In-depth Analysis of Sector Rotation and Sustainability of Capital Flows in the Hong Kong Stock Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

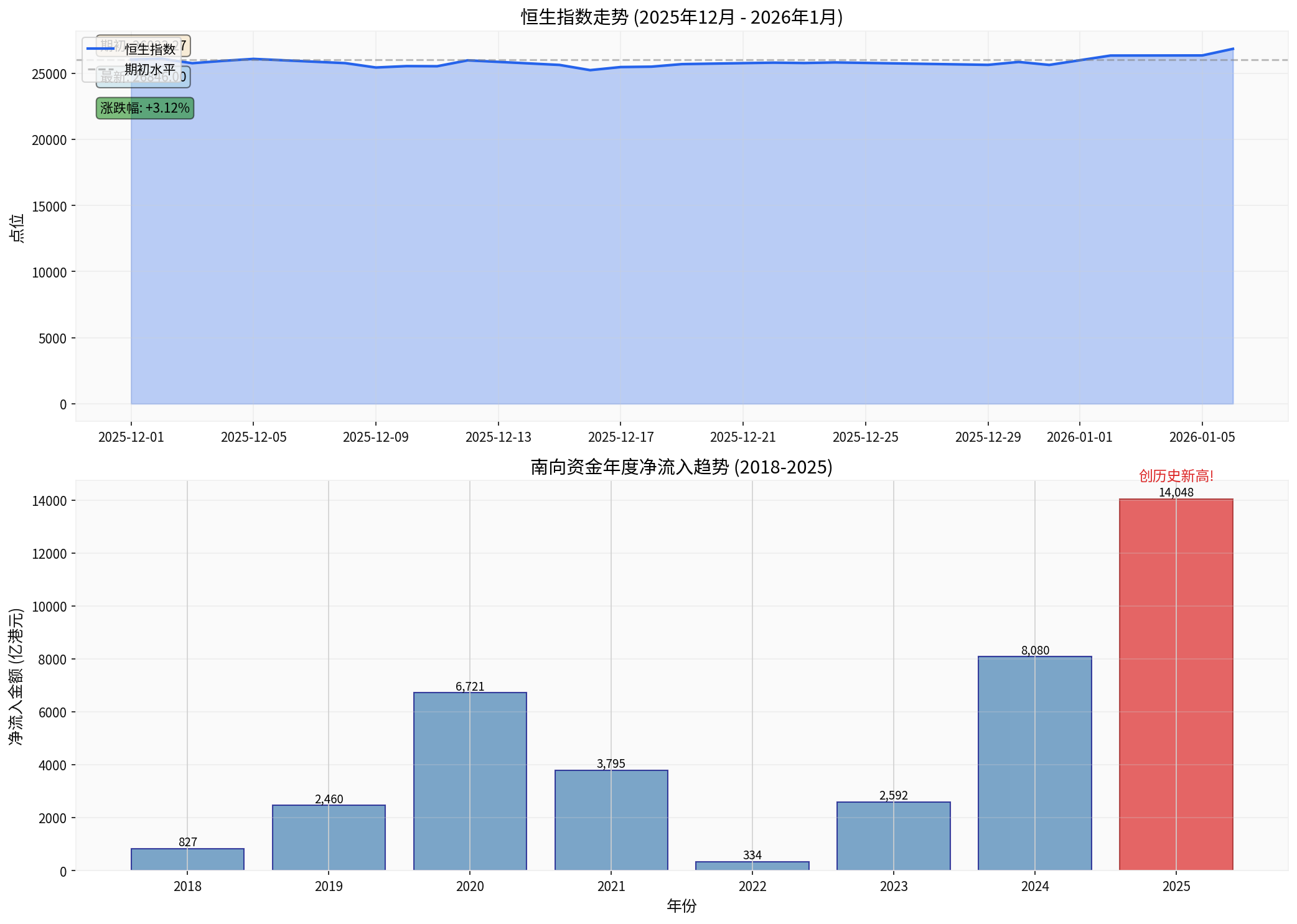

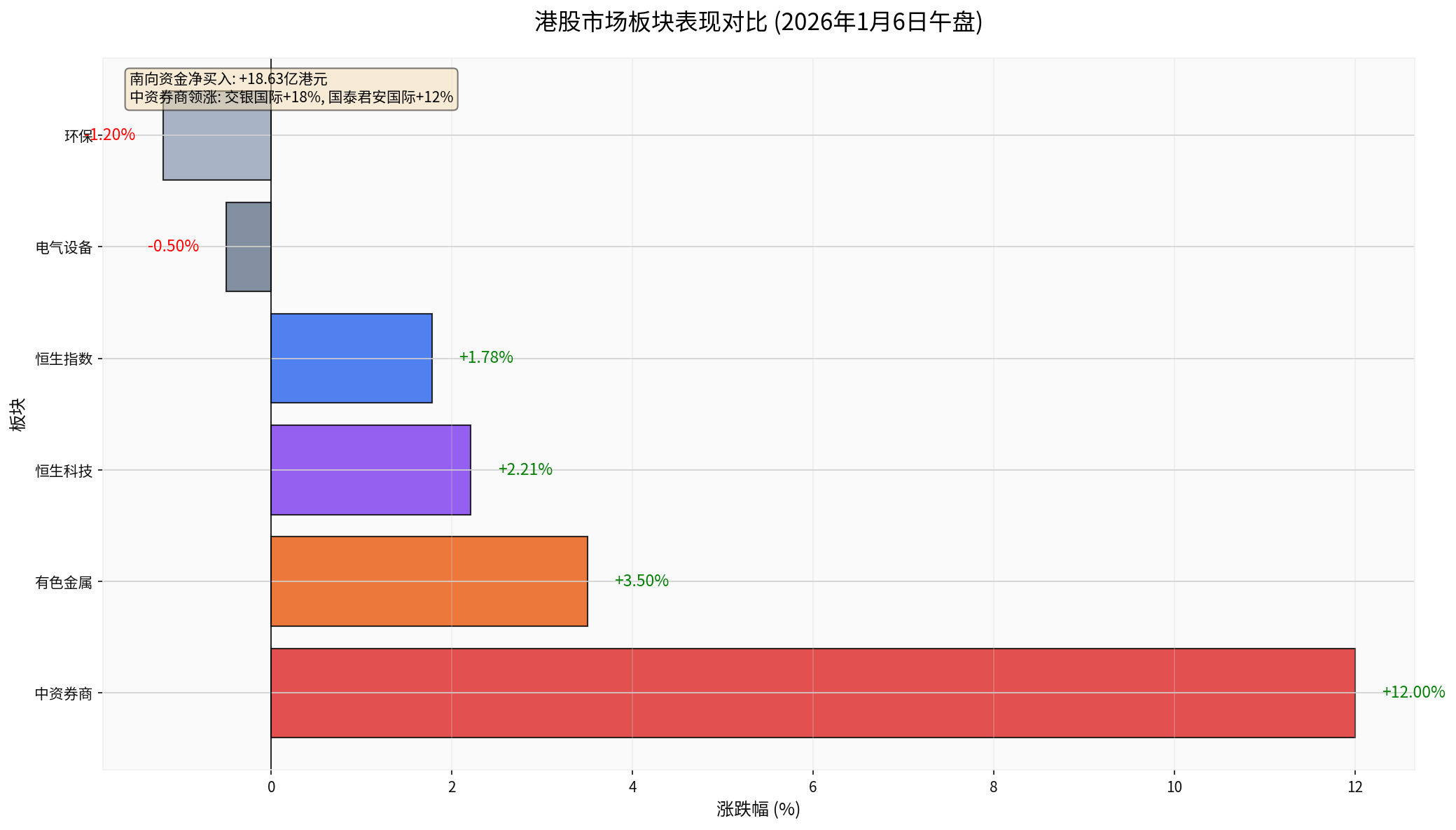

As of midday closing on January 6, 2026, the Hang Seng Index closed at 26,844 points, up 1.89%[0], and the Hang Seng Tech Index rose 2.21%. Since December 2025, the Hang Seng Index has increased by 3.12%, showing a steady upward trend [Chart 1]. The Hang Seng Index is currently in the upper-middle range of its 52-week interval (18,671-27,382)[0], with a healthy technical pattern.

- BOCOM International (3366.HK)rose more than 18%. Although the stock fell 9.09% in December, today’s strong rebound indicates active capital intervention[0]

- Guotai Junan International (1788.HK)rose more than 12%. The stock has increased by 5.67% in December, showing a continuous strengthening trend[0]

- Driving Factors:

- In the first three quarters of 2025, 46 comparable listed brokerages achieved a net profit of RMB 179 billion, a year-on-year increase of 62%, with brokerage and proprietary trading businesses being the main growth drivers[1]

- As the blocking points for medium and long-term capital to enter the market are gradually cleared, the allocation demand for funds such as social security, insurance, and wealth management is expected to be released. Brokerages will play a key intermediary role in serving the financing of new productive forces and promoting “long-term capital for long-term investment”[1]

- The overall valuation repair space of the brokerage industry is worth looking forward to[1]

- Benefiting from improved global macroeconomic expectations and rising commodity prices

- Leading non-ferrous metal stocks such as Zijin Mining performed brightly in 2025[1]

- Reflecting the intensified internal differentiation in the market

- May be related to short-term profit-taking and sector rotation

- Valuation Advantage:The overall valuation of the Hong Kong stock market is still at a relatively low level, and the AH Premium Index provides arbitrage space for southbound capital[1]

- Dividend Yield Advantage:The high dividend strategy continues to attract long-term funds such as insurance capital. Data shows that the financial industry became the largest net inflow sector of southbound capital on the day, attracting RMB 3.188 billion in a single day[1]

- Profit Improvement:The profitability of Hong Kong-listed companies generally improved in 2025, providing fundamental support for stock prices

- Optimization of Interconnection Mechanism:Hong Kong Stock Connect has become an important link between the mainland and Hong Kong markets. After enterprises are included in Hong Kong Stock Connect, liquidity and valuation are expected to be improved, forming a virtuous cycle of “listing → inclusion in Hong Kong Stock Connect → improved liquidity → valuation repair”[1]

- Medium and Long-Term Capital Entry:The allocation demand for medium and long-term funds such as social security, insurance, and wealth management continues to be released

- Domestic Liquidity Easing:Against the background of interest rate cuts at home and abroad, southbound capital is expected to maintain a net inflow trend in 2026[1]

- Shift in Residents’ Asset Allocation:After further domestic interest rate cuts, the profit-making effect of the stock market is expected to drive residents’ deposits to continue to move, and retail capital entry is also expected to become an incremental capital source for Hong Kong stocks in the future[1]

- High Short-Term Sustainability:The current valuation of the brokerage sector is still in a reasonable range. With the increase in market trading activity and the development of business diversification, profitability is expected to continue to improve

- Medium and Long-Term Highlights:As intermediaries in the capital market, brokerages will directly benefit from the “long-term capital for long-term investment” policy and the growth in financing demand for new productive forces

- High Correlation with Macroeconomy:If the global economy continues to recover, demand for non-ferrous metals will remain strong

- Cyclical Fluctuation Risk:Need to pay attention to commodity price fluctuations and changes in supply and demand relationships

- Outstanding Long-Term Allocation Value:Insurance capital’s enthusiasm for “sweeping” dividend assets in Hong Kong stocks continues to rise[1]

- Stable Income Attribute:In an environment of falling interest rates, high dividend assets are scarce

Many institutions believe that with the continuous improvement of macroeconomic fundamentals and the continuous implementation of industrial policies, the Hong Kong stock market is expected to continue its steady operation[1]. Specifically:

- Southbound Capital:Expected to continue the net inflow trend in 2026, with market discourse power continuing to rise[1]

- Foreign Capital Flow:The start of the Federal Reserve’s interest rate cut cycle will bring incremental funds to emerging markets, and foreign capital will selectively allocate based on industry prosperity and corporate fundamentals[1]

- Investment Themes:Fields related to technological innovation and high-end manufacturing are still expected to be the core themes of market attention[1]

- Pay attention to the catch-up opportunities in the Chinese brokerage sector, focusing on leading brokerages with strong certainty of performance growth

- Seize the phased opportunities in the non-ferrous metals sector, but need to control positions

- Focus on allocating to high dividend sectors (finance, energy, utilities) to enjoy stable dividend income

- Layout in the technology growth sector, focusing on leading companies in sub-fields such as artificial intelligence, semiconductors, and new energy

- Pay attention to targets with large AH premiums, and seize the valuation repair opportunities brought by sustained inflow of southbound capital

- Global macroeconomic downturn risk

- Geopolitical uncertainty

- Unexpected tightening of Federal Reserve monetary policy

- The brokerage sector is greatly affected by market trading activity; need to pay attention to changes in market turnover

- The non-ferrous metals sector has cyclical fluctuation risks

- High dividend sectors need to be alert to valuation pressure brought by rising interest rates

Overall, the sector rotation and capital flows in the Hong Kong stock market have strong sustainability:

-

Southbound Capital Inflow Trend Established:The record-high net inflow amount in 2025 and the continuous increase in market discourse power indicate that southbound capital has become an important pricing force in the Hong Kong stock market. Driven by multiple factors such as valuation advantages, policy support, and adequate capital, southbound capital is expected to continue to flow in 2026[1].

-

Clear Logic of Sector Rotation:The outbreak of the Chinese brokerage sector has fundamental support, the strength of high dividend sectors meets the allocation needs of long-term funds, and the strength of the non-ferrous metals sector benefits from improved macroeconomic expectations.

-

Market Ecology Remodeling:The Hong Kong stock market is forming a new pattern of “domestic capital leading, foreign capital following”[1]. The continuous inflow of southbound capital not only brings liquidity but also reshapes the market’s valuation logic.

[0] Gilin API Data

[1] China Securities Journal - “Dividend Yield Advantage of Hong Kong Stock Connect Dividend Low Volatility ETF Target Index is Prominent” (https://www.cs.com.cn/tzjj/etf/202601/t20260106_6531807.html)

[1] Securities Times - “Epic Net Purchase of Southbound Capital, Exceeding HK$1.4 Trillion for the Whole Year” (https://www.stcn.com/article/detail/3568902.html)

[1] Caifuhao - “Hello! Hong Kong Stocks” (https://caifuhao.eastmoney.com/news/20260103151945639500700)

[1] Securities Times - “Just Now! Brokerage Stocks Suddenly Burst!” (https://www.stcn.com/article/detail/3573127.html)

[1] AAStocks - “New China Life Insurance and China Pacific Insurance Stock Prices Continue to Hit Historical Highs” (http://www.aastocks.com/sc/stocks/analysis/china-hot-topic-content.aspx?id=YLC6099711N&source=YOULIAN&catg=4)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.