Can Wegovy Oral Replicate Injectable's Commercial Success? Novo Nordisk Weight Loss Drug Competitive Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Novo Nordisk officially launched the oral version of Wegovy (semaglutide 25mg tablets) in the United States on January 5, 2026, which is the world’s first oral GLP-1 receptor agonist approved for weight loss [1]. The product has the following key features:

- First-mover Advantage:Becomes the first oral GLP-1 weight loss drug to hit the market, leading Eli Lilly’s orforglipron by approximately 1-2 years

- Significant Efficacy:Clinical trials show an average weight loss of 16.6%, comparable to the injectable version of Wegovy [2]

- Affordable Pricing:Monthly cost ranges from $149 to $299, more accessible than the injectable version

- Patient Preference:Addresses the fear of injections in approximately two-thirds of patients [3]

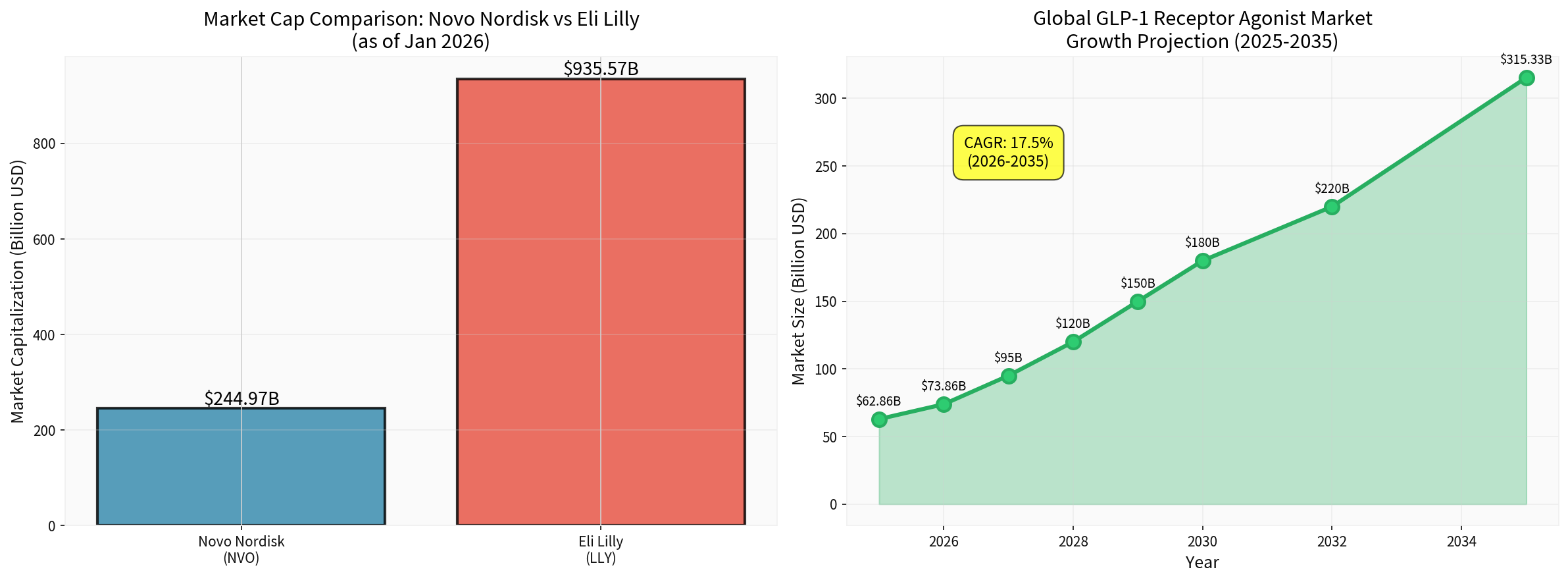

- The global GLP-1 market is expected to grow from $62.86 billion in 2025 to $315.33 billion in 2035 (CAGR of 17.5%) [4]

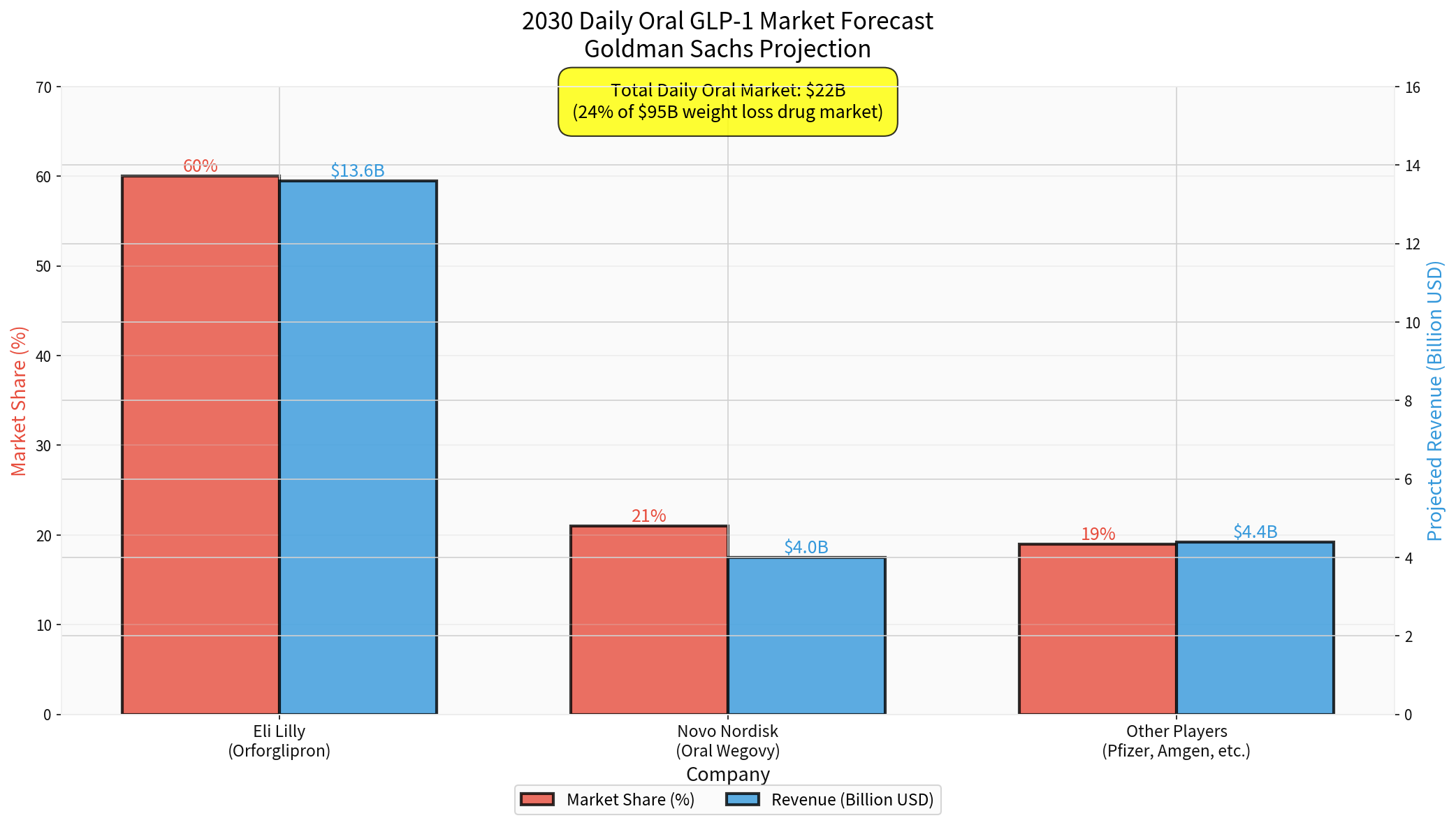

- By 2030, daily oral drugs are expected to account for 24% of the weight loss drug market ($22 billion) [5]

- Only 2% of obese patients in the U.S. receive drug treatment, leaving huge room for market penetration [6]

| Item | Details |

|---|---|

Approval Date |

December 22, 2025 (FDA-approved) |

Launch Date |

January 5, 2026 (U.S.) |

Dosage Specifications |

1.5mg, 4mg, 9mg, 25mg |

Administration Method |

Once daily oral administration |

Monthly Cost |

$149-$299 (self-paying patients) |

Availability |

Available at over 70,000 U.S. pharmacies and multiple telemedicine platforms [7] |

According to phase 3 clinical trial data from OASIS4:

| Efficacy Indicator | Result | Comparison |

|---|---|---|

Average Weight Loss |

16.6% | Injectable Wegovy: ~15% |

Actual Weight Loss |

13.6% | Placebo group: 2.4% |

Proportion of Patients with ≥20% Weight Loss |

33.3% | Injectable Wegovy: 30%+ |

Cardiovascular Risk Improvement |

Significant | Comparable to injectable version [8] |

- Obesity Prevalence:40% of U.S. adults suffer from obesity [9]

- Treatment Penetration:Currently only 2% of patients receive drug treatment [10]

- Indication Expansion:New indications such as cardiovascular diseases, sleep apnea, NASH

- Oral Advantage:Studies show up to two-thirds of adults have a fear of injections [11]

The pricing strategy of oral Wegovy reflects Novo Nordisk’s market expansion intent:

| Comparison Dimension | Oral Wegovy | Injectable Wegovy |

|---|---|---|

Monthly Cost (Self-paying) |

$149-$299 | $1,000-$1,350 |

Administration Frequency |

Once daily | Once weekly |

Insurance Coverage |

To be expanded | Gradually expanding |

Patient Out-of-Pocket Cost |

Significantly reduced | Still high |

| Product | Status | Efficacy | Expected Launch |

|---|---|---|---|

Orforglipron |

Phase 3 completed | 72-week weight loss of 12.4% | 2026-2027 |

Zepbound (Injectable) |

Launched | 22.5% weight loss | Already launched |

- Eli Lilly’s market cap is $935.57 billion, approximately 4x that of Novo [0]

- Goldman Sachs predicts: By 2030, Lilly’s oral drug will account for 60% of the market share ($13.6 billion), Novo for 21% ($4 billion) [12]

- Orforglipron’s once-daily administration advantage directly competes with oral Wegovy

- Amgen (AMGN):MariTide (Phase 2)

- Pfizer (PFE):Danuglipron (in development)

- Viking Therapeutics:VK2735 (early stage)

| Competitive Dimension | Novo Nordisk | Eli Lilly |

|---|---|---|

First-mover Advantage |

✓ First oral GLP-1 launched | ✗ 1-2 years behind |

Efficacy |

16.6% weight loss | Orforglipron: 12.4% |

Product Line Breadth |

Ozempic, Wegovy, Rybelsus | Mounjaro, Zepbound |

Production Capacity |

Expanding but still in shortage | Continuously expanding |

Market Cap |

$244.97 billion | $935.57 billion |

R&D Pipeline |

Strong | Strong |

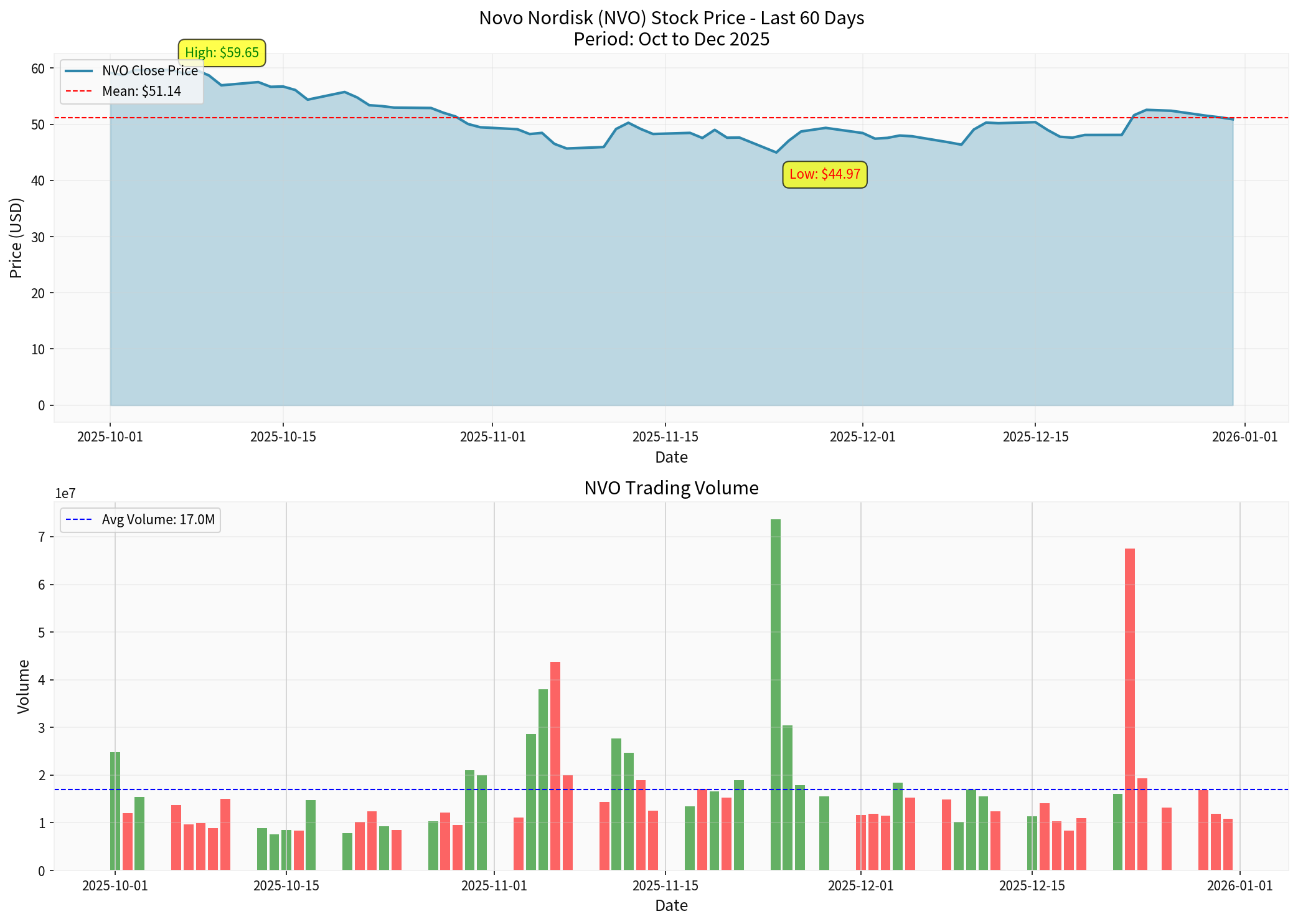

According to latest data [0]:

| Indicator | Value | Explanation |

|---|---|---|

Current Stock Price |

$55.11 | Closing on January 5, 2026 |

Daily Increase |

+5.19% | Driven by oral Wegovy launch |

52-week Range |

$43.08 - $93.80 | 41% drop from high |

Market Cap |

$244.97 billion | ~26% of Lilly’s |

P/E Ratio |

15.02x | Significantly lower than Lilly’s 51x |

- Stock price has sharply回调 from 2025 high, reflecting market concerns about intensified competition

- Low P/E may provide valuation buffer

- Oral Wegovy launch has short-term positive impact on stock price (+5.19%)

| Financial Indicator | Value | Evaluation |

|---|---|---|

Net Profit Margin |

35.61% | Excellent |

Operating Profit Margin |

45.78% | Excellent |

ROE |

77.86% | Excellent |

Current Ratio |

0.78 | Low but manageable |

Analyst Rating |

64% Buy | Overall positive [0] |

- First-mover advantage: First oral GLP-1 weight loss drug launched, building brand awareness and prescription habits

- Clinical validation: Efficacy comparable to injectable version, with complete safety data

- Pricing advantage: Starting price of $149 significantly lower than injectable version, expanding accessibility

- Product line synergy: Forms a complete GLP-1 product matrix with Ozempic, Wegovy, Rybelsus

- Manufacturing capability: Experience in large-scale production of semaglutide

- Daily administration: Compliance may be affected compared to weekly injections

- Production capacity constraints: Injectable Wegovy already faces supply shortages; oral version may exacerbate this

- Market cap gap: Compared to Eli Lilly, capital scale is smaller, resource allocation may be limited

- Dependence on single product: Semaglutide series accounts for a high proportion of total revenue

- Market penetration: Only 2% of obese patients receive drug treatment, huge growth space

- Oral market: Expected to reach $22 billion by 2030

- Indication expansion: Cardiovascular diseases, NASH, sleep apnea

- Emerging markets: Expansion potential in China, Europe, etc.

- Combination therapy: Combination with drugs of other mechanisms

- Lilly competition: Orforglipron may launch in 2026-2027 with comparable efficacy

- Biosimilars: Semaglutide will face generic competition after patent expiration

- Regulatory risks: Continuous safety monitoring, side effects may affect the market

- Payer pressure: Insurance companies restrict GLP-1 coverage

- Price pressure: Pricing pressure will continue as competition intensifies

- Unique positioning of oral Wegovy with almost no direct competition in next 1-2 years

- Gradual expansion of production capacity, alleviation of supply shortages

- Approval of new indications (cardiovascular, kidney diseases) expanding patient base

- Eli Lilly’s orforglipron may launch in late 2026 or early 2027

- Injectable Zepbound has better efficacy (22.5% vs 16.6%), may attract patients seeking maximum efficacy

- By 2030, oral GLP-1 market will reach $22 billion [13]

- Novo is expected to account for 21% ($4 billion), Lilly for 60% ($13.6 billion) [14]

- Injectables will still dominate the market (76% share, $73 billion)

- Production capacity expansion: Ensure sufficient supply of injectable and oral versions

- Combination therapy: Develop triple-target agonists (e.g., competitors to retatrutide)

- New indications: Cardiovascular diseases, NASH, sleep apnea

- Pricing strategy: Balance accessibility and profitability

- Market expansion: Deeply penetrate U.S. market, expand to Europe and Asia

- Reasonable valuation: P/E of 15x significantly lower than industry average and Lilly’s 51x

- First-mover advantage: Oral Wegovy has almost no direct competition in next 1-2 years

- Strong financials: 35%+ net profit margin and 77%+ ROE show excellent profitability

- Growth space: Obesity treatment market penetration is only 2%, huge space

- Eli Lilly’s market cap is 4x that of Novo, with more abundant R&D and commercialization resources

- After Orforglipron launches, Novo’s oral market share may be compressed

- Injectable Zepbound has better efficacy, may attract patients pursuing maximum efficacy

Oral Wegovy

- ✓ No direct oral competitors in next 1-2 years

- ✓ Starting price of $149 significantly lowers entry barrier

- ✓ Addresses patients’ fear of injections (two-thirds of population)

- ✓ Forms product combination with injectable version, covering patients with different preferences

- ✗ Eli Lilly’s orforglipron has comparable efficacy (12.4% vs 16.6%), may launch in 2026-2027

- ✗ Goldman Sachs predicts Novo’s oral market share is only 21%, far lower than Lilly’s 60%

- ✗ Daily administration compliance may be lower than weekly injections

Oral Wegovy will become an important growth engine for Novo Nordisk, but

[0] Gilin API Data - Novo Nordisk (NVO) Stock Quote, Company Profile, Financial Indicators

[1] HCP Live - “FDA Approves Semaglutide (Wegovy) Pill As First Oral GLP-1 for Weight Loss” (https://www.hcplive.com/view/fda-approves-semaglutide-wegovy-pill-as-first-oral-glp-1-for-weight-loss)

[2] Science Daily - “Wegovy in a pill? Massive weight loss results revealed” (https://www.sciencedaily.com/releases/2025/11/251106003913.htm)

[3] Drug Discovery Trends - “Novo Nordisk launches first GLP-1 pill for obesity, but Lilly may dominate the oral market eventually” (https://www.drugdiscoverytrends.com/novo-nordisk-launches-first-glp-1-pill-for-obesity-but-lilly-may-dominate-the-oral-market-eventually/)

[4] Towards Healthcare - “GLP-1 Receptor Agonist Market to Grow at 17.5% CAGR till 2035” (https://www.towardshealthcare.com/insights/glp-1-receptor-agonist-market-sizing)

[5] CNBC - “What’s next for the weight loss drug market: pills, rivals, insurance” (https://www.cnbc.com/2025/11/02/whats-next-for-the-weight-loss-drug-market-pills-rivals-insurance.html)

[6] Fast Company - “Wegovy pill: Where to find Novo Nordisk’s new GLP-1 for weight loss—and how much it costs” (https://www.fastcompany.com/91469193/wegovy-pill-cost-pricing-retailers-for-new-novo-nordisk-weight-loss-glp1)

[7] UPI - “Novo Nordisk’s GLP-1 weight-loss pill now available in U.S. pharmacies” (https://www.upi.com/Top_News/US/2026/01/05/Novo-Nordisk-Wegovy-pill/1171767632750/)

[8] PR Newswire - “Novo Nordisk presents four new analyses on oral semaglutide 25 mg” (https://www.prnewswire.com/news-releases/novo-nordisk-presents-four-new-analyses-on-oral-semaglutide-25-mg-wegovy-in-a-pill-at-obesityweek-2025-including-demonstrated-reductions-in-cardiovascular-risk-factors-3025605329.html)

[9] Drug Discovery Trends - Same as [3]

[10] Science Daily - Same as [2]

[11] Drug Discovery Trends - Same as [3]

[12] Eli Lilly Press Release - “Lilly’s oral GLP-1, orforglipron, demonstrated meaningful weight loss” (https://lilly.gcs-web.com/news-releases/news-release-details/lillys-oral-glp-1-orforglipron-demonstrated-meaningful-weight)

[13] CNBC - Same as [5]

[14] CNBC - Same as [5]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.