In-depth Analysis of the Sustainability of A-Shares' 'Slow Bull' Market Trend

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

On the first trading day of 2026, the A-share market achieved a ‘good start’, with the Shanghai Composite Index surging 1.38% to close at

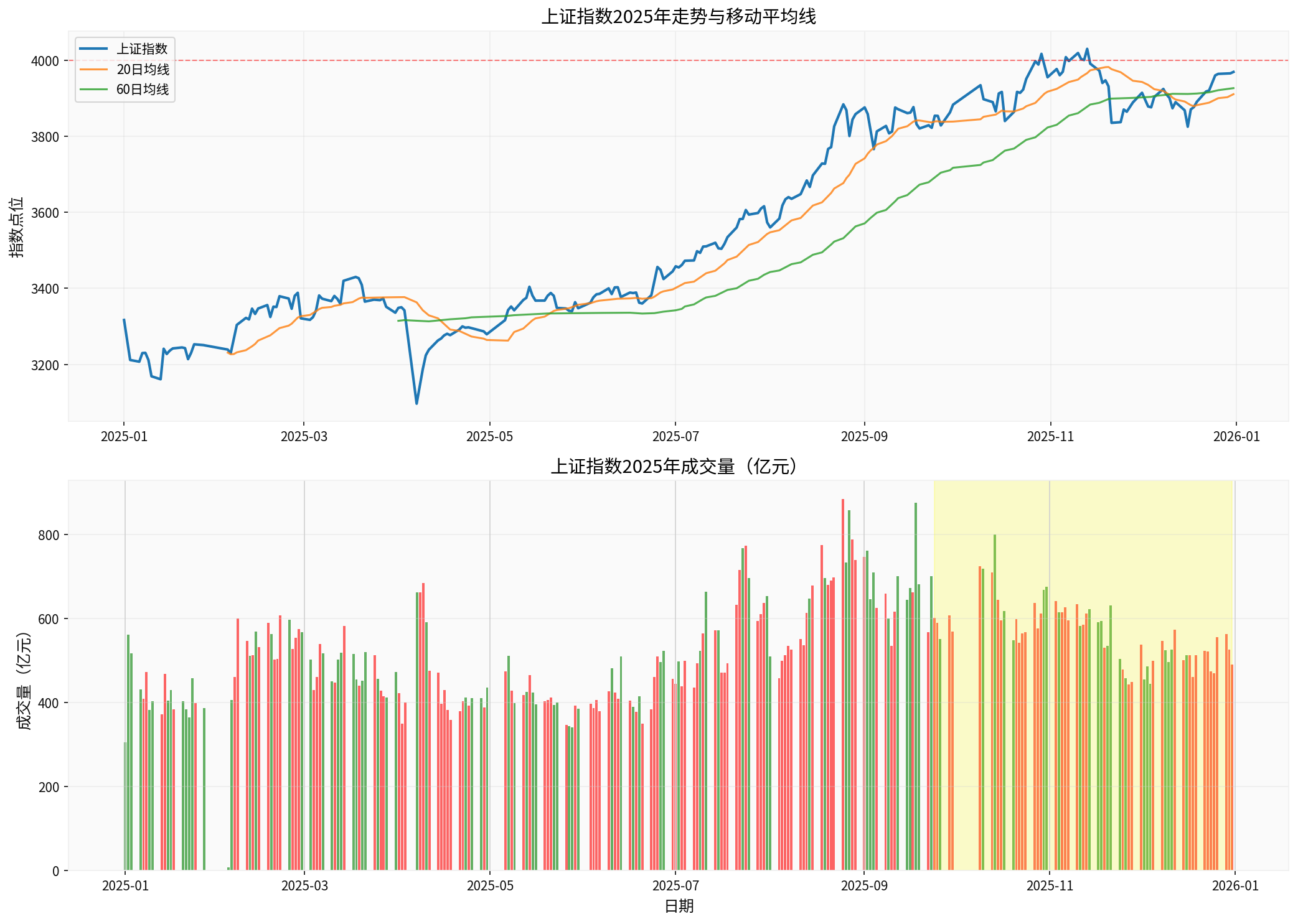

From the full-year performance of 2025, A-shares experienced a distinct ‘slow bull’ market trend:

- Annual increase: The Shanghai Composite Index rose from 3316.50 points at the beginning of the year to 3968.84 points at the end of the year, with an increase of19.67%

- Annual high: It reached a high of 4029.50 points, a new high in nearly a decade

- Market activity: The annual turnover exceeded 400 trillion yuan for the first time, with an average daily turnover of 1.72 trillion yuan

- Market value scale: The total market value of A-shares exceeded the 100 trillion yuan mark for the first time, becoming the world’s second-largest stock market [2]

The chart shows that the Shanghai Composite Index showed a steady upward trend throughout 2025, accelerated after September 24 driven by policies, and closed strongly with an ‘11-day consecutive rise’ at the end of the year. Trading volume increased simultaneously, indicating active capital participation.

- GDP growth: The GDP grew by5.2%year-on-year in the first three quarters of 2025, ranking among the top in major global economies. Many brokerages predict that the GDP growth rate will remain around5%in 2026 [2][3]

- Price level: The PPI index, which has been in negative growth since October 2022, is expected to turn positive around the middle of2026and rise to the range of 0.2%-0.5% by the end of the year. CPI is expected to return to the ideal level of 2% [2][4]

- Earnings growth expectation: The earnings growth rate of non-financial A-share enterprises is expected to achieve a year-on-year growth of5%-16.5%, with neutral expectations concentrated at8%-12%. Everbright Securities predicts that the earnings growth rate of non-financial A-share enterprises will rise to around10%in 2026 [2][5]

- Earnings-driven logic: In 2026, A-shares will bid farewell to the market trend dominated by valuation expansion in the past two years and enter a new stage driven bysubstantial repair of corporate earnings. Stabilization on the price side will directly alleviate the dilemma of enterprises ‘increasing revenue without increasing profits’ [2]

- Technology main line: The AI revolution has entered a critical application period, and China’s innovative industries have entered the performance realization stage. Hard technology sectors such as artificial intelligence, semiconductors, computing power, and humanoid robots will become the core main lines [1][2]

- Supply and demand improvement: After three years of capacity reduction cycle and the promotion of policies such as ‘anti-involution’, more procyclical industries are expected to approach supply-demand balance, laying the foundation for earnings repair [2]

- Deficit scale: The fiscal deficit rate in 2025 was set at about4%, issuing 1.3 trillion yuan of ultra-long-term special treasury bonds and 4.4 trillion yuan of local government special bonds. The deficit rate in 2026 is expected to remain at4%, corresponding to a deficit scale of about6.6 trillion yuan[4]

- Special bond expansion: The new special bond quota is expected to rise to4.6 trillion yuan, and the issuance scale of ultra-long-term special treasury bonds is expected to increase to2 trillion yuan, expanding by 200 billion yuan and 700 billion yuan respectively compared to 2025 [4]

- Policy focus: Fiscal policy will focus on three directions: stabilizing people’s livelihood, promoting consumption, and expanding investment, while balancing supply and demand development [3]

- RRR and interest rate cuts: The central bank is expected to cut interest rates by10 to 20 basis pointsand reduce the reserve requirement ratio by0.5 to 1 percentage point, corresponding to roughly one to two policy adjustments [4][3]

- Policy space: The RMB exchange rate has回升 to above 7.0, and the net interest margin of the banking industry has stabilized at 1.42% for two consecutive quarters, opening up space for subsequent monetary policy [4]

- Structural tools: Monetary policy will pay more attention to precision and effectiveness, with structural tools focusing on key areas such as technology finance, green finance, and inclusive finance [3]

- Start of the 15th Five-Year Plan: 2026 is the first year of the 15th Five-Year Plan. The policy side will continue to exert efforts to build a modern industrial system led by scientific and technological innovation and supported by advanced manufacturing [1][6]

- Scientific and technological innovation: ‘Leading the development of new quality productivity with high-level scientific and technological self-reliance and self-improvement’ is an important content of the 15th Five-Year Plan period, and industries related to scientific and technological innovation will continue to receive policy support [6]

- Exchange rate trend: The RMB exchange rate has回升 to above 7.0, and the core fluctuation range in 2026 is expected to be6.80-7.15, with the exchange rate center stable at around 6.9 at the end of the year. In some optimistic scenarios, it may break through 6.8, and the annual appreciation幅度 is expected to reach around5%[7][8]

- Internationalization process: The internationalization process of the RMB is accelerating, and measures such as promoting RMB settlement in iron ore trade enhance the status of the RMB in the global monetary system [2]

- Attractiveness improvement: The expectation of RMB appreciation will attract more foreign capital to allocate high-quality A-share assets, promote the decline of the US dollar index, and form a良性 cycle of ‘opening-stability-appreciation’ [7]

- Fed rate cut cycle: The Fed is still in the rate cut cycle and is expected to continue to cut rates in 2026. The misalignment correction of the Sino-US monetary policy cycle will be the core macro-driving force for the RMB to strengthen [2][8]

- Capital flow: The narrowing of the Sino-US interest rate spread will fundamentally reverse the pressure of capital outflows in the past few years and attract bond funds to continue to return to the Chinese market [8]

- Capital inflow scale: The net inflow scale of A-share capital in 2026 is expected to expand to1.56 trillion yuan, bringing liquidity support to the upward market [5]

- Foreign capital allocation: Currently, global capital is still underweight in Chinese assets, and the rebalancing of international capital allocation is worthy of attention [5]

- Resident capital: The allocation demand of domestic residents’ idle funds has been activated by the profit-making effect, and coupled with various medium and long-term funds entering the market one after another, the capital side of the stock market is expected to remain active [5]

- Margin trading balance: The margin trading balance rose against the trend to2.55 trillion yuan, and the holding cycle of financing customers has lengthened, shifting from ‘chasing up and selling down’ to mid-line layout [8]

- China Post Securities: The resonance of fundamental improvement, policy dividend release, and liquidity repair, the foundation of the A-share ‘slow bull’ market trend is still solid [1]

- CSC Financial Co., Ltd.: The A-share bull market is expected to continue, and the index is still expected to fluctuate upward but the increase will slow down. Investors pay more attention to fundamental improvement and prosperity verification [2]

- CICC: The upward fluctuating market trend of A-shares in 2026 is still expected to continue, but after a certain valuation repair, the importance of fundamentals will further increase [5]

- Huaan Securities: A-shares in 2026 are expected to gradually transition from liquidity-driven to profit-driven Bull Market Phase III, with procyclical sectors dominating [6]

- Hualong Securities: The ‘slow bull’ will still continue, and A-shares are expected to break through upward [6]

- Goldman Sachs: Continue to recommend overweighting A-shares and Hong Kong stocks in the Asia-Pacific region in 2026, and expect the Chinese stock market to continue the bull market, with an expected increase of38%by the end of 2027 [1][6]

- UBS Securities: The earnings growth rate of all A-shares in 2026 is expected to further rise from 6% in 2025 to8%[6]

Although mainstream institutions are generally optimistic, the following risks still need to be paid attention to:

- External uncertainty: 2026 is the US mid-term election year, and there are still potential uncertainties in Sino-US economic and trade relations [6]

- Valuation pressure: After a certain valuation repair, the cost-effectiveness of equity assets has decreased, and excessive short-term increases may lead to an early peak of the bull market [6]

- Correction of technology sectors: Need to be alert to the structural/stage correction risk of technology sectors [2]

- Too fast appreciation of the RMB: If the RMB exchange rate is stronger than 6.8, it may put pressure on export enterprises [8]

2.

3.

- Rise rhythm: From rapid rise → low-slope slow bull

- Market style: From growth dominance → balanced large and small caps, procyclical dominance

- Investment main line: Technology growth (AI+, advanced manufacturing) + procyclical recovery + supply and demand improvement

- Scientific and technological innovation: Hard technology sectors such as AI, semiconductors, computing power, and humanoid robots are still the industrial main lines

- Procyclical sectors: Industries with improved supply and demand after capacity reduction, such as non-ferrous metals, mechanical equipment, and power equipment

- Consumption recovery: Industries benefiting from the ‘old-for-new’ policy and consumption recovery

- Low valuation repair: Sectors with still low valuations and improved fundamentals

- Rationally看待波动: The market in 2026 may show a ‘rise first then stabilize’ rhythm, need to pay attention to the possible increase in volatility

- Focus on fundamental matching: In the context of valuation rise, need to pay attention to the matching rhythm with fundamentals

- Exchange rate risk management: Export enterprises should establish a neutral awareness of exchange rate risk and make good use of foreign exchange derivative product tools

- Diversified allocation: Avoid excessive concentration in a single industry and build a diversified investment portfolio

The A-share ‘slow bull’ market trend is based on the solid foundation of the resonance of fundamental improvement, policy dividend release, and liquidity repair [0]. As the first year of the 15th Five-Year Plan, 2026, supported by multiple favorable factors such as steady economic recovery, improved corporate earnings, continuous policy efforts, and sufficient capital inflow, the A-share market is expected to continue the ‘slow bull’ pattern of fluctuating upward.

However, investors need to recognize that the market characteristics will undergo important changes: from valuation expansion-led to substantial repair of corporate earnings-driven, from rapid rise to low-slope slow bull, from growth style dominance to balanced large and small caps. This change requires investors to pay more attention to industrial research, focus on real profit, maintain patience and determination, and grasp structural opportunities in the wave of ‘systematic slow rise’.

[0] Jinling API Data

[1] Securities Times -

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.