Analysis of the Investment Impact of Beijing's Trillion-Yuan AI Industry Target on A-Shares and Hong Kong Stocks AI Sectors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

January 5, 2026, Beijing officially released the

According to data from the Beijing Municipal Development and Reform Commission, the scale of Beijing’s artificial intelligence core industry is expected to reach

After the policy release, AI-related sectors in A-shares and Hong Kong stocks both showed obvious positive reactions:

- A-share AI leader iFLYTEK (002230.SZ)rose7.06%in a single day, with trading volume reaching 134.69M, far higher than the average daily volume of 42.20M [0]

- Tonghuashun (300033.SZ)rose3.08%, with a market capitalization of 17.854 billion USD [0]

- Hong Kong stock SenseTime-W (0020.HK)rose0.90%, SMIC (0981.HK)rose 1.86%[0]

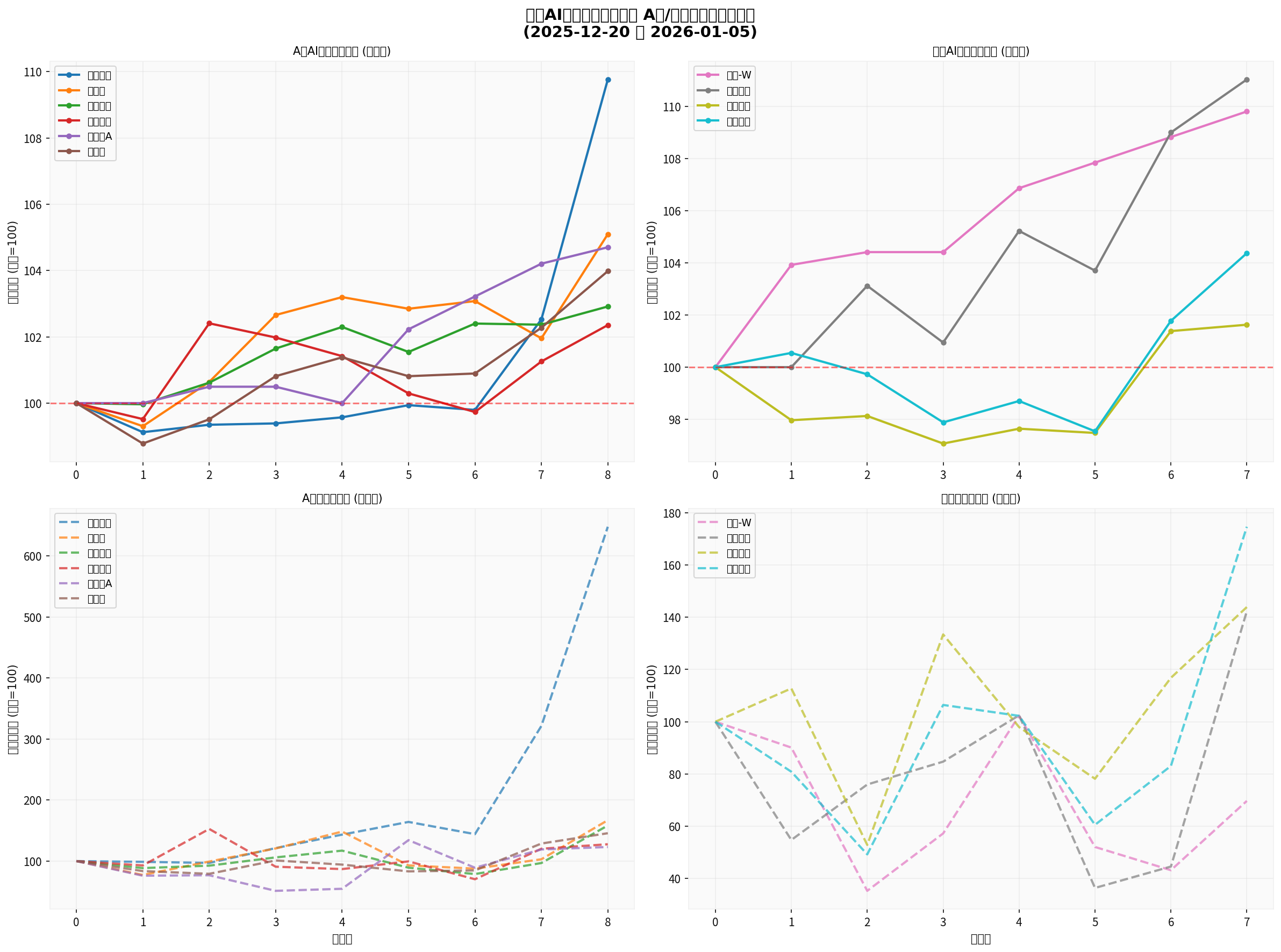

Chart Description: The chart shows the price and volume changes (normalized, with the first day as 100) of major AI-related stocks in A-shares and Hong Kong stocks from December 20, 2025 to January 5, 2026. It can be seen that iFLYTEK in A-shares performed the most prominently (+9.77%), while SMIC (+11.03%) and SenseTime-W (+9.80%) in Hong Kong stocks led the gains.

Beijing’s “Nine Major Actions” cover the entire AI industry ecosystem:

- Technological Innovation Origination Action- Tackling core technologies such as new model architectures, swarm intelligence, and world models

- Action to Strengthen the Foundation of Independent Intelligent Computing Ecosystem- Improving the performance of domestic computing chips, interconnect chips, and storage chips

- High-Quality Data Aggregation Action- Reform of market-oriented allocation of data elements

- Full-Domain Application Empowerment Action- Building pilot bases in healthcare, manufacturing, education, and other fields

- Scientific Intelligence Paradigm Innovation Action- Accelerating the construction of new infrastructure such as intelligent instruments and simulation software

- Embodied Intelligence Full-Chain Leap Action- Implementing the innovative application action plan for humanoid robots

- Innovation Ecosystem Leadership Action- Cultivating 100-billion-yuan industrial clusters

- Open Source and Open Collaboration Action- Building an open and collaborative ecosystem

- Security Governance Escort Action- Establishing a security governance framework [3]

- Implement more than 100AI benchmark applications

- Gather industrial investment funds of over 200 billion yuan

- Add more than 10new listed companies

- Add more than 20new unicorn enterprises [3]

According to web search data and brokerage API data,

-

Domestic AI Chips:

- Cambricon- Revenue in the first three quarters of 2025 reached 4.607 billion yuan, a year-on-year surge of2386.38%, achieving a net profit of 1.605 billion yuan, turning from loss to profit significantly year-on-year [4]

- Domestic computing chips of different architectures such as Moore Threads, KunLun Chip, and Qingwei Intelligenceare continuously improving their performance [5]

-

Optical Modules (CPO):

- Zhongji Innolight- Revenue in the first three quarters of 2025 reached 20.505 billion yuan, a year-on-year increase of 44.43%; net profit was 7.132 billion yuan, a year-on-year increase of 90.05% [4]

- Eoptolink- Revenue in the first three quarters reached 16.505 billion yuan, a year-on-year increase of 221.70%; net profit was 6.327 billion yuan, a year-on-year increase of 284.37% [4]

- Eoptolink’s annual increase in 2025 reached 424.03%, and Zhongji Innolight increased by396.38%, leading the AI computing power sector [4]

-

AI Servers:

- Foxconn Industrial Internet- Revenue in the first three quarters of 2025 reached 603.931 billion yuan, a year-on-year increase of 38.4%; net profit was 22.487 billion yuan, a year-on-year increase of 48.52% [4]

- Revenue of cloud service providers’ GPU AI servers increased by more than 300%year-on-year in the first three quarters [4]

-

Liquid Cooling Equipment:

- Envicool- Revenue in the first three quarters reached 4.026 billion yuan, a year-on-year increase of 40.19%; deeply embedded in the world’s top computing power ecosystem [4]

- Four basic models form a pattern: Douyin Doubao, Zhipu GLM, Moonlight Kimi, Baidu Wenxin[5]

- Beijing has 209 registered models, with capabilities in reasoning, coding, etc., reaching the best in open-source global standards [5]

- A matrix of vertical models empowering thousands of industries is taking shape

- A number of intelligent agent platforms such as Kouzi, Famou, JoyAgenthave emerged [5]

- OpenAI expects ARR to exceed 20 billion USDby the end of 2025 [6]

- Taking Doubao as an example, the daily tokens usage exceeded 50 trillionin December 2025 [6]

- Large models themselves are the most representative AI applications, with leading global models reaching ARR of 10 billion USD [6]

According to web searches,

-

AI Phones/AIPCs:

- AI phones are a prerequisite for the explosion of other AI terminals

- It is expected that top global manufacturers will invest extremely in this new entrance battle [6]

-

Autonomous Driving:

- In December 2025, China’s first batch of L3 autonomous driving models obtained access permits

- It is expected that autonomous driving technology will achieve new breakthroughs in 2026 [7]

-

Embodied Intelligence (Humanoid Robots):

- Tesla plans to launch Optimus V3 mass production in 2026

- Long-term plan for annual production capacity of 10 million units, with final cost reduced to20,000 USD[6]

- Beijing-Tianjin-Hebei joint effort to cultivate 100-billion-yuanembodied intelligence industrial clusters [3]

- Tesla plans to

-

Advertising and E-commerce:

- With the improvement of multimodal generation capabilities, AI will bring revolutionary changes in advertising creativity, material generation, algorithm efficiency improvement, etc. [7]

-

Scientific Intelligence:

- Application of AI in drug research and development, material science, etc., is accelerating [3]

The “High-Quality Data Aggregation Action” clearly proposes:

- Promote reform of market-oriented allocation of data elements

- Build a data circulation and transaction system

- Construct high-quality datasets [3]

- Cambricon- Domestic AI chip leader; its stock price reached a high of 1595.88 yuan/share in 2025, with market capitalization exceeding 600 billion yuan at one point, surpassing Kweichow Moutai to become the “stock king” at the end of the year [4]

- Zhongji Innolight (300308.SZ)- Optical module leader; annual increase of396.38%[4]

- Eoptolink (300502.SZ)- Optical module leader; annual increase of424.03%[4]

- Foxconn Industrial Internet (601138.SH)- AI server leader [4]

- iFLYTEK (002230.SZ)- A-share AI application leader; rose7.06%in a single day after policy release [0]

- Tonghuashun (300033.SZ)- Financial AI application leader; rose3.08%[0]

- A-share annual turnover exceeded 400 trillion yuanfor the first time in 2025, an increase of nearly60%compared to 2024 [4]

- 54 AI computing power concept stockshad a total turnover of24.54 trillion yuanduring the year [4]

- Zhongji Innolight topped the list with 2.52 trillion yuanturnover, and Eoptolink ranked third with2.32 trillion yuan[4]

- SMIC (0981.HK)- Domestic chip manufacturing leader; rose1.86%after policy release, with market capitalization of 75.349 billion USD [0]

- SenseTime-W (0020.HK)- AI visual algorithm leader; rose0.90%after policy release, with market capitalization of 8.297 billion USD [0]

- Tencent Holdings (0700.HK)- Market capitalization of 5.67 trillion USD, with strong AI application scenarios [0]

- Alibaba Group (9988.HK)- Cloud computing and AI application leader; rose2.55%after policy release, with market capitalization of 2.83 trillion USD [0]

- AI-related stocks in Hong Kong are mainly platform tech stocks, with rich application scenarios and data resources

- Compared to A-shares, Hong Kong stocks have more attractive valuations: Alibaba’s P/E is only 21.02 times, Tencent’s is 25.25 times [0]

| Dimension | A-Shares | Hong Kong Stocks |

|---|---|---|

Core Beneficiary Direction |

Domestic computing power hardware, chips | Platform applications, cloud computing |

Valuation Level |

High (iFLYTEK P/E:149.56) | Relatively reasonable (Tencent P/E:25.25) |

Liquidity |

Active (daily turnover exceeding 1 trillion yuan) | Relatively stable |

Policy Sensitivity |

High (directly benefits from domestic substitution) | Medium (indirectly benefits) |

Representative Stocks |

Cambricon, Zhongji Innolight, iFLYTEK | Tencent, Alibaba, SMIC, SenseTime |

Based on brokerage API data, web searches, and policy analysis, we recommend focusing on the following three investment themes:

- Optical modules: Zhongji Innolight, Eoptolink

- AI chips: Cambricon, Hygon Information

- AI servers: Foxconn Industrial Internet, ZTE

- Liquid cooling: Envicool

- A-shares: iFLYTEK, Tonghuashun, 360 Security

- Hong Kong stocks: Tencent Holdings, Alibaba Group, SenseTime-W

- Humanoid robots: Sanhua Intelligent Control, Tuopu Group

- Autonomous driving: Desay SV, Foryou Group

- AI phones/PCs: Luxshare Precision, BOE Technology

-

Valuation Risk: Some AI concept stocks have overvalued valuations, with bubble risks. For example, iFLYTEK’s P/E is as high as 149.56 times [0]

-

Technology Route Risk: AI technology iterates rapidly, and there is a risk of technology routes being disrupted

-

Commercialization Implementation Below Expectations: Some AI applications are still in the early stage, and there is uncertainty about the time of commercialization implementation

-

Intensified International Competition: Global AI competition is fierce, and technology blockades and trade frictions may affect the industrial chain development

-

Policy Execution Risk: The trillion-yuan target is difficult to achieve, and there is a risk of policy execution falling short of expectations

According to analysts,

Beijing’s trillion-yuan AI industry target sends a clear policy signal and will have a profound impact on AI sectors in A-shares and Hong Kong stocks:

- Short-term (1-3 months): Market sentiment is boosted, and computing power hardware leaders continue to lead gains

- Mid-term (6-12 months): Commercialization of large models accelerates, and the application end begins to deliver performance

- Long-term (over 2 years): New directions such as embodied intelligence and scientific intelligence explode, forming new growth curves

[0] Jinling API Data - Real-time stock quotes, historical prices, market capitalization data

[1] National Business Daily - “City 24 Hours | ‘First City of Artificial Intelligence’ calls for breaking 1 trillion yuan in two years” (https://www.nbd.com.cn/articles/2026-01-05/4207619.html)

[2] China News Service - “Beijing will implement ‘Nine Major Actions’ to strive for AI core industry scale exceeding 1 trillion yuan in two years” (https://www.chinanews.com.cn/cj/2026/01-05/10546365.shtml)

[3] Smart City Industry Analysis - “Action Plan for Building an Innovation High Ground in Artificial Intelligence in Beijing Officially Released: Will In-depth Implement Nine…” (https://www.smartcity.team/policies/…)

[4] Eastmoney.com - “[Financial Analysis] 2025 AI Computing Power Becomes Core Theme: Multiple Concept Stocks Welcome ‘Highlight…’” (https://wap.eastmoney.com/a/202512313606982145.html)

[5] Securities Times Online - “Is there a bubble in AI? 2026 AI Investment Key Still Depends on ‘Iteration Ability’ and ‘Implementation Ability’ of AI Large Models” (https://www.stcn.com/article/detail/3562080.html)

[6] Wall Street CN - “2026 AI Theme is Clear: Computing Power Lays the Foundation, Phones Break the Ice, Four Explosive Points in Place” (https://wallstreetcn.com/articles/3762504)

[7] China Daily - “AI-driven innovation to transform manufacturing, health and mobility” (https://global.chinadaily.com.cn/a/202601/05/WS695b8686a310d6866eb320fc.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.