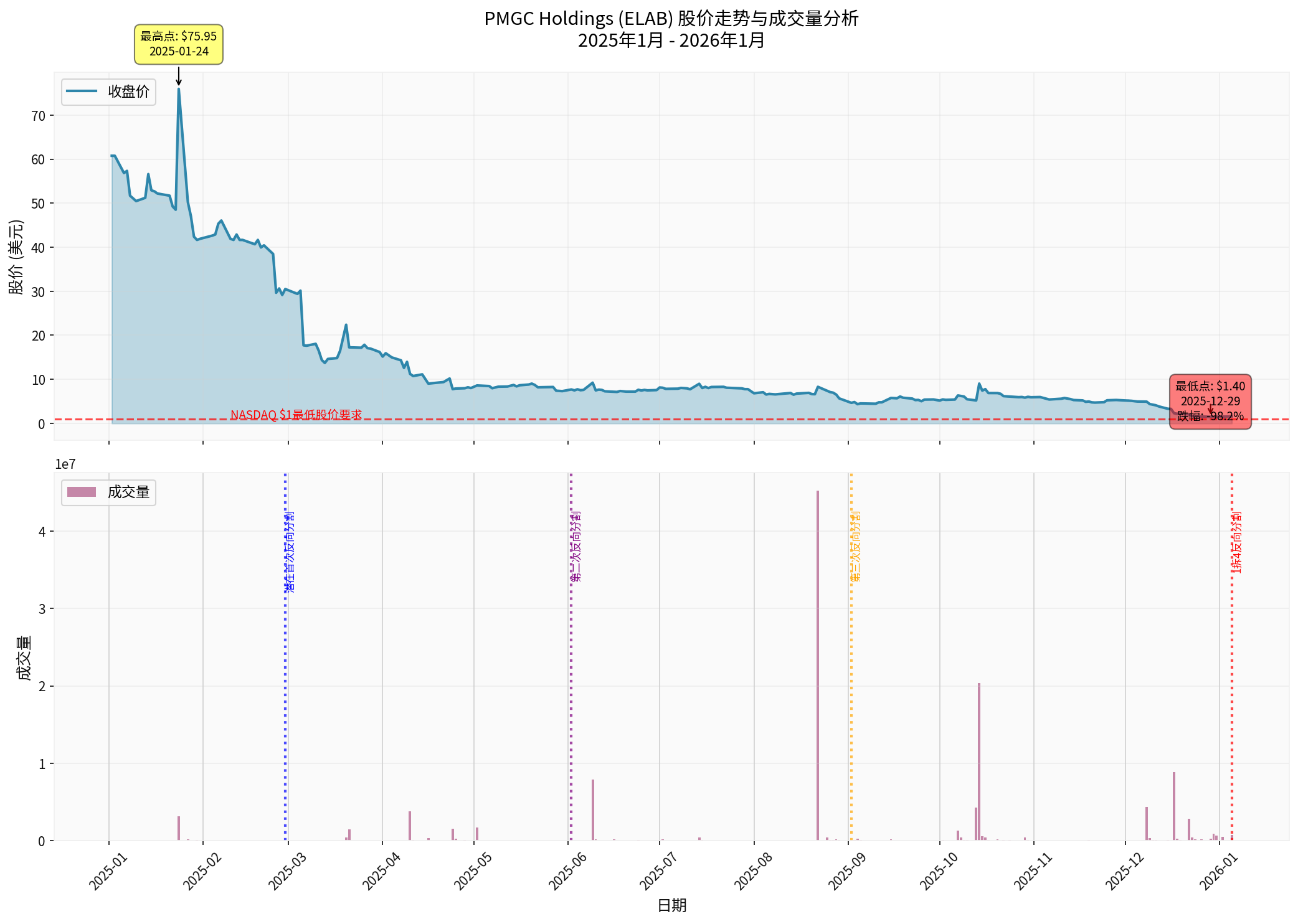

Based on the latest data and market information, PMGC Holdings (ELAB)'s 1-for-4 reverse stock split indeed reflects the severe financial challenges facing the company. Here is a comprehensive analysis:

NASDAQ requires listed companies to maintain a minimum bid price (buy price) of $1 per share. When a stock trades below $1 for 30 consecutive trading days, the company will receive a delisting warning notice [1]. Reverse split is the main method for the company to regain compliance:

- Pre-split status: The stock price has fallen to $1.42 (even as low as $1.40 at the end of December 2025), approaching the delisting threshold [0]

- Post-split expectation: Theoretically, the stock price will rise to approximately $5.68 ($1.42 ×4), moving away from delisting risk [1]

According to brokerage API data, ELAB had only about

- Pre-split: Approximately 2,014,852 shares

- Post-split: Approximately 503,713 shares

- Adjustment scope: Issued and authorized shares are split 1-for-4 simultaneously [1]

Web searches show that ELAB has conducted

According to financial analysis data, ELAB faces multiple financial crises:

| Key Indicator | Value | Interpretation |

|---|---|---|

Market Capitalization |

$683,000 | Extremely micro-cap company with very high liquidity risk [0] |

Return on Equity (ROE) |

-50.79% | Severe losses, shareholder value destroyed [0] |

Price-to-Book Ratio (P/B) |

0.10x | Market price is only 10% of book value; market is extremely pessimistic [0] |

1-Year Stock Performance |

-97.17% | Nearly complete collapse; investors suffered heavy losses [0] |

3/5-Year Stock Performance |

-99.99% | Long-term value almost zero [0] |

Free Cash Flow |

-$5.49 million | Continuous capital outflow; viability is questionable [0] |

- Q3 2025: Loss per share of $4.95, revenue of only $286,000 [0]

- Q2 2025: Loss per share of $1.61

- Q1 2025: Loss per share of $2.90, revenue of only $152,000 [0]

The loss magnitude deteriorated sharply in Q3 2025, indicating that business fundamentals are still worsening.

-

Waterfall-like Decline: After reaching a peak of $75.95 on January 24, 2025, the stock price plummeted to a low of $1.40, with a drop of up to98.2%during this period [0]

-

Reverse Split Signals: The vertical dashed lines in the chart mark potential reverse split points in March, June, and September 2025, indicating that the company repeatedly uses this tool

-

Abnormal Trading Volume: The average daily trading volume reaches 490,000 shares, which is extremely high relative to the total outstanding shares of 500,000, indicating speculative trading rather than long-term investment [0]

-

Current Technical Status:

- The stock price is in a consolidation state with no obvious trend [0]

- Support level: $1.42

- Resistance level: $2.71

- KDJ indicator shows a short-term oversold rebound signal [0]

- Number of Shares Held: Every 4 shares become 1 share

- Theoretical Market Value: Remains unchanged (100 shares × $1.42 = $142 before split; 25 shares × $5.68 = $142 after split)

- Voting Rights: The shareholding ratio remains unchanged, and voting rights are not affected

| Risk Type | Specific Impact |

|---|---|

Liquidity Risk |

Outstanding shares decrease from 2 million to 500,000; trading may become thinner, and bid-ask spreads may widen |

Market Confidence |

Reverse split is regarded by the market as a “value destruction signal”; historical data shows that the stock price continues to fall after multiple splits [1] |

Financing Capacity |

Micro-capitalization and continuous losses will severely limit future equity financing capacity |

Institutional Avoidance |

Most institutional investors have minimum stock price and market capitalization thresholds; reverse split may lead to further reductions by institutions |

-

Reverse Split Dependence: Multiple reverse splits in 2025 [1], indicating that the company cannot support the stock price through business improvement

-

Extreme Valuation Levels:

- A P/B ratio of 0.10x means the market believes the company’s asset value is severely overestimated

- If the company liquidates, shareholders may only recover 10% of their investment

-

Going Concern Doubts:

- Free cash flow remains negative (-$5.49 million) [0]

- Extremely small revenue scale (only $286,000 in Q3) [0]

- Widening loss magnitude (loss per share of $4.95 in Q3) [0]

-

Delisting Risk Not Fundamentally Resolved:

- Even if the stock price is compliant in the short term after the split, if fundamentals do not improve, the stock price may fall below $1 again

- According to NASDAQ rules, if a company has conducted a cumulative reverse split of 200:1 or higher in the past two years, it will not be eligible for a new compliance period, and delisting proceedings will start immediately [2]

| Investor Type | Recommendation |

|---|---|

Long-term Value Investors |

Avoid : Fundamentals have deteriorated severely, no clear path to turn losses around |

Short-term Traders |

Extremely High Risk : Poor liquidity, high volatility; only suitable for those with extremely high risk tolerance |

Existing Shareholders |

Evaluate Exit : Consider stop-loss or reduce positions unless the company announces a specific transformation plan |

- Q4 2025 Financial Report(expected in March 2026): Focus on whether it achieves break-even

- Cash Flow Improvement: Clear path to positive free cash flow

- New Business Progress: Revenue contribution from the aerospace and biotech businesses mentioned by the company

- Stock Price Maintenance Capability: Whether it can stay above $1 for 180 days after the split (NASDAQ compliance requirement)

PMGC Holdings’ 1-for-4 reverse stock split is

[0] Jinling API Data - ELAB Real-time Quotes, Company Profile, Financial Analysis, Historical Price Data (2025-2026)

[1] StockTitan - “PMGC Holdings Inc. Announces Anticipated Reverse Stock Split” (https://www.stocktitan.net/news/ELAB/pmgc-holdings-inc-announces-anticipated-reverse-stock-oakx2sjmdrph.html)

[2] Akerman LLP - “SEC Approves Changes to NYSE and Nasdaq Minimum Price Rules” (https://www.akerman.com/en/perspectives/sec-approves-changes-to-nyse-and-nasdaq-minimum-price-rules-what-public-companies-need-to-know.html)

[3] Globe Newswire - “PMGC Holdings Inc. Announces Reverse Stock Split Effective January 6, 2026” (https://www.globenewswire.com/news-release/2026/01/06/3213298/0/en/PMGC-Holdings-Inc-Announces-Reverse-Stock-Split-Effective-January-6-2026.html)

[4] Quiver Quantitative - “PMGC Holdings Inc. Announces 1-for-4 Reverse Stock Split Effective January 6, 2026” (https://www.quiverquant.com/news/PMGC+Holdings+Inc.+Announces+1-for-4+Reverse+Stock+Split+Effective+January+6%2C+2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.