Systematic Assessment of Clearwater Analytics (CWAN) Insider Sales Impact on Investor Confidence and Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

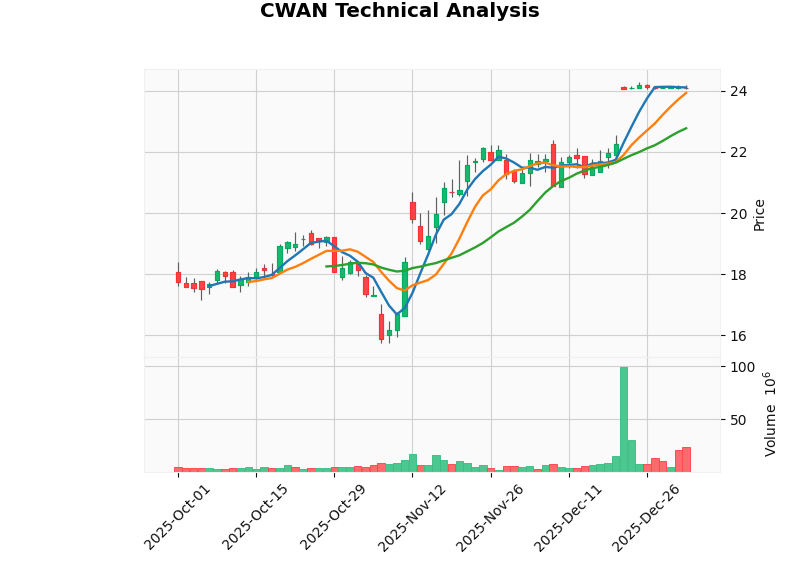

- Acquisition Offer: On December 21, 2025, CWAN announced it would be acquired by a consortium led by Permira and Warburg Pincus for $24.55 per share in all cash, corresponding to an enterprise value of approximately $8.4 billion, representing a premium of about 47% over the closing price on November 10, 2025 (approximately $16.69) [News Source].

- Gap Between Offer Price and Current Price: As of January 5, 2026, CWAN closed at $24.10, only about 1.8% away from the acquisition price of $24.55, indicating the market has fully priced in the deal completion [0].

- Insider Sales: Public data shows CWAN has insider sale activities; relevant reports indicate total insider sales in 2025 were approximately $107,000 [News Source]. Additionally, a Form 144 Report of Proposed Sale of Securities was filed on December 23, 2025, indicating compliant reduction declarations [News Source].

- Business: SaaS platform for investment accounting, risk and performance analysis for institutional investors, covering asset management, insurance, pensions, etc. [News Source].

- Finance: TTM net profit margin approximately 73.71%, ROE around 36.15%, but operating margin only about 0.19%, indicating a special profit structure (possibly related to one-time or non-operating items) [0].

- Valuation: P/E ratio approximately16.06x, P/S ratio around12.60x, market capitalization about $6.94 billion [0].

- Trends: Stock price rose about37.4% in the past3 months, fell about11.4% in the past year; current technical pattern is sideways/no clear trend, support around $22.77, resistance around $24.36 [0].

####1. Quantitative Scale and Relative Significance

- Sale amount: approximately $107,000 [News Source].

- Relative scale: calculated against the market capitalization of about $6.94 billion, this sale is equivalent to only about0.0015% of the market cap, statistically a minimal proportion.

- Comparable threshold: generally, a single insider sale below1% of their holdings or below0.01% of market cap is usually regarded as “small, routine” reduction. This sale amount is far below this threshold, more reflecting personal asset allocation, liquidity management or tax planning needs, rather than a major negative signal about prospects.

####2. Interpretation of Insider Sales in Merger Context

- Transaction Lock-in Effect: After merger agreement announcement, insider sales are usually strictly constrained by window periods, quiet periods and internal control compliance; meanwhile, the transaction price of $24.55 is significantly higher than previous market prices, so moderate cash-out by insiders within compliance framework is a rational choice.

- Weakened Information Content: Once a merger transaction is announced, the company’s short-term stock price is mainly driven by transaction completion probability, regulatory approval and delivery schedule, rather than marginal transaction behaviors of insiders.

- Compliance Disclosure: Form144 and related public documents indicate this sale is in compliance with disclosure requirements, with no abnormal or concentrated large-scale selling by executives [News Source].

####1. Cognitive Differences Among Different Investor Types

- Institutional Investors and Merger Arbitrage Funds: Focus more on transaction completion certainty, regulatory approval progress, financing arrangements and antitrust risks. For extremely small-scale insider sales, they usually do not constitute key variables.

- Long-term Fundamental Investors: Value more the net retention rate of SaaS business, product roadmap and customer structure, as well as long-term operation and capital allocation after merger. This sale is minimal in scale, with limited impact on long-term confidence.

- Retail and Emotional Investors: Prone to be influenced by the simplified narrative of “insider selling = bearish”. It should be noted that the sale amount is extremely low relative to market cap, and occurred after the merger offer announcement, so it should not be over-interpreted as collective selling by insiders or negation of company prospects.

####2. Information Asymmetry and “Transaction Lock-in” Effect

- After the merger agreement takes effect, information about transaction terms, completion conditions and regulatory paths is highly symmetric, so the information content of marginal transaction behaviors of insiders drops significantly.

- Insiders are more likely to conduct moderate reduction based on personal financial arrangements after transaction uncertainty is eliminated, rather than new, undisclosed negative information at company level.

####1. Short-term Pricing Anchor: Merger Transaction Price and Arbitrage Space

- Transaction price of $24.55 becomes the pricing center; current stock price is about $24.10, implying an arbitrage space of about1.8%. Key factors affecting stock price are: transaction completion probability, regulatory approval and delivery schedule, rather than marginal transaction behaviors of insiders.

####2. Medium and Long-term Valuation Considerations

- If transaction is completed smoothly: company delists, stock price locks in near $24.55 cash consideration until delivery; during this period, insider sales have limited impact.

- If transaction is terminated due to regulatory, financing or shareholder reasons: stock price will return to fundamental valuation (referring to TTM profit and industry comparable company valuation system), and business quality and growth path need to be re-examined. However, currently, the scale of insider sales is not sufficient to become a core driver of valuation deviation.

####1. Timeline and Key Events

- December21,2025: Merger agreement announcement ($24.55 cash consideration) [News Source].

- January23,2026: End of go-shop period (window to seek higher offers).

- First half of2026 (expected): Regulatory approval and delivery completion (regulatory progress is one of the biggest uncertainty sources).

- Recent: Continuously monitor SEC documents (including Form4/144 and other insider transaction disclosures), as well as progress of regulatory agencies, legal proceedings and shareholder proxy voting.

####2. Monitoring Indicators and Risk Signals

- Transaction Structure: Financing arrangements, debt terms, resilience of operating cash flow to interest coverage [News Source].

- Regulatory and Litigation: Antitrust review, progress of shareholder litigation (some law firms have initiated investigations into transaction fairness) [News Source].

- Insider Activities: If multiple executives conduct large-scale, concentrated reduction, it may indicate changes in expectations of transaction or fundamentals, requiring re-evaluation.

- Industry and Macro: Impact of interest rate changes on valuation and refinancing pressure of highly leveraged transactions, as well as overall activity of merger market.

- Internal Control and Disclosure: CWAN should strictly follow SEC requirements on insider transaction disclosure and window period management, ensuring timeliness and accuracy of Form4/144 and other documents.

- Compliance Transaction Plan: Sound 10b5-1 plan and pre-approved transaction window can effectively reduce market doubts; investors are advised to pay attention to whether the company has relevant policy disclosures.

- Governance and Independence: During merger review, the role of board special committee and independent financial/legal advisors is crucial, helping to enhance transaction fairness and transparency.

####1. Existing CWAN Shareholders

- Scenario Evaluation:

- High transaction completion probability, clear timeline: Hold until delivery to get cash consideration close to $24.55.

- Transaction has substantial risks: Consider partial position reduction or build hedging (such as buying put options or using derivatives to hedge downside risks), and dynamically adjust based on regulatory progress.

- Focus Points: Regulatory dynamics, financing stability and possibility of competitive offers.

####2. Merger Arbitrage Traders

- Entry Conditions: Evaluate risk-adjusted returns under the premise of about1.8% arbitrage space and controllable regulatory and financing risks.

- Hedging Methods: Consider shorting relevant securities of acquirers (if feasible), or use option strategies to hedge tail risks when delivery uncertainty rises.

####3. New Investors and Watchers

- It is not recommended to chase up or sell based on this event as a single signal. Current pricing is mainly driven by transaction completion probability, and the space for fundamental analysis is compressed.

- If seeking fundamental growth targets, valuation and business quality of comparable SaaS peers may provide clearer comparison benchmarks.

####4. Risk Management

- Merger Risks: Negative changes in regulation, financing, competitive offers and shareholder voting.

- Market Risks: Negative impact of macro liquidity tightening on highly leveraged transaction valuation and refinancing pressure.

- Operational Risks: Continuously pay attention to SEC disclosures and company announcements, avoid emotional transactions based on one-sided information.

[0] Jinling API Data (CWAN Company Overview, Real-time Quotes, Historical Prices, Financial Analysis, Technical Analysis)

[1] Business Wire - “CWAN Stock Alert: Halper Sadeh LLC Investigates Fairness of Sale” (https://www.businesswire.com/news/home/20251221360785/en/CWAN-Stock-Alert-Halper-Sadeh-LLC-is-Investigating-Whether-the-Sale-of-Clearwater-Analytics-Holdings-Inc.-is-Fair-to-Shareholders)

[2] WebProNews - “Clearwater Analytics Agrees to $8.4B Buyout by Permira-Led Consortium” (https://www.webpronews.com/clearwater-analytics-agrees-to-8-4b-buyout-by-permira-led-consortium/)

[3] Barron’s - “Clearwater Analytics Stock Surges After $8.4 Billion Take-Private Deal” (https://www.barrons.com/articles/clearwater-analytics-stock-take-private-deal-02014ee4)

[4] Benzinga - “What’s Behind The Jump In Clearwater Analytics (CWAN) Stock Today?” (https://www.benzinga.com/trading-ideas/movers/25/12/49541850/whats-behind-the-jump-in-clearwater-analytics-cwan-stock-today)

[5] The Motley Fool - “Stock Market Today: Clearwater Analytics Surges on $8.4 Billion Take-Private Deal” (https://www.fool.com/coverage/stock-market-today-dec-22-clearwater-analytics-surges-on-usd8-4-billion-private-deal-news/)

[6] SEC EDGAR - Clearwater Analytics Holdings, Inc. Form 144 (Report of Proposed Sale of Securities) (https://www.sec.gov/Archives/edgar/data/1866368/000119312525329166/0001193125-25-329166-index.htm)

[7] ts2.tech - “CWAN Stock on Dec.24,2025: $24.55 Take-Private Deal and Key Dates” (https://ts2.tech/en/clearwater-analytics-cwan-stock-on-dec-24-2025-24-55-take-private-deal-latest-analyst-forecasts-and-key-dates-to-watch/)

[8] Yahoo Finance - “Clearwater Analytics downgraded to Neutral from Overweight at Piper Sandler” (https://finance.yahoo.com/news/clearwater-analytics-downgraded-neutral-overweight-220030375.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.